Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Tax As % Of Income : 000

Did you know that you may not pay the same tax rate onall your income? The higher rates only apply to theupper portions of your income.

TaxAct Costs Less: File for less and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online 1040 filing products on 07/07/2022.

Maximum Refund Guarantee: If an error in our software causes you to receive a smaller refund or larger tax liability than you receive using the same data with another tax preparation product, we will pay you the difference in the refund or liability up to $100,000 and refund the applicable software fees you paid us. Find out more about our Maximum Refund Guarantee.

$100k Accuracy Guarantee: If you pay an IRS or state penalty or interest because of a TaxAct calculation error, we’ll pay you the difference in the refund or liability up to $100,000. This guarantee applies only to errors contained in our consumer prepared tax return software it doesn’t apply to errors the customer makes. Find out more about our $100k Accuracy Guarantee.

Satisfaction Guarantee: If you are not 100% satisfied with any TaxAct product, you may stop using the product prior to printing or filing your return. We are unable to refund fees after you print or e-file your return.

Refund Transfer: Refund Transfers are fee- based products offered by Republic Bank & Trust Company, Member FDIC. A Refund Transfer Fee and all other authorized amounts will be deducted from the taxpayers tax refund.

Calculating Income Tax Rate

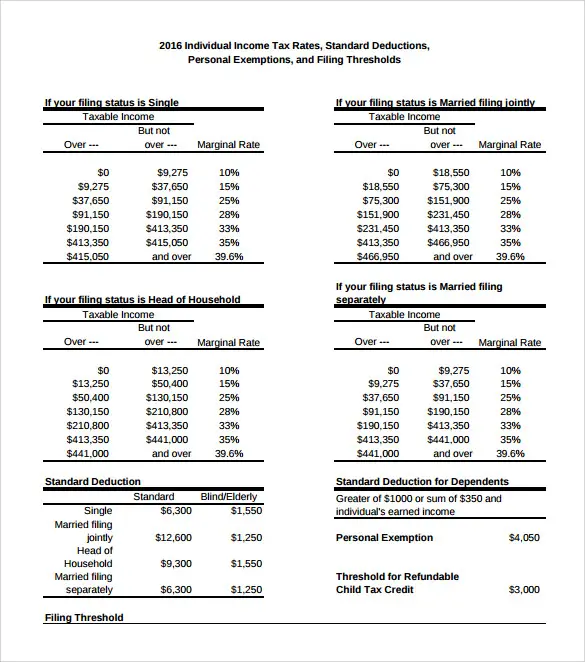

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

Also Check: When Do You Need To File Taxes 2021

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

Autumn Budget 2022 And How It Impacts Your Income As Calculator Shows If You’re Better Or Worse Off

The country is facing the biggest tax burden for many years with millions being hit in the pockets

- 08:20, 18 NOV 2022

The Autumn Statement landed yesterday , but millions of people around the country will be wondering what the real world impact will be on their finances. Although there were a few sops with cost of living payments, the UK is facing the biggest tax burden for many years – and headlines this morning reflected the grim nature of what Brits can expect, including youve never had it so bad.

Nottinghamshire Live has created an online calculator which will look at some of the big decisions made by the Chancellor and how it impacts on you if you enter some information. It will tell you what the impact is likely to be on your income and what you pay out.

Jeremy Hunt told the Commons yesterday that as of April 2023, the Minimum Wage will rise by 9.7 per cent – coming as a much-needed boost for around two million low-paid workers. The National Living Wage, which currently sits at £9.50 per hour for those aged 23 and over, will be raised by 92p to £10.42 from April next year.

Read more: Autumn Statement: Key change for 600,000 on universal credit announced

The minimum wage per hour paid to those between 21 and 22 will rise from £9.18 to £10.18. Also, from £6.83 to £7.49 for those aged 18 to 20, and from £4.81 to £5.28 for under-18s and apprentices.

Read next:

Read Also: What Is The Tax Rate On 401k After 65

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Jamaica Tax Calculator 2022/23

The Jamaica Tax Calculators in this section allow you to calculate income tax and payroll taxes and deductions. This includes calculations for employees in Jamaica to calculate their annual salary after tax and for employers to calculate their cost of employment for their employees in Jamaica. The Jamaica Tax Calculator and salary calculators within our Jamaica tax section are based on the latest tax rates published by the Tax Administration Jamaica . On this page you can use the latest tax calculator and find supporting links to relevant documents and

If you found the Jamaica Tax Calculator useful, please leave a rating below. This helps us to identify popular tools and allocate additional support. Please note you can find links to the income tax rates and historical salary calculators further donwn this page.

Read Also: Where Do I Mail My Taxes In California

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Budget Tax Calculator: What Does The Autumn Budget Mean For Your Pay

MILLIONS of households will be worse off following the news that the freeze on income tax will be extended.

As part of his Autumn Statement the Chancellor announced that rates and thresholds will be frozen until 2028.

Income tax is paid at different rates, depending on how much you earn – and some people pay nothing at all.

That’s because there’s something known as the personal allowance, which is an amount you can earn before you start paying income tax.

The current freeze was meant to come to an end in 2026, but extending this will drag millions more into paying a higher tax rate.

This is due to inflation and rising wages and will mean more workers will go over the thresholds for paying higher tax.

You May Like: What Is Property Tax In California

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

You May Like: What Is The Income Tax Rate In Arizona

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratiothat lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Also Check: Where Is My Unemployment Tax Refund

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

How To Use The Income Tax Calculator For Fy 2022

Following are the steps to use the tax calculator:

1. Choose the financial year for which you want your taxes to be calculated.

2. Select your age accordingly. Tax liability in India differs based on the age groups.

3. Click on ‘Go to Next Step’

4. Enter your taxable salary i.e. salary after deducting various exemptions such as HRA, LTA, standard deduction, and so on.

Or else, just enter your salary i.e salary without availing exemptions such as HRA, LTA, standard deduction, professional tax and so on.

5. Along with taxable salary, you must enter other details such as interest income, rental income, interest paid on home loan for rented, and interest paid on loan for self occupied property.

6. For Income from Digital Assets, enter the net income , such income is taxed at 30% Plus applicable surcharge and cess.

7. Click on ‘Go to Next Step’ again.

8. In case, you want to calculate your taxes under the old tax slabs,you will have to enter your tax saving investments under section 80C, 80D, 80G, 80E and 80TTA.

9. Click on ‘Calculate’ to get your tax liability. You will also be able to see a comparison of your pre-budget and post-budget tax liability .

Note: Whichever field is not applicable, you can enter “0”.

You can even get your tax computation on your mail.

Don’t Miss: How Much Do Business Owners Pay In Taxes

How Ameriprise Compares

When it comes to financial services companies, we offer a unique approach. Check out how Ameriprise compares to other financial advisor companies.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Road Tax For New Cars

If your car was registered after the 1st of April 2017, you will have to pay car tax. This tax amount is based on the CO2 emissions of the vehicle.

If your vehicle has emissions reading in the lowest bracket , the tax will be low too. However, even within the emissions brackets, there are three tax differentiations too – these are based on the type of fuel you put in your car.

The emissions brackets formally used to distinguish the price of tax are:

And the three categories of vehicle that can change the amount of tax you pay within each emissions bracket are:

The most expensive road tax is for category one with an emissions bracket of Over 255g/km. This costs £2,365 per year.

Recommended Reading: Where Can I Get My Tax Returns

How To Use The Take

To use the tax calculator, enter your annual salary in the salary box above

If you are earning a bonus payment one month, enter the £ value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Find out the benefit of that overtime! Enter the number of hours, and the rate at which you will get paid. For example, for 5 hours a month at time and a half, enter 5 @ 1.5. There are two options in case you have two different overtime rates. To make sure the calculations are as accurate as possible, enter the number of non-overtime hours in the week.

New! If your main residence is in Scotland, tick the “Resident in Scotland” box. This will apply the Scottish rates of income tax.

If you know your tax code, enter it into the tax code box for a more accurate take-home pay calculation. If you are unsure of your tax code just leave it blank and the default code will be applied.

If you have a pension which is deducted automatically, enter the percentage rate at which this is deducted and choose the type of pension into which you are contributing. Pension contributions are estimates, click to learn more about pension contributions on The Salary calculator.

If you receive Childcare vouchers as part of a salary sacrifice scheme, enter the value of the vouchers you receive each month into the field provided. If you signed up for the voucher scheme before 6th April 2011, tick the box – this affects the amount of tax relief you are due.