How To Apply For Benefits And Credits

To apply for the Canada child benefit and to register your child or children for theGST/HST credit, fill out and send the followingtwo forms to the Canada Revenue Agency :

To apply for the GST/HST credit for you or your spouse or common-law partner, fill out Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada for the year that you became a resident of Canada. Use this form only if you don’t have children. If you have children under 19, use My Account or Form RC66, Canada Child Benefits Application.

If you live in Quebec, you should also apply for child assistance through Retraite Québec.

Include the following information with your application:

- Record of Landing or confirmation of permanent residence issued by Citizenship and Immigration Canada

- Citizenship certificate

- Notice of Decision or a Temporary residents permit issued under the Immigration and Refugee Protection Act

- valid temporary or permanentmailing address

- a void cheque if you are applying for direct deposit

- proof of birth for your children who were born outside Canada

Note

Include the amount of income you earned before you entered Canada on Form RC66SCHand Form RC151.

Residency Under Us Tax Law

The taxation of an individual who is not a U.S. citizen or U.S. national is dependent on the residency status of such individual.

In general, the controlling principle is that U.S. tax residents are taxed in the same manner as U.S. citizens on their worldwide income, while nonresidents are taxed according to special rules contained in certain parts of the Internal Revenue Code .

An individual who obtains a green card is treated as a lawful permanent resident and is considered a U.S. tax resident for U.S. income tax purposes. For assistance in determining whether you are a U.S. tax resident or nonresident please refer to Determining Alien Tax Status.

In general, when you initially obtain a green card, your residency starting date is the first day in the calendar year on which you are present in the United States as a lawful permanent resident officially approved your petition to become an immigrant).

If you received a green card abroad, then the residency starting date is the first day of physical presence in the United States after you received the green card. For more information, please refer to Residency Starting and Ending Dates.

For tax years in which you are both a U.S. tax resident and nonresident , please refer to Taxation of Dual-Status Aliens.

Individual Taxpayer Identification Number

Unauthorized immigrants are also eligible to file taxes using whats called an ITIN number.

These numbers allow individuals who are not eligible for a Social Security number to pay taxes they are required to pay to the federal government.

The IRS estimated that in 2015, about 4.4. million people paid their taxes using ITIN numbers. They paid about $5.5 million in Medicare and payroll taxes and about $23.6 billion in total taxes.

And while those figures are not exclusively attributed to unauthorized immigrants, using ITIN numbers to pay taxes is one of the most popular ways for them to do so, said Alex Nowrasteh, director of immigration studies at the libertarian Cato Institute.

This is a nice workaround for everybody and especially for unauthorized immigrants who want to keep their noses clean and attract as little attention as possible, Nowrasteh said.

Nowrasteh said that upwards of 75% of unauthorized immigrants file taxes with the federal government. He added that the existence of ITIN numbers is a sign of the governments desire to collect taxes regardless of status.

Its an indication of how broken a lot of the immigration system is, but it is a workaround that is probably the least bad option when compared to the other options, which are identity theft and borrowing someone elses Social Security number, Nowrasteh said.

Also Check: Ccao Certified Final 2020 Assessed Value

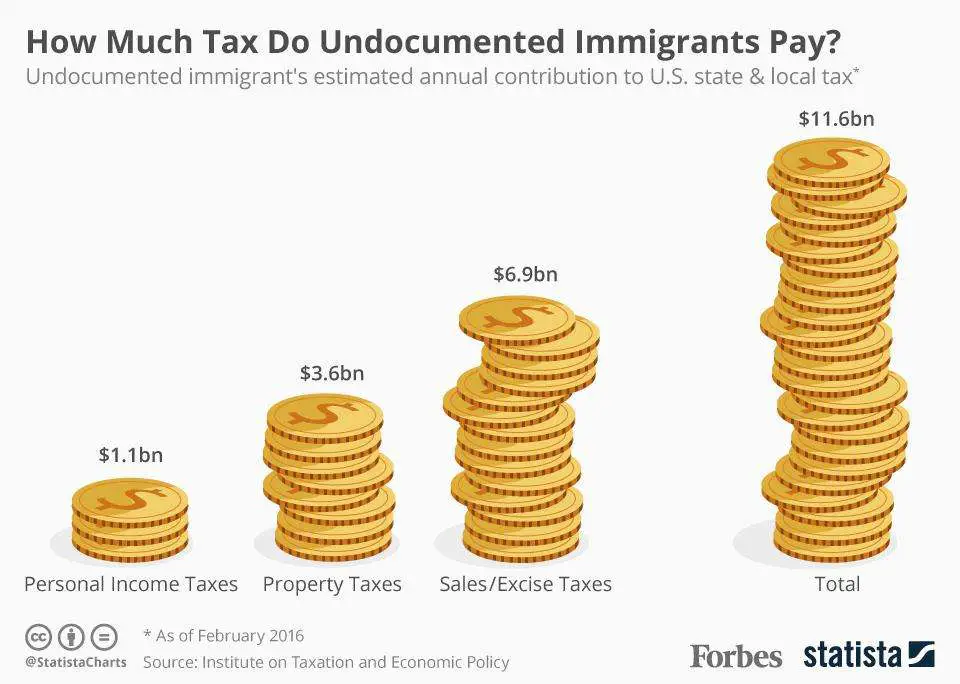

Undocumented Immigrants State & Local Tax Contributions

Released March 2nd, 2017

A newly updated report released today provides data that helps dispute the erroneous idea espoused during President Trumps address to Congress that undocumented immigrants are a drain to taxpayers. In fact, like all others living and working in the United States, undocumented immigrants are taxpayers too and collectively contribute an estimated $11.74 billion to state and local coffers each year via a combination of sales and excise, personal income, and property taxes, according to Undocumented Immigrants State and Local Tax Contributions by the Institute on Taxation and Economic Policy.

On average, the nations estimated 11 million undocumented immigrants pay 8 percent of their incomes in state and local taxes every year. While it is unlikely to happen in the current political environment, undocumented immigrants state and local tax contributions could increase by up to $2.1 billion under comprehensive immigration reform, boosting their effective tax rate to 8.6 percent.

Verify: Do Undocumented Immigrants Pay Taxes

Its less than a week until Tax Day, and amid an ongoing debate on illegal immigration, we wanted to Verify: Do undocumented immigrants file taxes?

The numbers are tough to track here, from the number of undocumented immigrants living and working in the U.S., to the number of those undocumented immigrants and their employers who contribute to payroll benefits, to the undocumented immigrants who choose to file taxes in the first place.

According to research, many undocumented immigrants will apply for a job using a fake social security number. In turn, only a handful of states require all employers to use a system called E-Verify that validates an employees eligibility and social security number.

READ MORE:

There are two ways an undocumented immigrant can file taxes.

Also Check: Are Doordash Tips Taxed

Effect On Income Inequality

Economist David Card wrote in 2009 that immigration has a minor impact on income inequality and wages: “Together these results imply that the impacts of recent immigrant inflows on the relative wages of U.S. natives are small. The effects on overall wage inequality are larger, reflecting the concentration of immigrants in the tails of the skill distribution and higher residual inequality among immigrants than natives. Even so, immigration accounts for a small share of the increase in U.S. wage inequality between 1980 and 2000.”

What Deductions Can You Claim

You may be able to reduce your total income by claiming deductions that you qualify for. A deduction is an amount that is allowed to you provided that you qualify for it. If so, its subtracted from your total income. The result is called taxable income which is used to calculate your federal and provincial or territorial tax. The following deductions are some of the most common.

Registered retirement savings plan contributions

Generally, you cannot deduct contributions you made to a registered retirement savings plan in 2021 if this is the first year that you will be filing a return in Canada.

If you filed a return in Canada for any tax year from 1990 to 2020, you may be able to claim a deduction for RRSP contributions that you made in Canada for 2021. The CRA determines the maximum amount you can deduct based on certain types of income you earned in previous years.

You can view yourRRSP deduction limit online on My Account or on the MyCRA mobile app.

For more information, go to Line 20800 RRSP deduction.

Pension income splitting

If you and your spouse or common-law partner were residents of Canada on December 31, 2021, you can elect to split pension income that qualifies for the pension income amount . To make this election, you and your spouse or common-law partner must complete and attach Form T1032, Joint Election to Split Pension Income, to your returns.

For more information, go to Pension income splitting.

Moving expenses

Support payments

Treaty-exempt income

Recommended Reading: Efstatus Taxactcom

Why Some Undocumented Immigrants Choose To Pay Taxes

The National Immigration Law Center breaks down a number of reasons why undocumented immigrants pay taxes, including:

It shows theyre complying with federal tax laws.

It can help them demonstrate good moral character if they later have an opportunity to legalize their immigration status.

Tax return records could be used to document work history and presence in the US, steps that may help them be eligible for legal immigration status in the future if lawmakers pass immigration reform.

How Much Do Undocumented Immigrants Pay In Taxes

Donald Trump may not have paid federal income taxes for 20 years, but the undocumented immigrants he rails against certainly have, according to the head of a Latino civic engagement organization.

Maria Teresa Kumar, CEO and president of Voto Latino, said on NBCs Meet the Press that “no one is surprised” by the New York Times report on Trumps personal finances and pointed out Trumps “hypocrisy.”

“He keeps talking about undocumented immigrants. Undocumented immigrants pay $12 billion of taxes every single year. They pay their taxes. They have skin in the game. He is not contributing to a system that he says he’s going to go in and fix,” Kumar said.

Kumar referred us to an Atlanticpiece about undocumented immigrants paying Social Security taxes. It cites a note issued by the Social Security Administration in 2013 that contains the $12 billion figure. But the calculation is based on contributions from immigrants and their employers, not just the immigrants themselves.

According to the Social Security Administration, there were nearly 11 million undocumented immigrants in the United States in January 2009. Factoring out kids, nonworking immigrants and those working in the underground economy and not paying taxes, the Social Security Administration estimated about 3.1 million unauthorized immigrants who worked and paid Social Security taxes in 2010.

Social Security Administration analysts said “a relatively small portion” of those who could draw benefits do so.

Our ruling

Recommended Reading: Doordash Tax Tips

How Illegal Immigrants Pay Taxes Canada

Taxes are not paid by illegal immigrants. Taxation of income cannot be imposed because illegal immigrants do not have legitimate employment. Yet, they may still be subject to property taxes and all associated sales taxes, yet are still required not to receive any of the services and benefits these taxes actually provide.

Property You Owned Before You Arrived In Canada

If you owned certain properties at the time you immigrated to Canada, the CRA considers you to have sold the properties and to have immediately reacquired them at a cost equal to their fair market value on the date you became a resident of Canada. This is a deemed disposition.

Your property could include items such as shares, jewelry, paintings or a collection.

Usually, the FMV is the highest dollar value you can get for your property in a normal business transaction.

You should keep a record of the FMV of your properties on the date you arrived in Canada. The FMV will be your cost when you calculate your gain or loss from disposing the property in the future.

You dispose of your property when, for example:

- You sell it

- You give it

- It is destroyed or stolen

If you have a loss resulting from the disposition of those properties, you can only deduct those losses from any gains you had from selling the same type of property. You cannotuse this type of loss to reduce any capital gains you had from selling other types of properties.

Recommended Reading: 1040paytax.com Legitimate

Refund Or Balance Owing

Federal tax credits

For the part of the year that you were a resident of Canada, if you were an eligible educator, you can claim the eligible educator school supply tax credit for eligible supplies expenses paid in 2021 that relate to the period of residency.

For the part of the year that you were not a resident of Canada, you can claim the above tax credit for eligible supplies expenses paid in 2021 that relate to the period of non-residency if:

- the Canadian-source income you are reporting for the part of the year that you were not a resident of Canada represents 90% or moreof your net world income for that part of the year

- you had no income from sources inside and outside Canada for that part of the year

However, the total amount you can claim cannot be more than the amount you could have claimed if you were a resident of Canada for the whole year.

Provincial or territorial tax credits

You may be entitled to claim certain provincial or territorial tax credits. For more information, go to Provincial and territorial tax and credits for individuals for the province or territory where you resided on December 31 of the tax year.

Federal foreign tax credits

After you become a resident of Canada, you may receive income from the country or region where you used to live or from another country or region. This income may be subject to tax in Canada and the other country. This could happen if:

Provincial or territorial foreign tax credits

How Can I Get An Itin

Fill out the ITIN application, IRS Form W-7, which is pretty basic, compared to other tax forms. You dont have to reapply every year after youre assigned an ITIN, but you can no longer use the number if you eventually do receive an SSN. You must use your ITIN on a federal tax return at least once in three years.

Heres how to get an ITIN:

- Fill out the form with your name, your addressesboth in the United States and elsewhereand information about your place and date of birth.

- Explain why youre applying, using the various checkboxes that are available. They include indicating whether youre a non-resident alien or U.S. resident alien.

Undocumented workers would generally use the U.S. resident alien box if theyve passed the substantial presence test.

- Submit proof of your identity. Acceptable documents include original or certified copies of your passport, foreign military ID, birth certificate, or medical records. The form doesnt ask whether youre in the country legally, but it does ask for your date of entry into the country.

- Send Form W-7 along with your completed tax return. Dont send it ahead of time, before you file your return.

The IRS indicates that processing the W-7 form will take anywhere from seven to eleven weeks.

The IRS provides a list of available certified acceptance agents in each state if youre feeling challenged by the requirements and need help completing your Form W-7.

Recommended Reading: How To Appeal Property Taxes In Cook County

After You Apply For Benefits And Credits

You dont have to apply for benefits and credits every year however, every year you must:

- File your income tax and benefit return To continue receiving the benefit and credit payments that you are entitled to, you have to file your income tax and benefit returnon time every year,even if you have no income in the year. If you have a spouse or common-law partner, they also have to file a return every year.

- Keep your personal information up-to-date To make sure you are getting the right amount of benefits and credits, you must keep your personal information updated with the CRA.

- Keep your supporting documents in case the CRA asks for them In the future, you may receive a letter from the CRA as part of the validation process, asking you to confirm your personal information.

Sign up for:

- direct deposit to make sure you never miss a payment in the mail

- the MyCRA mobile application or My Account so that you can get your personalized benefit information anywhere, anytime

-

the benefits and credits electronic mailing lists to know when you will get your next payment

Does Immigration Benefit The Country

It is beneficial to the economy to hire foreigners, build a stronger skills base, increase demand, and introduce new products and technologies. As well as immigration, he or she has significant social issues. Immigration is frequently cited as causing overcrowding, congestion, and an overburdened public service system.

Don’t Miss: Are You Self Employed With Doordash

Do Undocumented Immigrants Pay Taxes In Canada

In this Myth 3 section, we examine illegal immigrants. Taxes are not paid by illegal immigrants. a person with no status or immigration status in Canada, youre entitled to certain situations, such as an application for humanitarian and compassionate grounds. A lawyer can help you find your ideal scenario.

Identification And Other Information

It is important that you complete the entire identification and other information area on page 1 of your tax return. The CRA needs your identification and other information to assess your tax return and calculate your goods and services tax/harmonized sales tax credit, plus any benefits you may be entitled to under the Canada child benefit .

Residence information

When completing this area on your return, enter the date you became a resident of Canada for income tax purposes.

Your spouse’s or common-law partner’s information

Their SIN

Enter your spouse’s or common-law partner’s SIN if they have one. Otherwise leave it blank.

Net income from line 23600 of their return to claim certain credits

Enter your spouse’s or common-law partner’s net world income for 2021 regardless of their residency status. Net world income is the net income from all sources both inside and outside of Canada.

In the space under this line, enter your spouse’s or common-law partner’s net world income for the period that you were a resident of Canada.

Recommended Reading: How Much Taxes Deducted From Paycheck Mn