Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Amend Prior Tax Returns

Did you know you can amend tax returns up to 10 years back to trigger a refund from a prior year? Perhaps youve missed tax credits or deductions from prior years its easy to do, and Im sure most of us have made simple mistakes on our tax return.

The good news is that you can easily adjust your tax return by completing a form called T1-ADJ . Note that you may be able to make changes online with the Change my return service available in CRAs My Account. Make sure youre amending a prior return and not filing a second tax return for that year.

Here are a few other commonly missed tax deductions and credits that can put more money back into your wallet:

- Brokerage fees. Fees paid for stocks that were bought or sold in your non-registered account in the past 10 years can be deducted on your tax return. Better yet, open an account with Questrade and dont pay any fees for ETF purchases.

- Capital losses. If you sold shares in a stock or ETF for less than the price you paid, you should record the capital loss for that year even if there are no capital gains in the same year to offset it. Thats because a capital loss can be carried forward to future years and eventually be used to offset any capital gains in the future.

- Disability amount If you have a child born with a severe disability you can get a credit for the disability amount. You must get your doctor to fill out a certificate confirming the diagnosis.

How Long Do Tax Refunds Take To Be Paid

Should you be eligible for a tax refund, it generally takes less than 21 days for the refund to be paid. This clock starts from the date when this amount is agreed with the IRS.

If you file online, you can check the status of your return to see if you are due a refund so long as 24 hours have passed from the time you filed. This can be done on the IRS2Go app or through Where’s My Refund? on IRS.gov.

If you file by post, though, then you may have to wait around four weeks before you receive an update on your tax return’s status.

In either case, the tax refunds will eventually be paid to you.

Recommended Reading: Efstatus.taxact.com

Why You Have To File A Tax Return

You’ll be asked to complete Form W-4 for your employer when you begin a new job. The information you enter on this form determines how much in the way of taxes will be withheld from your pay. The decisions you make when you set up your payroll withholding by completing this form can easily result in under or over-paying your taxes. Payroll withholding usually isnt exactly right.

The IRS introduced a revised Form W-4 for the 2021 tax year. Its much easier to complete, guiding you through the process with various questions and eliminating the complicated allowances that once had to be figured out.

The IRS recommends updating your W-4 and withholding requirements whenever you experience a life event that could affect your tax obligation, such as marriage, the birth of a child, or receiving unexpected sources of income.

Youre required to file a tax return every year to come up with a final tally of your tax situation. The process determines whether you owe taxes beyond what youve already paid, or whether youre owed a refund of the taxes that have been withheld. Your tax return is normally due on or near of the year following the tax year. In 2022, the year in which you’ll file your 2021 tax return, the due date is April 18.

Tax Refund Calculator: How Much Will John Get Back In Taxes

John is a single 30-year-old with no dependents. Last year, he made $75,000, withheld $15,000, and collected no government benefits.

Check out how much he could get for his 2017 tax refunds .

Subtract the red circle from the blue for the refund.

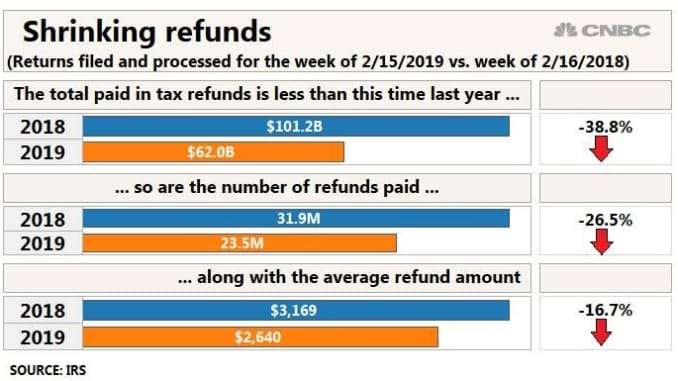

$3,105. Just about the average for tax refunds! AND with the new tax laws, he stands to get even more in his refunds in 2019 .

How about someone whos married with children?

Bonus:

You May Like: How Do Taxes For Doordash Work

Heres How To Get Prior

IRS Tax Tip 2018-43, March 21, 2018

As people are filing their taxes, the IRS reminds taxpayers to hang onto their tax records. Generally, the IRS recommends keeping copies of tax returns and supporting documents at least three years. Taxpayers should keep some documents such as those related to real estate sales for three years after filing the return on which they reported the transaction.

How To Get A Copy Of Your Tax Transcript

There are three ways to get a copy of your tax transcript.

The easiest way is to use the IRSs online transcript portal, Get Transcript. To use this service to access your transcripts online, youll need to provide your Social Security number, filing status from your most recent return, date of birth and the mailing address from your most recent tax return. Youll also need a few other things: an email account, a mobile phone with your name on the account, and an account number from an eligible account to verify your identity.

You can also fill out and mail in a copy of Form 4506-T or use the Get Transcript by Mail option through the Get Transcript portal. But if you make your request that way, you should be prepared to wait 30 days to receive your copy. Finally, if youre a phone person, you can also get a copy of your transcript by calling the IRS at 1-800-908-9946. Phone orders typically take five to 10 business days.

One thing to note: The IRS is now issuing transcripts that block out portions of your Social Security number, telephone number, last name and address. Thats why youll have to provide an account number to verify your identity so they can use it to match up with your file. By limiting the amount of personal information on the transcript, the IRS hopes to help reduce the risk of identity theft.

Don’t Miss: Do I Have To Pay Taxes On Plasma Donation

Filing A Return Even Without A Provisional Assessment

Even if the Tax and Customs Administration has not sent you a provisional assessment you may still be required to file a tax return. To determine whether you need to pay tax or are entitled to a refund and if so, how much, you can use the Tax and Customs Administrations income tax return program.

If you live outside the Netherlands, you can use the Tax return program for non-resident taxpayers. If you do not wish to file a digital tax return, or if you are unable to, you should request a C form. If you only lived in the Netherlands for part of the year, you should use an M form.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Don’t Miss: Do You Pay Taxes On Plasma Donations

Netfiling Your Tax Return

- To avoid losing your tax return in the mail, consider Netfiling your tax return instead.

- When you NETFILE your tax return, you receive a confirmation number instantly from the CRA as proof that your tax return was received.

- Processing your tax return is a lot faster if you NETFILE you also receive your tax refund a lot sooner.

You can also use the CRAs My Account to double check that your return was transmitted OK.

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

You May Like: Property Tax Protest Harris County

Paused Student Loan Payments

In March 2020, the U.S. Department of Education gave millions of Americans the option to pause monthly student loan payments, and nearly 90% of borrowers have accepted.

While the break offered relief through 2021, there’s a trade-off at tax time: no write-off for student loan interest.

Typically, borrowers may deduct up to $2,500 of interest, depending on how much they paid, and it’s an “above-the-line” tax break, reducing gross income, even without itemizing deductions.

It could be $500 or $600 at the end of the day, in real money, after that adjustment.Patrick AmeyAdvisor at Financial Advisory Service, Inc.

The $2,500 benefit starts to phase out in 2021 with modified adjusted gross income over $70,000 for single filers and $140,000 for joint returns.

Single borrowers above $85,000 or couples filing together over $170,000 aren’t eligible.

It’s significant for lower to middle-income filers making student loan payments, said Patrick Amey, a CFP and advisor at Financial Advisory Service in Overland Park, Kansas.

“It could be $500 or $600 at the end of the day, in real money, after that adjustment,” he said.

Heres What You Need To Do:

Also Check: Pastyeartax Com Review

What People Get Wrong About Tax Refunds

I have a confession to make: I actually love the kooky weirdo financial experts you see on TV or on their online soapbox who lecture you about taxes. Because 99.99% of the time they are DEAD WRONG about money.

One of their favorite go-to buzz phrases:

If youre getting a tax refund, youre giving the government free money!

TRANSLATION: If you get a refund, that means the government took your money and earned interest on it for an entire year!!

Then these experts are typically out of breath because of their own brilliance.

Let me break this down for you.

The average tax refund is about $3,000. Lets assume that money would have been sitting in a savings account with a 1.45% APY .

How much interest did you lose through your tax withholdings? $3.62 a month.

OMG!! The government is stealing the equivalent of a latte each month! Time to dump a bunch of tea in Boston Harbor.

Heres a hard truth: If you had that money, you probably would have spent it. Thats not a slight against you thats just human psychology. We as humans have an incredibly finite amount of willpower. Thats why cost-saving measures like cutting out lattes or lunch at your favorite sandwich spot arent realistic.

And yes, technically, theyre right. You could have been earning interest on the money. I live in a world of reality, however, which means that technically isnt always correct.

Can You Simply Approve The Tax Return Or Do You Need To Make Any Changes Or Additions

If all of the information entered in the tax return is correct and you do not wish to make any changes or additions to it, you can approve it. In some cases, you will need to enter some additional information for example, if you are a business owner or if you have sold a residential property or some shares. All relevant details must be entered in your tax return via our e-service or on your paper tax return form before you file it.

Recommended Reading: Aztaxes Gov Refund

Why Havent You Received Your Refund

The CRA may keep some or all of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

What Is Income Tax Refund

Income tax refund-related fraud is a growing problem. Its where a thief uses your information to file a tax return to claim a refund. The fraudulent return will contain your information, then direct the refund which is grossly exaggerated to a different bank account. The thief will usually file the return very early in the year, likely February, to claim the refund before you file your legitimate return.

If that happens, you can also request a copy of the fraudulent return. To do that, youll use IRS Form 4506-F, Request for Copy of a Fraudulent Tax Return.

The IRS will work with you to resolve the fraudulent filing, and you wont forfeit any refund youre legitimately entitled to. But it may help to obtain a copy of the fraudulently filed return to reconstruct what happened.

You May Like: Mcl 206.707

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

You will also need to file a provincial income tax return for Quebec.

For details: What to do when someone has died

For details: Leaving Canada

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

Dont Count On That Tax Refund Yet Why It May Be Smaller This Year

- If youre banking on a tax refund, it may be smaller, or you may owe money this season, according to financial experts.

- The advance child tax credit, paused student loan payments and year-end mutual fund payouts may cause higher taxable income for 2021.

If you’re banking on a tax refund, it may be smaller, or you may owe money this season, according to financial experts.

Typically, you get a federal tax refund when you’ve paid or withheld more than the amount you owe, based on taxable income.

The IRS subtracts the greater of the standard or itemized deductions from adjusted gross income to reach taxable income, and there are a few reasons why it may be higher in 2021.

You May Like: Do I Have To File Taxes For Doordash If I Made Less Than $600

How Do I Get My Tax Refund

Luckily for you, the IRS is very good about getting your tax refund to you.

In fact, you can check out the IRSs Wheres my refund? tool to find the status of your tax refund right now. And according to the IRS, they issue nine out of ten refunds back to the taxpayer within 21 days after they file their taxes.

Ultimately, though, how soon you get your refund back depends on two things:

- How you file your taxes

- How you elect to receive your refund

If you decide to file your taxes through good old fashioned pen and paper, its going to take considerably longer to get your refund back. In fact, youre going to have to wait four to six weeks before youre even able to check your status on their Wheres my refund? tool.

There is another route though: Electronic tax filings.

You receive your tax refund even faster when you file it electronically via platforms like TurboTax or IRS e-file. There you can elect to receive your refund through direct deposit . Its secure, fast, and the same way the government deposits millions of Social Security and Veteran Affairs benefits each year.

When you get your money back, be sure to put it to good use:

So you know how much youre getting back and how to get your money. Now lets get into what you might be getting WRONG about your tax refund.