Where Does The Money Go

Public spending is expected to be £928 billion, £86 billion more than it was last year . This is £55 billion more than what the tax revenue will be this year, meaning that the HM Treasury has planned to use more money than what it has coming in. This is most probably due to COVID-19 and the cost of covering the NHS, as well as other help packages that the government has created to help the Brits and companies stay afloat.

This year, the biggest spend increase will be on net debt interest, which will see a 30% increase from £43 billion in 2019/2020 to £56 billion in 2020/2021. The biggest spending overall will be on social protection, which will get £285 billion to work with this year, £29 billion more than last year.

Public spending 2020/2021

| £23 billion |

Policy Basics: Where Do Our State Tax Dollars Go

Understanding where state tax dollars go and the trends in state spending can help state policymakers make good decisions about how to pay for important services now and in the future.

States help educate the nations children, build and repair its roads and bridges, provide health coverage to low-income families and their children, and much more. Many of these services are essential to building strong, healthy communities and the nations long-term economic vitality.

In total, the 50 states and the District of Columbia spent $1.2 trillion in state revenues in fiscal year 2016, according to the most recent survey by the National Association of State Budget Officers.

As a share of state spending, education has remained fairly constant over the last decade. The share of state budgets devoted to Medicaid has grown, the share devoted to corrections and transportation has fluctuated some, and the share for cash assistance to low-income families has declined.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Recommended Reading: Www..1040paytax.com

Policy Basics: Where Do Our Federal Tax Dollars Go

The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

In fiscal year 2019, the federal government spent $4.4 trillion, amounting to 21 percent of the nations gross domestic product . Of that $4.4 trillion, over $3.5 trillion was financed by federal revenues. The remaining amount was financed by borrowing. As the chart below shows, three major areas of spending make up the majority of the budget:

Two other categories together account for less than a fifth of spending:

This category contains the net interest function .

Tax Money During The Coronavirus Pandemic

The UK government has stepped up with financial help for companies and individuals in need during the coronavirus crisis. Here are some of the helpful actions that the government has taken to help:

Guaranteed business loansThe government made an initial £330 billion available to help businesses that are struggling.

Public services support£30 billion was added to support public services such as the NHS, individuals and businesses.

The Hardship FundThe government increased The Fund by 1,000% in April 2020 to help those in need. During the normal tax year, The Fund has £500,000 to help very low paid workers who are temporarily out of work as a result of crime. Since the effects of COVID-19 have been increasing the number of those without a steady income, £500 million have been made available to help provide council tax relief to those who need it the most.

Mortgage or rental holidayTo avoid evictions during the crisis, homeowners and tenants can apply to take a break from their rent and mortgage payments for three months.

Statutory Sick Pay Normally, when an employee takes a leave of absence due to sickness, the employer pays Statutory Sick Pay to the employee for up to 28 weeks. If you run a small or medium-sized business and one of your employees needs SSP, you might be eligible to reclaim the costs.

Don’t Miss: Freetaxusa Legit

Will Social Security Be Available When I Retire

Yes, if you are 50 or older right now. Younger than that age? Maybe, maybe not.

And even if it is still functioning, it likely wont pay out enough income for you to comfortably retire. That means you need to plan accordingly and start saving as much as possible by contributing to retirement accounts such as an IRA or a 401.

As massive as the Social Security fund is, its not massive enough to allow you to retire comfortably. Demographic trends show that more people will be retiring and taking money in the coming years, while fewer will be working and contributing to the fund.

The trust funds are predicted to grow through 2021. After that, the total cost of the program is expected to exceed its income.

Lawmakers have long known that reforms are necessary, but politicians have been petrified at the voter backlash that might ensue if they tinker with the program. But the clock is ticking, and the SSA predicts it will strike midnight in 2034.

Sadly, that means workers who have paid into the fund for decades likely wont be able to reap the benefits of the system and collect funds for retirement.

If that happens, the SSA says it will be able to pay benefits until 2090. So, in essence they are simply kicking the problem down the street and making it your kids and grandkids problem.

Two Weeks Left To Renew 2022 Transaction Privilege Tax License

The Arizona Department of Revenue is urging businesses to renew their TPT licenses, which are due January 1, 2022.

TPT licenses are valid for one calendar year, from January 1 through December 31.

Taxpayers must renew the license before continuing business in Arizona. Failure to renew, or renewals after January 1, will incur penalties and/or late fees.

You May Like: Does Doordash Send A 1099

What Does This Mean

While individual Americans have no direct control over how their tax dollars are spent, it’s important to know where the money goes. It’s especially important to understand that any major increases — say in defense spending, as President Donald Trump has proposed — require cuts elsewhere. With more than two-thirds of the budget going to social insurance programs, it’s hard, if not impossible, to make major changes without impacting those programs.

Most of your tax dollars go to taking care of other Americans, followed by paying for defense. The amounts devoted to everything else, including the most controversial and hotly debated government programs, amount to a relative pittance compared to the overall amounts being spent.

Where Do My Taxes Go

Tax Day has come and gone this year. Just because its gone, doesnt mean taxes are still not on peoples minds, especially when taxpayers have to pay into the IRS and dont receive a refund. Whether you are a disgruntled or curious taxpayer, were here to answer: Where are my tax dollars going?

Long story short, It was prepared by the Committee for a Responsible Federal Budget , a nonpartisan nonprofit group in Washington that monitors federal spending.

Looking at the graphic, you can see half of all spending goes for Social Security benefits and Medicare, while another 20% is for defense and military benefits. Fringe expenses include education, food stamps, refundable credits, transportation, and SSI.

Check out the breakdown here:

Allie Freeland

Allie is the Contributing Editor of the H& R Block blog, Block Talk. She has been a practicing grammar geek since 2007.

The tax experts at H& R Block outline how students and parents can file Form 8863 and document qualified expenses. Read about Form 8863 here.

You May Like: 1099 Form Doordash

How Are Our Tax Dollars Spent

Whether the average tax liability is just under $10,000 or a little less than $15,000, it’s still a lot of money for most people, and it’s important to know where those dollars go. Pew Research broke down how the United States federal government spent $3.95 trillion in 2016, with senior writer Drew DeSilver noting that the country is basically a giant insurance company that has a side business in defense:

About $2.7 trillion — more than two-thirds of the total — went for various kinds of social insurance . Another $604 billion, or 15.3% of total spending, went for national defense net interest payments on government debt was about $240 billion, or 6.1%. Education aid and related social services were about $114 billion, or less than 3% of all federal spending.

Every other program — public broadcasting, NASA, national parks, foreign aid, and everything else — adds up to the remaining 6% of the federal budget. Here’s how each major spending area breaks down:

- 24% Social Security

- 6% Other

- 3% Education

Historically, according to Pew, federal spending has hovered around 20% of gross domestic product . In 2016 total spending was 21.5% of GDP, and over the long term, the biggest growth in spending has been on the various human services programs . The share of GDP spent on defense has actually fallen to 3.3% in 2016 after hitting a high of 6% in 1986.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

You May Like: Is Doordash 1099

What Makes Federal Revenue Increase Or Decrease

The majority of federal revenue comes from individual and corporate income taxes as well as social insurance taxes. When individuals and corporations earn more money, they pay more in taxes, and thus federal revenue increases. Alternatively, if they make the same amount, but tax rates increase, the federal revenue will also increase. Decreases in federal revenue are largely due to either individuals or corporations making less money or a decrease in tax rates.

The federal government funds a variety of programs and services that support the American public. The federal government also spends money on interest it has incurred on outstanding federal debt, including Treasury notes and bonds.

What If Social Security Is My Retirement Plan

Do everything possible to keep that from happening. Americans are trying to correct that flawed strategy, though theres plenty of room for improvement.

The countrys retirement score was 83, according to the 2021 Fidelity Investments biennial Retirement Savings Assessment study a three-point improvement over a similar study done three years earlier. That score falls into the good zone. That score means the typical saver was on target to have 83% of the income Fidelity estimated they will need for retirement.

Thats up dramatically from a score of 62 in 2005, but the study also revealed that half of the 3,100 people surveyed probably wont have enough to cover essential retirement expenses.

A 2019 report by The Motley Fool is even grimmer. It found the average retirement savings for American families with some savings was just $65,000.

As insufficient as that number is, there are many other Americans who are headed for disastrous retirements in terms of financial aspects because of their lack of savings. One in four Americans have zero retirement savings, and among the others who are putting money away are likely under-saving. Coupled together, that meant the median for all U.S families was just $5,000 in savings.

Social Security cannot make up for that shortfall. The only strategy is to get your financial house in order and start saving more.

9 MINUTE READ

Read Also: Doordash Mileage Calculator

Here’s Where Your Federal Income Tax Dollars Go

You worked hard for that money youre about to send to the IRS in less than two weeks. Like many tax filers you’re probably asking yourself where all that money goes when the state and federal governments get their hands on it.

If you have trouble balancing your checkbook, imagine trying to keep track of where $3.6 trillion goes every year. Thats roughly what Uncle Sam spent last year.

For the complete, gory details, you can check the latest estimates from the official budget at the Government Printing Office, where youll find the governments finances sliced and diced by agency, department, function and source. But were going to skip reading the 250-page version and get our numbers from a summary analysis from the Center on Budget and Policy Priorities.

A $3.6 trillion budget has a lot of large numbers. To make it a little easier to imagine which of those tax dollars is yours, heres roughly how the federal budget compares to your budget and mine. Picture Uncle Sam, sitting at the kitchen table, trying to make ends meet.

Lets assume for this exercise that the federal budget came to $52,000 a year or $1,000 a week which is about the median household income in the U.S. For our purposes, that $1,000 a week is tax free.

Last year, the three biggest federal budget items were Social Security, health care and defense spending. So if Uncle Sam was a median wage earner, he’d have spent more than $600 of his $1,000 weekly paycheck on just those three programs.

Where Do All Your Tax Dollars Go Find Out With Our Tax Tracker

It’s the $2.8 trillion-dollar question many people ponder when they write that check payable to the U.S. Treasury. Where does all that money come from? And whereexactlydoes my money go?

If you have trouble balancing your checkbook, imagine trying to keep track of where $2.8 trillion goes every year. Even with armies of government accountants and auditors, it’s hard to know with certainty exactly where each dollar of your income taxes ends up.

What you will find when you look is a lot of very big numbers. To scale them down to what your budget looks like, here’sroughlyhow the federal government spent your money last year: Assuming you made $1,000 a week , the three biggest consumers of your money were Social Security and health careeach of which ate up about $230 of your $1,000 weekly paycheck.

Next up is military spending, which includes everything from salaries for the troops to new ships and fighter jets. That ate up about $160 of your $1,000a smaller piece of the pie than last year.

The Treasury Departmentwhich is in charge of collecting and accounting for all this moneytakes about $100 for itself. The biggest chunk of that goes to pay interest on the national debt.

Read MoreHow to file an extension on your taxes

And while some readers complain about seeing their tax dollars going to fund aid to other countries, it’s not a big number. Last year, $5.33 per thousand went to pay for international assistance.

Recommended Reading: Prontotaxclass

See Where Your Tax Dollars Go With Your Federal Taxpayer Receipt

OVERVIEW

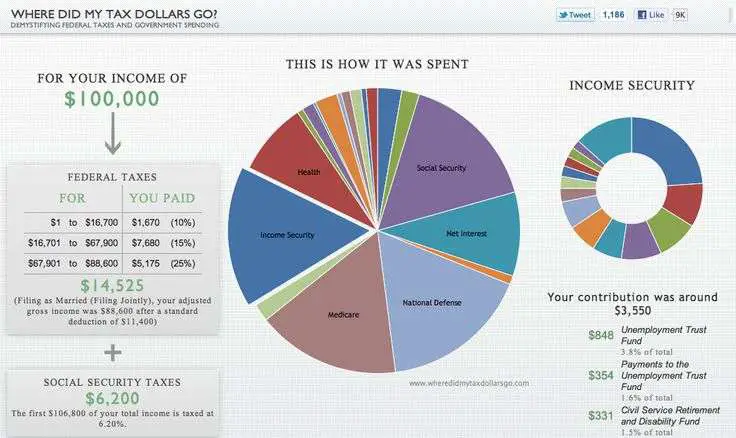

Your Federal Taxpayer Receipt is a new tool that shows you where your tax dollars are being spent.

Interested in finding out how your hard-earned tax dollars are spent? Now taxpayers can with the new “Your Federal Taxpayer Receipt” tool that The White House launched on April 15, 2011.

Simply enter a few details about your taxes and you’ll get a “receipt” that shows you how many of your tax dollars have been paid into various programs and services like national defense, health care, veterans’ benefits, space, science and technology, and education. You can expand each of these areas to see more-detailed breakdowns by category.

It’s okay if you don’t have your tax information handy. The Taxpayer Receipt allows you to choose from several income levels that can estimate this information for you.

If you’re interested in getting a peek into how the numbers in your receipt are calculated, a Behind the Numbers link lets you see the percentages of overall spending across federal programs and services for Fiscal Year 2017.

Try Your Federal Taxpayer Receipt now to see where your tax dollars went.

Where Do Your Federal Income Tax Dollars Go

Benjamin Franklin once said, Our new Constitution is now established, and has an appearance that promises permanency but in this work nothing can be said to be certain, except death and taxes.

We know enough about death, but have you ever thought about where your Federal Income Taxes go? Its a question Im often asked, so this article outlines my reply, updated annually as Federal income tax revenue changes.

So Exactly Where Did Your Federal Income Taxes Go Last Year?The National Priorities Project recently broke down the United States $4.2 trillion-dollar Federal budget detailing where your tax dollars were allocated. As you might have expected, the majority of your Federal income tax dollars go to Social Security, health programs, defense and interest on the national debt.

In 2015, the average U.S. household paid $13,000 in Federal income taxes. CNNMoney designed this easy-to-understand infographic based on a dollar bill to highlight where the Government spent the average tax receipts. The breakdown of your tax dollar includes:

The Details:

How You Can Minimize Your Federal TaxesIf youre tired of paying too much in taxes annually per the figures in this article, its time to schedule a consultation. Please contact me at BooksinBalance.com today to discuss your bookkeeping, accounting and tax planning for 2017.

You May Like: How To File Taxes As A Doordash Driver