Calculate Your Employees Pay

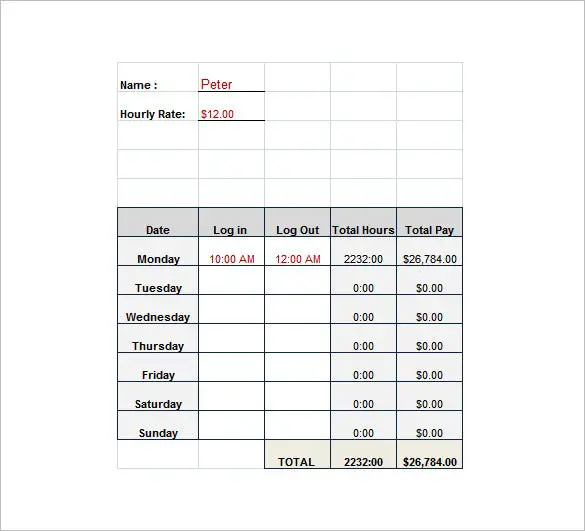

These days, robust payroll software can turn calculating an employees pay into one of the simplest parts of running payroll taxes. Payroll software can simplify things with features like timesheets, attendance systems, and digital times that let you track the working hours of multiple employees.

In general, calculating employee pay by yourself is most feasible if your business staffs only a few hourly or salaried employees. If this is the case, remember to account for any tips that your employees receive as well as their commission, PTO/sick leave, and overtime pay in addition to their standard salaries and hourly wages.

Read our complete guide on how to calculate payroll if you need additional help.

Exemption For Disabled Veterans

Veterans of the U.S. Armed Forces who have been disabled as a result of their service might be eligible for a very generous disabled veteran’s exemption. This exemption is equal to 100% of the appraised value of their primary residence.

Texas also offers a property tax exemption for solar- or wind-powered energy devices, as well as several exemptions for charitable organizations and businesses.

Federal And State Tax Balance

The table below provides an indication of any outstanding tax which you may be liable for and/or any tax rebates due. Note: This tax rebate calculation is indicative only, whilst we aim to provide a 100% accurate tax calculation we DO NOT guarantee of the accuracy of the tax calculations herein.

| Withholdings | |

|---|---|

| $3,720.00 | $3,720.00 |

1 A negative figure indicates that you have overpaid tax and that you are due a tax rebate.

Don’t Miss: How Do Taxes Work With Robinhood

Example Tax Calculation For $ 6000000 With Line By Line Calculations

Are you earning $ 60,000.00 per year in Texas? The tax calculation below shows exactly how much Texas State Tax, Federal Tax and Medicare you will pay when earning $ 60,000.00 per annum when living and paying your taxes in Texas. The $ 60,000.00 Texas tax example uses standard assumptions for the tax calculation. This tax example is therefore a flat example of your tax bill in Texas for the 2022 tax year.

In the following tables, we break down your tax return line by line to show how your tax is calculated including non-refundable tax deductions.

Your personal salary and tax calculations, see the table below for a full breakdown and analysis of your salary and tax commitments for 2022.

Employment & Training Investment Assessment

The Employment and Training Investment Assessment is the sixth component of your tax rate . As a separate assessment of 0.10 percent of wages received, the assessment is imposed on each company paying contributions under the Texas Unemployment Compensation Act.

The proceeds of the assessment are put in the employment and training investment holding fund’s account. The Replenishment Tax Rate is decreased by the same amount by law, therefore your tax rate will not increase as a result of this assessment.

Read Also: How Do I Do My Tax Return Online

Texas Median Household Income

| 2010 | $48,615 |

Payroll taxes in Texas are relatively simple because there are no state or local income taxes. Texas is a good place to be self-employed or own a business because the tax withholding won’t as much of a headache. And if you live in a state with an income tax but you work in Texas, you’ll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. If you’re considering moving to the Lone Star State, our Texas mortgage guide has information about rates, getting a mortgage in Texas and details about each county.

Be aware, though, that payroll taxes arent the only relevant taxes in a household budget. In part to make up for its lack of a state or local income tax, sales and property taxes in Texas tend to be high. So your big Texas paycheck may take a hit when your property taxes come due.

Monthly Salary Breakdown For $6000000

In the tax overview above, we show the illustration for a monthly take home pay as a straight 1/12th of your annual income. Not all employers calculate income this way. Some employers calculate your monthly income and pay monthly Federal / State taxes by diving your total annual income by the number of days in a year, then multiplying that daily amount to provide a monthly salary that changes each month depending on how many days there are in the month .

If your employer calculates you monthly salary in this way, the below calculator illustrates the amounts you should expect to pay in Federal Tax, State Tax, Medicare, Social Security and so on. The Tax and Take home example below for an annual salary of $60,000.00 is basically like a line by line payslip example.

| Month | Income |

|---|---|

| $49,442.00 |

Also Check: When Are Taxes Being Sent Out

Two: Collect Documentation From Employees

Employee paperwork is essential for correctly entering data in the appropriate columns on an employee’s slot in your payroll administration system. After researching Texas payroll tax rules, you’ll need the right employee documentation, such as your W-4 form, W-2 form, and I-9 form.

- The Form W-4 gives business owners the information they need to figure out how much to withhold from employee wages for federal income tax contributions in Texas. Remind your staff that they need to amend their W-4 tax forms to reflect recent life changes.

- Employers must use Form I-9 to verify that their employees are legally able to work in the United States. I-9s must be completed on the first day of employment, and employers must complete their component of the I-9 within three business days following that.

- The IRS requires companies to deliver Form W-2 salary and tax statements to their employees at the end of each year. Employers must provide a W-2 for each employee who receives a salary or wage under the terms of employment.

How To Calculate Salary After Tax In Texas In 2022

The following steps allow you to calculate your salary after tax in Texas after deducting Medicare, Social Security Federal Income Tax and Texas State Income tax.

Recommended Reading: What Is Additional Child Tax Credit

While Itep’s Findings Were Compiled From 2018 Data One Expert Says Not Much Has Changed In Texas Over The Last Four Years

Californians reportedly pay less in taxes than Texans do, according to resurfaced data from Institute of Taxation and Economic Policy.

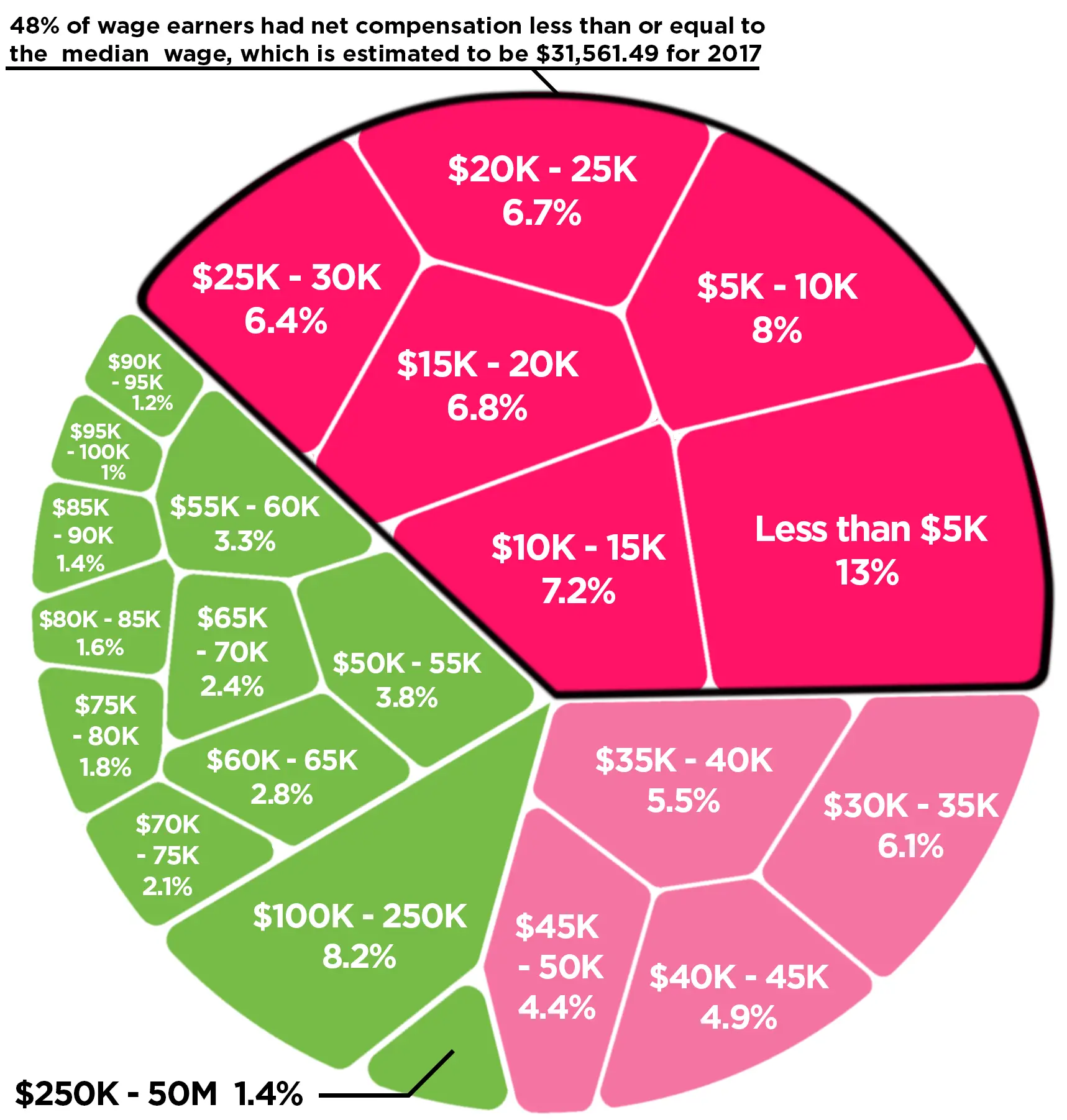

Texas politicians and CEOs often tout the state as “low-tax” because workers here aren’t forced to pay the local government a percentage of their income, in contrast to places like California. However, recently resurfaced data shows that may only apply if you’re a wealthy resident here. A popular post recently shared on Reddit’s main economic forum displayed a graphic that explained how Texans actually pay more in taxes than Californians do, unless those Texans are in the top one percent of all earners.

The graphic reportedly contains 2018 data from the Institute of Taxation and Economic Policy , which compiled statistics regarding IRS income tax, sales tax, property tax, and information from Bureau of Labor Statistics’ Consumer Expenditure Survey from sources including the U.S. Census Bureau, according to a report by the San Antonio Express News.

Make Sure Youre Following Texas Payroll Laws

We recommend referring to the first section of this article for existing payroll laws in Texas. To quickly summarize, Texas boasts a lean set of payroll tax requirements that are relatively easy to comply with when reporting payroll taxes. Business owners need to do their due diligence and comply with Texas payroll laws to a tee, especially considering that they dont need to worry about state income taxes.

Texas may be a big state, but its list of payroll taxes is quite small. Texas single state-level payroll tax is for unemployment insurance, which is the responsibility of the employer along with federal unemployment and income taxes as well as Additional Medicare tax.

Recommended Reading: What Is Federal Withholding Tax

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See .

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Also Check: How Do I Look Up My Car Taxes

Readers Like You Make Our Journalism Possible

Our Fall Member Drive is underway, and we need your support. With midterm elections less than two months away, our reporting will be a critical source of truth and information for Texans across the state and beyond. If you value our work, donate to support us today so our newsroom can be there for you in 2023 and for whatever else this year brings.

Who Sets The Appraisal Value For My Property

The value of your home is based on the appraisal of a tax assessor. Your local government hires the assessor, who bases the value of your home on similar homes in your area. You can get some idea of your homes value just by seeing what other houses in your neighborhood are selling for. This is one of the factors an assessor may use to value the property in your area.

Read Also: How Much Is Washington State Sales Tax

Texas State Income Tax

Texas has a population of over 28 million and is the second largest US state. The median household income is $59,206 .

Brief summary of Texas state income tax:

- zero state income tax

From Wikipedia

Texas tax year starts from July 01 the year before to June 30 the current year. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator:

Remember To Keep Records

It’s well worth your time to set up a system for storing pertinent personnel information and documents. For example, if an employee quits or is dismissed, you’ll probably want to keep their earnings information on hand. Details like these should be included in your payroll records:

- Employee’s full name and Social Security number

- Address and ZIP code

- Total hours worked each day by employee

- Overtime and other forms of compensation

- Payment schedules and dates

Recommended Reading: How To Pay Off Tax Debt

How About Federal Payroll Taxes

There are also a few federal taxes that all employers must pay or withhold from their employees’ earnings.

The tax thatboth employers and employees must payis theFederal Insurance Contributions Act tax.

FICA has two parts: Social Security tax and Medicare tax.

For Social Security tax, employees and employers each contribute 6.2% of earnings up to $132,900. For Medicare tax, the rate is 1.45% on all earnings for both employees and employers.

The tax thatonly employers must payisfederal unemployment tax.

The current tax rate is 6% on the first $7,000 of each employee’s wages each year. Most employers, however, can qualify for a 5.4% federal tax credit by paying their state unemployment taxes on that. That makes the effective FUTA rate just 0.6%.

The two taxes thatonly employees payare:

What If You Need Help Paying Your Texas Property Taxes

Of course, if you currently have a low income, the fact youre not paying income tax is cold comfort. As the cost of basic essentials rises but your household income does not, you may wonder how youre going to pay your property taxes.

Before you panic, find out if youre eligible for one of six Texas property tax exemptions. If youre over 65 or disabled, check with your tax preparer to see if you qualify. You could save a significant amount of money and discover youre able to manage your taxes in Texas.

If youre not exempt and in danger of becoming delinquent on property taxes in Texas, you could incur debilitating fees and interest. Help is available with property tax assistance from Tax Ease.

Recommended Reading: How To File Taxes From Last Year

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

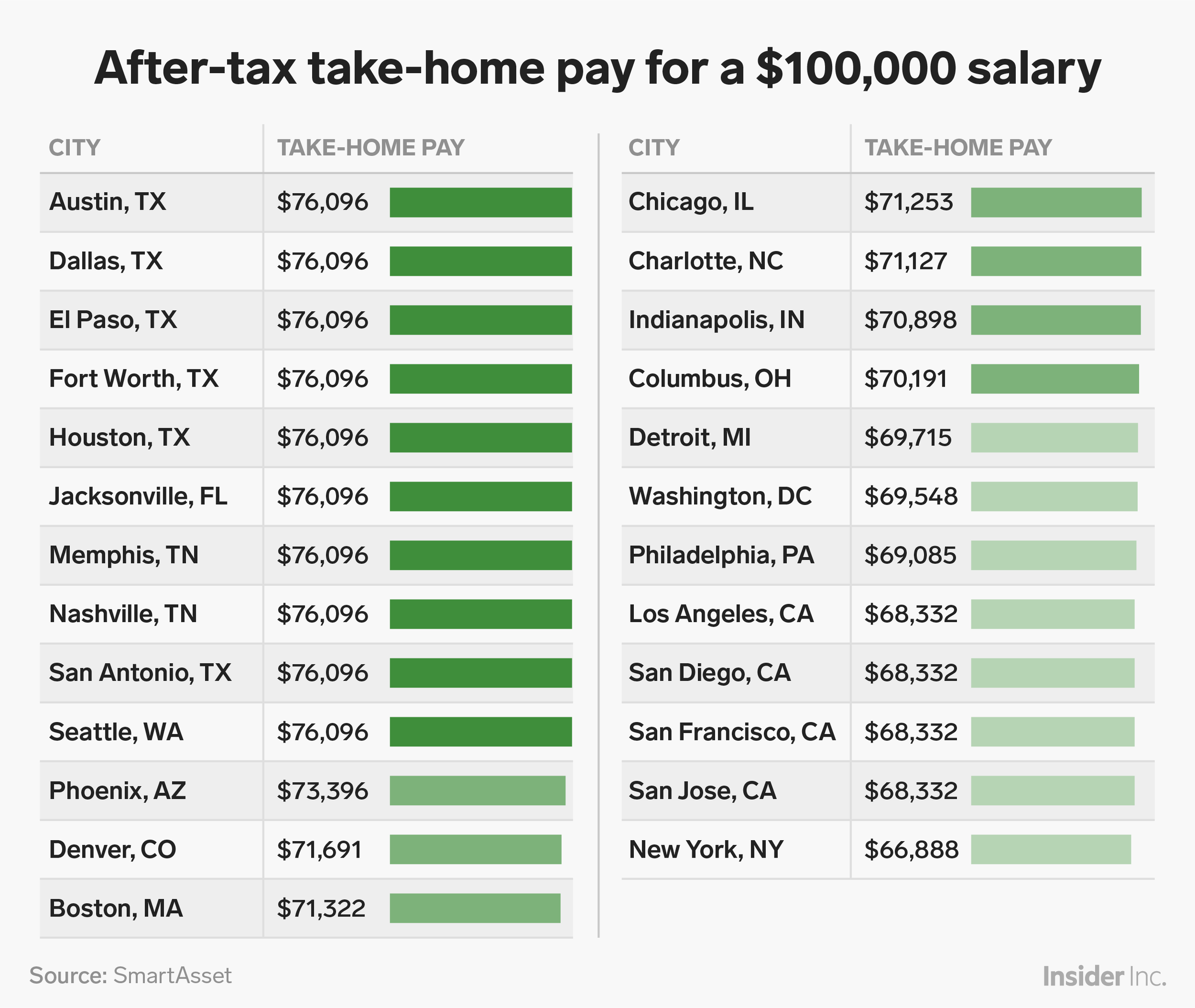

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Recommended Reading: How Do I File My Unemployment Taxes

Texas Sales Tax Calculator

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Texas has a 6.25% statewide sales tax rate,but also has 999 local tax jurisdictions that collect an average local sales tax of 1.684% on top of the state tax. This means that, depending on your location within Texas, the total tax you pay can be significantly higher than the 6.25% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Texas: