Massachusetts Issues Guidance On New Pass

On September 30, 2021, the Massachusetts Legislature adopted an elective pass-through entity excise tax in response to the federal state and local tax deduction cap of $10,000. For tax years beginning on or after January 1, 2021, certain qualifying pass-through entities may elect to pay a new-entity level excise tax on qualified income that is taxable in Massachusetts at a 5% tax rate. Qualified members of an electing PTE are eligible for a credit equal to 90% of a members distributive share of PTE excise paid. Massachusetts issued the following guidance:

- An eligible pass-through entity is defined as an S corporation under section 1361 of the Internal Revenue Code , a partnership under section 7701 of the IRC or a limited liability company that is treated as an S corporation under these sections.

- The PTE Excise tax is not mandatory, and the related provisions only apply to a PTE if they elect to be subject to the excise. This election is made on an annual basis.

- Once an election is made for that particular tax year, it is irrevocable for that year and is binding on all qualified members of the PTE.

- Qualifying pass-through entities can make an election annually by filing Form 3, Form 355S or Form 2, and is confirmed by submitting new Form 63D-ELT. The election cannot be made on an amended form. Form 63D-ELT must be filed on or before the due date of the PTEs tax return, accounting for valid extensions. Qualified members cannot opt out of an election.

Consequences Of Not Making Or Being Late On Employment Tax Payments

If employers fail to remit payroll tax payments or send them in late, it could have the following impact:

- Employers may face criminal and civil sanctions

- Employees may lose access to future Social Security or Medicare benefits

- Employees may lose access to future unemployment benefits

If youre late making deposits for FICA or federal income taxes, youll be charged penalties.

Change In Withholding When You Start Social Security

Many retirees who have a pension are surprised by the increase in their taxes when they start Social Security. The amount of your Social Security benefits subject to taxation depends on your other sources of income. If your pension started a few years ago, and now you are starting Social Security benefits, you will likely need to increase your tax withholding.

Read Also: How Much Tax Do You Pay On Doordash

Capital Gains Tax In Massachusetts

In Massachusetts, capital gains are taxed at one of two rates. The standard income tax rate of 5.00 percent applies to most long-term capital gains, as well as interest and dividend income. On the Massachusetts income tax return, capital gains in those categories are recorded as taxable income.

Short-term capital gains, which are realized in less than a year, as well as long-term gains on the sale of collectibles, are taxed at a rate of 12 percent.

Overview Of Massachusetts Taxes

Massachusetts is a flat tax state that charges a tax rate of 5.00%. That goes for both earned income and unearned income . No Massachusetts cities charge their own local income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Don’t Miss: 1040paytax Customer Service

What Are Federal Taxes

Federal taxes are the taxes that are withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax and Federal Insurance Contributions Act . Federal Unemployment Tax Act is another type of tax withheld, however, FUTA is paid solely by employers.

For employees, there, unfortunately, isnt a one-size-fits-all answer to how much federal tax is taken out of my paycheck. The amount withheld depends on several factors. However, working with calculators and understanding how payroll taxes work can help give an idea of what take-home pay will look like.

What Small Business Owners Need To Know For Payroll

All of the information above can apply to both business owners and employees. For example, as a small business owner, if youre asked how much federal tax is taken out of my paycheck by employees, youll have a better understanding to explain the process. Additionally, if youre asking this question for your personal paychecks youll also know. If youre one of the small business owners following a DIY approach to payroll, you really need to know the above information.

To handle payroll on your own, make sure that youre getting Form W-4 from employees during onboarding. Additionally, youll want employees to verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season. From there, payroll calculators will be your friend. Payroll calculators can help you calculate what payroll will be for salaried employees and contractors.

Also Check: Where Can I Amend My Taxes For Free

File Scheduled Withholding Tax Payments And Returns

Withholding taxes in Massachusetts might be paid weekly, monthly, quarterly, or annually, depending on the payment schedule. Your payment schedule will eventually be determined by the average amount deducted from employee paychecks over the course of a year. The more you withhold the more withholding tax payments you’ll have to make.

The specific financial thresholds for the various payment plans, as well as other rules, may vary over time, so check with the DOR at least once a year for the most up-to-date information.

Payment deadlines are as follows:

- Weekly: Payment is required on the 7th, 15th, 22nd, and last day of each month within three business days.

- Monthly: Payments must be received by the 15th of the month following the month in which the tax was withheld.

- Quarterly: Payments must be received by the last day of the month after the quarter’s conclusion.

- Payment is required annually on the last day of the month following the calendar year .

The due date is extended to the next business day if the payment is due on a Saturday, Sunday, or holiday.

Regardless of their annual tax liability, all new enterprises are expected to make payments and file returns online. To make payments, go to the state’s WebFile for Business website. Older firms may still be able to file documents on paper.

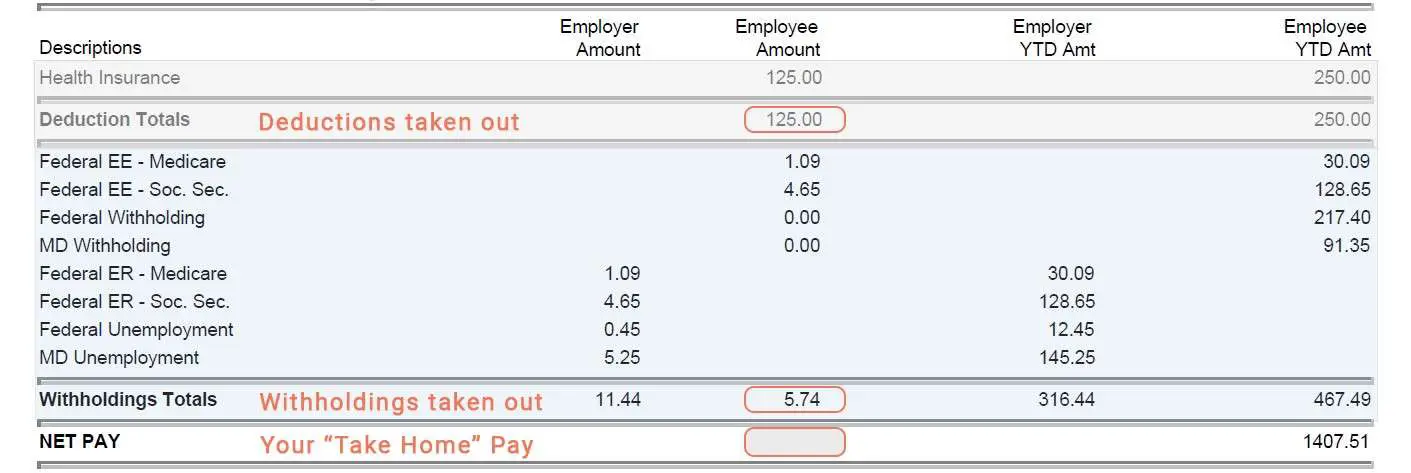

Eight : Take Other Deductions

You’re not quite done yet with deductions. Here are some other possible deductions from employee pay you might need to calculate:

- Deductions for employee contributions to health plan coverage

- Deductions for 401 or other retirement plan contributions

- Deductions for contributions to internal company funds or charitable donations.

Remember, all deductions start with and are based on gross pay.

You May Like: Plasma Donation Income

Other Massachusetts Paycheck Laws

Be aware of these additional Massachusetts paycheck rules.

- New hires: You must report new or rehired employees and independent contractors through MassTaxConnect within 14 days of hire.

- Pay stubs: Pay stubs must include:

- the name of the employer and employee,

- the payment date,

- hourly rate, and

- any deductions or increases made during the pay period.

Electronic pay stubs are allowed, as long as the employee can print them out for free.

- Minimum wage:

| $15.00 / hour |

Youre on your way to calculating your Massachusetts payroll. You can use Gustos Massachusetts Hourly Paycheck Calculator to get started. With just a few clicks, youll see how easy it is to accurately calculate your payroll taxes!

Want to leave the payroll work to someone else?

Your Employer Withholds A 62% Social Security Tax And A 145% Medicare Tax From Your Earnings After Each Pay Period

1.) were not in fact entitled to the income, and 2.) have repaid the. Taxpayers who have paid massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct such amounts of that income from their gross income if it is later determined that they: Oct 22, 2020 · how much tax is taken away from your paycheck? See full list on smartasset.com What is the massachusetts payroll tax rate? Any income you earn above $142,800 doesn’t have social security taxes withheld from it. What is massachusetts state tax withholding form? Note that you can claim a tax credit of up to 5.4% for paying your massachusetts state unemployment taxes in full and on time each quarter, which means that you’ll effectively be paying only 0.6% on your futa tax. Mar 03, 2020 · learn about the claim of right deduction. A deduction is allowed for dependents under 12 years old, dependents 65 years or older, or disabled dependents. Jan 01, 2020 · when massachusetts income tax withheld is $500 or more by the 7th, 15th, 22nd and last day of a month, pay over within 3 business days after that. Jan 12, 2021 · the tax rate is 6% of the first $7,000 of taxable income an employee earns annually. What is the massachusetts tax law?

Also Check: Doing Taxes For Doordash

Personal Tax Credits Returns

You may have to ask your employees or your pensioners to complete a federal and a provincial personal tax credits return using a federal Form TD1 and a provincial Form TD1.

For more information, see Chapter 5, “Deducting income tax” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

State New Hire Reporting

Massachusetts requires that you report any new hiring within 14 days of the employee’s start date. New employees can be reported online, by mail , or by fax 376-3262. You must record new hiring online if your company has 25 or more employees.

If you have workers or contractors in other states, you can register them with the state of Massachusetts, which will forward the information to the appropriate agencies in the state where they work.

You May Like: Doordash Tax Tips

Massachusetts Issued Regulations On Pte Excise

Chapter 63D of the Massachusetts General Laws, allows partnerships, S corporations, and certain trusts to make an annual election to pay the new PTE Excise at the entity level. The new PTE Excise is imposed at a rate of 5% of the amount of income that is subject to the Massachusetts personal income tax at the individual partner, shareholder, or beneficiary level. Qualified members are allowed a personal income tax credit for 90% of their pro rata share of the PTE Excise paid.Chapter 63D will not apply to any taxable year for which the federal limitation on the state and local tax deduction has expired or is otherwise not in effect. For additional information on the PTE Excise election, computation of the excise, and the filing and payment requirements, please contact a member of the SALT team.

What Is The Massachusetts Payroll Tax Rate

It definitely pays to save 90% on your tax bill. What is the massachusetts tax law? Jan 01, 2020 · when massachusetts income tax withheld is $500 or more by the 7th, 15th, 22nd and last day of a month, pay over within 3 business days after that. If you earn over $200,000, you’ll also pay a 0.9% medicare surtax. 1.) were not in fact entitled to the income, and 2.) have repaid the. Mar 03, 2020 · learn about the claim of right deduction. Apr 29, 2021 · the maximum deduction is $4,800 for one qualifying dependent, or $9,600 for two or more dependents as of tax year 2020. How do you calculate payroll taxes? See full list on smartasset.com See full list on smartasset.com The deduction amount is $3,600 for one dependent. Any income you earn above $142,800 doesn’t have social security taxes withheld from it. Note that you can claim a tax credit of up to 5.4% for paying your massachusetts state unemployment taxes in full and on time each quarter, which means that you’ll effectively be paying only 0.6% on your futa tax.

Your employer withholds a 6.2% social security tax and a 1.45% medicare tax from your earnings after each pay period. If you earn over $200,000, you’ll also pay a 0.9% medicare surtax. 1.) were not in fact entitled to the income, and 2.) have repaid the. How do you calculate payroll taxes? Jan 12, 2021 · the tax rate is 6% of the first $7,000 of taxable income an employee earns annually.

You May Like: Plasma Donation Tax

Form Td1x Statement Of Commission Income And Expenses For Payroll Tax Deductions

If your employees want you to adjust their tax deductions to allow for commission expenses, they have to complete Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions.

You deduct tax from your employees’ commission pay using the “Total claim amount” on their TD1 forms in the following situations:

- if your employees do not complete a Form TD1X or

- if they tell you in writing that they want to cancel a previously completed Form TD1X

Losses From Criminally Fraudulent Investment Arrangements

Fraudulent arrangements often take the form of so-called “Ponzi” schemes, in which the party perpetrating the fraud receives cash or property from investors, purports to earn income for the investors, and reports to the investors income amounts that are wholly or partially fictitious.

Also Check: 1099 Nec Doordash

Adding Square Payroll As Your Unemployment Insurance Tax Administrator

In order to file and pay your Massachusetts unemployment insurance taxes, Square Payroll needs to be authorized as your Third Party Administrator .

Please follow these instructions from the MA Department of Unemployment Assistance to authorize us.

The whole process can be completed online and you will need the following information:

-

Square Payrolls Massachusetts UI TPA ID: 105349

-

Roles to assign to

-

Account Maintenance Update and Submit

-

Payments Update and Submit

-

Employment and Wage Detail Update and Submit

Please note that you will need to unauthorize any previous agents/payroll providers who had the above roles.

Ontario Indexing For 2022

For 2022, the provincial income thresholds, the personal amounts, and the tax reduction amounts have been indexed. They have been changed based on changes in the consumer price index.

The indexing factor for January 1, 2022, is 2.4%. The tax credits corresponding to the claim codes in the tables have been indexed accordingly. Employees will automatically receive the indexing increase, whether or not they file Form TD1ON, 2022 Ontario Personal Tax Credits Return.

Read Also: Look Up Employer Ein Number

What’s New As Of January 1 2022

The major changes made to this guide since the last edition are outlined.

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2022. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022.

For 2022, employers can use a Federal Basic Personal Amounts of $14,398 for all employees.

The federal income tax thresholds have been indexed for 2022.

The federal Canada Employment Amount has been indexed to $1,287 for 2022.

The Ontario income thresholds, personal amounts, surtax thresholds and tax reduction amounts have been indexed for 2022.

Quarterly Tax Payment Due Dates

Quarterly FUTA taxes are due if you owe more than $500 in taxes each quarter. The due dates are:

- Quarter one: April 30

- Quarter three: Oct. 31

- Quarter four: Jan. 31

However, SUTA tax due dates varies by state. For example, in Michigan, the taxes are due on the 25th of the month instead of the end of the month: April 25, July 25, Oct. 25, and Jan. 25. Failing to meet the deadline may result in a penalty or late tax payment interest assessment. Therefore, you not only have to know what taxes to withhold and pay but also when and how to pay itby state.

Don’t Miss: Tax Preparation License

Calculate Income Tax In 5 Steps

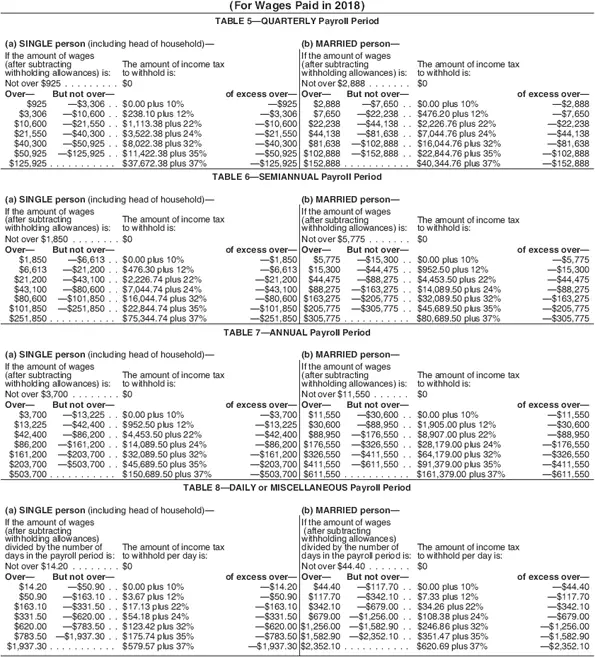

There are five main steps to work out your income tax liability or refunds. First, you need to determine your filing status to understand your tax bracket.

Step 1 Filing status

There is 4 main filing status:

- Single

- Head of Household

Your marital status and whether you have any dependent will determine your filing status.

For example, if you are single and have a child, then you should file as Head of Household.If you are married but preferred to file separately from your partner , then you will file as Married, Filing Separately.

Refer to IRS to understand more.

Step 2 Adjusted gross income

The second step is to figure out your adjusted gross income.

The formula is:Total annual income Adjustments = Adjusted gross income

Income means money received for pretty much any reason such as wage, rental income, side hustle, unemployment benefits, etc. You just need to add them up to determine your annual income. If youre paid hourly, you will need to multiple it with your total annual hours.

Adjustments are also known as above-the-line deductions.There are 2 types of deductions: above-the-line & post-tax .

Some of the adjustments are:

- Student loan interest

- Moving expenses for a job

- College tuition and fees

For the complete breakdown of the various type of above-the-line deductions or adjustments, refer to this article from thebalance.com.

Step 3 Taxable income

Now you need to figure out your taxable income.

The formula is:Adjusted gross income = Taxable income