Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

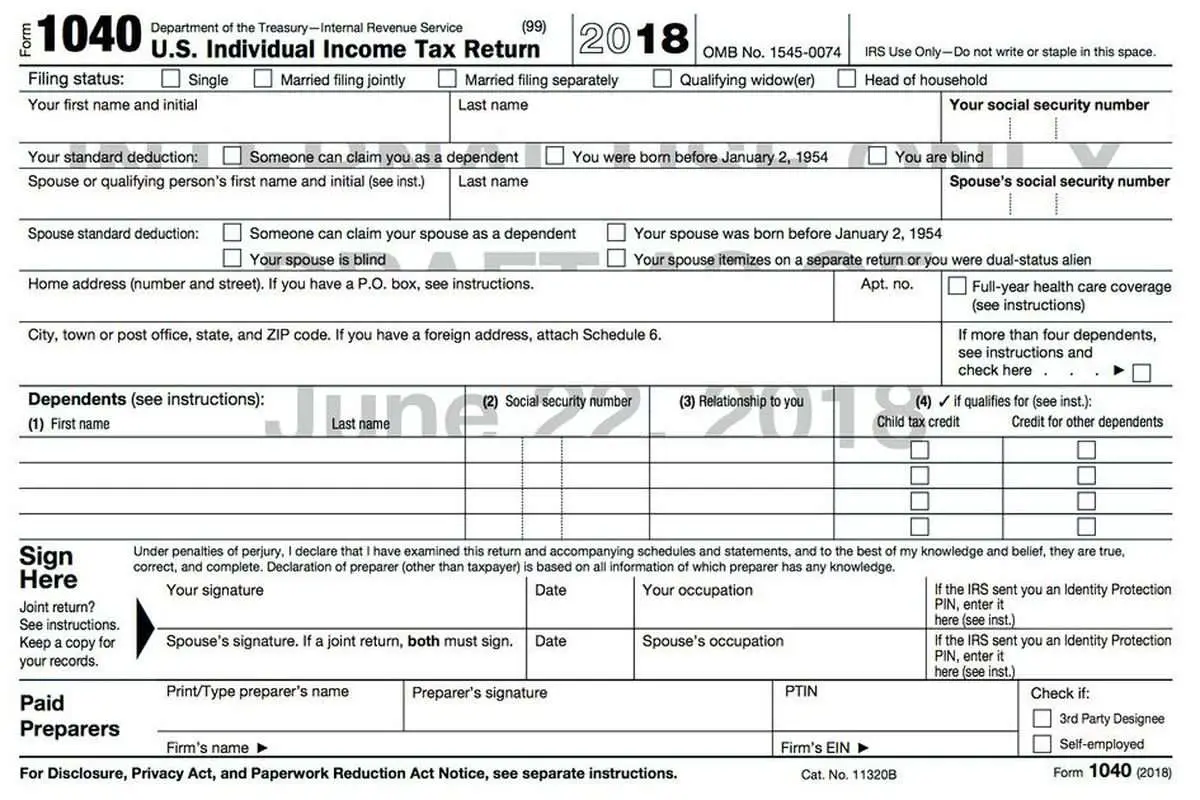

What Is An Irs 1040 Form

OVERVIEW

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations. There have been a few recent changes to the federal form 1040. Well review the differences and show you how file 1040 form when it comes to tax time.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. Depending on the type of income you report, it may be necessary to attach additional forms, also known as schedules.

Here’s a guide to all of the 1040 variations you may come across. to begin preparing your tax documents.

How Do I Attach Tax Forms

For supporting statements, arrange them in the same order as the schedules or forms they support and attach them last. n Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. n Use the coded envelope included with your tax package to mail your return.

Don’t Miss: Turbo Tax 8962

Is It Possible To Make A Mistake On A 1040x

Never fear Form 1040X is designed for just such a circumstance. And lest you think youre the only person whos made a mistake on a federal tax return, relax. According to the IRS, youre in good company. The IRS estimates that nearly 6 million amended returns were filed during the 2018 calendar year.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Read Also: Doordash 1099 Example

Why Is My Tax Return Taking So Long Canada

If you owe money to a government agency, you might not receive your refund as soon as it is due. The IRS would be willing to consider whether you were overpaid some benefits, including Employment Insurance , Canada Child Benefit , the GST and HST Credit, or have a balance owing from a previous tax year.

Where Do I Mail My Amended Tax Return

Internal Revenue Service Austin, TX 73301-0052. Alaska, California, Hawaii. Use this address if you file January 1, 2021 through June 18, 2021: Department of the Treasury Internal Revenue Service Fresno, CA 93888-0422 Starting June 19, 2021, use the following address: Department of the Treasury Internal Revenue Service Ogden, UT 84201-0052

Read Also: Ntla Tax Lien

When To File Your Return

If you file your return on a calendar year basis, the 2020 return is due on or before . A fiscal year return is due on the 15th day of the 4th month following the end of the taxable year. When the due date falls on a Saturday, Sunday, or holiday, the return is due on or before the next business day. A fiscal year return should be filed on a tax form for the year in which the fiscal year begins. For example, a 2020 tax form should be used for a fiscal year beginning in 2020. See Directive TA-16-1, When a North Carolina Tax Return or Other Document is Considered Timely Filed or a Tax is Considered Timely Paid if the Due Date Falls on a Saturday, Sunday, or Legal Holiday.

Out of the Country: If you are out of the country on the original due date of the return, you are granted an automatic four month extension to file your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of the Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date of the return until the tax is paid.

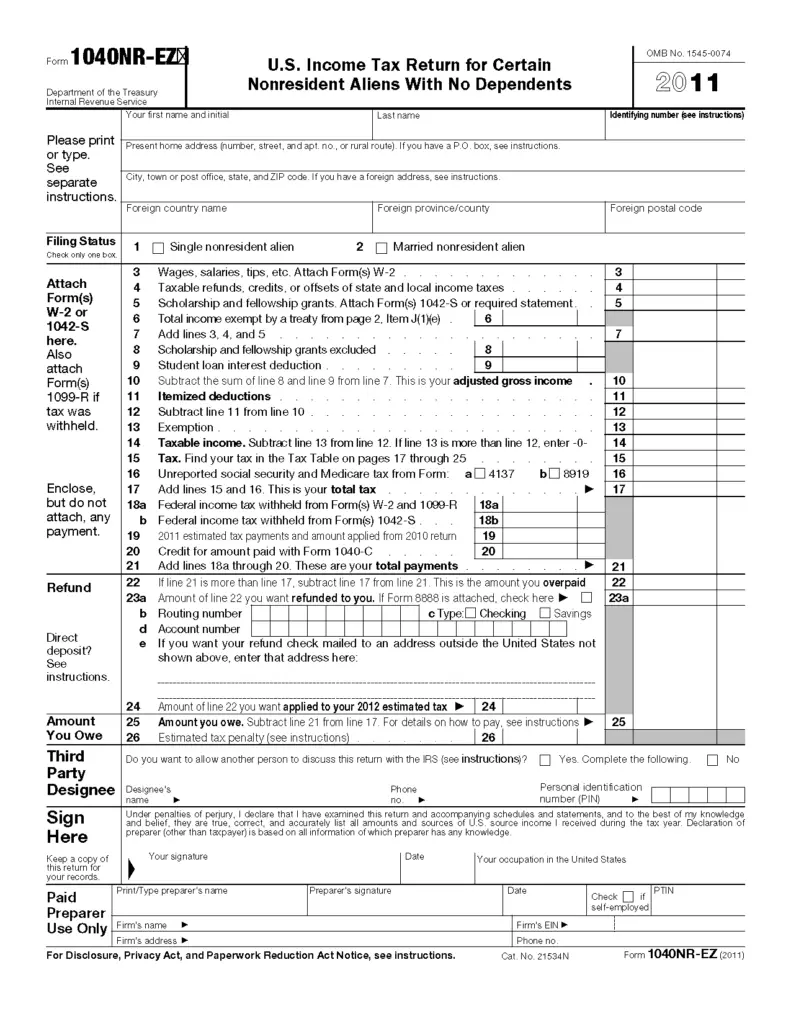

Nonresident Aliens: Nonresident aliens are required to file returns at the same time they are required to file their federal returns.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Is Doordash Taxable Income

Who Can File Form 1040

Taxpayers who must remit payment to the IRS and choose to do so with a check or money order must file Form 1040-V. Mailing payments to the agency is an option if there’s a figure on the “Amount You Owe” line of your Form 1040, 1040-SR, or 1040NR. Taxpayers also have the option to make their payment electronically, which allows them to avoid having to print, fill out, and mail Form 1040-V altogether.

Do not staple Form 1040-V or your check/money order to your tax return when you send it to the IRS.

Where To Send Returns Payments And Extensions

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Lara Antal

It’s usually best to go the extra mile when you’re dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. That’s even more applicable if you’re one of the few people who still files a paper or snail-mail tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

Don’t Miss: Door Dash 1099

Penalty & Interest Charges

- You will receive penalty on your individual income tax return/payment if not paid within the specified time due per The Revenue Act of 1941.

- Penalty is charged at 5% for the first two months and then 5% for each additional month thereafter up to a maximum of 25%.

- Interest is calculated by multiplying the current interest rate by the amount of tax you owe.

- You may request a waiver of penalty in writing. You are required to explain your reason for late payment of tax. You must submit supporting documentation and meet the reasonable cause criteria outlined in the Revenue Administrative Bulletin 1995-4 before a waiver of penalty will be considered.

Sign And Date Returns

If youre filing a joint return, you and your spouse must sign, even if only one of you generated income.

Both signatures should be on E-filed returns and paper returns

You can sign with your identification number for electronic filers, which is a unique five digits identifier that each taxpayer selects through their modified gross income.

Also Check: Pastyeartax.com Review

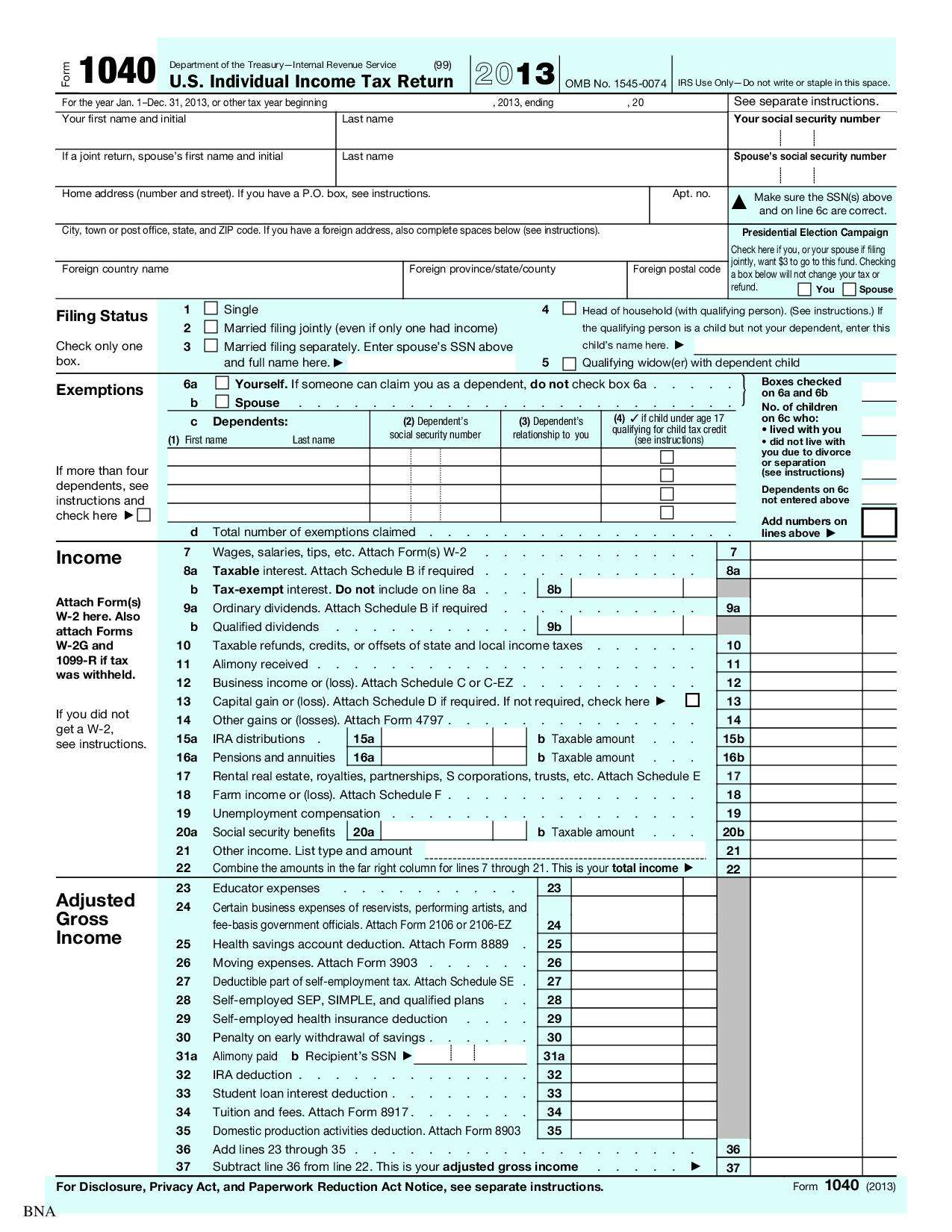

What Is The Purpose Of A 1040 Form

Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Your AGI is an important number since many deduction limitations are affected by it.

On line 11 of the tax year 2021 Form 1040, you will report your AGI. You can reduce it further with either the standard deduction or the total of your itemized deductions reported on Schedule A. Itemized deductions include expenses such as:

If the total of your itemized deductions does not exceed the standard deduction for your filing status, then your taxable income will usually be lower if you claim the standard deduction. Beginning in 2018, exemption deductions are replaced with higher child tax credits and a new other-dependent tax credit.

TurboTax will do this calculation for you and recommend whether choosing the standard deduction or itemizing will give you the best results.

Here’s How Long It Will Take To Get Your Tax Refund In 2022

Three in four Americans receive an annual tax refund from the IRS, which often is a family’s biggest check of the year. But with this tax season now in progress, taxpayers could see a repeat of last year’s snarls in processing, when more than 30 million taxpayers had their returns and refunds held up by the IRS.

Treasury Department officials warned in January that this year’s tax season will be a challenge with the IRS starting to process returns on January 24. That’s largely due to the IRS’ sizable backlog of returns from 2021. As of December 31, the agency had 6 million unprocessed individual returns a significant reduction from a backlog of 30 million in May, but far higher than the 1 million unprocessed returns that is more typical around the start of tax season.

That may make taxpayers nervous about delays in 2022, but most Americans should get their refunds within 21 days of filing, according to the IRS. And some taxpayers are already reporting receiving their refunds, according to posts on social media.

However, so far, the typical refund is about $2,300 less than the average refund check of about $2,800 received last year. That could change as the tax season progresses, given that tens of millions of Americans have yet to file. But it could signal that taxpayers could get smaller checks this year, an issue for households already struggling with high inflation.

Read Also: How Much Money Should I Save For Taxes Doordash

Do You Have To Use The Irs Form 1040

Before 2019, there were shorter versions of Form 1040 for filers with simpler returns. These were Form 1040EZ and 1040A, but they no longer exist. The IRS now requires most taxpayers to use Form 1040. However, starting with the 2019 tax year, taxpayers age 65 and up may be able to file using the new Form 1040-SR.

Receipts And Proof Of Expenses

The IRS does not require taxpayers to attach receipts or proof of expense payments claimed on tax returns, but you must hold onto receipts and copies of any other items used to prepare your return, and keep them handy. In the event a return you file is selected for an audit, youll need to show proof of your expenses to your examiner, or items you claimed could be disallowed.

Recommended Reading: Efstatus Taxact Com Login

What Are The Most Recent Changes To Form 1040

The biggest change to Federal Form 1040 is that a new Line 30 has been added for the Recovery Rebate Credit. This is for taxpayers who didn’t receive payments or could have received a larger payment from the government when economic impact payments went out in 2021. These taxpayers can claim that amount as a refundable credit here.

For 2020 only, the “Amount You Owe” section of Form 1040, states: “Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you owe for 2020.” This means that since employers were allowed to defer payments of the employer’s share of social security tax due to the CARES Act, this deferred amount will be reported in the payments section of Form 1040, Schedule 3, Line 12e. It will be entered as a “Deferral for certain Schedule H or SE filers.”

Another change to Form 1040 that showed up in 2020 is that there are three lines to report withholdings. On Form 1040, Line 25a will be for W-2 withholdings, Line 25b will be for 1099 withholdings, and Line 25c will be for other withholdings.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Can You File A Paper Tax Return

While most people go for the e-filing or professional accountant route, its still entirely possible to file your income taxes by mail and all on your own. While filing the old way saves you from hacking risks, paper filing does tend to take longer, which means you might have to wait longer for your refund if youre expecting one.

You May Like: Doordash Tax Write Offs

Do I Need To File Taxes

Whether you should file a tax return or not is dependent on a few factors, which include

- Age

- Tax filing status

- Etc.

You can consider filing your tax returns if the following apply to you

- Youre eligible for specific tax credits

- Your employer deducted income tax from your paycheck

- The IRS estimated your tax payments or last years refund was added to this years estimated tax.

Use A Secure Method To Mail Your Return

Always use a secure method, such as certified mail, return receipt requested, when you’re sending returns and other documents to the IRS. It will provide confirmation that the IRS has actually received your documents or payment.

In addition to addressing it correctly and using sufficient postage, be sure the envelope is postmarked no later than the date your return is due. If you use registered mail, the date of the registration is the postmark date if you use certified mail, the date stamped on the receipt is the postmark date. If you use an IRS-approved private carrier , make sure the return is sent out no later than the date due.

Don’t Miss: Efstatus Taxact Com 2016

What Is Form 1040

Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service along with their tax return if they choose to make a payment with a check or money order. The IRS has different filing centers that taxpayers can send their payments and 1040-V forms depending on where they live. Filers who don’t wish to do so can send their payments electronically, thus alleviating the need to file Form 1040-V.

Payment For A Tax Due Return

You may choose a direct debit from a checking or savings account when the return is e-filed and supported by the software. A direct debit is a tax payment electronically withdrawn from the taxpayer’s bank account through the tax software used to electronically file the individual income tax return. Submitting the electronic return with the direct debit information provided, acts as the taxpayer’s authorization to withdraw the funds from their bank account. Requesting the direct payment is voluntary and only applies to the electronic return that is being filed.

Payments can be made by using the Michigan Individual Income Tax e-Payments system.

- If you have received an assessment from the Michigan Department of Treasury’s Collection Services Bureau, use the Collections e-Service payment system.

- Payments for 2020 tax due returns can be made using this system. Prior year payments are currently not accepted electronically.

- Any payment received after April 15th will be considered late and subject to penalty and interest charges. However, you may submit late or partial payments electronically.

- Estimate penalty and interest for a tax due return.

Payment can also be made by check or money order with your return. Make checks payable to “State of Michigan,” print your complete Social Security number and appropriate tax year on the front of your check or money order.

You May Like: Do You Claim Plasma Donation On Taxes