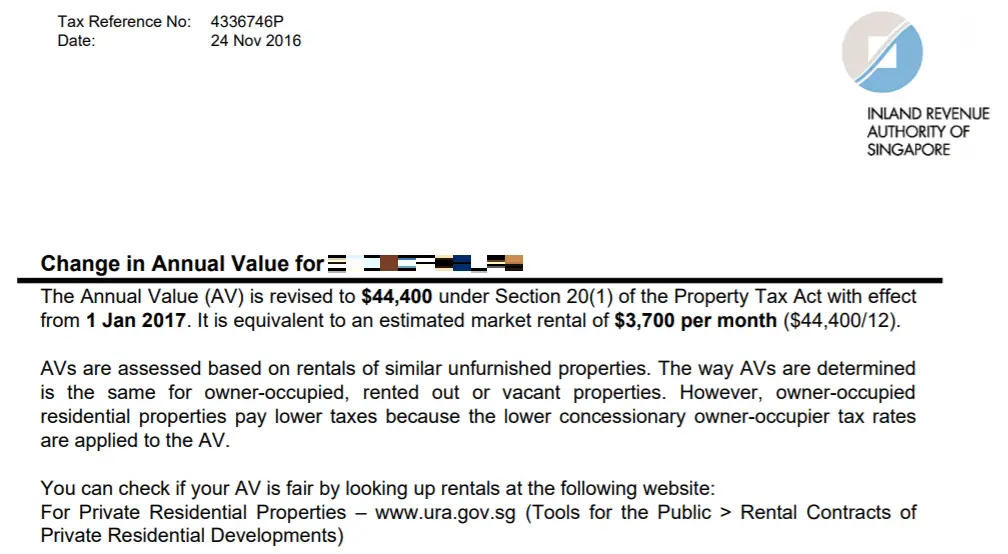

Property Owners Not On Giro

If you are not paying by GIRO, any additional tax payable is due 1 month from the date of notice.For instance, property owners receive their valuation notice on 23 Jun 2021, the payment due date will be on 23 Jul 2021, 1 month from the date of notice.For your convenience, we encourage you to pay your tax by GIRO. You can enjoy up to 12 months interest-free instalments or opt for a one-time GIRO deduction. Additional tax payable will be automatically reflected in your new payment plan and refunds will be credited into your account.

Find The Assessed Value Of The Property

To find your propertys assessed value, the local government will order an appraisal on the property. Some areas conduct annual appraisals. Others do them every 3 years or less frequently .

Some localities use the market value and others use the appraised value . Either way, they take a percentage of this value to come up with the assessed value.

The percentage they use is called the assessment ratio or the percentage of the homes value thats taxable. The ratios vary drastically around the country.

For example, if your homes market value is $300,000 and your local government taxes 60% of the value, youd pay taxes on $180,000 rather than $300,000.

Property Tax Overpayments At Year

If an overpayment has created a credit of less than $3,000 on your tax account at the end of the year, the credit will be transferred and applied to the next upcoming tax billing. This only occurs if there has not been an ownership change within the year of the credit and that the account is in good standing. If there are arrears on the account, such as other charges the credit will not be automatically transferred.

Recommended Reading: How Do I Find My School District Code For Taxes

Understanding The Difference Between Tax Rates And Home Value

Your home value is how much your home is currently worth. The tax rate is a percentage of your home value. Even if your tax rate remains the same next year, you still may owe more property taxes if the value of your home increased.

Lets say your home was worth $200,000 last year and the tax rate was 2%. You owed $4,000 last year in property taxes. This year, your tax rate stays the same at 2% but your home is now assessed to be worth $215,000. That means youll owe $4,300 this year.

Tax Policies And Mill Rates

After the Province, Regina Separate School Division, Regina Public Library Board and City determine their annual budgets, the City uses the mill rates and council-approved tax policies to calculate your property tax. Tax policies are set by Council and can impact the amount of property taxes paid. For example: during a revaluation, City Council reviews its current tax policies and any other tax policy options available.

The Province sets the tax policy for education property tax, including Province-wide mill rates to calculate the education tax for all properties.

You May Like: How Are Annuity Death Benefits Taxed

Apply Your Municipalitys Millage Rate

Youll typically see property taxes noted as millage rates. A mill rate is a tax you pay per $1,000 of your homes value. For every $0.001 mill rate, youll pay $1 for every $1,000 in home value.

It sounds complicated, but heres a simple formula. Find out your countys mill rate and divide it by 1,000. Next, multiply your homes assessed value by the mill rate, and thats your property tax liability.

For example, if your area’s mill rate is 8.5 and your homes assessed value is $200,000, youd do the following.

8.5/1000 = $0.0085

Why Is Your Mortgage Lender Even Involved In Property Taxes

If youre in the process of buying your home and taxes are brought up, or your lender has contacted you about property taxes, you may wonder why lenders even care about taxes. Unpaid property taxes can result in a lien. And that lien is superior to the rights of the lender.

That means if you go into foreclosure, the lender would have to pay any property tax liens on it before they can resell it and recoup their losses. This isnt something lenders want to deal with, so they often step in to ensure property taxes are paid the entire time youre paying the mortgage.

Recommended Reading: What Is Additional Child Tax Credit

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

How Can I Pay My Property Taxes

Most lenders will give you the option to tack your property taxes onto your monthly mortgage payment. To do this, they simply take your annual property taxes and divide the total amount by how many mortgage payments you make each year. Using the example above, if you made 12 monthly mortgage payments each year, your lender could add $406.25 onto each of your payments. With this option, your lender then takes on the responsibility of paying your municipality.

Alternatively, you can also pay the municipality directly, by phone, mail, online or by setting up a pre-authorized payment plan.

Also Check: What Is 1040 Sr Tax Form

How Much Are My Property Taxes

There is no universal rate for property taxes, as theyre calculated based on home value and the area where you live. Different zip codes will have different property tax rates, then factors like your homes age,size and condition will affect its assessed value.

To determine how much youll end up paying in property taxes, youll simply multiply your homes assessed value by the tax rate in your area, also called a levy.

Assessed value x your areas property tax rate = annual property taxes.

For example: The average home value in San Francisco, California, is about $1,500,000. Meanwhile, the property tax rate in the city is 1.18%. That means a San Francisco resident can expect to pay about $18,000 in annual property taxes.

Do I Really Need To Pay Property Taxes

Yes! Everyone who owns property has to pay property taxes. That includes homeowners. And if you own other types of property , youll pay property taxes on those too.

But if youre renting someplace, like an apartment or an office space, you dont have to worry about property taxes. Thats on your landlord!

You May Like: How Much Is H& r Block For Taxes

Who Can Participate In Epp

Homeowners can participate in the EPP providing the following conditions are met:

Are Property Taxes Included In Mortgage Payments

Paying property taxes is inevitable for homeowners. The amount each homeowner pays per year varies depending on local tax rates and a propertys assessed value .If youre unsure of how and when you must pay real estate taxes, know that you might be paying them along with your monthly mortgage payments.

A financial advisor can help you put a financial plan together for your home buying goals.

You May Like: How To Get My Income Tax Return Copy Online

Enrol For Monthly Automatic Withdrawals

Step 1: Request a Property Tax Monthly Payment Plan application form.

Step 2: Complete the application formunique to your property and tax account and sent to you by the City of Edmonton within 3 business days.

- Ensure you accept the terms and conditions of the Property Tax Monthly Payment Plan enrolment indicated on the reverse of the application form

- Include a VOID cheque or your financial institutions banking pre-authorization form

- If applicable, include a separate cheque for the initial payment or indicate how you are making the payment

Step 3: Return your signed application form to the City by mail or email.

- Ensure you submit an initial payment, if necessary

- Attach any additional documents, if required

Note:

- If you are paying property taxes on behalf of a property/business owner, include a letter of authorization with the completed application form

- If you are signing as the Executor or Power of Attorney, submit supporting documents with the completed application form

Properties With Deceased Owners

What I need to do as a legal representativeUpon demise of the owner, property tax notices will be addressed to the Legal Personal Representative of the Estate of the Deceased and the LPR is responsible for the payment of property tax.The LPR is also required to engage a lawyer or contact HDB to have the property legally transferred to the beneficiaries. The lawyer or HDB would then notify IRAS of the new owner/within 1 month of the transfer.Once IRAS has been notified of the new owner, IRAS will correspond with that person on all property tax matters, including payment of property tax.

Don’t Miss: How Do I Know If I Filed Taxes Last Year

Last Year’s Property Tax Amount

This amount indicates the previous years municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

What Impacts Property Taxes

Property taxes are explicitly tied to home value. What impacts home value? Mainly, the size, location and age of your home. All of these things contribute to how your home is assessed. A few factors to watch out for when thinking about property taxes are the following:

- Age of your home

- Median home value in your area

You May Like: Does Wyoming Have State Income Tax

How Much Is Too Much When You Pay Property Taxes

When youre on the hunt for a new home, youre probably thinking more about how big the backyard is than how much youll have to pay in property taxes. We get itthe backyard is way more fun to think about!

Still, if you forget to factor in property taxes, that backyard might not look so great when your first mortgage payment comes due!

At Ramsey, well always tell you to keep your monthly mortgage payment to no more than 25% of your take-home pay when buying a house. And that mortgage payment includes your property taxes. In other words, if those property taxes push your monthly payment above 25% of your income, you need to look elsewhere!

Lets go back to Jim and Pam. They bring home $6,000 per month, and theyre looking to buy a home that fits within their budget. That means a maximum monthly payment of $1,500.

They find two houses they like in neighboring towns. Both houses cost $200,000 and have an assessed value of $160,000.

The only difference between the houses is that the property tax rate in one town is 1% while the rate in the other is 2%. You might be thinking, 1% isnt that big of a deal. Oh, but it is!

If Jim and Pam move to the town with the higher property tax rate, that 1% difference means theyll pay twice as much in property taxes. Heres how that works out:

|

$1,388 |

$1,522 |

If they choose House B, theyll end up paying an extra $1,600 in property taxes each year. You can probably think of some things youd rather do with that kind of money!

Properties Being Sold Or Transferred

Upon completion of the sale or transfer of the property, property owners need not write in to notify IRAS of the successful sale/transfer. Usually the conveyancing lawyer would notify IRAS of the new owner/ within 1 month of the sale or transfer by filing a Notice of Transfer. Once the transfer of ownership has been updated, the new owner may access their property details via myTax Portal.

Once the sale or transfer is complete, all property tax related correspondence including property tax bills will be sent to the new owner. As the new property owner, you will be liable for property tax on the property.

Also Check: How Much Should I Put Aside For Taxes 1099

How Many Times A Year Do You Pay Property Taxes In California

Remember: UNDER CALIFORNIA LAW, IT IS THE RESPONSIBILITY OF THE TAXPAYER TO OBTAIN ALL TAX BILL AND TO MAKE TIMELY PAYMENT. For secured property taxes, the first installment is due November 1 and delinquent after December 10, and the second installment is due on February 1 and delinquent after April 10.

Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

Recommended Reading: What Time Do Taxes Need To Be Filed

What Months Do Property Taxes Cover In California

Taxes for the months of are due November 1st, with a late fee of 10% added if your payment is not postmarked by December 10th. Then, taxes for January through June are due by February 1st, with a late fee of 10% plus $10 added if you havent paid by April 10th.

How Does The Epp Work

Property taxes are billed in March, are due at the end of May and cover the period from January 1 to December 31 of each year. If you pay through EPP you do not need to worry about the payment deadline or incurring late payment penalties. The plan simplifies your budgeting by dividing your annual property tax amount into 12 equal monthly payments. These payments are automatically withdrawn from your bank account each month on a day you select between the 15th and the 28th of the month starting in March, with your account being paid in full after your February payment.

When you receive your annual Tax Notice in March of the following year your monthly payment will be adjusted to reflect the new total tax amount, ensuring your account is always paid in full.

EPP automatically continues from year to year, unless you contact us in writing to cancel. If you cancel your EPP participation for any reason, including sale of the property, all unpaid taxes become due and payable and subject to interest and penalties.

Note: The plan is based on a 12-month period. Depending on whenyour application is received, you may be required to make an initial payment equal to the missed payments up to the time your application is processed and the first payment is withdrawn from your account.

Read Also: What Expenses Are Tax Deductible For Self Employed

How Do You Know How Much You Owe In Property Tax

The amount you owe in property taxes is fairly easy to calculate. Youll just need some information:

- The assessed value of the home

- The property tax percentage for your area

For example, if youre in a county that charges a 1% property tax and your home and land are valued at $100,000, you would owe $1,000 in taxes. Typically, the county or other tax office issues a valuation assessment prior to or around the time it issues tax bills.

Your Property Tax Notice

The City is the agent for all property tax collection within its boundaries. Your property tax notice is a statement identifying how much your property tax is for the current tax year, including details of the taxing authorities that receive a portion of your tax dollars.

Supplementary Tax Notice

If you make changes to your home that affect the assessment, you may also receive a Supplementary Tax Notice in addition to your Tax Bill. This notice represents a change in your taxes for a portion of the year.

Also Check: Is Doordash Worth It After Taxes

Are California Property Taxes Prepaid

In California, you pay half the tax in advance, and the other half in arrears of the start of the fiscal year. Arrears, however, is a deceptive term because it literally means money owed as a past due amount. The due dates are set forth by state law and you must pay the taxes on those dates.