Do I Need To File One

A Schedule C is for sole proprietorships, that is, a business you own by yourself and isnât registered with your state as a specific type of business. You will also need to file a Schedule C if you are the sole member of an LLC (these are referred to as single-member LLCs or SMLLCs.

According to the IRS, you must file Schedule C: to report income or from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

How To Fill Out A Schedule C For A Sole Proprietor Or Single

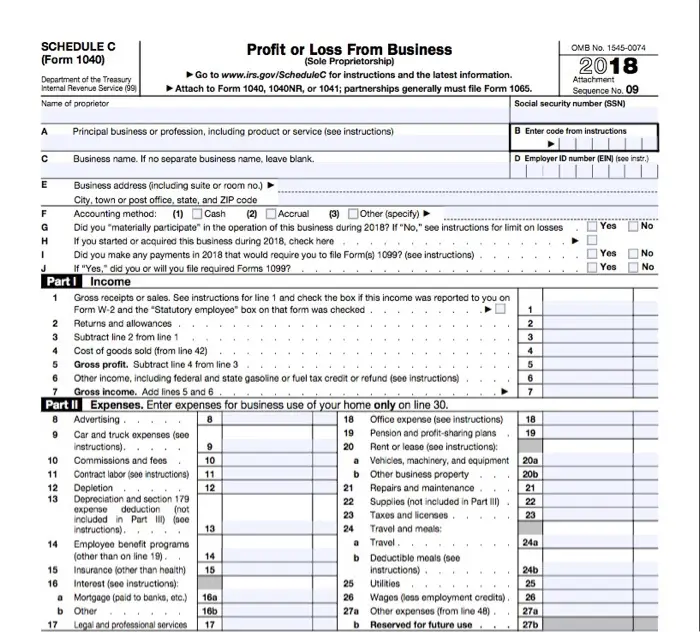

Schedule C is a tax form for small business owners. Here is how to fill out a Schedule C for a sole proprietor or single-member LLC.

Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. Schedule C is a form attached to your personal tax return that you use to report the income of your business as well as business expenses, which can qualify as tax deductions. As you will see by reading this article, Schedule C can be complicated, overwhelming, or confusing. We highly recommend you consult a tax professional for help, or at the very least, use tax software to complete the calculations in the form, rather than trying to fill it out by hand. Regardless of how you choose to do it, its helpful to familiarize yourself with the form so you can gather and prepare all of the information you will need. Here is how to fill out a Schedule C for a sole proprietor or single-member LLC.

Is Schedule C The Same As A W

Schedule C is not the same as a W-2. Schedule C reports income earned as a self-employed person either through a sole proprietorship or single-member LLC. W-2s report income youve earned as an employee of a business.

You can earn W-2 income and also still report separate income on Schedule C. This usually requires working as a freelancer, independent contractor, at a side gig, or running your own small business. Though, these side incomes will need to come from work you perform regularly and for the expectation of earning a profit, or the income would be considered to come from a hobby and would go on Schedule 1 rather than Schedule C.

Read Also: Doordash Driver Tax Deductions

How To File Schedule C

You must file Schedule C along with your Form 1040. If you are filing by mail, you should attach Schedule C to the form. You also have the option of e-filing them.

For the 2019 tax year and beyond, you have the option of using the new Form 1040-SR for seniors to prepare your personal income taxes if you were born before Jan. 2, 1955. Form 1040-SR has a larger type font and allows for easy reporting of income from sources common to seniors, including Social Security and distributions from retirement plans.

Information About Business Use Of Your Home

The space in your home that you use for business purposes is deductible on Schedule C, with several qualifications and limitations. It must be used exclusively and regularly for your business, either as your principal place of business or as a separate structure for storing inventory or product samples.

To calculate this deduction, you will first need to find the percentage of your total home square footage thats used by your business. Then you can use either actual expenses or a simplified method for calculating the deduction amount.

Don’t Miss: Doordash How Much To Save For Taxes

What Are Ordinary And Necessary Expenses

For business expenses to be deductible, they need to be both ordinary and necessary. The IRS considers an expense to be ordinary if it is common and accepted in your industry. For an expense to be considered necessary for your business, it must be one that is helpful and appropriate for your trade or business. An expense doesn’t have to be indispensable to be considered necessary.

For example, if you work in an office setting, expenses like office furniture, supplies, software, and computer hardware are likely all ordinary and necessary expenses youd expect to pay in your line of work.

Amending A Schedule C

You should not try toamend your return until it has been fully processed and you have received yourrefund or your payment has cleared. Amended returns do not catch up toyour original return and replace them they are processed as two separatereturns.

Amended returns haveto be printed and filed by mail. It can take the IRS up to 12 weeks orlonger to process them. If you are due a larger refund than on youroriginal return, your amended return should only show the difference and youwill receive a separate check for it. If you owe money on your amendedreturn, it will show only the new amount owed, you will have to mail a checkwith the return.

Youcan check the status of your Form 1040X, Amended U.S. IndividualIncome Tax Return,using the Where’sMy Amended Return? onlinetool or by calling the toll-free telephone number 866-464-2050 three weeksafter you file your amended return.

Please see theTurboTax FAQ below for more information.

Also Check: Does Doordash Take Taxes Out

How Bench Can Help

Filing taxes may be the finish line, but bookkeeping is the marathon that gets you there. With Bench, you have a team of experts running that distance for you.

Your Bench bookkeeping team automates your financial admin by connecting bank accounts, credit cards, and payment processors to import information into our platform. Your team also answers questions and completes your tax prep ahead of filing.

With a premium Bench subscription, we handle your bookkeeping and provide year-round tax services, including tax filing. We file your federal and state taxes and give you access to unlimited, on-demand consultations with a tax professional. Weâre here to ensure youâre up-to-date on the latest tax information, maximizing every deduction and seizing available tax credits to minimize your tax bill. Learn more.

What Is A Sole Proprietorship

A sole proprietorship is a business a sole person operates and controls that is not set up as another legal business entity separate from yourself, such as a corporation or partnership. Generally, there’s no legal separation between you and your business. You own and run the business by yourself, are entitled to all of the profits, and are responsible for its losses and liabilities. Often, freelancers, gig workers, independent contractors and other small business owners operate as a sole proprietorship.

Even if you just use your lawn mower to cut your neighbors grass for $10 per yard on weekends, youre likely a sole proprietor and need to report your business finances on Schedule C.

Read Also: Appeal Property Tax Cook County

What Information Does Schedule C: Profit Or Loss From Business Include

This schedule asks about the taxpayers business name, product or service, business address, accounting method, gross receipts or sales, and cost of goods sold. The Schedule C is also where business owners report their tax-deductible business expenses, such as advertising, certain car and truck expenses, commissions and fees, supplies, utilities, home office expenses, and many more. A business expense must be ordinary and necessary to be listed as a tax deduction on Schedule C.

Small business owners also use Schedule C to take a deduction for the use of a personal vehicle for business purposes, to report when it was placed in service for business purposes, and to report the number of miles that it was driven for business use.

A business expense must be ordinary and necessary to be listed as a tax deduction on Schedule C.

What Are The Steps Involved In Filing Schedule C

Filing Schedule C can help you deduct business expenses and net profit or loss. You need to file Schedule C if you are self-employed. The IRS recommends adding up all your business expenses before determining your net profit or loss.

The following steps will guide you through the process of filing Schedule C in 2022:

The IRS offers a tax deduction to self-employed individuals equal to 50% of the net profit from their business. If you are a small business or sole proprietor, you are self-employed and must file Schedule C with your tax return to claim this deduction. The IRS allows deductions for the cost of doing business, including advertising costs and home office expenses, but some items cannot be deducted at all.

Also Check: Www.efstatus.taxact.com

Information For Cost Of Goods Sold

If your business sells products, the cost of buying, making, and shipping those products is calculated separately to get a total for the year, called cost of goods sold. For this calculation, youll need to know the cost of inventory at the beginning and end of the year. You will also need to know all of the direct and indirect costs, including the cost of labor, materials, and supplies. See IRS Form 1125-A Cost of Goods Sold for more details on how to calculate this cost.

Income The Heart Of Schedule C

Now we get into the real meat of the Schedule C. Part I Income starts by asking if your business had any income. If you answer Yes, youll get a couple of fields for that income. , youll enter the information on a 1099-NEC screen with fields that match the form you received, and that then flows the income to your Schedule C, which youll be able to review at the end by previewing a PDF of your return.)

You May Like: How Do You Do Taxes For Doordash

Gather The Necessary Business Information

Before filling out your Schedule C, you need to prepare your P& L report for the prior year. No matter how you compile your income and deductions, a few simple bookkeeping tips can make the process much easier.

Youll also want to have your general business information ready, like your employer ID number if you have one. If this is not your first year filing Schedule C, have your prior Schedule C available as it will provide a lot of the required information.

Here are the five things youll need to complete the form:

Schedule C businesses are not required to have a separate EIN unless you have employees. If you dont have an EIN, youre required to display your Social Security number on tax forms that you send to vendors and contractors like Form W-9 and Form 1099. Its wise to get an EIN to avoid disclosing your Social Security number.

Get Help With Small Business Taxes And Filing Irs Schedule C

Business tax forms, like the IRS Schedule C, can get tricky when you are left to your own devices. But dont fret were here to help!

Have a side business? Take control of your taxes and get every credit and deduction you deserve. File with H& R Block Online Deluxe or H& R Block Online Premium .

Have questions about self-employment taxes and other small business tax issues? Rely on our team of small business certified tax pros to get your taxes right and keep your business on track. Find out how Block Advisors can help with your small business taxes.

Our small business tax professional certification is awarded by Block Advisors, a part of H& R Block, based upon successful completion of proprietary training. Our Block Advisors small business services are available at participating Block Advisors and H& R Block offices nationwide.

Related Topics

The tax experts at H& R Block outline how students and parents can file Form 8863 and document qualified expenses. Read about Form 8863 here.

Don’t Miss: Paying Taxes For Doordash

Where Would I Find My Schedule C

If you are wanting to find the section within TurboTax where you either enter or have entered your self-employment income and expenses which will be reported on Schedule C of your tax return, do the following steps:

Definition And Example Of Schedule C Of Form 1040

Schedule C of Form 1040 is a tax schedule that must be filed by people who are self-employed. It’s a calculation worksheet, the “Profit or Loss From Business” statement. Your self-employment income from the year is entered and tallied here, then carried over to your Form 1040 tax return after any allowable business expenses are deducted.

Recommended Reading: Tax Write Offs Doordash

Do I Have To File A Schedule C

Yes, all sole proprietorships must file a Schedule C with their taxes. A Schedule C form is a detailed form as figures for income, expenses and cost of goods sold all need to be recorded. A net profit or loss figure will then be calculated, and then used on the proprietors personal income tax return .

Typically, a sole proprietor files their personal and business income taxes together, on one return. This type of business is referred to as a pass-through entity. This means the profit is only taxed once.

You can access Schedule C, here.

How To File Schedule C Of Form 1040

You can file Form 1040 and Schedule C the same way you file the rest of your tax forms, whether you prefer to do so by mail or electronically. Be sure to include any necessary payments with your form if you file by mail. Send it to your state’s IRS processing office, postmarked on or before the deadline, which is usually April 15. You can pay online if you e-file your tax return, but be sure to submit it before the deadline.

You May Like: How To Take Out Taxes For Doordash

How Can You Prove An Oral Contract

Unfortunately, without solid proof, it may be difficult to convince a court of the legality of an oral contract. Without witnesses to testify to the oral agreement taking place or other forms of evidence, oral contracts won’t stand up in court. Instead, it becomes a matter of “he-said-she-said” – which legal professionals definitely don’t have time for!

If you were to enter into a verbal contract, it’s recommended to follow up with an email or a letter confirming the offer, the terms of the agreement , and payment conditions. The more you can document the elements of a contract, the better your chances of legally enforcing a oral contract.

Another option is to make a recording of the conversation where the agreement is verbalized. This can be used to support your claims in the absence of a written agreement. However, it’s always best to gain the permission of the other involved parties before hitting record.

Who Has To File Schedule C

Sole proprietors and single-member limited liability companies need to fill out Schedule C when they prepare their individual 1040 tax return.

Not sure if youre either of those? A sole proprietorship is a business that you own by yourself and isnt registered as a specific business type, like a corporation or an LLC. Its the default business structure when you earn money from self-employment without registering as a different type of business.

A single-member LLC is a limited liability company that only has one member. When you form a single-member LLC you have the option to be treated as a corporationand file a corporate tax returnor instead report your profit or loss on Schedule C like a sole proprietor does.

Recommended Reading: How Much To Set Aside For Taxes Doordash

How Do You Find Your Net Profit Or Loss

At this point, youve figured out your gross income and your expenses. And now its a matter of simple subtraction: gross income – expenses = net profit or loss. Hopefully you earned a profit! But even if you had a loss, you have to report that on your taxes.

Your net profit or loss goes on your main 1040 tax form as part of the income component. Youll also include it on Schedule SE to calculate your self-employment tax, which is a 15.3% tax made up of both the employee and employer portions of Social Security and Medicare taxes.