Determining The Amount Of Taxes You Should Withhold

If you are newly retired, it can be difficult to figure out how much in taxes to withhold from your pension as your tax rate depends on your household sources of income and deductions.

When you add up all of your sources of income and subtract your deductions, you get your taxable income, which determines your tax bracket. You can use this tax bracket to estimate how much to withhold. When you look at a chart of tax rates, you can see that higher amounts of income will be taxed at higher rates.

Tax planning can help you figure out the right amount to withhold. With tax planning, you put together a “pretend” tax return, called a “tax projection.” As you transition into retirement, you might want to work with a CPA, tax professional, or retirement planner to help you with this.

If you prefer to do it yourself, you can plug numbers into an online 1040 tax calculator to get a rough estimate, or you can fill out your federal tax form as if you were filing taxes. Follow the instructions to see where each source of income goes. Calculate the tax you think you will owe. Divide that by your total income. Use the answer to see what percentage to withhold.

How Much Is Typically Taken Out Of A Paycheck For Taxes

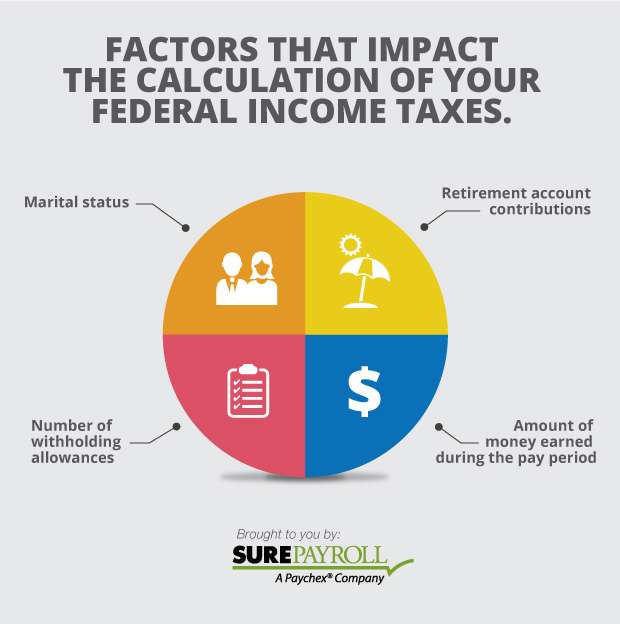

Every first-time jobholder is probably a bit surprised to find the amount on their first paycheck is less than their total earnings. The difference between the amount of money earned, or gross pay, and the amount a worker takes home is due to taxes. All wage earners are required to pay certain federal taxes that are automatically withheld from their wages. Some states also withhold for state income tax. Understanding exactly how much in taxes is taken out of your paycheck can help lessen the shock.

How Do I Calculate Salary To Hourly Wage

Multiply the hourly wage by the number of hours worked per week. Then, multiply that number by the total number of weeks in a year . For example, if an employee makes $25 per hour and works 40 hours per week, the annual salary is 25 x 40 x 52 = $52,000.

Important Note on the Hourly Paycheck Calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

Recommended Reading: Do I Need To Report Roth Ira Contributions On My Tax Return

Ways To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions such as charitable donations or deducting property taxes and the mortgage interest paid on a home loan and property taxes. Deductions can lower how much of your income is ultimately taxed.

Tax credits, such as the earned income tax credit, or child tax credit, can also put you into a lower tax bracket. They allow for a dollar-for-dollar reduction on the amount of taxes you owe.

The Taxes Owed Depend On Your Age The Type Of Account And More

How much you will pay in taxes when you withdraw money from an individual retirement account depends on the type of IRA, your age, and even the purpose of the withdrawal. Sometimes the answer is zeroyou owe no taxes. In other cases, you owe income tax on the money you withdraw. You can even owe an additional penalty if you withdraw funds before age 59½. On the other hand, after a certain age, you may be required to withdraw some money every year and pay taxes on it.

There are multiple IRA options and many places to open these accounts, but the Roth IRA and the traditional IRA are by far the most widely held types. The withdrawal rules for other types of IRAs are similar to the traditional IRA, with some minor unique differences. These include the , Simple IRA, and SARSEP IRA. Each has different rules about who can open one. But before getting into the details, you should know that the Internal Revenue Service refers to a withdrawal from an IRA as a “distribution.”

Also Check: Efstatus Taxact Com Login

When You Owe Income Tax On A Withdrawal

Once you reach age 59½, you can withdraw money without a 10% penalty from any type of IRA.

If it is a Roth IRA and you’ve had a Roth for five years or more, you won’t owe any income tax on the withdrawal. If it’s not, you will.

Money deposited in a traditional IRA is treated differently from money in a Roth.

If it’s a traditional IRA, SEP IRA, Simple IRA, or SARSEP IRA, you will owe taxes at your current tax rate on the amount you withdraw. For example, if you are in the 22% tax bracket, your withdrawal will be taxed at 22%.

You won’t owe any income tax as long as you leave your money in a traditional IRA until you reach another key age milestone. Once you reach age 72, you will be required to take a distribution from a traditional IRA. Act in December 2019).

The IRS has specific rules about how much you must withdraw each year, the required minimum distribution . If you fail to withdraw the required amount, you could be charged a hefty 50% tax on the amount not distributed as required.

There are no RMD requirements for your Roth IRA, but if money remains after your death, your beneficiaries may have to pay taxes. There are several different ways your beneficiaries can withdraw the funds, and they should seek advice from a financial advisor or the Roth trustee.

How Much Do You Get Back In Taxes For A Child In 2020

There are multipletax breaks for parents, including the child tax credit. For 2020, the child tax credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 of that amount is refundable meaning if the credit reduces your tax bill to zero, you could receive the difference back as a refund. Tax reform expanded the credit to also include a $500 nonrefundable credit for qualifying dependents who arent children, and boosted the phase-out limits to an AGI of more than $400,000 for taxpayers who are married filing jointly and $200,000 for everyone else. The higher limits mean that more people could qualify for the credit.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

How Is Social Security Financed

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $142,800 , while the self-employed pay 12.4 percent.

In 2020, $1.001 trillion of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes. The remainder was provided by interest earnings $76 billion and revenue from taxation of OASDI benefits $41 billion .

The payroll tax rates are set by law, and for OASI and DI, apply to earnings up to a certain amount. This amount, called the earnings base, rises as average wages increase.

Tax rates for employees and employers each under current law

| Year |

|---|

Also Check: Where Is My State Refund Ga

Find The Federal Tax Brackets

IRS Publication 15 details various withholding procedures for employers and features tables delineating the percentage tax rate for employees based on their withholdings. Before consulting a percentage tax withholding table, determine the amount of gross pay to remove from the tax calculation.

A single worker with one allowance listed on the W-4 has $155.80 removed. If the worker earns $800, the $155.80 is subtracted and the new total of $644.20 is plugged into the IRS percentage method table. The table reveals the worker is taxed $35.90 plus an additional 15 percent of any earnings in excess of $447.

Check State Numbers Twice

Always double-check your employee’s state withholding certificates as allowances and deductions can compute differently using state tax information. In Louisiana, workers claim exemptions and deductions versus allowances. A person claiming one personal exemption and one deduction and earning $800 every two weeks has $18.27 withheld. The tax tables for many states specify a dollar amount of taxation versus a percentage or dollar and percentage combination.

Also Check: How Can I Make Payments For My Taxes

What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

Penalties For Not Withholding Enough

The IRS expects to be paid taxes as soon as wages are earned. If the information in an employees W-4 results in too little being withheld for taxes, the employee could be subject to a penalty for underpayment of taxes, even if the taxes are subsequently paid when the employee files a tax return.

The only employees who are exempt from withholding taxes are those who had no tax liability in the previous year and expect to owe no taxes in the current tax year. All other employees need to be sure to have enough withheld to cover their tax liability. Those who have significant additional income from investments or interest are encouraged by the IRS to make additional estimated tax payments to cover nonwage income.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

When To Change How Much Tax Is Withheld From Your Pension

When you are working, you can change the amount of tax withheld from your paycheck each year. In retirement, you can do that, too. When your tax situation changes, you will want to adjust your tax withholding.

For example, your first year of retirement you may have a salary for part of the year, and you may have a spouse who is still working, so you may need to withhold a larger amount in taxes from your pension for that year. In subsequent years, your income may change, which means you should adjust your tax withholding.

The following events may trigger a need to change your tax withholding in retirement:

- Your spouse stops working.

- You or a spouse take on part-time work.

- You pay off a mortgage or take on a mortgage.

- You have a large amount of taxable capital gains from the sale of a property, mutual funds, or stock.

- You take withdrawals from an IRA or 401 account.

- You and/or a spouse start Social Security benefits.

- You reach age 72 , and required IRA distributions begin

You May Like: How Much Is H& r Block Charge

Whats The Difference Between Federal Taxable And Adjusted Gross Income

Adjusted gross income is your gross income minus above-the-line adjustments . These can include certain business expenses, contributions to health savings accounts, educator expenses, student loan interest and other adjustments. After youve calculated your AGI on your Form 1040, you then deduct your standard deduction or itemized deductions, and any qualified business income, to arrive at your taxable income. Thats the amount of income youll have to pay taxes on.

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Read Also: Www.1040paytax.com

Median Might Be A Better Term

It might be easier to understand the median tax burden of American taxpayers instead. A median number is one that falls right in the middle. Half of all taxpayers would pay less than a median figure, and half would pay more.

The top 50% of taxpayers paid 97% of all federal income taxes in 2017, the last tax year for which comprehensive and vetted statistics are available, according to the Tax Foundation. As a result, the bottom 50% paid just 3%.

Based on these and other figures, the Tax Foundation derives an average tax rate of 16% for the top 50% of taxpayers, just 4% for the bottom 50%, and an average of 14.6% overall.

But this is just one way of looking at the equation. Theres also something known as the tax wedge, and the figures from the Tax Foundation reflect only incometaxes. Social Security and Medicare also take a percentage of Americans earnings. Technically, these should be considered when weighing an average tax burden, too.

How And When To Pay Estimated Taxes

Payments are due four times a year:

- 1st payment April 15

- 2nd payment June 15

- 3rd payment September 15

- 4th payment January 15 of the next year.

If your income is steady throughout the year, you can divide your payments up into four equal payments. If your business is seasonal, or you have a change in your business income, you may have to make smaller or larger payments in one or more quarters.

You can use the quarterly vouchers included in IRS Form 1040-ES to make these payments.

If you use a tax preparer or tax preparation software to prepare your tax return, they will include an estimated tax calculation and copies of vouchers. You must make the payments yourself in one of three ways:

- Mailing in the payment with the voucher

- Paying online using IRS Direct Pay, your credit or debit card, or one of the other IRS payment options

See IRS Form 1040-ES for copies of vouchers and details on these and other payment methods.

You can make additional estimated tax payments to make up for a quarter with more income, and you can also make your estimated payments weekly, bi-weekly, or monthly, as long as you have paid enough by the quarterly due date. It’s easier to make these payments online, through one of the IRS-approved payment methods.

Also Check: How Much H And R Block Charge For Taxes