Register For Local Sales Tax

In most states, businesses pay all sales tax collections to the state, and any district level taxes are distributed to the counties and cities.

Colorado does not operate like most other states. In Colorado, counties and cities may elect to have businesses pay local sales taxes to a local governing body. Such counties and cities are known as Self Collecting jurisdictions. See a full list of “Self Collecting” jurisdictions in Colorado at the Colorado Department of Revenue sales tax spreadsheet.

To further explain filing and collection of sales tax in a home rule jurisdiction, consider the following illustrations:

How To Collect Sales Tax In Colorado

In Colorado, you will always collect a sales tax based on your buyers’ location. If the buyer is physically located in your store, that means you will charge the sales tax rate applicable in your jurisdiction. However, if an in-state buyer places an order remotely, you must charge the sales tax rate applicable to their in-state shipping address.Colorado also has several cities that are considered “home rule”, where the Colorado Department of Revenue does not collect local sales taxes. You will need to collect and remit local taxes separately in these cases.

Are Sellers Required To Accept Exemption Or Resale Certificates

Sellers are not required to accept exemption or resale certificates from other states. If the vendor doesnt accept the certificate, the buyer will have to pay sales tax on the merchandise being purchased. In most cases, they will be able to get a credit for the sales taxes paid later on their sales tax filing.

You May Like: File Missouri State Taxes Free

Sales And Use Tax Return

- You are responsible for filing a return by the due date.

- Returns must be filed even if no tax is due to city.

- We no longer mail tax returns to businesses.

Effective January 1, 2021, the city tax rate has decreased to 3.07% for all transactions occurring on or after that date. Use the tax return below for purchases on or after the effective date.

Colorado Sales Tax Filing Due Dates

It’s important to know the due dates associated with the filing frequency assigned to your business by the Colorado Department of Revenue. This way you’ll be prepared and can plan accordingly. Failure to file by the assigned date can lead to late fines and interest charges.

All sales tax filing must be completed by the 20th of the month following the end of your assigned collection period. Below, we’ve grouped Colorado sales tax filing due dates by filing frequency for your convenience. Due dates falling on a weekend or holiday are adjusted to the following business day.

Don’t Miss: How To Look Up Employer Tax Id Number

City Sales Tax Information

Taxable Items and Services

The City of Golden sales tax must be collected on all sales, leases and rentals of items in the City, including items delivered into the City. Transactions which are taxable in Golden but may be taxed differently by the State of Colorado and other Colorado jurisdictions include such things as:

- Telecommunications services

- Installation of equipment required to receive or transmit telecommunications service

- Gas and electric for residential and most commercial consumption

- All food sales

- Cover charges considered a part of the amount paid for food and drink

- Hotel/Motel lodging services

- Items dispensed from coin-operated devices

- Fabrication labor

Following are a few of the exemptions as stated in the City Code:

- Professional services, such as accounting and legal

- Sales of prescriptions and medical supplies as defined by the Code

- Cigarettes

- Labor, excluding fabrication labor, is not taxable if separately stated on invoices.

All exempt sales must be properly documented.

Golden tax should not be collected if an item sold is delivered outside the City limits. You should contact the City where the item is delivered to determine if you need to collect that Citys tax. Be careful not to rely on mailing addresses to decide which tax to collect mailing addresses do not always correspond to the City boundaries. Whenever merchandise is delivered out of the City, it must be clearly stated on the invoice.

Refunds

Purchase of a Business

Audits

Who Must Obtain A Business And Sales/use Tax License

Any business engaged in commerce of any kind, including all service businesses and all businesses selling products and taxable goods, either in a home-based or commercial location within the City of Littleton is required to register with the city by completing a Business License – Sales Use Tax Application. A separate license is required for each physical location where a retailer operates a retail business within the city.LICENSES ARE NOT TRANSFERABLE.Business establishments located outside the Littleton city limits that engage in retail sales of tangible personal property to Littleton businesses or residents, which are delivered to locations within the city, must also obtain a sales tax license. There is no charge for the Business and Sales/Use Tax License Application.

Read Also: Have My Taxes Been Accepted

Do You Have Nexus In Colorado

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Colorado.

You probably have nexus in Colorado if any of the following points describe your business:

- A physical presence in Colorado: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- A significant amount of sales in Colorado within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Colorado is $100,000 in annual sales. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

What Is A One Time Use Tax

If you purchase an existing business within the Littleton city limits or establish a new business within the Littleton city limits, a one-time use tax of 3.00% must be paid on the purchase price of all furniture, fixtures, equipment and supplies made incidental to the opening of your business. This “One Time Use Tax” form will be sent to you along with your license. This form must be completed and returned to the city within 30 days even if no taxable purchases were made.

You May Like: How Can I Make Payments For My Taxes

What Steps Should A Business Take To Accept An Exemption Certificate

When a business is presented with a resale certificate, the burden of proof is on the seller to verify that the buyers information is correct and to keep these records. Failing to verify this information may put the liability of paying Colorado sales taxes on the seller.

To verify whether a Colorado exemption certificate is valid

- Review the certificate to make sure it is completely filled out.

- Verify the purchasers Colorado Sales Tax License by visiting the Colorado Department of Revenues website and click on the Verify a License or Certificate link.

- Sellers are also responsible for considering whether the goods and services sold are consistent with the purchasers claim that the sale is exempt from sales taxes if the purchases are over $250. For example, if the buyers business is a car dealership, but they want to purchase office supplies tax-free, the seller should investigate further.

- Keep a file of exemption certificates.

More information regarding the documentation of exempt sales can be found from the Colorado Department of Revenue 1 CCR 201-4.

City Of Brighton Sales & Lodging Tax

In 2000, Brighton residents voted to become Home Rule Jurisdiction and adopted a Charter, with provision for the City of Brighton to collect its own sales tax. Taxable transactions are specified in the City of Brighton Municipal Code. The City may charge sales tax on items on which the State of Colorado does not. For instance, the City taxes food for domestic consumption while the State does not. Each vendor should read the City of Brighton Municipal Code, Sections 3-38-75 and Sections 3-28-80 to become acquainted with City taxable transactions and exemptions.

In addition to sales tax, the City of Brighton has a 3% lodging tax on the price of lodging accommodations provided in the City.

For more information go to the Sales Tax Page.

Read Also: Where’s My Tax Refund Ga

What Address Do I Mail My Colorado State Taxes To

Where Do I Mail My Colorado State Tax Return? All tax returns in Colorado should be mailed to the Colorado Department of Revenue, 1375 Sherman Street, Denver, CO 80261. Adding a Plus 4 number to this address will guarantee that your details are routed in the right direction and the correct office deals with your returns and payments.

The Town Sales Tax Rate Is 4 Percent

The Town’s Revenue Division is responsible for licensing businesses that operate within Town and collecting the proper amount of sales tax.

Remember to file the proper tax form using the 4 percent rate for the Town of Castle Rock.

If needed, access a blank Sales Tax Return .

Sales tax returns need to be received by the Town, or postmarked, no later than the 20th of the month due. Monthly filers should submit the previous months sales. Quarterly filings are due April 20, July 20, Oct. 20, and Jan. 20. Annual filings are due Jan. 20.

Remember to pay your taxes on time to avoid interest and late fees.

You May Like: Tsc-ind Ct

How To Register For A Colorado Seller’s Permit

You can register for a Colorado sales tax license online through the DOR. To apply, youll need to provide the DOR with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

There may be additional licensing requirements in home rule cities.

What Is A Public Improvement Fee

Public Improvement Fees are not a sales tax. They are not administered or collected by the City of Colorado Springs.

Most often PIFs are a private fee that developers require their tenants/retailers to collect from customers. This fee is collected as part of sales transactions and is generally a percentage of the sales amount. The developer/property owner may normally implement at PIF without municipal approval.

The PIF may be used for any designated purpose but is generally used to pay for infrastructure, on-site improvements, and maintenance .

Public Improvement Fees must be listed on the sales receipt as a separate line item from the sales tax.

Recommended Reading: How To Buy Tax Lien Certificates In California

How To Register For Sales Tax In Colorado

Okay, so you have nexus! Now what?

The next crucial step in complying with Colorado sales tax is to register for a sales tax permit. Itâs actually illegal to collect tax without a permit. So to get all your ducks in a row, start with tax registration first.

You can find directions about how to register in Colorado on their Department of Revenue website.

When registering for sales tax, you should have at least the following information at hand:

- Your personal contact info

- Social security number or Employer Identification Number

- Business entity

- Bank account info where youâll deposit the collected sales tax

Is A Resale Certificate The Same As A Sales Tax Id

The sales tax license and exemption certificate are commonly thought of as the same thing, but they are actually two separate documents. The sales tax license allows a business to sell and collect sales tax from taxable products and services in the state, while the exemption certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

Related: How to register for a Colorado Sales Tax License

After registering, a sales tax number will be provided by the Department of Revenue. This number will be listed on the Sales Tax Exemption Certificate.

A Sales Tax Exemption Certificate is provided by the Department of Revenue to document tax-free transactions.

You May Like: Do I Need To Report Roth Ira Contributions On My Tax Return

About The Brighton Prairie Center Public Improvement Fee

A PIF is applicable on sales made at the Prairie Center. A PIF is a private fee collected by businesses on sales/services made at the site. The money is used to pay for the public improvements for the development of the site, such as curbs and sidewalks, storm management systems, sanitary sewer systems, public street lighting, and road and bridge development. A PIF is specifically a fee and NOT a tax therefore, it becomes part of the overall cost of the sale/ service and is subject to sales tax.

The PIF at Prairie Center is not collected by the City, but by a third part administrator, CliftonLarsonAllen LLP, hired by the owner of the development site.

How Often Should You File

- Annual filing: If your business collects less than $15.00 in sales tax per month then your business should file returns on an annual basis.

- Quarterly filing: If your business collects between $15.00 and $300.00 in sales tax per month then your business should file returns on a quarterly basis.

- Monthly filing: If your business collects more than $300.00 in sales tax per month then your business should file returns on a monthly basis.

Note: Colorado requires you to file a sales tax return even if you have no sales tax to report.

Read Also: How Can I Make Payments For My Taxes

Filing When There Are No Sales

Once you have a Colorado sales tax license, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

Sourcing Sales Tax In Colorado: Which Rate To Collect

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale .

As of April 2019, Colorado is in the process of changing its sales tax sourcing rules for in-state sellers. Prior to December 1, 2018, Colorado retailers were only required to collect the taxes they had in common with Colorado consumers. Effective December 1, 2018, with a grace period through May 31, 2019, the state is switching to destination sourcing. Colorado businesses must collect and remit the full sales tax rate in effect at the location of the consumer the destination of the sale when taxable goods are delivered to a Colorado address. Destination sourcing also applies to out-of-state sellers.

For additional information, see Information for in-state retailers Information for out-of-state retailers and Colorado adopts new sales tax collection requirements for in-state sellers in the wake of Wayfair.

You May Like: What Does Locality Mean On Taxes

What Else Should I Know About Sales Tax

Excess city sales tax collected must be remitted to the city on Line 6 of the sales tax return.

You must file a return even if you have not made any sales during the tax period. By filing this return, a delinquency notice will not be generated.

You must maintain your books and records used in determining your tax liability for a period of three years. This is because in the event your business is selected for an audit, for whatever reason, the records will be available for review. The burden of proof of exempt sales and purchases rests with you. All information provided by you to the City of Littleton will be kept confidential.

Failure To Collect Colorado Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

Recommended Reading: How Much H And R Block Charge For Taxes

When To File Taxes In Colorado

When you register for sales tax, Colorado will assign you a certain filing frequency. Youâll be asked to file and pay sales tax either monthly, quarterly, or annually.

Usually the frequency they choose is based on the amount of sales tax you collect from buyers in Colorado. High-revenue businesses file more frequently than lower volume businesses, for example.

Colorado sales tax returns are due on the 20th day of the month following the reporting period. If the due date falls on a weekend or holiday, then your sales tax filing is generally due the next business day.

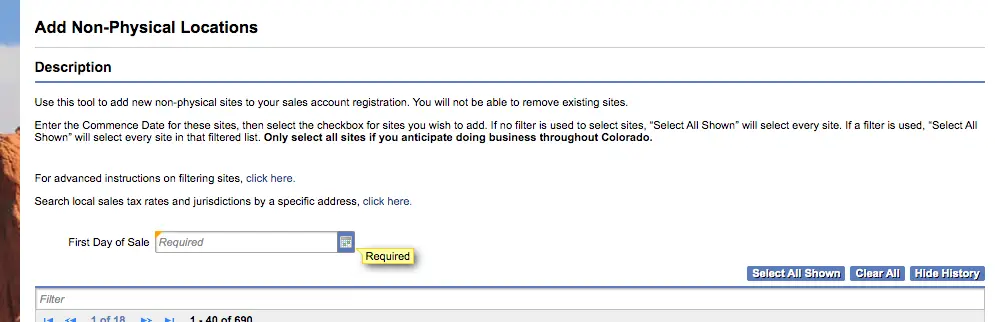

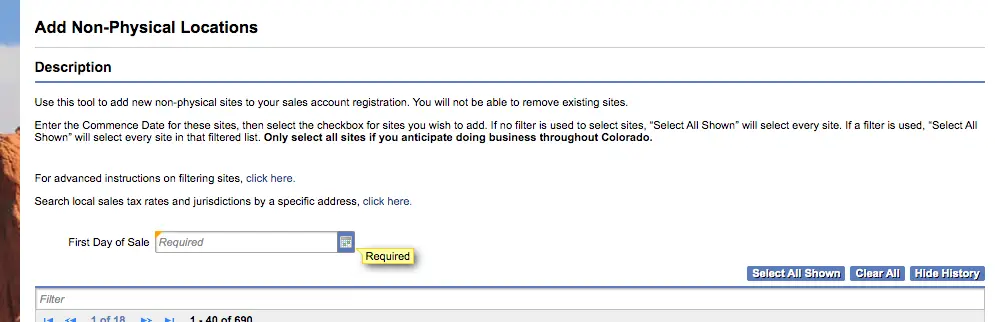

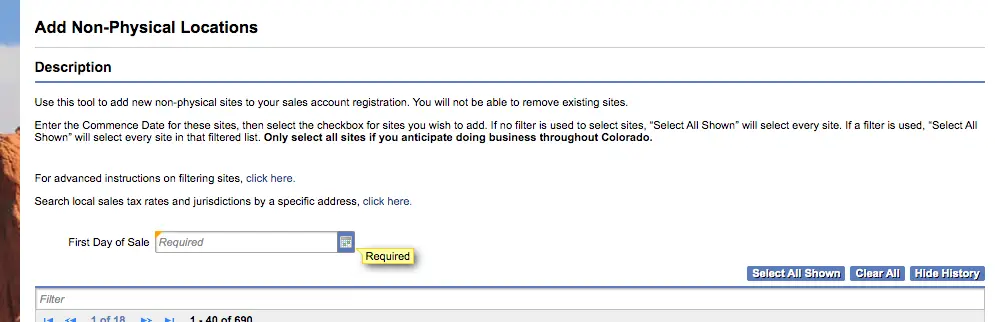

Note: As Of January 5 2021 There Is A New Online Sales And Use Tax Process

The City has sent out registration letters for your business with information about logging in to the new sales and use tax system. This letter includes your activation code. After youve registered, you will see any open tasks due to the City in your Business Center, and you also will receive reminders by email.

What if I dont receive a registration letter?

Please check your spam folder, and add the email address to your safe sender list. If you do not know your activation code, email for assistance. Or, you can contact the City at or 303-651- 8672

Also Check: How Much Time To File Taxes