Send A Paper Return By Mail

If you are mailing someone elses paper return

If you prepare other peoples returns, mail each persons return in a separate envelope. However, if you file returns for more than one year for the same person, put them all in one envelope.

More Information About California Tax Payments

This information is provided for informational purposes only. State requirements are subject to change. To verify current requirements or to get more information on filing California tax returns, visit FTB.ca.gov. Alternately, you may call the customer service department of the California Tax Board at 800-852-5711 between 7 a.m. and 5 p.m. PST. The agency also has an automated help line, which can be reached 24 hours per day by calling 800-338-0505. Contacting customer service is a good option if you are wondering about the status of your tax filing, payment, or refund.

If You Do Not Have A Remittance Voucher

You can order personalized remittance vouchers and in some cases print your own. See Order remittance vouchers or payment forms.

You can also write any of the following identification details on the front memo field of your cheque:

- social insurance number,

- business number,

- non-resident withholding tax account number.

If you want to give us additional instructions indicating where you want your payment to be applied, include it on a separate sheet of paper in the mailing envelope.

You May Like: How Do I Find Out Property Taxes

Where Do I Mail My Federal Tax Return

If you’d likeTurboTaxs print feature becomes available on February 21 when NETFILE opens.

If you choose to print and mail your federal tax return, you have to wait until NETFILE opens for the tax season in February. Once completed, choose your province address from the list provided for specific mailing instructions:

Mail your tax return to:

Winnipeg Tax Centre

Mail your tax return to:

Sudbury Tax Centre

Area residents of Hamilton, Kitchener, London, Thunder Bay, Waterloo, and Windsor, mail your tax return to:

Winnipeg Tax CentreWinnipeg MB R3C 3M3

Area residents of Barrie, Belleville, Kingston, Ottawa, Peterborough, St. Catharines, Sudbury, and Toronto, mail your tax return to:

Sudbury Tax Centre

Area residents of Montreal, Outaouais, and Sherbrooke, mail your tax return to:

Sudbury Tax Centre

Residents of all other Québec areas, mail your tax return to:

Jonquière Tax Centre

View the CRA’s T1 return contact page for information on where to mail your tax return.

More like this

Where Do I Mail My California Tax Return

Sandy is a professional freelance writer and author. She specializes in health topics with a focus on Celiac disease, sleep apnea, and autism.

Are you wondering where to mail your California tax return? The question is very specific, but it also implies that an individual is forgoing the other options for filing their return. Both businesses and individual residents may electronically file their California tax returns. Those who opt to mail in their California taxes can still do so, but you may find that e-filing it is faster and just as safe.

Don’t Miss: How To Complete K1 Tax Form

Are You A Nonresident Or Part

If you work in California but are a resident in another state, or only a part-time resident in California, you will need to double-check to make sure your California taxable income on line 35 of Form 540NR is the correct amount. It needs to be accurately transferred from line 5, Part IV of Schedule CA.

Out Of State Employment

Residents living in northern California and working in may also be responsible for filing California taxes with that state. The same is true for residents of SoCal working . However, this does not apply to residents working in Nevada, as this state does not currently collect income tax.

Note: States & U.S. territories may make changes to their tax laws with little notice. We do our best to keep this information up-to-date, but it is provided on an “AS IS” basis. For more see our terms.

You May Like: Was Tax Day Extended 2021

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How Can I Get Property Tax Postponement For Senior Citizens Or Blind Or Disabled Persons

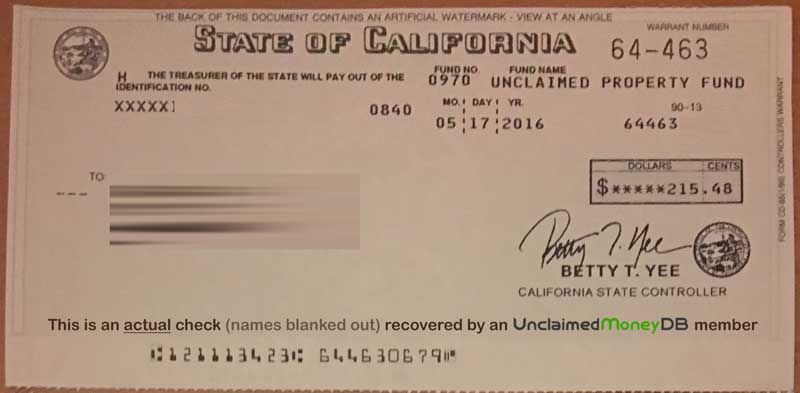

In September 2014, Assembly Bill AB 2231 Chapter 703, Statutes of 2014, reinstated a modified Property Tax Postponement program. The State Controller’s Office will begin accepting new PTP applications beginning October 1, 2016.

Go to the SCO website for more information. If you have any questions, call 1.800.952.5661 or email [email protected].

Also Check: How To File Your Taxes For Free

Can I Fax My Taxes To The Irs

You Cannot Fax Tax Returns While you cannot fax your tax return, you cant email them either. You have two options for filing your tax return: e-file it or mail it. IRS guidelines promote e-filing and for good reason. Its generally safer, faster and easier than preparing a paper return and mailing it.

How To File Your California State Tax Return

You have multiple options for tax preparation, filing and paying your California state income tax.

- E-file and pay for free with CalFile through the Franchise Tax Boards website. Youll need to create an account.

- File for free through an online tax-filing service.

- E-file through a fee-based tax-filing service.

- through the FTB website. You can complete and mail these forms to the Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001, if no balance is due or youre owed a refund. If youre filing with a payment, mail it to PO Box 942867, Sacramento, CA 94267-0001.

Recommended Reading: Are Donations To Nonprofit Organizations Tax Deductible

Tax Information For Tax Year 2021

For California residents the deadline for filing federal and state tax returns for the year 2021 is Monday, April 18, 2022. See the 2022 Tax Calendars .

San Francisco Public Library does NOT carry 1099 forms. To order 1099 forms, and other tax products, call the IRS assistance center at 829-3676.

Federal and California Tax Forms: The CA tax forms are not ready yet. Once CA State Franchise Tax Board updates their webpage we’ll update this page to reflect the new forms.

Filing A State Income Tax Return

The State of California requires an annual report of income, and assesses tax on the same type of income that is taxed by the federal government. However, unlike the federal government, California does not require an annual tax report from those who made less than the minimum filing requirement or had no income at all. Individuals who earned less than the minimum filing requirement do not have to file. Visit the Filing Requirements section of the California Franchise Tax Board for more information.

If you do not have a filing requirement but had state taxes withheld from your income, you will need to file a California tax return in order to receive any refund.

If you made income in another state and would like to know about that state’s filing requirements, please click here.

Don’t Miss: Can You File Taxes Before Feb 12

California Alcohol Cigarette And Gas Taxes

Products that face separate tax rates include alcoholic beverages, tobacco products and gasoline. For alcohol and cigarettes, rates are assessed based on the quantity of the product purchased. Wine, for example, faces a rate of 20 cents per gallon. For regular gasoline, there is a 51.10 cent per gallon excise tax.

When Are Current Year Secured Property Taxes Due

The Total Amount Due is payable in two installments:

The tax payment should be mailed to:Alameda County Treasurer-Tax Collector1221 Oak Street, Room 131Oakland, CA 94612

Read Also: Where Do I Get Irs Tax Forms

New Mailing Address For Some Western States As Fresno California Paper Tax Return Processing Center Closes

IR-2021-185, September 14, 2021

WASHINGTON The Internal Revenue Service will close its paper return processing center in Fresno, California, permanently at the end of September this year. Originally announced in 2016, this closure is part of a larger, ongoing efficiency strategy as most taxpayers now file electronically.

The number of individual returns taxpayers filed electronically has grown from 90 million in 2008 to over 145 million in 2020, which is more than 90% of all returns filed. The IRS expects this trend to continue for both individual and non-individual returns.

Wheres My Refund California

To check the status of your California state refund online, go to .

You will be prompted to enter:

- Social Security number

- Numbers from your address

- Your exact refund amount

Then, click on Check Your Refund.

You can check on refund status by phone: or Weekdays, 7 a.m. to 5 p.m.

You can check on refund status by chat. Sign into MyFTB to chat weekdays, 7 a.m. to 5 p.m.

You may send a letter asking for a status of your refund:

Franchise Tax Board

PO Box 942840

Sacramento CA 942840-0040

The refund normally takes up to two weeks to receive if you e-filed and up to four weeks for paper return.

Also Check: Can I File Taxes If I Have No Income

Email Notifications For Individuals

Email notifications gives you the option to receive correspondence online from the Canada Revenue Agency instead of by mail from Canada Post.

When you are registered to receive email notifications from the Canada Revenue Agency , we will send you an email to confirm that you are registered for the service. After that, when eligible correspondence is available for you to view in My Account or when important changes happen on your account, we will send you an email.

After you are registered for this service, CRA correspondence that is eligible for the service will not be printed and mailed to you.

Step : State Taxes With The Franchise Tax Board

Your PTA will need to file its state taxes annually:

- If your PTA has gross receipts of $50,000 or less, you can file a 199N electronically.

- If your PTA has gross receipts that are normally greater than $50,000, your PTA will need to file a Form 199.

- Once you have filed the 199N or Form 199, go to Step 4.

YOURE ALMOST DONE!

Don’t Miss: Are Debt Settlement Fees Tax Deductible

Assistance With Filing Your Return

-

Volunteer Income Tax Assistance and Tax Counseling for the Elderly – Search by city or county for best results.

-

Tax Aid provides free high-quality tax return preparation for Bay Area families.

-

Earn it! Keep it! Save it! List of Bay Area counties that offer tax help, courtesy of the United Way.

- Free Tax Help: File your taxes for free online and by phone.

-

If you believe a federal tax issue cannot be resolved online or over the phone, call the Taxpayer Assistance Center at 1-844-545-5640.Or find a TAC near you. Assistance at the TAC requires an appointment.

What Is An Unsecured Property Escape Tax Bill

An unsecured escape assessment is the increased amount in valuation over the regular assessed valuation from a delayed reappraisal of the property and/or an erroneously applied homeowner’s exemption valuation reduction where the taxes are not a lien against real estate. An unsecured personal property escape tax bill taxes the increased amount over the regular tax bill. An unsecured property escape tax bill based on real property retroactively taxes the increased amount of valuation over the regular tax bill.

Read Also: How To Get Out Of Capital Gains Tax

Fill Out The Correct Form For Your Business

Amended return forms, by business type| Business type | |

|---|---|

|

|

|

|

| Limited Liability Company : |

|

What Is A Secured Property Supplemental Tax Bill

A supplemental assessment is an adjustment in real property valuation resulting from upward changes in assessed value due to changes in ownership or completion of new construction. A secured property supplemental tax bill retroactively taxes the supplemental assessment of property on a pro- rata basis as a result of the assessor’s reappraisal of property at its full cash value on the date that a change in ownership occurs or new construction is completed.

Recommended Reading: What Are New Market Tax Credits

Workshop: California State Income Tax Filing

Attend of the workshop during March or April to learn about the California state’s filing requirements. A member of the California Franchise Tax Board will present these workshops to assist you with filing any required state tax forms. We recommend completing your federal tax return before attending one of these workshops. Students or scholars who are considered nonresidents for California state tax filing will complete and file California Tax Form 540NR those who are considered residents for California state tax filing will complete and file California Tax Form 540.

The 2022 workshops have concluded. The next-year workshop information will be posted here in the beginning of 2023.

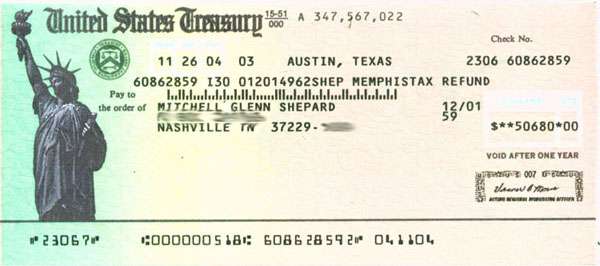

Where To Send Your Individual Tax Account Balance Due Payments

| Internal Revenue Service CenterAustin, TX 73301-0010 | |

| Alabama, Alaska, Arkansas, California, Delaware, Georgia, Hawaii, Illinois, Indiana, Iowa, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Washington, Wisconsin | Internal RevenueService CenterKansas City, MO 64999-0010 |

| Arizona, Colorado, Connecticut, District of Columbia, Idaho, Kansas, Maryland, Montana, Nebraska, Nevada, North Dakota, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, West Virginia, Wyoming | Internal RevenueService CenterOgden, UT 84201-0010 |

| All APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the Virgin Islands*, Puerto Rico , a foreign country: U.S. citizens and those filing Form 2555, 2555-EZ, or 4563 | Internal Revenue |

Don’t Miss: How To Do Your Own Taxes

Sales & Use Tax In California

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration and pay the state’s sales tax, which applies to all retail sales of goods and merchandise except those salesspecifically exempted by law. The use tax generally applies to the storage, use, or other consumption in Californiaof goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchasesshipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate,and any district tax rate that may be in effect.

State sales and use taxes provide revenue to the state’s General Fund, to cities and counties through specific statefund allocations, and to other local jurisdictions.

What Happens If My Current Year Secured Property Tax Amount Due Is Unpaid By June 30 At : 00 Pm

If the amount due is unpaid at 5:00 p.m. June 30, it will be necessary to pay delinquent penalties, costs, redemption penalties which accrue on the first of every month at the rate of 1.5%, and a redemption fee. If June 30 falls on a Saturday, Sunday or legal holiday, no redemption penalties shall attach if payment is made by 5:00 p.m. on the next business day. Property delinquent for the first year shall be declared defaulted for non-payment of taxes. After 5 years, the Tax Collector has the power to sell tax-defaulted property that is not redeemed.

Also Check: Do I Have To Pay Taxes

How Do I Send My Tax Documents To The Irs

Use the U.S. Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS. Mailing Tips

What Are Unsecured Property Taxes

Taxes on property that are not a lien against real property sufficient, in the assessor opinion, to secure payment of taxes. Taxes on unsecured property tax the assessments on personal property such as office furniture, machinery, equipment, boats, airplanes, etc., and assessments based on real property that are not a lien against real property.

You May Like: When Do Child Tax Credits Start

Where Do I Send My 3911 Tax Form

Where do I send Form 3911 for stimulus check? You can write to the Internal Revenue Service, Attention: Tax Products Coordinating Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001.

- Per Form 3911 you should mail the form to the Internal Revenue Service center where you would normally file a paper tax return. To find the mailing address, please select your state from the IRS Where to File Paper Tax Returns With or Without a Payment site.