Sole Proprietorship Taxes For Llcs

Moreover, its important to note that even if your business is an LLC, you may still be filing taxes as a sole proprietor. Since an LLC is a legal status granted at the state level, and not a federal tax status, single-member LLCs are subject to sole proprietorship taxation. If your LLC has two members, youll be classified as a partnership for tax purposes however, either single- or multi-member LLCs can elect to file their taxes as a corporation by completing IRS Form 8832.

With this in mind, if your business is an LLC and youre unsure of what your tax status is, youll want to consult with your business accountant or attorney, especially if this individual helped you form your LLC.

Taxes For Freelancers And Sole Proprietorships

Starting your own business as a sole proprietorship or freelancer can be intimidating. The idea of not knowing how much money you will make regularly and dealing with new concepts like advertising and budgeting is often enough to scare even some of the bravest entrepreneurs away. Freelancers often work on contract for many different clients, so their income can be sporadic. Some freelancers choose to freelance on the side or use the work as extra income. Sole proprietors, on the other hand, are often associated with an established business location, will generally work full time, and are more likely to hire employees. Regardless, their tax treatment is similar.

If you think you are ready to dive in, you should not only consider your workload and future you should also have a good handle on what your taxes will look like. Planning now can help you avoid a nasty tax surprise at the beginning of next year.

Tax Deductions For Sole Proprietorships

You can file your income and take deductions on the federal Form 1040, “U.S. Individual Income Tax Return.” Sole proprietors must also file Schedule C, “Profit or Loss From Business.” On this form, you report your business income and expenses. A sole proprietorship is not a separate business entity from the owner you are simply reporting your personal business activities on Schedule C as part of your personal tax return.

The IRS allows certain exceptions to income expenses that qualify for an exception are known as tax-deductible, or just deductions. Deductions reduce the amount of your total income subject to taxes because the IRS only taxes what is known as taxable income so if you have $80,000 in total income and $10,000 in deductions for the year, then you only pay taxes on $70,000 of actual net profit from your business.

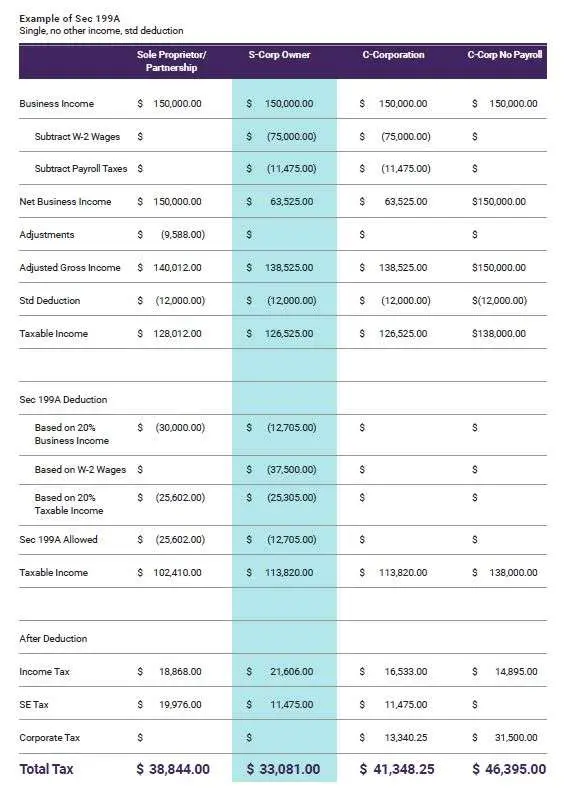

Deductions can be divided into two groups: standard deductions and itemized deductions. An individual taxpayer qualifies for either a standard deduction or itemized deduction but not both each year they file their return.

You May Like: How To Get 1099 From Doordash

What Is The Biggest Disadvantage Of Sole Proprietorships

The biggest disadvantage of a sole proprietorship is that the business owner is personally liable for all business debts and obligations of the business. This means that if the business cannot pay its debts, the creditors can go after the personal assets of the business owner, including their home, car, and savings account. In addition, if there is a lawsuit against the business, the business owner is personally responsible for any judgment against the business.

This is in contrast to a corporation or LLC, which is a separate legal entity from the owners who are not personally liable for the debts and obligations of the business . This liability protection is one of the biggest advantages of forming a corporation or LLC.

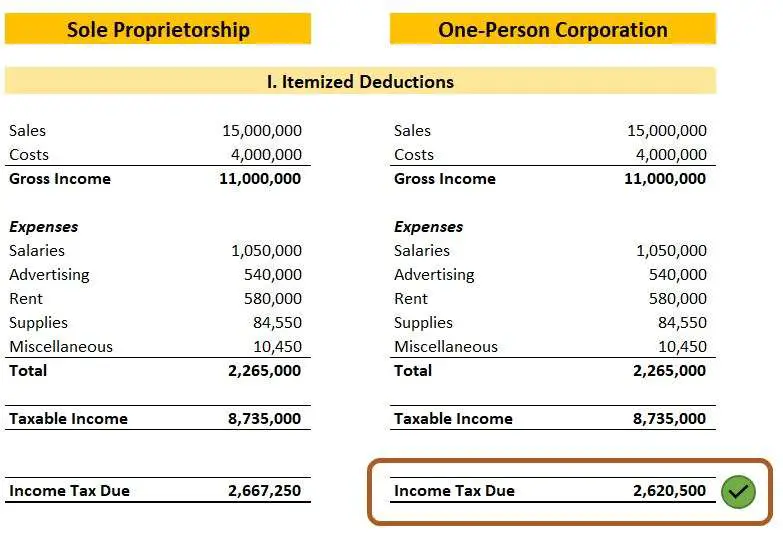

Can Being A Corporation Instead Of A Sole Proprietorship Help You Save Money On Taxes

Thats a difficult question to answer because it depends on the individuals tax situation. Corporations file a corporate tax return and pay the corporate tax rate, but corporate owners pay tax on dividends they receive. For sole proprietors, income from all sources is combined to get a net taxable income. The federal tax rates vary depending on the persons tax filing status.

Other factors, like whether the business has a loss or profit, and available tax credits and dividends in each business type also come into play when figuring a business owners personal tax liability. This question is best answered by having a licensed tax professional review your sole proprietorship income on a regular basis.

Don’t Miss: Ntla Tax Lien

Sole Proprietorship Taxation: Income And Self

As we explained, as a sole proprietor youll report and pay income tax on your businesss profitand youll do so by filing additional forms with your personal return, Form 1040. This being said, most sole proprietors only need to file two forms with their individual return. Lets take an in-depth look at each of these forms.

All Your Business Tax Deductions Are Reported On Form T2125 Statement Of Business Or Professional Activities

One of the great things about running your own business is that you have a much larger pool of potential tax deductions, from the cost of a new printer in your office through Capital Cost Allowance.

Heres a page that lists some common business deductions for a small business. All of your business expenses and deductions will be recorded on Form T2125 and then subtracted from your business income, resulting in your net business income or loss.

Did you know that you can claim some business expenses before your business even opens?

Don’t Miss: How Does Doordash Affect Taxes

Getting A Tax Id Number

As a small business owner, it might be a good idea to get an Employer Identification Number for tax purposes. Your EIN is used just like a Social Security number. It can be used in your tax documents, applying for business licenses, and opening a business bank account.

Not every type of business needs an EIN, however. If you have employees, you must get an EIN. You must also get an EIN if you have certain retirement plans as well. Nonetheless, many freelancers and sole proprietorships forgo getting an EIN because they simply do not need it. Perhaps they work alone, or they only hire independent contractors. The IRS provides a handy checklist to determine whether you actually need an EIN.

What Is The Tax Bracket For A Small Business

Most small businesses are not taxed like corporations.

The Internal Revenue Service agency does not recognize the legality of a sole proprietorship, partnerships, limited liability companies and limited liability partnerships as taxable corporation they are instead considered pass through entities. This means that taxable income goes directly to the owners and members who report the income on their own personal income and pay taxes at the qualifying rate.

Since most small businesses are charged at an individual income tax level, here is the Federal tax brackets for 2019 for single taxpayers tax brackets:

You May Like: Doordash Driver Tax Calculator

Filing Your Sole Proprietorship Taxes

Your sole proprietorship’s profits are treated as simple income on your personal income tax return, but with a few caveats. First, you will be taxed for the full profits of your business, even if you have not personally withdrawn the money. Second, in addition to a traditional personal income tax statement, you will have to fill out a Schedule C and a Schedule SE which you submit alongside your 1040 income tax return to the IRS.

In a sole proprietorship, you can take business deductions just like with other forms of business. This means that you can deduct things such as operating expenses and advertising, as well as business-related travel and entertainment . Start-up costs, such as buying business equipment, can also typically be deducted.

To take advantage of deductions, however, you will need to keep meticulous records. If you’re going to take a deduction, you should be able to demonstrate to the IRS that it was a legitimate business expense.

Finally, it is smart to keep separate accounts for your personal and business expenses. This will help you maintain clear, business-only records. Just as importantly, this will also demonstrate to the IRS if they ever audit you that you tried to separate your business expenditures from your personal ones.

How Much Can A Small Business Make Before Paying Taxes

Small businesses must keep records of their business activities and pay taxes on the money they make. You may be the only employee of your small business and operating as a self-employed independent contractor but federal income taxes apply to your income. The simplest business to set up is to become a sole proprietorship where you are the owner and the liabilities of the business are yours. Calculating profit and loss determines income and you can deduct expenses from income to determine your tax liability.

If you have made than $400 in self-employment income, you must pay self-employment tax on this income. If your business has employees, you must withhold federal and maybe state income taxes along with Social Security and Medicare taxes and unemployment insurance taxes.

RELATED ARTICLES

Recommended Reading: Doordash Deductions

As A Sole Proprietor You Have A Different Income Tax Filing Deadline

Self-employed people such as sole proprietors have until to file their income tax. This applies to spouses too, so if your spouse or common-law partner is self-employed, you also have until June 15th to file. However, note that the payment due date for any balances owing on your income tax was April 30th. If you would like to have an expert take all the guessing work off your hands and do your return from start to finish then TurboTax Live Full Service for Self-Employed* is the right service for you.

How do I know if I have whats considered business income?

Are you unsure about whether the Canada Revenue Agency would consider you to have business income or not? See two of our TurboTax blogs that will provide you with more detailed information on understanding your business obligations at tax time.

How Sole Proprietor Landlords Pay Income Tax

The main difference between reporting income from your sole proprietorship and reporting earnings from a job as an individual is that you must fill out two forms to successfully pay federal income tax for the year.

First, sole proprietors must fill out Form 1040, which is the standard individual tax return. This form reports personal income. But to report business income, landlords or sole proprietors will fill out an additional form known as Schedule C which reports business profits and losses.

To complete the Schedule C form, calculate the taxable income of the rental business, including all income and business expenses. The outcome of this calculation is known as the net income .

This net income or loss of the rental business is entered on Line 31 of the Schedule C, along with the landlords other income or losses. If the business has a profit, then the figure is entered on Line 3 of the Form 1040. Losses may be used to reduce the landlords total adjusted gross income on the tax return.

Sole proprietor landlords tax bracket and the amount of federal income tax owed will be based on your combined income from both forms Form 1040 and Schedule C.

Also Check: Doordash Tax Percentage

Sole Proprietor Or Company: Whats Best For Tax

Getting a new business venture off the ground is an equally exciting and stressful time. Youre enthusiastic about getting your new product or service out into the market, but you face quite an administrative process to get it off the ground legally.

A decision that often stumps many small business owners is whether to operate as a sole proprietor or as private company, a PTY Ltd. We receive many questions about this from entrepreneurs wanting to know the tax implications of each route.

So lets first have a look at an overall comparison of the two entities.

Recommended Reading: How Many Solar Panels For Rv

How To Pay Yourself As A Sole Proprietor

Running a successful business involves handling and managing multiple things. A business owner is responsible for giving appropriate employee payroll according to their position. However, the question arises for a business owner who is the sole proprietor of his business

as he might have questions about how to pay himself as a sole proprietor! In this article, we will consider doubts related to this question and understand how a business owner or self-employed can pay himself for his professional work. We are going to cover the points given below in this article –

You May Like: Tax Deductible Home Improvements

What Happens If A Sole Proprietor Doesnt Pay Estimated Taxes

The U.S. tax system is pay as you earn, and the IRS expects taxpayers to pay taxes on their income during the year they earn it, rather than waiting until they file their taxes early the following year. If you didnt pay enough tax on your business income during the year, you may have to pay a penalty for underpayment. You may also be charged a penalty if your estimated tax payments are late, even if you receive a refund.

You may be able to decrease the penalty if:

- You increase your withholding from employment income.

- You have uneven income during the year, so you annualize your income and make unequal payments during the year.

- You qualify for later payment due to a casualty or .

- You retire after age 62 or become disabled during the year and didnt make the payments due to reasonable cause.

How Does A Sole Proprietor Pay Their Taxes

Sole proprietors pay their estimated taxes quarterly. These payments are due on the 15th of April, June, September, and January. If you arent sure how much to pay and your income is fairly steady, you can use last years return as a guide and divide what you paid then by 4.

You can use IRS Form 1040-ES to help you figure out how much to send each quarter. Details on how to submit your estimated payments to the IRS are included in the instructions for that form as well.

This article from The Balance SMB, How Do I Calculate Estimated Taxes For My Business, has more details and some good tips as well.

Also Check: Do I File Taxes For Doordash

Maximize Your Cca Allowance

CCA is Capital Cost Allowance and it is one of many ways in which businesses reduce taxable income in Canada. Its a tax deduction used to claim for the loss in value of capital assets due to wear and tear or obsolescence.

If you buy a property like furniture or a computer, or other a piece of equipment to use in your business, you cant deduct the entire cost of it on your income tax for that particular year. Instead, you use capital cost allowance to deduct a calculated portion of the expense as an income tax deduction and continue doing this over a period of years until the property or the equipment fully depreciates.

What many businesses are not aware of is that they dont have to claim CCA in the year that it occurs. The CCA is not a mandatory tax deduction, so you can use as much or as little of your CCA claim in a particular tax year as you wish, and carry any unused portion forward to help offset a larger income tax bill in the future. It doesnt make sense for you to take your full CCA claim deduction in a year that you have little or no taxable income.

Be aware, though, of the 50% rule: In the year that you acquire an asset, you usually can only claim 50% of the CCA that you would normally be able to claim. And in some cases, the available for use rule means that you cant claim capital cost allowance until the second tax year after you acquired an asset.

Sole Proprietorship Tax Calculator

If you just want to figure out how much tax you owe, walk through our free Estimated Tax calculator to get your sole prop tax liability. But if you want to understand how it all works, read on.

Sole proprietorships are the most basic business structure in the United Statesâthey donât require paperwork, a separate bank account, or filing fees to get started. Theyâre also the default business structure for individual-owned businesses. For example, if you started up a side gig as an independent contractor doing copywriting this year, the IRS automatically considers you to be a sole proprietorship.

But what does running a sole prop mean for your taxes? Which IRS forms do you have to fill out? And what about single-member LLCsâare they taxed like sole proprietorships?

Hereâs what you need to know.

Recommended Reading: Do You Pay Taxes On Doordash

How Sole Proprietorships Are Taxed: Ultimate Guide

As a sole proprietor, you are in charge of the day-to-day operations, from paying the bills to making sales calls. You are also responsible for paying taxes on your earnings and any other taxes that may apply to your business. Its important to understand how youll be taxed as a sole proprietor so that you know what to expect when it comes time to file.

Federal And State Estimated Taxes

Estimated taxes arent a separate class of tax by themselves. When you pay estimated tax, youre actually paying money ahead toward what you think youll owe for income and self-employment tax at the end of the year. Normally, an employer would withhold money from your paychecks to be applied to your tax liability. But if youre a self-employed sole proprietor, youll have to do this yourself.

Federal and state estimated taxes are due in January, April, June and September. The first tax payment of the current tax year is in April. As a result, the last is due in January of the following year. Filing deadlines are typically the 15th day of their respective month, unless the 15th falls on a holiday or weekend. In that case, the filing deadline would be the next regular business day. You can file these taxes with Form 1040 ES. However, you also have to file your income taxes for the previous year in April.

Its important to make sure youre paying enough in estimated taxes each quarter. Shorting your estimated taxes could trigger an underpayment penalty if you end up owing more in taxes at the end of the year.

Don’t Miss: Grieved Taxes