How Do Property Taxes Work

Typically, a county or city assessor sets property values, and the county treasurer collects property tax payments. Depending on the location of a property, the relevant jurisdiction will typically send a property tax bill to the property owner based on the assessed value, payable in quarterly, annual or biannual payments.

Property taxes are an example of an ad valorem tax and are calculated based on a propertys assessed value. The assessed value may equal what the property would sell for on the open market, depending on local tax rules, or a percentage of that market value.

In some states, individual taxing districts set a budget, which then helps determine the taxes, along with any special levies passed in that district. In places like California, property taxes are limited to the homes initial purchase price, plus inflation. In Texas, properties generally have to be reappraised based on market value once every three years.

Not paying property tax bills on time could lead to significant fees, interest charges, penalties, and potentially a tax lien certificate against the home.

Many state, county and city property tax programs can reduce, defer or assist with the amount due for qualifying individuals, such as senior citizens, veterans, people with disabilities, widows, or people with limited income. To claim an exemption, youll need to file paperwork.

How To Calculate Property Tax

If youre interested in estimating the value of your property taxes yourself, you can follow this formula:

Property Tax = Assessed Value × Tax Rate

Since there are many factors that go into each portion of this equation, the answer you come up with will only be an estimate and may not mirror how much you actually end up paying in property taxes but it can be good to see an estimate to get a feel for your potential tax bill.

The property value in this equation is the assessed value of your home. Your assessed value can be estimated by looking at comparative properties or calculated by someone like a home assessor. Your tax rate will vary depending on where you live it is usually decided by your county, city or town. However, its important to note that the assessed value doesnt necessarily match the appraised value. Many states have laws that limit assessed value to a percentage of your appraised fair market value.

Heres an example: Lets say you live in Chicago, Illinois, and the assessed value of your home is around $280,000. The average tax rate in Chicago is about 2.1%, so how much should you expect to pay in property tax?

Property Tax = ×

$5,880 = ×

According to this example, you could expect to pay about $5,880 annually. If youd like to try the formula for yourself, you can likely find your city or countys average tax rate online. There are also many online property tax calculators that can find that information for you.

Whos Eligible For The Homestead Tax Exemption

In some states, youll get the homestead exemption if your income is low, youre a senior, you have a disability or you are a veteran. In most cases, these exemptions cant be combined if you fall into more than one category. Some states also set an upper limit on the value of homes that can qualify for exemptions.

State governments cant directly affect property tax rates because rates are set at the local level. So statewide homestead tax exemptions are a way for state governments to lower property tax bills indirectly. They do this to encourage homeownership, keep residents happy and give a property tax discount to people in need of a tax break.

Also Check: Where Do I Mail My Federal Tax Return

Who Pays The Tax

Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax. Typically, the owner of a property must pay the real estate taxes. However, anyone who has an interest in a property, such as someone living in the property, should make sure the real estate taxes are being paid.

Your Taxes Decrease If

- The budgets decrease and the taxable values of all properties remain the same.

- The budgets and taxable value of property in the entire government unit remain the same but the taxable value of the individuals property decreases.

- The budgets and taxable value of the individuals property remain the same but the taxable value of the property in the entire government unit increases.

Don’t Miss: Are You Taxed On Cryptocurrency Gains

How Can I Buy A Home Subject To A Tax Sale

Tax sales are often conducted via auction by a municipality and are publicly announced. You can often find auction announcements in local newspapers or online. You could also contact a municipality directly and inquire. Note that the tax lien is attached to the property itself, and not to the previous owner. This means that the buyer of the property will also have to satisfy the tax lien before the title can change hands.

Ontarios Property Assessment And Taxation System

Property assessments are determined by MPAC.

Assessments are shared with municipalities.

Municipalities determine investments required to build thriving communities.

Your property assessment and the property taxes you pay are not the same thing.The information on this page will help you better understand the relationship between your propertys assessed value and your property taxes.

Read Also: How To Pay Llc Taxes

Overview Of Property Taxes

Property taxes in America are collected by local governments and are usually based on the value of a property. The money collected is generally used to support community safety, schools, infrastructure and other public projects. Use SmartAssetâs tools to better understand the average cost of property taxes in your state and county.

| Enter Your Location |

| of Assessed Home Value |

Property Tax System Basics

Translation:

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools, streets, roads, police, fire protection and many other services. Texas law establishes the process followed by local officials in determining the value for property, ensuring that values are equal and uniform, setting tax rates and collecting taxes.

Texas has no state property tax. The Texas Constitution and statutory law authorizes local governments to collect the tax. The state does not set tax rates, collect taxes or settle disputes between you and your local governments.

Your local property tax system has several main components.

The property owner, whether residential or business, is responsible for paying taxes and has a reasonable expectation that the taxing process will be fairly administered. The property owner is also referred to as the taxpayer.

An appraisal district in each county, administered by a chief appraiser, appraises the value of your property each year. The appraisal district’s board of directors hires the chief appraiser. Local taxing units elect the board directors and fund the appraisal district based on the amount of taxes levied in each taxing unit. For more information about your local appraisal process, please contact your county’s appraisal district. The appraisal district can answer questions about exemptions and how your appraised value was determined.

Don’t Miss: When Will I Receive My Taxes

What Does House Tax Mean

Definition: Property tax is the annual amount paid by a land owner to the local government or the municipal corporation of his area. The property includes all tangible real estate property, his house, office building and the property he has rented to others.

Is your house paid for by taxes?

Every homeowner pays taxes based on their homes value and the property tax rates for the county or city. Most areas charge property taxes semiannually, and you pay them in arrears. For example, in 2021, youd pay the property taxes for 2020.

What Are Property Taxes

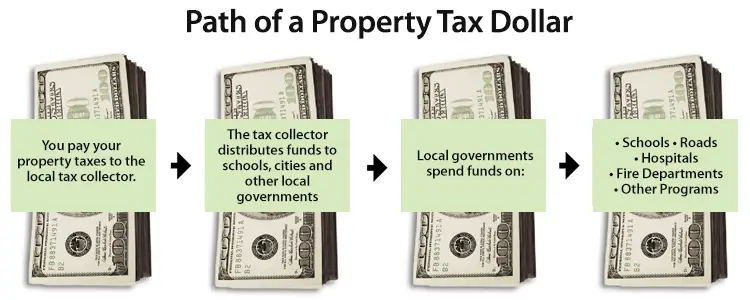

A report from the Urban Institute, a nonprofit research organization, says that state and local governments collected $577 billion in property taxes in 2019 . Property taxes are part of the cost of owning a home and they are paid every year, so its good to know what those taxes are used for and where exactly your money is going.

Property taxes make up a certain percentage of each states revenue. State and local governments rely on property taxes to fund community services such as the police department you call in the event of an emergency, the public school your children attend, the public parks and libraries you enjoy, the well-maintained roadways you travel, and much more.

Recommended Reading: How To File Taxes For Personal Business

Definition And Examples Of Property Taxes

Property owners pay property tax to local governments based on how the city, county, or state determines the value of the property, whether thats land, the overall value of a home, a commercial building, or even a car. These taxes often fund schools, and other local government needs, such as fire and police protection, libraries, city services, transportation and recreation.

Property taxes can apply to all types of property, including boats, aircraft, and vehicles.

But the term property tax tends to be used for real estate. In particular, many people focus on property tax regarding home-related taxes.

Residential property taxes ranged from 0.31% in Hawaii to 2.13% in New Jersey per year in 2019, according to The Tax Foundation, a tax policy nonprofit. As an example, a home valued at $500,000 with a 1% property tax rate means the homeowner would pay $5,000 per year in property taxes.

Property taxes are typically managed at the county level, but there can also be specific property taxes for other jurisdictions like individual towns, cities, or school districts. Philadelphia, for example, has its own real estate tax on property owned within the city.

Property Taxes Around The World

Despite their stability, transparency, and low propensity for economic harm, property taxes are a relatively minor source of revenue in most developed countries.

On average, countries in the Organisation for Economic Co-operation and Development derive less than 6 percent of total revenues from property taxes.

Don’t Miss: Where Is My Federal Tax Return

What Does Iht Tax Mean

by Molly Sutherland | Aug 30, 2022 | Blog, probate, Wills

IHT is a tax on the estate of someone who has died. Most often, an estate will include all property, possessions and money owned by the deceased at their time of death. It is a tax that does not apply to every estate and is only payable by estates with a value greater than the threshold set.

What Is The Role Of The Iowa Department Of Revenue

The Iowa Department of Revenue assists local governments in making property tax assessments fair and in compliance with the law. It does not collect or use property taxes.

Recommended Reading: How Much Is The Penalty For Filing Taxes Late

Questions About Your Property Assessment

Use our free online tool, AboutMyProperty, to learn more about how your property was assessed and how its value compares to similar properties in your area.

At MPAC, we know understanding your property assessment is important to you, so we want to help you in any way we can. If you disagree with your propertys assessed value, you can file a Request for Reconsideration for our review, free of charge.

Why Do I Have To Pay Property Taxes

In all 50 U.S. states, the majority of property owners are required to pay real estate taxes. These taxes are vital to making sure local governments can provide the infrastructure and public services their communities need. Most citizens in the community rely on the government to provide at least one important public service.

Additionally, in many areas of the country, local property taxes make up the lions share of funding for public schools.

You May Like: How To Buy Tax Lien Properties In California

Read Also: Where Can I Get Oklahoma Tax Forms

Property Tax: Definition Uses And How To Calculate

TheStreet

When you purchase a home or piece of property, the tax you pay annually to local government for municipal services such as police and fire protection is often, fittingly, called property tax.

Property tax is a local government ‘ad valorem’ tax — a tax on the assessed value of real estate owned, most often a house and the land where it sits, paid to a local government by the owner.

How The Tax Is Calculated

Property tax is calculated based on the:

- general municipal tax rate and any additional municipal tax rates for special services provided by your municipality

- property value

Municipal tax rate

Municipal tax rates are established by your municipality and can vary, depending on the type of property you own.

Each year, municipalities decide how much they want to raise from property taxes to pay for services and determine the tax rate based on that amount.

To learn about the tax rates in your municipality, contact the finance or treasury department of your local municipality. Some municipalities may have a property tax calculator available on their website.

Education tax rate

Education taxes help fund elementary and secondary schools in Ontario. Education tax rates are set by the provincial government.

All residential properties in Ontario are subject to the same education tax rate. The education tax rates can be found in Ontario Regulation 400/98.

Don’t Miss: When Is The Last Day To Apply For Tax Return

Property Taxes And Your Mortgage: What You Need To Know

10 Min Read | Jan 14, 2022

I love taxes! Said no one ever.

Paying taxes is like taking a trip to the dentistits a part of life, but not a fun part. Property taxes are no exception.

Seasoned homeowners know property taxes are part of the deal. But its easy for new home buyers to overlook how property taxes can affect their budget during all the excitement of buying a house.

Even if you remember to factor in these pesky little boogers, youve probably got some questions about them: How are property taxes paid? How often do you pay property taxes? When do you pay them? And are property taxes included in your mortgage payment?

Lets cut through some of the confusion about property taxes so you dont make a mistake that could cost you hundredsor even thousandsof dollars!

How Do Property Taxes Support A Growing Community

We believe that growth should pay for itself, and property taxes help make that happen.

Imagine a community named Tinytown, with only five properties.

Tinytowns local government uses taxes on those properties to pay for public services like police, fire response, schools, roads and parks.

Now imagine that Tinytown doubles in size over time. Local government would need to increase services to meet the needs of the growing community.

But how should Tinytown pay for those additional services? In Idaho, local governments can increase the total amount of property taxes they collect to account for new construction and annexation, ensuring owners of new properties pay their fair share. 1

However, the State of Idaho has considered legislation that would stop local governments from collecting property taxes for new construction. If that happens, Tinytown would not be able to fund services its community needs.

1Impact fees also help growth pay for itself. New development is typically charged an impact fee to fund the construction of public facilities like parks and fire stations. However, impact fees cannot be used to pay for the staffing those facilities require, like firefighters and parks maintenance crews. Thats where property taxes come in.

You May Like: What Is The Last Day To File Taxes In Texas

Determine If Your Local Taxes Are Increasing

To determine if your local taxes are increasing, you should examine tax levies not tax rates. Tax rates are not accurate indicators of how much more a school district or local government is collecting in taxes this year. This is because tax rates are based on the total taxable assessments in school district or municipality. If the value of property in the jurisdiction changes, that will skew the tax rate. For example:

- a town increases its assessments but keeps the tax rate the same. As a result of the increased assessments, the town collects more in taxes. To collect the same amount in taxes, the tax rate should drop proportionally.

If you want to know if the school district, city, town, or county is spending more, look at the budget. If you want to know if it’s collecting more in taxes, look at the levy and the total amount to be collected in taxes.

Your Taxes Increase If

- The budgets increase and the taxable value of all properties remain the same.

- The budgets and taxable value of property in the entire government unit remain the same but the taxable value of the individuals property increases.

- The budgets and taxable value of the individuals property remain the same but the value of the property in the entire government unit decreases.

You May Like: Can I File Taxes Without All My W2s

How Does Property Tax Work

The amount owners owe in property tax is determined by multiplying the property tax rate by the current market value of the lands in question. Most taxing authorities will recalculate the tax rate annually. Almost all property taxes are levied on real property, which is legally defined and classified by the state apparatus. Real property includes the land, structures, or other fixed buildings.

Ultimately, property owners are subject to the rates determined by the municipal government. A municipality will hire a tax assessor who assesses the local property. In some areas, the tax assessor may be an elected official. The assessor will assign property taxes to owners based on current fair market values. This value becomes the assessed value for the home.

The payment schedule of property taxes varies by locality. In almost all local property tax codes, there are mechanisms by which the owner can discuss their tax rate with the assessor or formally contest the rate. When property taxes are left unpaid, the taxing authority may assign a lien against the property. Buyers should always complete a full review of outstanding liens before purchasing any property.