What Are The Outcomes

To date, $51 billion has been invested in low-income communities through the NMTC program, supporting a wide variety of activities including: small businesses, manufacturing facilities, for sale housing, charter schools, health care centers, child care centers, shopping centers and grocery stores, to name but a few.

Approximately seventy-five percent of projects are located in severely distressed communities, characterized by poverty rates of greater than 30 percent, median family incomes of less than 60 percent of the area median income, or unemployment rates at least 1.5 times the national average.

Through 2017, NMTCs financed 6,619 businesses and real estate projects, helping to develop or rehabilitate 205 million square feet of real estate and creating or retaining 800,200 jobs.

It has been estimated that the NMTC generates over $8 of capital for every $1 of federal subsidy.

The Government Accountability Office reported that an estimated 88 percent of NMTC investors said that they would not have made the same investment without the NMTC.

Ongoing Training And Guidance

- In-house compliance program creation with customized onsite training

- Community Impact Information System reporting and documentation Documentation for maintenance of CDE status

- Semi-annual testing procedures

- Investment/QLICI/QALICB due diligence and documentation

- Establishing procedures for data collection and filing IRS Form 8874A

New Markets Tax Credit Program: How It Works

The New Markets Tax Credit program, or NMTC, attracts investment for real estate projects, community facilities, and operating businesses. New Markets Tax Credits are federal income tax credits used to encourage private investment in low-income communities around the United States. This video provides a basic overview of the NMTC program and projects that are particularly attractive for investment. To find out if your project is eligible, visit the Baker Tilly New Markets Tax Credit mapping tool.

For more information on this topic, or to learn how Baker Tilly project finance specialists can help, contact our team.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments.

Read Also: Irs Employee Lookup

Awards Will Spur Economic And Community Development Nationwide

Washington– The U.S. Department of the Treasurys Community Development Financial Institutions Fund announced $5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide. A total of 100 Community Development Entities were awarded tax credit allocations, made through the calendar year 2020 round of the New Markets Tax Credit Program .

These investments will create jobs and spur economic growth in urban and rural communities across the country, Secretary of the U.S. Treasury, Janet L. Yellen, said. Many of the communities that will receive these funds have confronted economic challenges over many decades. Challenges which have been made more difficult by a lack of investment. Its critical that Congress sustain these investments over time by making the New Markets Tax Credit Program permanent.

For over 20 years, the New Markets Tax Credit has facilitated essential investments into low-income communities and businesses helping them to rebuild after years of disinvestment and enabling them to recover from external forces, such as the current pandemic, which have caused disproportionate harm to the businesses and families in these communities, said CDFI Fund Director Jodie Harris.

An Overview Of The New Markets Tax Credit

Chad Qian

Earlier this year, Senator Roy Blunt and Senator Ben Cardin introduced the New Markets Tax Credit Extension Act of 2019, which would permanently extend the New Markets Tax Credit and increase NMTC allocations, among other changes. The NMTC was originally established by the Community Renewal Tax Relief Act of 2000. It was part of a broader set of Third Way reforms under the Clinton administration that aimed to improve conditions in poor communities via ostensibly market-friendly policies. The NMTC is currently set to expire at the end of this year.

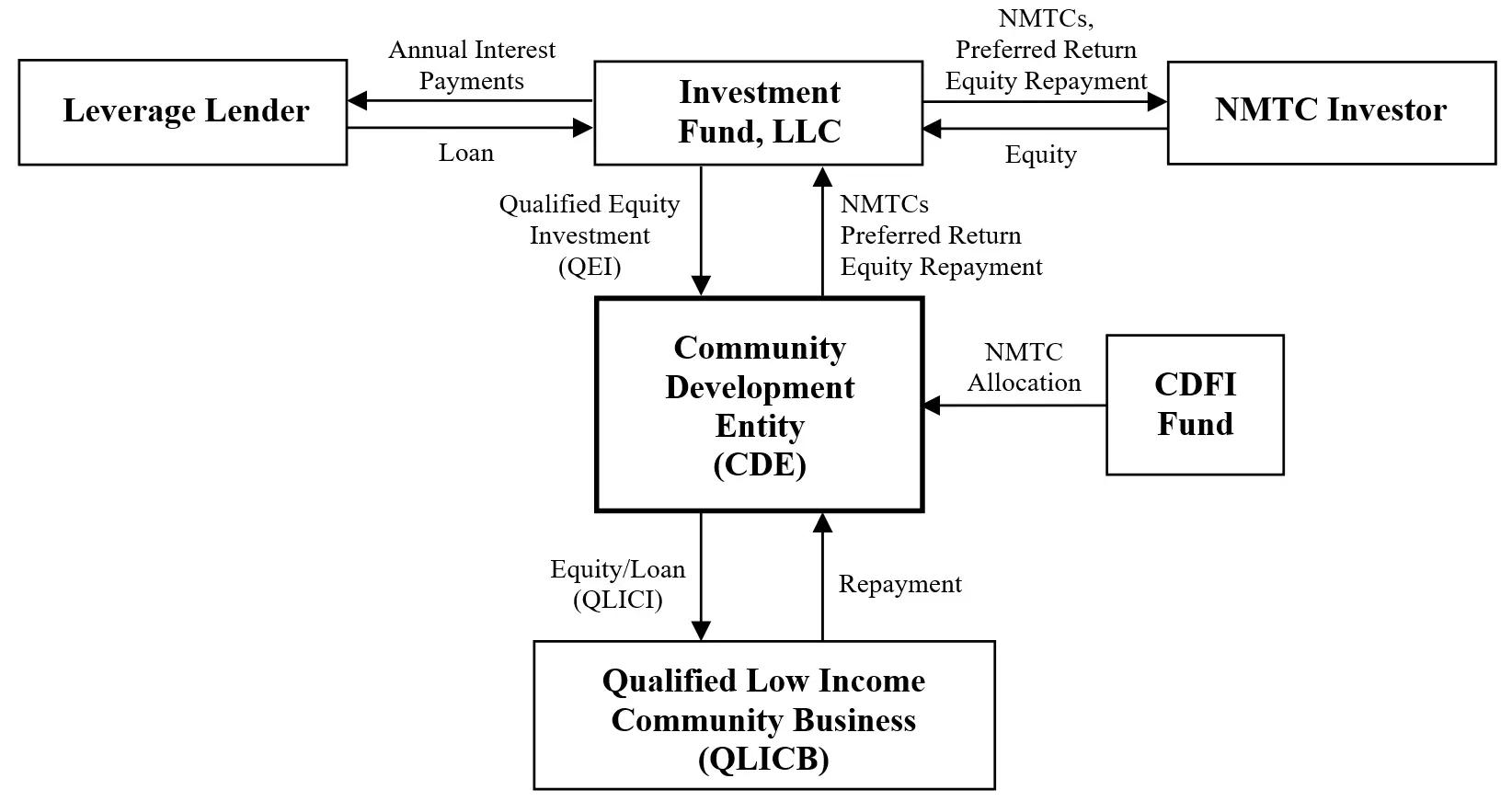

Under the NMTC program, the Community Development Financial Institutions Fund, a part of the Treasury Department, reviews applications by investment entities, known as Community Development Entities . These CDEs need to have a primary mission of serving low-income communities, and they need to have local community representation on governing or advisory boards . In reviewing applications, the CDFI Fund ranks CDEs according to their business strategy, capitalization strategy, management, and expected community impact, then awards NMTC allocations to qualifying CDEs. These CDEs then go on to attract investors, who provide equity investment to the CDEs.

You May Like: Doing Taxes For Doordash

Demystifying New Market Tax Credits

Summer 2009

The New Market Tax Credit program can be intimidating for even the most knowledgeable business, real estate and banking professionals, and yet, the program is a beneficial tool for financing certain real estate and other projects that otherwise wouldnt have the necessary funds to get off the ground. The New Markets Tax Credit program is a federal program that was created to address the lack of capital available to business and economic development ventures in low-income communities and hurricane-damaged areas. As such, it has been a tremendous resource and one of the most effective government programs helping south Louisiana and other Gulf Shore areas recover from Hurricane Katrina. The NMTC program is not limited to storm damaged areas, it also is available nationally to low income areas, called census tracts. There are qualifying census tracts located throughout the state including: Lafayette, Baton Rouge, Lake Charles, ShreveportBossier City, New Orleans, Houma, Monroe and Alexandria.

Heres how the program works:

Over the past two years, McGlinchey Stafford has been involved in several NMTC deals that funded projects benefiting the New Orleans area including:

- funding of acquisition costs for a major medical facility located in Kenner, which reopened after Katrina and brought back more than 400 permanent jobs and

- renovation and construction of a 4,000 square foot outpatient imaging facility, including MRI and CT Scan, to be located on Magazine Street.

What Has Been Lisc’s Involvement

LISC has placed $987 million in NMTC equity investments in 130 different projects in low-income communities throughout the country, supporting $2.7 billion in total development costs.

To date, LISC NMTC investments have supported:

- More than 20,000 construction and permanent jobs

- 10.6 million square feet of commercial and community space

- Healthcare facilities serving almost 4000,000 patients

- Educational facilities serving 45,000 students

- More than to 670 housing units

LISC has invested NMTCs in community projects including retail, manufacturing, arts, healthcare and childcare facilities, and schools. Some examples include:

Recommended Reading: Efilemytaxes

New Market Tax Credit Program

The New Market Tax Credit Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. The NMTC Program attracts private capital into low-income communities by permitting individual and corporate investors to receive a tax credit against their federal income tax in exchange for making equity investments in specialized financial intermediaries called Community Development Entities .

The Treasury Departments Community Development Financial Institutions Fund allocates tax credit authority to CDEs who to offer tax credits to investors in exchange for equity in the CDE. Using the capital from these equity investments, CDEs can make loans and investments to businesses operating in low-income communities on better rates and terms and more flexible features than the market. In exchange for investing in CDEs, investors claim a tax credit worth 39% of their original CDE equity stake, which is claimed over a seven-year period.

CDEs have approved service areas that range from local to national in scale. CDEs that may have available NMTC allocation authority remaining, and the amount of Qualified Equity Investments not yet raised, can be identified on the CDFI Fund website.

NMTC-qualified low income Census Tracts exist in all 5 counties of the Austin MSA and can identified with the CDFI Funds mapping tool.

What Are New Markets Tax Credits And How Do They Help Communities

The New Markets Tax Credit Program is a federal initiative created to spur private capital investment in low-income communities. Created under the Community Renewal Tax Act of 2000, NMTCs are allocated by the Community Development Financial Institutions Fund , a bureau within the United States Department of Treasury, under a competitive application process.

NMTC funding is available to certified Community Development Entities . Our experienced professionals at the Tax Advantage Group by Cherry Bekaert can assist with the preparation and filing of the CDE Certification application to the CDFI Fund. We also provide strategic planning related to the CDEs Controlling Entity and Governing and Advisory Boards.

We work in all areas of the NMTC Program, including Community Development Entity Certification, NMTC Allocation Applications, NMTC Management Services, and NMTC Placement.

The TAG by Cherry Bekaert team has successfully closed over $877 million of NMTC transactionsdemonstrating our broad range of project experience including community facilities, manufacturing and distribution facilities, and mixed-use real estate investments.

Weve been involved with NMTCs from day one, and related types of financing programs for decades. If youre looking for the team thats best positioned to help you navigate this landscape from start to finish, youve found it in TAG by Cherry Bekaert.

Learn More About Our Additional Strategic Financing Capabilities:

Recommended Reading: Filing Taxes With Doordash

Developers & Project Sponsors

We work locally and nationally with mission-driven developers, sponsors, and other Community Development Entities to build transformative projects in communities across the country. A small sample of the work weve accomplished with our partners includes:

- Unwinding NMTC transactions at the end of the compliance period

New Markets Tax Credits: Understanding The Power Of The Nmtc Program

Neal Hefferren

The New Markets Tax Program was created in 2000 under the Community Renewal Tax Relief Act to attract private capital to those projects benefiting low-income communities and persons, create jobs, and encourage additional economic development.

Projects in these communities have historically had trouble finding such investment, resulting in a lack of resources to meet community needs, including projects like job training centers, community health centers, grocery stores, mixed-use commercial developments, hospitals and others. NMTC helps these projects happen.

The Program, administered by the Community Development Financial Institutions Fund , a division of the U.S. Treasury Department, attracts private investment by awarding federal income tax credits to investors in return for their equity investments in qualified projects. These credits, equal to 39% of the investment made, are a dollar-for-dollar reduction in an investors tax liability, and are claimed over a seven-year period.

According to the CDFI Fund, the Program has been very effective, noting that since 2003, the NMTC Program has:

- Supported the construction of 37 million square feet of manufacturing space, 80 million square feet of office space, and 61 million square feet of retail space, and

- Catalyzed a ripple effect spurring further investments and revitalization in low-income communities

Lets first take a look at what projects are eligible for the NMTC Program.

Recommended Reading: How Much Is Taxes For Doordash

Importance Of Information For Investors

Many investors, especially the ones who manage their own portfolios with individual stocks instead of ETFs and mutual funds, should try and stay as updated about the market and businesses as possible. The more you know about a business, the better youll understand it as a potential investment.

Upcoming mergers, new product launch, legal complications, management overhauling, and several other factors can cause stocks to soar or tank. And if you are well informed about the market, you can make timely investment decisions based on the information you have.

An example would be Chorus Aviation . Stocks related to traveling and tourism started falling a bit before the broader market did. Chorus started seeing a downward motion in January. Though it didnt crater till February along with the rest of the market, many investors who anticipated what the pandemic could do to the airline unloaded it before the sell-off frenzy.

Between mid-February and early March, the stock went from $7.9 to 5.7 per share. Those who were well informed, read the analysis of the pandemic, and anticipated similarities from the SARS situation might have made the right call and sold early on.

Use With Other Programs

Sometimes the investors contribution and a loan from an LL are still not enough to completely fund a project. In those cases, the NMTC benefits may be combined with other incentive programs, such as Historic Preservation Credits, grants, charitable contributions if the QALICB is a non-profit, or state credits mirroring the federal NMTCs

Recommended Reading: Does Doordash Give 1099

Fee Imposed On Tax Credit Recipients

The DED has the authority to charge a fee in an amount up to 2.5% of the amount of tax credits issued. The implementation of this fee is effective on all applications received by the Department after September 7, 2005. Applications for entitlement tax credit programs currently held by the department where hard construction commences by October 15, 2005 shall not be subject to the fee. The fee shall be payable for deposit in the Economic Development Advancement Fund prior to the issuance of tax credits.

- The tax credit is not refundable or transferable. Any amount of credit that cannot be used in the taxable year may be carried forward to any of the taxpayers five subsequent taxable years.

- Tax credits earned by a partnership, limited liability company, S-corporation, or other pass through entity may be allocated to the partners, members or shareholders of such entity for their direct use in accordance with the provisions of any agreement among such partners, members, or shareholders.

- Qualified investments shall not be made following fiscal year 2010, unless the program is reauthorized by the general assembly.

The Hotels Nmtc Program Motivates Investments In Distressed Neighborhoods For Economic Rejuvenation

NMTC investors make financial commitments in organizations referred to as Community Development Entities which in turn offer funding to organizations in low-income neighborhoods.

The purpose of the solution is to spur desirable financial revitalization in these local areas.

A CBO Financial Subsidiary, Community Development Funding, LLC was one of only 66 teams to obtain NMTC allowance in Round 1 in 2003, and among 62 teams to be given an allotment in Round 2 – among only 10 groups to receive both 1st and 2nd round allotments.

Ever since, the CBO team has moved on to receive even more allotments for our own CDE, and assisted a wide range of clients with establishing CDEs and effectively looking for a direct NMTC allocation award. NMTCs develop benefits to tax credit financiers, companies that require capital, and state and local government and financial development bodies.

Don’t Miss: Tax Deductible Home Improvements

New Markets Tax Credit Program

| This article is part of a series on |

The New Markets Tax Credit Program is a federal financial program in the United States. It aims to stimulate business and real estate investment in low-income communities in the United States via a federal tax credit. The program is administered by the US Treasury Department’s Community Development Financial Institutions Fund and allocated by local Community Development Entities across the United States.

Minimize Your Nmtc Transaction Tax Obligations

We mitigate the impact of various federal and state taxes in your NMTC liquidation transaction. Specifically, we address original issue discount regulations, fee allocations with regard to deductibility timing, the impact of fees on recipients, QEI/investor redemption calculations under the Section 45D Safe Harbor provision, and imputed interest calculations, among other considerations.

Read Also: Donating Plasma Taxes

New Markets Tax Credits For Community Impact

Eleazar Bueno, Empanadas Monumental, New York City

Lendistry has been allocated New Markets Tax Credits by the U.S. Treasurys CDFI Fund to give historically underserved small businesses a chance to receive lower-cost financing than theyve had access to in the past. Weve partnered with Monge Capital, a minority business entity, to attract traditional investors to the underbanked business community.

Leverage Lender Benefits And Concerns

Lenders will typically enter into these transactions for a few different reasons. Primary among these is economic: theyre lending funds in exchange for lending fees. Additionally, they have the opportunity to create business relationships in areas where other banks may have been reluctant to lend. Further, subject to certain requirements, making these loans may help the bank meet its CRA requirement. CRA is the Community Reinvestment Act enacted by Congress in 1977, which encourages banks to help meet the credit needs of their communities for housing and other purposes, particularly in neighborhoods with low or moderate incomes.

Notwithstanding these benefits, lenders unfamiliar with the NMTC leveraged structure may have some hesitation about loan terms necessitated by the Programs rules. The primary loan limitation is that the LL cant have a direct mortgage on the projects property.

In order to give the LL comfort with this limitation, the A loan is typically secured by a pledge of the Investment Funds membership interest in the CDE. This means that if the QALICB defaults on the A Loan, and the CDE forecloses the loan, the LL can cause the foreclosure proceeds to be deposited in the Investment Fund, and then repaid to the LL to make it whole.

Don’t Miss: How To Get A 1099 From Doordash

Cdfi Fund Announces $5 Billion In New Markets Tax Credits

Awards will Spur Economic and Community Development Nationwide

WASHINGTON The U.S. Department of the Treasurys Community Development Financial Institutions Fund announced $5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide. A total of 100 Community Development Entities were awarded tax credit allocations, made through the calendar year 2020 round of the New Markets Tax Credit Program .

These investments will create jobs and spur economic growth in urban and rural communities across the country, Secretary of the U.S. Treasury, Janet L. Yellen, said. Many of the communities that will receive these funds have confronted economic challenges over many decades. Challenges which have been made more difficult by a lack of investment. Its critical that Congress sustain these investments over time by making the New Markets Tax Credit Program permanent.

For over 20 years, the New Markets Tax Credit has facilitated essential investments into low-income communities and businesses helping them to rebuild after years of disinvestment and enabling them to recover from external forces, such as the current pandemic, which have caused disproportionate harm to the businesses and families in these communities, said CDFI Fund Director Jodie Harris.