Report And Verify Your Taxes

The IRS Where’s My Refund? hotline, app and website allow you to check only the status of a refund. If you had to pay taxes and you filed a paper return, your avenues for verifying that your return was received are fewer. If you paid the taxes you owed via check, watch your bank account to see when the check has cleared.

You may mail your tax return certified mail, return receipt requested. Or you could send it Priority Mail, which will provide you with a tracking number you can use to verify the returns receipt.

Tips

-

Due to limited staff as a result of the COVID-19 pandemic, mailing paper returns may take considerably longer than usual to be processed. E-filing results in much faster processing.

Additionally, you can submit your paper return to a representative at a local IRS field office and get an “accepted” time stamp, or ask the rep to look up the status of your previously-filed return.

How Do Tax Returns Work

In the United States, tax returns are documented with the Internal Revenue Service or with the state or local tax collection organizations containing data used to ascertain taxes. Tax returns are by and large arranged utilizing structures recommended by the IRS or other important power.

In the U.S, people use varieties of the Internal Revenue Systems Form 1040 to document federal income taxes. Organizations will utilize Form 1120 and partnerships will utilize Form 1065 to record their yearly returns. An assortment of 1099 structures are utilized to report pay from non-business related sources. Application for programmed expansion of time to document U.S. individual income tax return is through Form 4868. Typically, a tax return starts with the citizen giving individual data, which incorporates their documenting status, and ward data.

How To Track Your Refund Using The Irs’ Where’s My Refund Tool

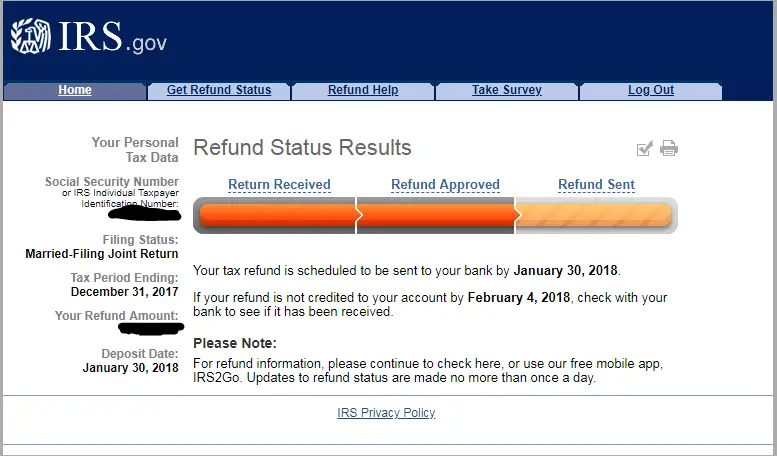

To use the IRS tracker tools, you’ll need to provide your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars, which you can find on your tax return. Make sure it’s been at least 24 hours before you start tracking your refund, or up to four weeks if you mailed your return.

Go to the Get Refund Status page on the IRS website and enter your personal data, then press Submit. You should be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

Also Check: Property Tax Protest Harris County

How Long After Tax Return Acceptance Will It Be Approved

The IRS has made two tools to help those of us who need to check if our refund has been finished. One of them is IRS2Go. The main IRS site traces how the application works and what extra tax information is given by the application. The subsequent source is a website page named Where is My Refund, which was made by the IRS. There you enter your own social security number, your refund date, and documenting status. Thereafter the IRS will let you know when you will get your check or direct deposit. It is fundamental to realize that the projections of the refund conveyance are reexamined each Wednesday, and you should wait for the status of the repayment for at any rate 72 hours in the wake of documenting.

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get you your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you are receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

Recommended Reading: How Much To Save For Taxes Doordash

So How Long Before Your Tax Rebate Will Be Paid

OK, we know youâre impatient. Once HMRC has authorised your tax-refund, you shouldnât have to wait too long, although the exact timespan will depend on what method youâve chosen for payment:

- Getting paid directly by bank transfer or onto a credit or debit card will usually take up to five working days.

- You can expect a cheque to hit your doormat inside five weeks.

- Got a P800 notice explaining that youâre due a tax refund and can claim it online? Youâll see the money in your bank account within five working days of making the claim. If you donât claim online inside 45 days, youâll get a cheque within 60 days of the date on the P800.

- When your P800 notice tells you that youâre due a cheque, youâll normally get this within two weeks of being notified.

If you reckon youâre owed a tax refund and you have a particularly complex case, itâs always a good idea to get in touch with a qualified accountant or specialist tax advisor to help you put together your claim.

Your tax-refund case will be dealt with much quicker if your claim is completed fully by professionals so that itâs easier for HMRC to deal with.

So, good luck, donât get too impatient and spend your tax refund wisely when it arrives.

What Happens After The Irs Accepts Your Tax Return

After the IRS accepts your tax return, the next step is for the agency to approve it. To do this, the IRS will look at whether you have any unpaid taxes and compare the figures you provided to determine if an error was made or your refund needs to be adjusted.

For instance, if you owe taxes from the prior year or dont qualify for a credit you thought you could claim, the IRS will reduce your refund accordingly. For the 2021 tax filing season, the IRS is urging taxpayers to wait for Form 6419, which outlines how much they received in CTC payments in 2021.

If you fail to record an item accurately, the IRS will likely reject your return and request the necessary corrections. This could result in your refund being delayed by weeks or even months, depending on how far behind the IRS gets during the tax filing season.

If all the information you provided was accurate and matched the IRSs records, your return could take anywhere from a few days to a few weeks to go from accepted to approved. The best way to determine the status of your return is using the IRS Wheres My Refund tool.

Use the Wheres My Refund? tool to start checking the status of your refund 24 hours after #IRS acknowledges receipt of your e-filed tax return. To access the tool visit

IRSnews

Don’t Miss: How Do You File Doordash On Your Taxes

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Read Also: Doordash 1099 Example

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

What Should I Do If I Cannot Pay My Tax

First, make sure you understand why you owe tax and that you are satisfied the amount you are told is owed is in fact correct. If you are not sure whether the amount is correct then you should ask for a detailed explanation. If you think the amount owed is incorrect, you may have certain grounds to dispute or appeal the debt. If you owe penalties as part of the debt, you may be able to appeal these penalties if you have grounds to do so, for example if you have a reasonable excuse.

If you need to take any action, you should do so before you enter into any arrangement to pay the amount demanded. HMRC should agree to postpone collection of any sums in dispute while any disputes or appeals are being dealt with. However, if any part of the debt is not in dispute you will be expected to make arrangements to settle this.

Recommended Reading: How To Get Your 1099 From Doordash

Finding Your Return Status

If you used a professional tax preparer who is an authorized IRS e-file provider, they should be able to tell you when your return was received and accepted by the IRS. All authorized e-file providers have a direct link to the IRS. Any information they give you on the status of your return should be current and accurate.

If you used an online commercial tax preparation service like TaxSlayer, TurboTax or Tax Act, they have automated systems to keep you informed. For example, TurboTax sends you an email that tells you your tax return was submitted and another one shortly after that tells you its been accepted or rejected. They also have tools so you can check on the status of your return at any time. You just need to enter a few pieces of information. For example, with TurboTax, you just enter your Social Security number and ZIP code.

Regardless of what method you used to e-file your tax return, if you have a refund coming, you can also use one of the IRSs refund tracking apps to find out if theyve received your e-filed tax return. Their mobile app is called IRS2Go. Their online app is called Wheres My Refund? They both give three responses: return received, refund approved and refund sent.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Don’t Miss: How To Look Up Employer Tax Id Number

Should You Call The Irs

Expect delays if you mailed a paper return or responded to an IRS inquiry about your 2020 return. Some returns require special handling such as those that require correction to the Recovery Rebate Credit amount or validation of 2019 income used to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return. If youre due a refund from your tax year 2020 return, you should wait to get it before filing Form 1040X to amend your original tax return.

How To Know If Irs Has Received My Return

If youre unsure, you can call Customer Support. Customers are always happy to help and are available to answer your questions. So, if youre wondering, How do I know if the IRS has received my tax return? take advantage of this helpful tool. Filing early helps ensure that your refund will be quicker than usual.

Youll also be less likely to be the victim of tax identity thieves. Also, you can use the IRS Tax Withholding Estimator to find out how much youll receive in your paycheck. The earlier you file, the more money you can save on taxes. Youll even be able to use the IRSs free tool to find out how much youll owe and what to do to get your refund faster.

Also Check: How To Get 1099 From Doordash

Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

To receive a notification when your refund is issued and other electronic communications about your income tax refund see Request electronic communications from the department.

Reasons Your Tax Refund Might Be Delayed

Although youre probably eager to receive your refund, it might take longer than 21 days for the IRS to process your return. Several issues might cause a delay, including:

Also Check: Do I Need To File Taxes For Doordash

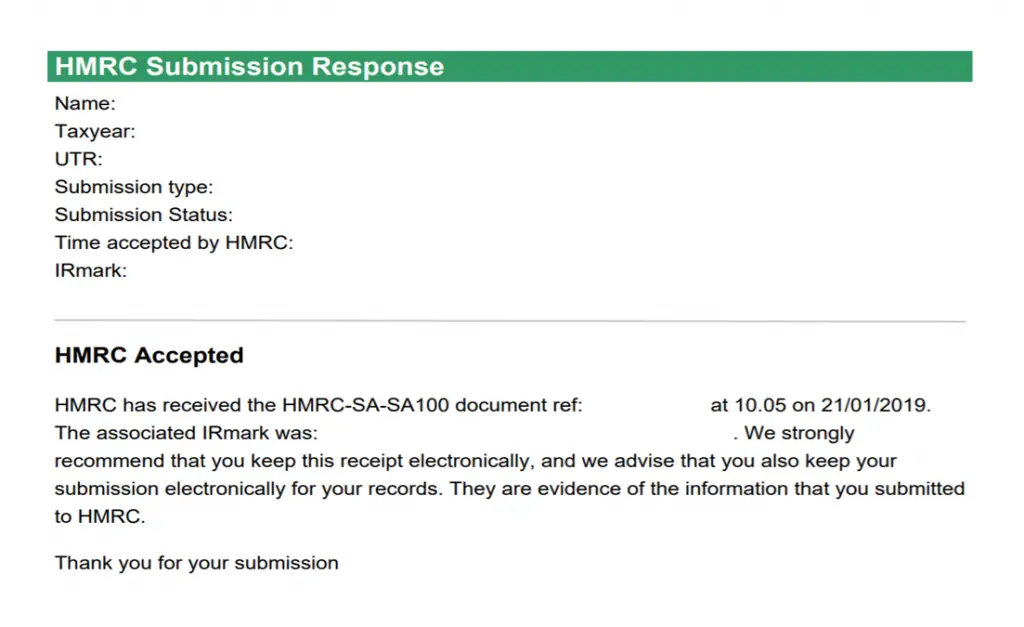

Understand Your Self Assessment Tax Bill

Understand your Self Assessment Tax Bill

- when you have finished filling in your return – in the section View your calculation

- in your final tax calculation – it can take up to 72 hours after you have submitted your return for this to be available in your account

You may need your tax calculation , for example if you are self-employed and applying for a mortgage.

Understanding your Bill

How To Check Your Return And Refund Status

The only way to track your return and refund is to use the Wheres My Refund? tool on IRS.gov. You can call the IRS Tax Help Line at 800-829-1040, but if your return is active on Wheres My Refund? you are unlikely to get any additional details not provided online.

Your return status should appear within 24 hours of filing your electronic return or within four weeks of mailing your paper return. A status of received indicates that the IRS has your return for processing, and a status of approved means that the IRS has approved your refund. You will also see when the funds are expected to be distributed, and the status will change to sent when your refund is on its way.

Recommended Reading: How Much Is Tax In Georgia

Also Check: 1099 From Doordash

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.