Get Help For Your Inheritance Tax

If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state inheritance tax, you should seek the counsel of an estate attorney. They can help you understand estate or inheritance taxes and your obligation to pay the tax and fill out the proper forms as well as answer any questions you might have.

Who Pays Estate Taxes

You might wonder how an estate tax could affect you if you inherit some money. Since the person who owned the estate is dead, they cannot pay taxes on the estate anymore. The person who gets the money might have to pay taxes. It all depends on how much they receive.

Tax laws changed in 2018, decreasing the amount people have to pay in estate taxes. People who receive less than $11.2 million as part of an estate can exclude all of it from their taxes. This number doubles to $22.4 million for married couples. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. Tax rates can change from one year to the next.

The Probate Process In Indiana Inheritance Law

While it typically gets a bad rap, probate was added into Indiana inheritance laws to protect the last wishes of a decedent, whether he or she had a testate will or not. If a decedent died intestate, the court will try to ensure proper intestate succession. Ultimately, though, the value of the estate governs how the court system will handle it. These options include:

- Supervised probate This form of probate is the most hands-on and call for court approval for any inheritances or other distributions of the estate.

- Small estate Estates containing property worth less than $50,000 in total can skip probate, although this does not include any real estate of the decedent.

- Unsupervised probate This is essentially an in-between and requires much less court attention than supervised probate. However, the estate executor and all heirs must consent to this form of probate.

Recommended Reading: What Is K 1 Tax Form

Dying Without A Will In Indiana

Intestate succession becomes the blueprint for the inheritance of a decedents property should he or she die without having created one. Each state handles this scenario differently, though in Indiana, intestate heirs include everyone from your spouse and children to your aunts and uncles.

The property the decedent owned gets split up into real property and personal property. Homes and any land are real property, while personal property is anything else, like your car and jewelry. Depending on who survives you, these items are inherited in varying percentages for different people.

Similar to its testate counterpart, an intestate estate requires its own executor to carry out property inheritances according to intestate succession law. In a perfect world, this would be someone whos familiar with the decedent.

How Does Inheritance Work

Most people have several possessions when they die. They might own a house and have money in investments or savings. If they made a will, all of it goes to the beneficiaries listed in the will. If they did not make a will, their money and property will automatically go to their next of kin. This person is usually a child or a relative. Everything they owned is part of the inheritance they pass on to other people when they pass away.

Also Check: How To Find Out Who Claimed You On Their Taxes

Options For Inheritance Of Property: Move In Rent Or Sell

After gathering the necessary financial information, assessing the physical state of the home and communicating with other stakeholders, its time to decide on what to do with the home youve inherited. Your decision to move in, rent or sell the property will depend on many financial, circumstantial and market decisions.

Dying With A Will In Indiana

For a will to be considered valid under Indiana inheritance laws, it must not only be handwritten or printed, but also contain the decedents signature along with those of two witnesses. Should a decedent be physically unable to sign his or her will prior to passing away, another person can sign for him or her. However, the decedent must give explicit direction for this to happen.

Anyone who creates a will that meets these requirements leaves behind whats considered a testate estate. This is undoubtedly the most ideal situation, as it affords the highest level of inheritance control to the decedent, allowing his or her personal wishes to dictate who receives his or her property after death.

An executor, sometimes called a personal representative and appointed through the decedents will, is essentially the manager of an estate. Duties for this position include paying off debts the decedent never took care of, distributing property to heirs and overseeing all final expenses.

Read Also: Where Can I Find My Real Estate Taxes

Consider The Alternate Valuation Date

Typically the basis of property in a decedents estate is the fair market value of the property on the date of death. In some cases, however, the executor might choose the alternate valuation date, which is six months after the date of death.

- The alternate valuation is only available if it will decrease both the gross amount of the estate and the estate tax liability this will often result in a larger inheritance to the beneficiaries.

- Any property disposed of or sold within that six-month period is valued on the date of the sale.

- If the estate is not subject to estate tax, then the valuation date is the date of death.

How To Avoid Inheritance Tax

If you live in a state with an inheritance tax, there are a few main ways to minimize or avoid inheritance taxes for a beneficiary:

-

Leave your whole estate to your spouse .

-

Give assets away before you die.

-

Pass on inheritances via an irrevocable trust.

-

Move to a different state before you die.

The simplest way to help your heirs avoid inheritance tax is to leave your estate to individuals who are exempt. Surviving spouses are always exempt from inheritance tax, but you may need to leave them your entire estate for them to receive the exemption. If you live in a state where other individuals are exempt, naming them your beneficiaries should also work.

If you don’t have an estate plan, you can create a will with Policygenius for just $120.

Recommended Reading: How Do You Add Sales Tax

Tax Implications: Do I Have To Pay Tax On An Inherited Property

Once you learn that youve inherited a house, youre likely wondering: Do I have to pay an inheritance tax on property? The act of inheriting a property doesnt trigger any automatic tax liability, but what you decide to do with the house move in, rent it or sell it will cause you to incur property taxes, capital gains taxes or other expenses .

The Federal Estate Tax

When politicians refer to the estate tax, theyre usually talking about the federal estate tax. When a person dies and leaves a substantial amount of wealth behind, the Internal Revenue Service takes a portion of that wealth as a tax before its distributed to heirs. Many people say this is unfair because the person already paid taxes on that money when they first earned it, so it shouldnt be taxed a second time when the person dies.

However, its important to understand that the overwhelming majority of people never have to pay the federal estate tax. According to the CBPP, less than 1 out of every 1,000 Americans have any tax collected from their estates. Under IRS rules, a person who dies in 2021 can leave up to $11.7 million in assets before the government touches a penny of it. Moreover, for , this amount doubles, so a couple can leave up to $23.4 million to their heirs tax-free.

Also Check: How To Pay Oklahoma State Taxes

Inheritance Tax Law Changes

The federal government does not impose an inheritance tax, so the recent tax changes from the Trump administration did not affect the inheritance taxes imposed by the states. The IRS did, however, change the federal estate tax exemption from 2018 to 2019, from $11.18 million to $11.4 million. But, just because the inheritance taxes didnt change in 2020 doesnt mean state legislatures wont change them going forward.

Who Pays The Inheritance Tax

Not every heir must pay an inheritance tax even in these six states. Each state has its own statutes for who is required to pay the inheritance tax and how much. Spouses usually dont have to pay the tax and most of the time, neither do adult children of the decedent. Some states allow for other relatives to inherit without paying a tax or paying less of a tax.

Heirs are usually broken down into three categories. First is the immediate family, which includes the spouse and children, parents, and grandparents. Second is the extended family, which would include siblings, and even aunts, uncles, and cousins. The third group is non-related heirs, which might include charitable organizations, friends, and even the decedents pets. Some states tax each of these groups at different rates.

You May Like: What States Do Not Tax Retirement Income

Uncommon Assets Seen To Go Through Probate

There are always exceptions to the rules, and this is the case with probate. There are some uncommon assets that may need to be part of the probate estate. In these situations, you need to know what to do with the assets.

A prime example is what would normally be a direct transfer of property, but the beneficiary has died. For instance, a person lists a sibling as the beneficiary of their bank account as payable upon death. That sibling passes away and the account owner didnt change the listed beneficiary before they died. Because the person listed as beneficiary is no longer living, the bank account will have to be included in probate.

Chapter 5 Determination Of Inheritance Tax

IC 6-4.1-5

IC 6-4.1-5-1.5 Fair market value appraisal dateSec. 1.5. For purposes of determining the fair market value of each property interest transferred by a decedent, the appraisal date for the property interest is the date used to value the property interest for federal estate tax purposes. However, if no federal estate tax return is filed for the decedent’s estate, the appraisal date for each property interest transferred by the decedent is the date of the decedent’s death. The finally determined federal estate tax value of a property interest is presumed to be the fair market value of the property interest for Indiana inheritance tax purposes, unless the federal estate tax value is determined under Section 2032A of the Internal Revenue Code. However, the presumption is rebuttable. A property interest that is valued for federal estate tax purposes under Section 2032A of the Internal Revenue Code shall be valued for Indiana inheritance tax purposes at its fair market value on the appraisal date prescribed by subsection .As added by Acts 1980, P.L.57, SEC.13.

IC 6-4.1-5-2 Referral of return to tax appraiser dutiesSec. 2. Within ten days after an inheritance tax return for a resident decedent is filed with the probate court, the court shall refer the return to the county inheritance tax appraiser. The county inheritance tax appraiser shall: investigate the facts concerning taxable transfers made by the

Also Check: How Are Property Taxes Calculated In Texas

How Much Is Inheritance Tax

Indiana inheritance tax was eliminated as of January 1, 2013. As a result, Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property and assets at death.

If property is owned in other states, there is the possibility that such property may be subject to the estate tax of the other state. To learn more about how to protect property from state estate taxation, and whether property owned outside of Indiana may be subject to a state estate tax, please call us.

Gift Taxes And The Personal Exemption

At first glance, it looks like it should be pretty easy to avoid paying the estate tax, no matter how much money you have. All you would have to do is give away your money to your intended heirs while youre still alive. As long as you gave away enough to reduce the value of your estate to $11.7 million or less, it wouldnt be taxed.

However, the government has already thought of that loophole. To close it, the Internal Revenue Service charges a gift tax of up to 40% on any large sums you give away during your lifetime. That includes not only cash, but also items with a significant cash value, such as jewelry and cars.

Under IRS rules, as of 2021, you can only give away $15,000 worth of gifts to any person in a given year without paying the gift tax. However, this limit doubles for a married couple. For example, a couple could give up to $30,000 per year to each of their children or grandchildren without triggering the tax.

When you make a gift thats higher than that amount, you have a choice. You can either pay the gift tax right away or count the gift against your personal estate tax exemption. This is the total amount of your wealth you can exempt from the estate tax, both during your life and after your death. Using this credit, you can give away up to $11.7 million during your lifetime without paying tax on it. But if you do use the entire amount, all of your estate becomes subject to taxation after your death.

Recommended Reading: What Cars Qualify For Federal Tax Credit

Spouses In Indiana Inheritance Law

A spouses share of an intestate decedents estate varies quite a bit and is dependent on who also survives him or her. For example, if the decedent and spouse have a child together, or a grandchild of a deceased child, the spouse is entitled to half of the estate.

For decedents who had at least one child with an ex-partner, though, the spouses share of the estate will alter. In this case, the spouse receives half of the decedents personal property and one-quarter of his or her real property, although any monetary claims against the real estate will need to be subtracted, according to Indiana inheritance laws.

Lets say there are no children in play but the decedents parents survive him or her. Because parents are considered further relatives than direct descendants, the spouse is given three-quarters of the estate, with the leftover one-quarter going to the parents.

In Indiana, if a spouse is found to have left or been cheating on the decedent at the time of his or her death, that surviving spouse could lose any rights to the estate.

Minimize Inheritance Tax Through A Trust

Another way to potentially avoid inheritance tax is to set up an irrevocable trust. A trust is a separate legal entity from the person who creates it and it allows you to move assets from your possession into the trust.

However, an irrevocable trust can only help with inheritance tax if the person who creates it no longer has control over it. They cannot have the right to change beneficiaries or receive any income from the trust. For that reason a revocable trust wonât help your beneficiaries avoid inheritance tax.

Talk with an estate planning attorney to see if an irrevocable trust is a good option for you.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

Recommended Reading: How Much Do I Owe In Property Taxes

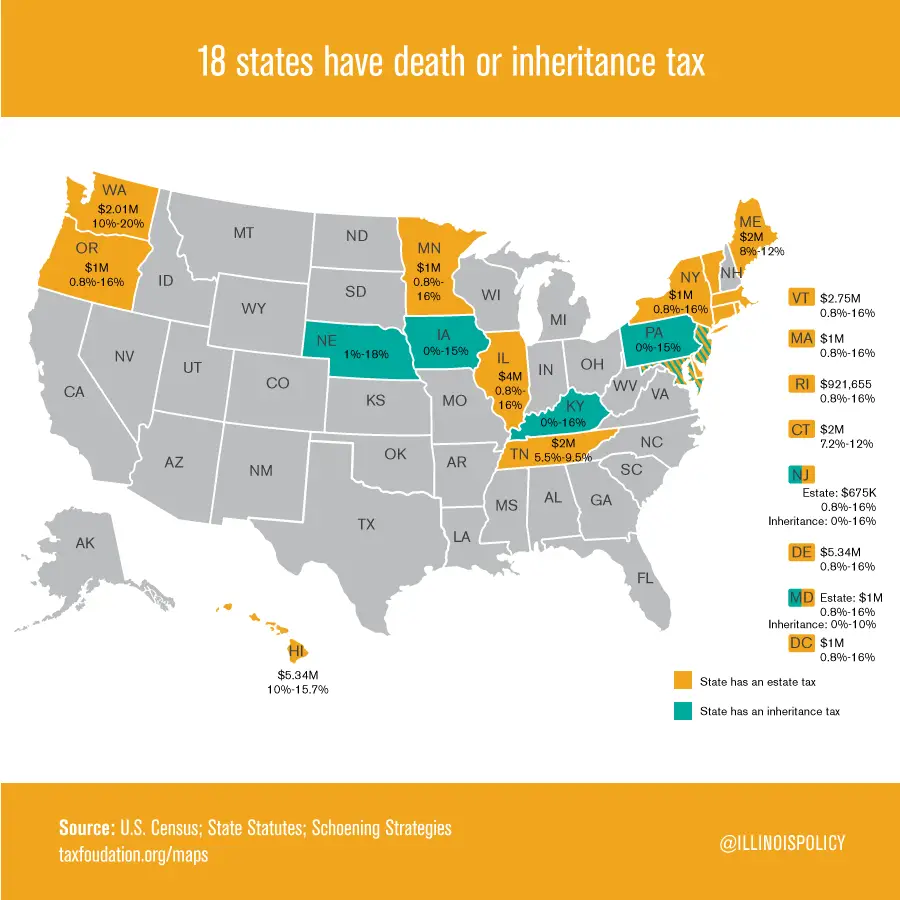

Does Your State Have An Estate Or Inheritance Tax

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both now that New Jersey has repealed its estate tax.

Hawaii and Washington State have the highest estate tax top rates in the nation at 20 percent. Washington has been at the top for a while, but Hawaii raised its previous top rate of 16 percent on January 1. Eight states and the District of Columbia are next with a top rate of 16 percent, a figure derived from an earlier era where states could soak up a portion of the federal estate tax without increasing the taxpayers overall liability, which is no longer the case. Massachusetts and Oregon have the lowest exemption levels at $1 million, and New York has the highest exemption level at $5.9 million.

Of the six states with inheritance taxes, Nebraska has the highest top rate at 18 percent. Maryland imposes the lowest top rate at 10 percent. All six states exempt spouses, and some fully or partially exempt immediate relatives.

Estate taxes are paid by the decedents estate before assets are distributed to heirs, and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest, and are thus based on the amount distributed to each beneficiary.

Was this page helpful to you?

Illinois Is One Of Few States With Death Tax Bill Would Make It Highest In Us

Increasing the estate tax would hurt family farms and businesses, drive wealth and investment out of Illinois. Most states are ending their death taxes.

Many states have moved away from taxing assets after people die because of the harm to family businesses and farms, but a new proposal before state lawmakers would boost Illinois estate tax 5 percentage points across the board, giving Illinois the nations highest top rate.

House Bill 3920 would hike the existing state tax on estates of over $4 million, which ranges from 0.8% to 16%, by 5 percentage points across the board. Unlike neighboring Wisconsin, Michigan, Indiana and Missouri, Illinois is one of just a dozen states that still have an estate or inheritance tax. Tax Foundation analyst Katherine Loughead noted, The top marginal estate tax rate under this proposal would become the highest in the country at 21%.

While the bills sponsors intend the extra revenues to be used to support Illinoisans with disabilities, hiking the estate tax would squeeze family farmers, reduce the accumulation of productive assets, encourage spendthrift behavior, fuel tax avoidance and evasion, and drive wealth to other states.

Increasing the estate tax would harm all Illinoisans, not just Illinois wealthiest families

When someone dies, the federal government taxes the estate by up to 40%. Then Illinois piles onto that with more taxes of up to 16%.

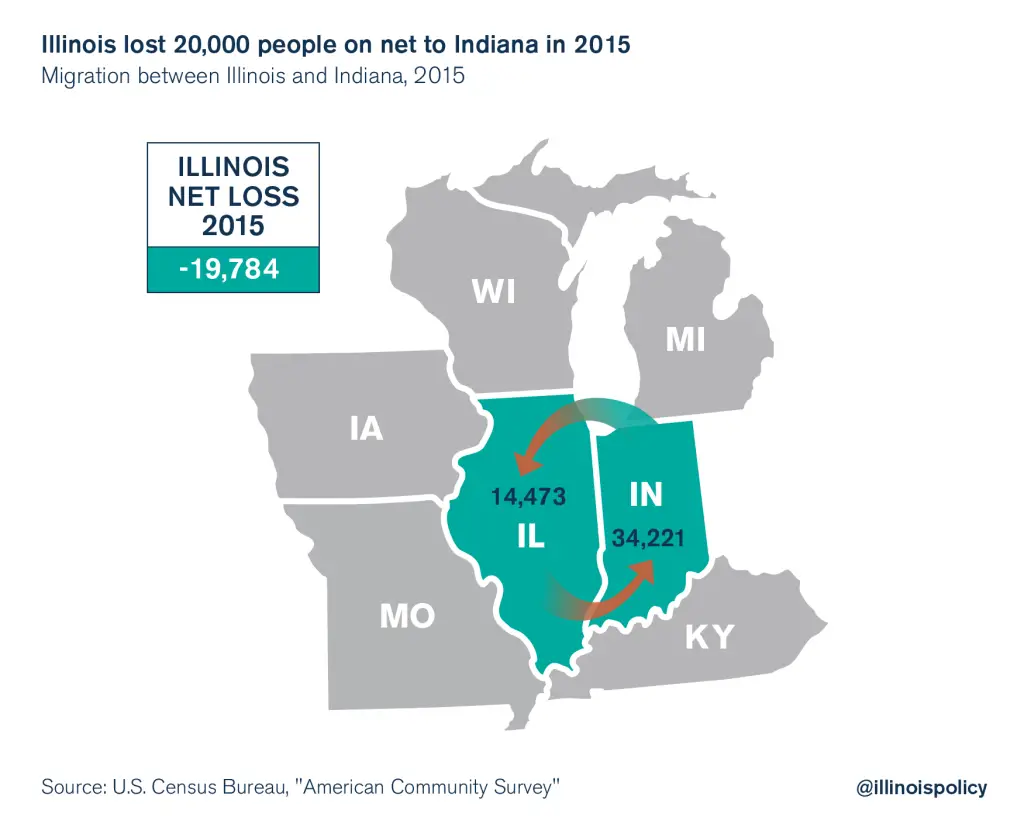

Increasing the estate tax would exacerbate Illinois exodus

Don’t Miss: Which State Has The Lowest Tax Rate