Your Personal Income Taxes

You may see the term gross income come up when filing your income taxes.

In this case, most people use the term gross income to refer to your total income, which you can find on Form 1040. That said, nontaxable types of income arent included in total income. Nontaxable income can include gift income and income used for certain retirement contributions.

You may also see the term net income when filing income taxes. You can calculate it using information from your federal tax return. Take your taxable income listed on your Form 1040 and then subtract your total tax . The result is your net income based on your tax return.

Importance Of The Agi

Your AGI impacts many of the tax deductions and credits you can take at tax time. Thats especially important because deductions and credits can increase your tax refund or reduce the amount of taxes you owe. Depending on your filing status, you may be subject to an AGI limita dollar amount that limits the deductions you can takewhich usually applies to higher income earners.

Generally, the more deductions and credits you take, the lower your taxable income.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

More Answers: Income & Household Size

- How do I upload documents to verify my income for the Marketplace?

-

If the Marketplace tells you to provide pay stubs, self-employment records, or other information to verify your income, follow these directions to upload documents.

- What is “MAGI,” and do I need to use it for anything?

-

The Heath Insurance Marketplace uses an income figure called Modified Adjusted Gross Income to determine the programs and savings you qualify for. For most people, its identical or very close to Adjusted Gross Income . MAGI is not a line on your federal tax return.

- The estimate instructions above are based on MAGI, but its not a term you need to know in order to apply or use tools on this site.

- What if I dont know my households recent Adjusted Gross Income?

-

Start with federal taxable wages for each income earner in your household.

- You should find this amount on your pay stub.

- If it’s not on your pay stub, use gross income before taxes. Then subtract any money the employer takes out for health coverage, child care, or retirement savings.

- Multiply federal taxable wages by the number of paychecks you expect in the tax year to estimate your income.

Don’t Miss: Tax Lien Investing California

How To Calculate Agi

Before you begin computing your AGI for tax purposes, you may want to find out if you need to file a tax return for the year. Nevertheless, the IRS recommends that you always file your tax return because if you do not owe the government, the government may be owing you, which means you’re eligible for a tax refund.

You can calculate your AGI for the year using the following formula:

Gross incomeâ the sum of all the money you earn in a year. Your gross income is a measure that includes all money, property, and the value of services received that the IRS considers ‘taxable income.’ It specifically consists of the following income sources:

- Gifts and inheritance

- Child support or foster care payments

- Disability payments

How Do I Reduce My Modified Adjusted Gross Income

The best way to lower your MAGI is to lower your AGI. You can do this by contributing more toward expenses that qualify as above-the-line deductions. These include HSA contributions, medical expenses exceeding 10% of your AGI, pre-tax retirement plan contributions, capital losses, mortgage interest, property taxes, and charitable contributions.

Also Check: How Do I Amend My State Tax Return

Determine Your Total Annual Income

Once you’ve gathered your income statements, begin calculating your total annual income. Do so by finding the sum of all the income you’re bringing in in a given year. If you’ve made or expect to receive any bonuses, be sure to include these in your annual income. If you earn an annual salary, most of the work has been done for you. If you work hourly, you can refer to your paycheck or simply multiply your hourly wage by the number of hours you worked per week and then multiply that by 52. This will give you your annual salary. If you’re married and filing a joint tax return, make sure to include your spouse’s annual income and bonuses as well since this is for your entire household.

The Benefits To Filling Out The Fafsa And What Its Application Entails

The Free Application for Federal Student Aid, often simplified to FAFSA, is a form for both undergraduate and graduate students to fill out in order to receive federal aid towards their education. The application involves reporting household income — including parentsâ income as well as the studentâs. The application involves referring to tax information like W2âs and tax returns, and it asks for other general information about the student.

Filling out the FAFSA is absolutely essential to receive funds towards college it qualifies students for grants, subsidized and unsubsidized loans, work studies, and more. The FAFSA is required of students from both private, public, and state-affiliated universities and can be filled out by students of all financial backgrounds.

For more information about the FAFSA, check out our guide to the application.

Recommended Reading: Cook County Appeal Property Tax

The Irs Uses Magi To Determine Ira Eligibility And More

The Balance / Bailey Mariner

Your modified adjusted gross income determines whether you are allowed to claim certain benefits on your taxes. These include whether you can deduct contributions to an individual retirement account . It also impacts what you can put in a Roth IRA each tax year.

Certain education-related tax benefits and income tax credits are based on MAGI. Under the Affordable Care Act, your household MAGI also impacts whether you can get income-based Medicaid or subsidized health insurance through the Marketplace.

In 2021, the American Rescue Plan allowed more households to access subsidized health insurance through the Marketplace. In tax years 2021 and 2022, you may be eligible for new tax credits that lower the cost of your Marketplace health insurance, even if your MAGI was too high to qualify in previous years. You will still need to file taxes at the end of the year to prove that your income was not too high for the tax credit.

The first thing to know is that your total income, modified adjusted gross income, and adjusted gross income are not the same things. Though they use most of the same base numbers, each is calculated in a slightly different way.

For tax-planning purposes, you will need to learn the differences and when to use each one.

Need To Know More About Adjusted Gross Income

Still have questions about Adjusted Gross Income? Our Tax Pros can help. Theyre dedicated to knowing the nuances of taxes and can help you understand your return.

Make an Appointment to speak with a tax pro today.

Related Topics

Learn more about Form 3921 and incentive stock option rules with the tax experts at H& R Block.

Don’t Miss: Www.1040paytax.com.

What Types Of Income Are Included In Agi

Adjusted gross income is your gross income which includes wages, dividends, alimony, capital gains, business income, retirement distributions and other income minus certain payments youve made during the year, such as student loan interest or contributions to a traditional individual retirement account or a health

Understanding Adjusted Gross Income Deductions

Understanding what deductions you are eligible for and what adjustments you are entitled to can be tricky since everyone, depending on life and financial circumstances, is subject to a specific different tax bracket and can qualify for additional refunds, breaks, and tax credits.

Depending on your personal and professional situation, you should decide to adjust your taxable income using either a standard deduction or an itemized deduction. Both deductions allow taxpayers to reduce their taxable income and are commonly used by professionals of every age, in every industry, and pay grade.

A standard deduction is a predetermined amount established by the IRS based on a taxpayers filing status, age, and whether or not they are disabled or claimed as a dependent on someone elses tax return.

If the value of expenses that you can deduct from your taxable income exceeds the standard deduction you qualify for, an itemized deduction may be a better option for you.

An itemized deduction allows taxpayers to specifically list all eligible tax adjustments, including mortgage interest, charitable gifts, and unreimbursed medical expenses, on schedule A of form 1040 when filing their taxes. Frequently, itemized deductions allow individuals to pay less tax than they otherwise would have if they used a standard deduction.

Both standard and itemized deductions can significantly reduce your taxable income and, depending on your tax bracket, can save you substantial amounts.

Also Check: Have My Taxes Been Accepted

How Your Adjusted Gross Income Affects Your Taxes

Your adjusted gross income affects the extent to which you can use deductions and credits to reduce your taxable income. For instance, consider the effect of AGI on medical and dental expenses for taxpayers who itemize.

Those who itemize can deduct only the amount of qualified medical and dental expenses that are higher than a certain percentage of their adjusted gross income. For 2020, this limit is once again 7.5% of your AGI. This means that if your medical and dental expenses dont exceed 7.5% of your AGI, you likely wont be able to deduct them at all.

AGI-related limits also apply to deductions for tuition and charitable contributions. You can generally deduct qualified charitable contributions you made only until the deduction amount reaches 50% of your AGI. Therefore, your AGI has a significant effect on which deductions and credits you can take, as well as how much theyre worth.

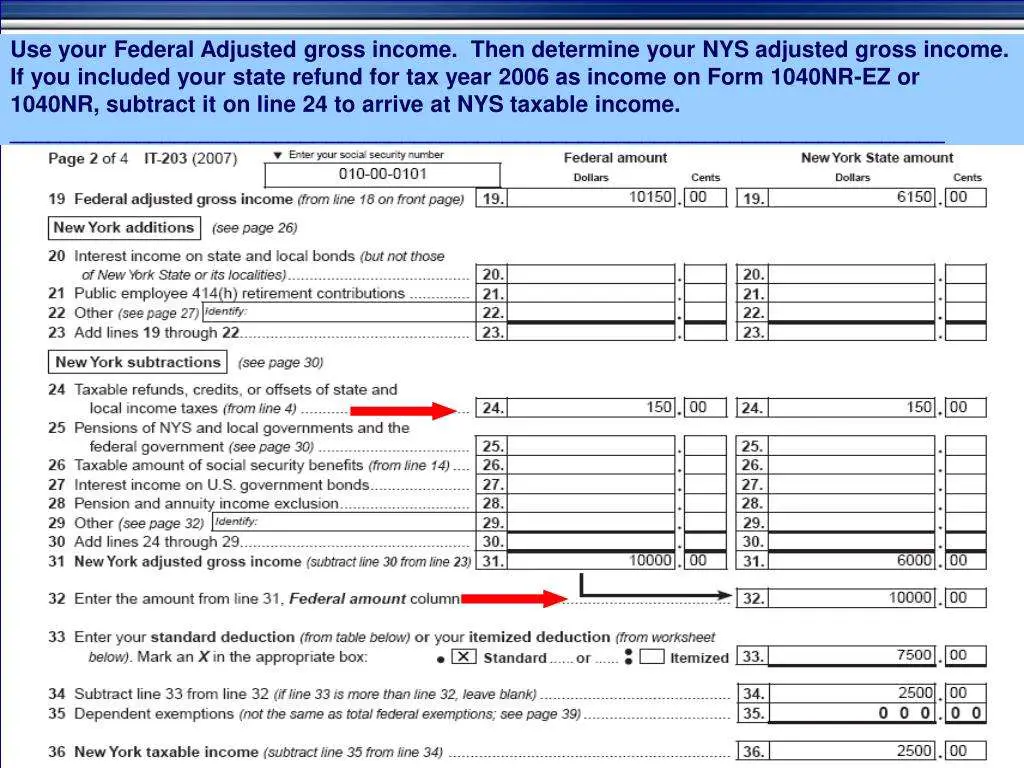

Your adjusted gross income is especially important if you live in a state that collects state income taxes. Many states use the AGI from your federal return as the starting point for state income tax calculations.

Federal Adjusted Gross Income Starting Point For Nc Return

The starting point for determining North Carolina taxable income is federal adjusted gross income. Therefore, a taxpayer must determine federal adjusted gross income before beginning the North Carolina return. If the taxpayer is not filing a federal income tax return, the taxpayer must complete a schedule showing the computation of federal adjusted gross income and deductions. The taxpayer must attach the schedule to the North Carolina income tax return.

Also Check: Notice Of Tax Return Change Revised Balance

American Airlines And Southwest Ceos Question Mask Need On Planes

Among other options available on Schedule 1, as well as an “Other income” line for anything else that applies but is not specifically mentioned. Some forms of income will warrant another form attached as proof.

With this, you can add up the first five lines from Form 1040 and the other forms of income on Schedule 1, and input them on line 6 of 1040 as your total income.

Line 7 is for adjusted gross income. Return to Schedule 1 and you’ll notice that the second half of the page is “Adjustments to Income.” Here, lines 23-35 are reserved for specific deductions the IRS considers “above the line” that can be removed from your total income. This includes:

- Student loan interest deduction

- Self-employed health insurance deduction

- IRA deduction

When you’ve input your qualifying income adjustments, add them up and put the sum in line 36 of Schedule 1. Back on the initial 1040 Form, line 7 is where you subtract those income adjustments from your total income , to get the number that is your adjusted gross income.

How your AGI varies from your total income will depend on the adjustments you need to make. Some people will have a lot of adjustments to make some may not have any at all and could end up with an AGI identical to their total income.

How Your Adjusted Gross Income Affects You

Your AGI is the basis for your taxes, not your gross income, because it represents your actual income. Your AGI also determines how you qualify for certain tax deductions and tax credits.

Some tax credits and deductions can benefit you more if your adjusted gross income is lower. If, for example, your out-of-pocket medical and dental bills exceed 7.5 percent of your AGI in a year, you can deduct the amount that exceeds 7.5 percent of your AGI. The lower your AGI and the higher your medical and dental expenses, the more you can deduct those expenses.

Your adjusted gross income is also used for your state tax return, which is why you need to complete your federal return first. Once youve filed your federal return and have your AGI , you can easily file your state tax returns.

Don’t Miss: How To Get Tax Preparer License

How To Calculate Adjusted Gross Income On W2

With some background knowledge about AGI and W-2, you can coast across the jumble of alphabet soup and get the tax terms clearer in your head. W-2 is a form used by employers to report your taxable income to you and to the IRS. You then use this information on Form 1040, 1040A or 1040-EZ to file your tax return. You will need information in addition to the details on your W-2 to calculate your AGI.

Step one in calculating your AGI is, to begin with the amount displayed in Box 1 of your form W-2 labelled Wages, Tips, Other Compensation. Step two includes adding any additional taxable income you have for the year in order to calculate your total taxable income. Most frequently, there is another form on which this taxable income is reported, it is known as 1099-INT for interest or 1099-DIV for dividends. The last step is to subtract any adjustments to income you qualify to claim.

Lets take a look at an example to help you understand better. If your W-2 shows that your taxable wages earned are $61,000 and there is an additional $1,000 in investment income and $500 in taxable interest, then your total taxable income is $61,000 plus $1,000 plus $500 which adds up to $61,500. However, say that you contributed $2000 to a traditional IRA and paid off a student loan interest of $1,200. You then find that your adjusted gross income is $59,300 after subtracting the $3,200 in total adjustments to income.

Dont Miss: How To Reduce Income Tax

Adjusted Gross Income Vs Modified Adjusted Gross Income

In addition to AGI, some tax calculations and government programs call for using what’s known as your modified adjusted gross income, or MAGI. This figure starts with your adjusted gross income then adds back certain items, such as any deductions you take for student loan interest or tuition and fees.

Your MAGI is used to determine how much, if anything, you can contribute to a Roth IRA in any given year. It is also used to calculate your income if you apply for Marketplace health insurance under the Affordable Care Act .

Many people with relatively uncomplicated financial lives find that their AGI and MAGI are the same number, or very close.

If you file your taxes electronically, the IRS form will ask you for your previous year’s AGI as a way of verifying your identity.

You May Like: Does Contributing To Roth Ira Reduce Taxes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do I Calculate My Agi

When you file with TaxSlayer, the calculation is done for you. This is one of the major benefits of filing your taxes online. If you are filing your return on paper, you will calculate your AGI right on Form 1040.

To figure out what your AGI is, youll want to find your gross income first. Thats anything you earned for the year, including wages, dividends, capital gains, retirement distributions, and so on. These amounts are added together on Form 1040.

Once youve added up all these and found your total, you will subtract any adjustment to income amounts that you have. These include:

Read also: Calculating adjusted gross income when married

Also Check: Efstatus Taxact Online

Adjusted Gross Income Vs Modified Adjusted Gross Income : Whats The Difference

Modified adjusted gross income is slightly different from AGI. Unlike your AGI which is one number, your MAGI may differ depending on the tax credit or deduction for which you claim. But similar to AGI, it can also determine which tax deductions or credits you might qualify for on your tax return.

Typically, your MAGI is your AGI adjusted for certain expenses and income. Generally, your MAGI calculation is your AGI but adding back student loan interest. However, the IRS may calculate your MAGI differently depending on the tax credit or deduction.

Here are a few examples of how MAGI determines certain tax deductions and credits:

Premium Tax Credits: Your MAGI for premium tax credits and other tax savings for is your AGI plus any untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest.

Child Tax Credit: Your MAGI for child tax credit and advance child tax credit payments is your AGI plus some sources of foreign income.

The American Opportunity Tax Credit: Your MAGI for the American Opportunity Tax Credit is your AGI plus some sources of foreign income.

For many taxpayers, their MAGI total is the same or very close to their AGI, since the adjustments that some taxpayers make will only slightly change the final number.