Do I Have To Pay Taxes On A $10000 Inheritance

The amount of tax you owe will depend on a variety of factors, including your marginal tax rate and whether the money is considered income, otherwise, capital gains tax may be levied on it.

In general, inheritance tax in Australia is not subject to GST, but there are some exceptions. If you have any questions about your tax obligations, it’s best to speak to an accountant or tax lawyer.

Do You Need To Report The Estate

In certain circumstances, you wont need to report the value of the deceaseds estate, as it will be counted as an excepted estate.

According to government guidance, most estates are excepted. However, the rules on this will depend on when they died, who they left their assets to, and whether any inheritance tax is due.

Dont Miss: Do You Pay Taxes On Dividends Reinvested

How Are The Assets Of A Deceased Person Taxed

Different assets are taxed in different ways.

Cottage, stocks, mutual funds and investment properties are considered non-registered capital assets. The CRA considers them as sold for fair market value at time of death and defines capital gains as the difference between the fair market value when the items were purchased and the fair market value when they were sold.

Any capital gains are 50% taxable and added to the deceased persons other income. When their final tax return is prepared, the estate will be taxed according to the deceaseds personal income tax rate.

As for registered assets such as RRSPs and RRIFs, these are also included as part of the deceaseds income and taxed at their personal income tax rate. There is no special treatment for any capital gains earned here.

Recommended Reading: What Is The Income Tax Rate In California

California Inheritance Tax And Gift Tax

California does not have an inheritance tax, estate tax, or gift tax. However, California residents are subject to federal laws governing gifts during their lives, and their estates after they die.

Each California resident may gift a certain amount of property in a given tax year, tax-free. In 2021, this amount was $15,000, and in 2022 this amount is $16,000. Estates valued at less than $12.06 million in 2022 for single individuals are exempt from an estate tax.

If the gift or estate includes property, the value of the property is determined by the fair market value of that property.

Selling A Deceased Parents Home

David bought a house in Sacramento and lived there for several years. David passed away, leaving the house to Bruce, his son, who also lives in Sacramento.

If Bruce waits to sell the house, he may be responsible for capital gains taxes on the amount the house increased in value between the date David died and the date Bruce sold the house.

If Davids house was worth $100,000 when he died and Bruce sold the house for $150,000 a few months later, Bruce would pay capital gains taxes on the $50,000 of the increased value of the house. Bruce can avoid these taxes by selling the house immediately, before its value increases.

If Bruce rents the house, he would be responsible for paying taxes on any income he received from his tenants.

You May Like: What Can I Write Off On My Taxes For Instacart

Cease And Desist Order Australia: Things You Need To Know

KMB Legal is a boutique law firm whose main practice areas are Family Law, Commercial Law and Personal Injury Law. Established in 2016 out of a need in the market for speciality legal services with a strong customer focus. We pride ourselves on our commitment to our clients, who dont see us as their law firm, rather as their trusted legal advisors.

Law Practice is owned by MB28 Holdings Pty Ltd ABN 58 436 026 865 Incorporated under the Legal Profession Act 2007

How Do You Avoid Inheritance Tax

One option is to give gifts to family members while you are still alive. Another option is to set up a trust fund.

This can be an effective way to ensure that your assets are distributed according to your wishes. Finally, you may also want to consider setting up a life insurance policy. This can provide financial security for your loved ones in the event of your death.

Don’t Miss: How To Reduce Taxes On Stock Gains

Do You Have To Pay Us Taxes On Foreign Inheritance

Though the passing of a loved one is undoubtedly a difficult event, it sometimes happens that a person benefits financially from such an occurrence because they are the recipient of an inheritance. In many cases, especially those involving large amounts of money, there are substantial reporting and withholding requirements that go along with an inheritance, thanks to U.S. tax laws. However, the situation can become more complicated if one or more parties are not American citizens or live outside the United States.

The IRS wont tax a foreign inheritance that comes from a someone who is not an American resident or citizen. That being said, you might need to report it to the IRS, just for informational purposes. If your foreign inheritance exceeds a certain amount, you will have to file IRS Form 3520, along with other forms, should they apply to your situation.

The certified public accounts at US Tax Help specialize in guiding American expatriates through tax season. Our team can help you understand how to report your foreign inheritance to the IRS. For guidance and helpful tips, visit our website or call the CPAs for American expatriates at US Tax Help today at 362-9127.

How Much Is Inheritance Tax

The amount of inheritance tax that you will have to pay depends on:

- the state in which you reside

- the size of the inheritance

- your relationship with the deceased

Generally, the tax is a percentage of the value of the property being inherited. The percentage can range from 0% to 18%, and there may be different rates for different types of property. You can find out more about the different tax rates with a free tax consultation.

| DID YOU KNOW:According to a 2021 OECD report, which includes 37 countries, only 24 countries around the world levy inheritance or estate taxation, and only 0.5% of the total tax revenue comes from an estate, inheritance, or gift taxes. |

Recommended Reading: How To Check My Tax Return

In Canada There Is No Inheritance Tax

Money received from an inheritance, like most gifts and life insurance benefits, is not considered taxable income by the CRA, so you dont have to pay taxes on that money or report it as income on your tax return.

Of course, this doesnt mean that an inheritance is immune from Canadian tax laws. The may have to pay taxes on the estates income before the money is released to you. By the time the estate is settled, the beneficiary should not have to worry about taxes.

The CRA treats the estate as a sale, unless the estate is inherited by the surviving spouse or common-law partner, where certain exceptions are possible. This means that the estate pays the taxes owed to the government, rather than the beneficiaries paying.

Also, if you invest your inheritance money, and earn income on that investment, you will be taxed on the income earned. The same rules apply if you sell a capital asset and it increases in value from the time you inherited it.

Visit the following CRA webpage for more information: Amounts That Are Not Taxed

Do I Have To Pay Taxes On An Inheritance From A Foreign Relative

May 13, 2022by Rania Combs

If you have close relatives, like parents, who are citizens and residents of a foreign country, there is a chance you might receive a gift or inheritance from them at some point in your life. You may wonder whether you will have to pay taxes on an inheritance you receive from a foreign relative.

In the United States, those who receive gifts are not required to pay any gift taxes. The burden of paying the gift tax falls on the gift-giver. The same is true for those who receive an inheritance. The fact that the gift is from a foreign person is irrelevant.

Therefore, if you receive a monetary gift or an inheritance from relatives abroad, you will not have to pay taxes on it.

However, you must report the gift or inheritance to the IRS if the amount you receive exceeds a certain threshold.

Don’t Miss: How To Calculate Tax In Texas

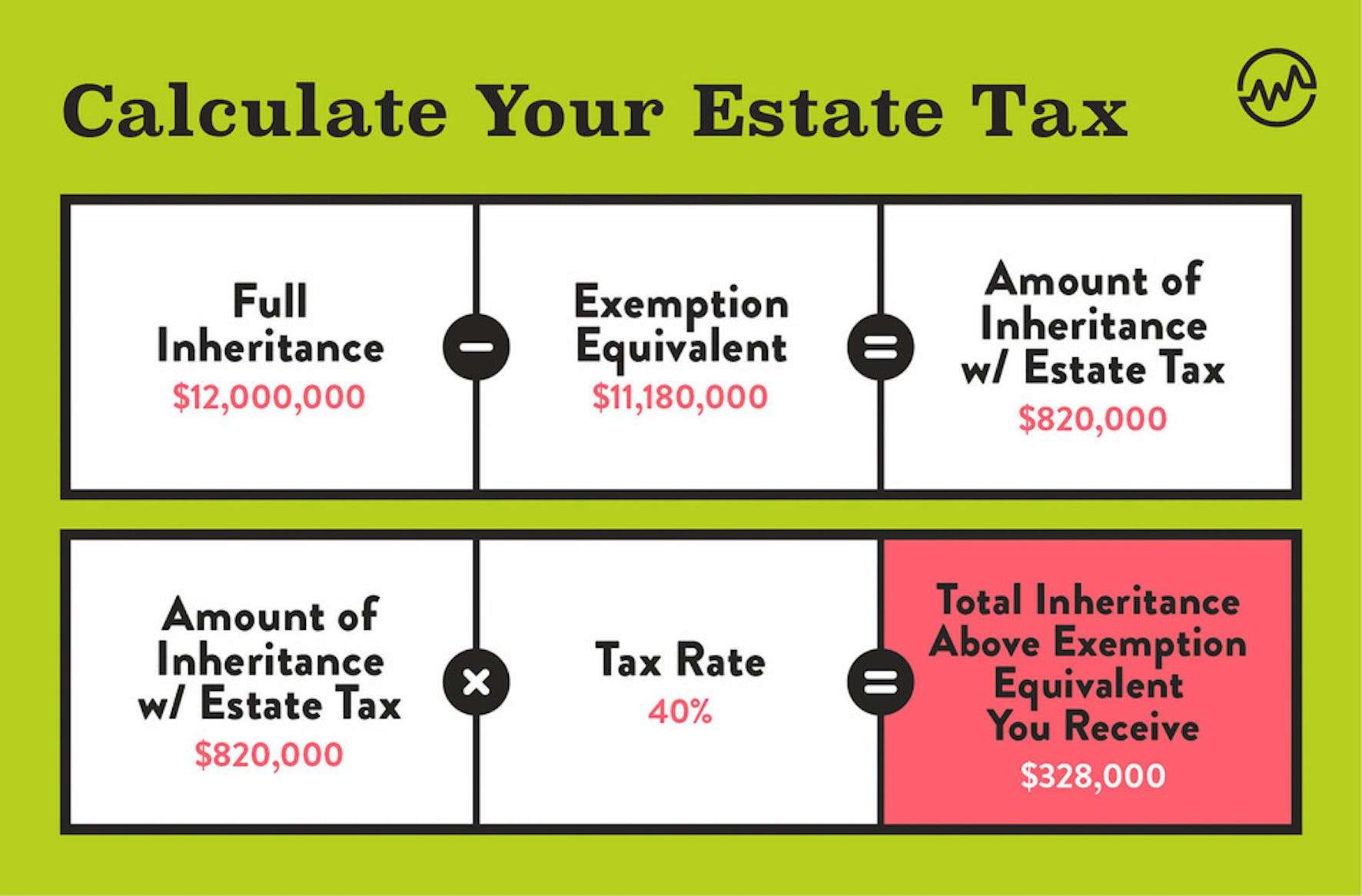

What Is The Federal Inheritance Tax Rate

There is no federal inheritance taxthat is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022. The tax is assessed only on the portion of an estate that exceeds those amounts. The rate is on a sliding scale, from 18% to 40%.

How To Avoid Inheritance Taxes

There are a number of ways that you can avoid taxes that come with inheriting assets.

Keep Below the Threshold

The best way to keep below the tax threshold is to give money away during your lifetime. You can do this through a trust or by making direct gifts to your heirs.

Put Assets Into a Trust

Another way to avoid taxes on inheritance money is to put the assets into a trust. If you do this, the trust will be the owner of the assets and not you. This means that when you die, the trust will be the official owner of the assets, benefiting your heirs.

Traditional and Roth IRA

Individuals are not subject to tax on the money within the inherited IRA, however, they will be taxed upon making distributions from the traditional IRA. The tax on withdrawals is the same as the original owners. Roth IRAs on the other hand are usually tax-free but you must delete the account within the next five years.

Irrevocable Trusts

Unlike the revocable living trust which can be altered at any time by its grantor, with an irrevocable trust account the grantor puts all assets in the hands of the trustee.

Such trusts are considered accidental loopholes as they are used largely for transferring assets to beneficiaries without paying gift or state inheritance taxes. As the grantor gives up ownership of the assets they are no longer part of his or her estate and will not be subjected to estate tax when the grantor dies.

Give Away Your Assets

The Lifetime Gift Tax Exemption

Life Insurance Policy

Read Also: What Will My Tax Return Be

Do You Pay Tax On Inherited Money In The Uk

This depends entirely on the amount of money or possessions that were left to you. There are various ways in which a person can inherit money in the UK. You dont usually have to pay any tax immediately, but you eventually might need to pay one of the following:

- Inheritance Tax

Lets break each of these down:

Put Everything Into A Trust

If you are expecting an inheritance from parents or other family members, suggest they set up a trust to deal with their assets. A trust allows you to pass assets to beneficiaries after your death without having to go through probate. Trusts are similar to wills, but trusts generally avoid state probate requirements and the associated expenses that wills typically have to go through.

- With a revocable trust, the grantor can take the assets out if necessary.

- An irrevocable trust usually ties up the assets until the grantor dies.

It may be tempting for parents to put their assets into joint names with a child, but this can actually increase the taxes the child pays.

- When joint owner dies, the other owner already owns a portion of of the assets. This means that there is a step up in cost basis on the portion that is inherited but not on the rest of the account.

- For long-held assets, this can mean a significant tax hit when the child sells the asset.

Read Also: How Much Is Tax In Alabama

Do You Get A 1099 For Inheritance

When a taxpayer receives a distribution from an inherited IRA, they should receive from the financial instruction a 1099-R, with a Distribution Code of ‘4’ in Box 7. This gross distribution is usually fully taxable to the beneficiary/taxpayer unless the deceased owner had made non-deductible contributions to the IRA.

Should You Accept Monetary Gifts Before Death

If you live in a state that charges inheritance tax, your loved one may want to gift you money before they die. This is a common way to get around the inheritance tax. As long as the donor sticks within the gift limits, which right now is $15,000 per year per person, the donor wont pay taxes. The receiver never pays taxes on gifts they receive.

You May Like: Do Churches Pay Payroll Taxes

Inheritance Taxes Vs Estate Taxes

Inheritance tax and estate tax are two different things. Inheritance tax is what the beneficiary the person who inherited the wealth must pay when they receive it. Estate tax is the amount thats taken out of someones estate upon their death. One, both or neither could be a factor when someone dies.

There is no federal inheritance tax, but there is a federal estate tax. In 2022, federal estate tax generally applies to assets over $12.06 million, and the estate tax rate ranges from 18% to 40%. Some states also have estate taxes and they might have much lower exemption thresholds than the IRS. Assets that spouses inherit generally aren’t subject to estate tax.

Because the estate tax and inheritance tax are different, some people can occasionally get hit with a double whammy. Maryland, for example, has an estate tax and an inheritance tax, which means an estate might have to pay the IRS and the state, and then the beneficiaries might have to pay the state again out of whats left. However, this isn’t the norm across the country.

» Planning your estate? Know the difference between wills and trusts

How To Use The Italy Inheritance Tax Calculator

You can view the calculator inline or full screen. The inline view displays the calculator surrounded by the normal menus and links to other tools and supporting information. The full screen view removes or the unnecessary information so you can focus solely on using the Italy Inheritance Tax Calculator. The following step-by-step guides to calculating inheritance tax online with the Italy Inheritance Tax Calculator covers all the functions within the inheritance tax calculator:

You May Like: How To Apply For Tax Exemption

Don’t Miss: What To Claim On Taxes

Inheritance Tax Vs Estate Tax

Inheritance taxes and estate taxes are often lumped together. However, they are two distinct forms of taxation.

Both levies are based on the fair market value of a deceased person’s property, usually as of the date of death. But an estate tax is levied on the value of the decedent’s estate, and the estate pays it. In contrast, an inheritance tax is levied on the value of an inheritance received by the beneficiary, and it is the beneficiary who pays it.

The distinction between an estate tax and an inheritance tax with identical rates and exemptions might make no difference to a sole heir. But in some rare situations, an inheritance could be subject to both estate and inheritance taxes.

According to the Internal Revenue Service , federal estate tax returns are only required for estates with values exceeding $11.7 million in 2021 and $12.06 million in 2022. If the estate passes to the spouse of the deceased person, no estate tax is assessed.

If a person inherits an estate large enough to trigger the federal estate tax, the decedent lived or owned property in a state with an inheritance tax, and the bequest is not fully exempt under that state’s law, the beneficiary faces the federal estate tax as well as a state inheritance tax. The estate is taxed before it is distributed, and the inheritance is then taxed at the state level.

What Is Inheritance Tax And How Does It Work

- In the UK there has been some form of inheritance tax as far back as 1694

- The taxing of estates has taken many forms over the years and with various names but in 1986 the name inheritance tax was first introduced and has remained ever since

- Over the years there have been numerous inheritance tax changes

- Inheritance tax is calculated on the total deceaseds estate, gifts made within 7 years, with tax paid on amounts over the nil rate band, also known as IHT threshold, applicable at the date of death

- There are further tax-free allowances concerning gifts made by the deceased in their lifetime

You May Like: How To Pay My Federal Taxes

Do You Have To Pay Taxes On A Trust Inheritance

Estate planning is crucial to ensure the capital and assets youve spent your career amassing remain with the beneficiaries of your choosing.

When you pass, however, those assets could be subject to inheritance and estate taxes depending on where you lived and how much wealth you left to your beneficiaries.

In this article well take a look at whether beneficiaries have to pay taxes on their trust inheritances, as well as examine state and federal inheritance and estate tax rates.

Inheritance Tax Rates In Ireland

The table below specifies the relevent inheritance tax rates applicable in Ireland, these were last updated in line with the .

Ireland Inheritance Tax Tables in 2022: Inheritance Tax Rates and Thresholds| Inheritance Tax Rate | |

|---|---|

| Up to 16,260.00 each | Beneficiary is unrelated to deceased |

You can view historic inheritance tax rates and other tax rates and allowances in the Ireland Tax Tables.

Recommended Reading: Who Can File Ez Tax Form