How Do I Determine The Unemployment Refund Amount

Because you didnt know the exact refund amount youre going to receive when the unemployment compensation is factored in your federal income tax return, you have to calculate it yourself. The easiest way to do this is by figuring out your taxable income by not adding the unemployment compensation exclusion youre eligible for and then tax liability. Lastly, compare it with your total tax payments and see how much is your total tax refund. You can then subtract the initial refund you received and find the difference to come up with the unemployment refund. Although this might take some work, take a look at the original copy of your federal income tax return for guidance.

Although this takes some work, it may not be worth it as the majority of the payments have arrived. Give the process a couple of days and youll receive your tax refund direct deposited into your bank account you provided with the IRS.

Adjusting Returns For Unemployment

Generally, unemployment compensation is taxable. But in March, the American Rescue Plan waived taxes on the first $10,200 in unemployment income, or $20,400 for a couple who both claimed the benefit, for those who made less than $150,000 in adjusted gross income in 2020 in light of the coronavirus pandemic.

Passage of the law came after some people had already filed their 2020 returns, leaving those taxpayers wondering if they’d need to submit an amended return. The IRS later confirmed it would adjust returns and automatically send refunds to eligible taxpayers.

The first of those payments went out in May. The IRS has since sent roughly 8.7 million unemployment compensation refunds totaling some $10 billion.

The agency will continue to adjust returns and send refunds through the summer, it said. It started the readjustment process with the simplest returns and is now moving through more complex ones.

Most people do not have to take any action or file an amended return to get a refund if they overpaid on unemployment compensation, according to the IRS. Some taxpayers who had their 2020 returns readjusted may not get a refund because the IRS first applied their overpayment to outstanding taxes or other debts owed at the state or federal level.

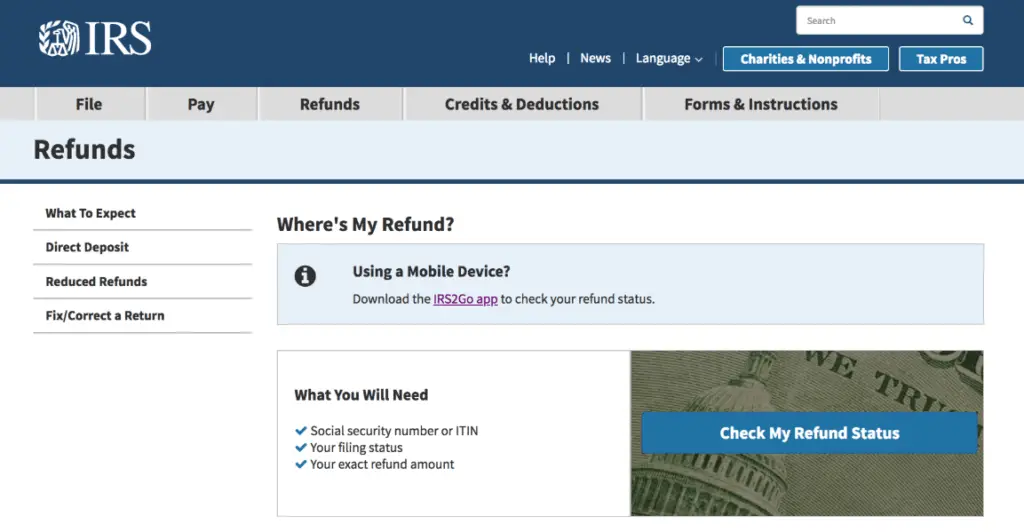

How To Check The Status Of The Payment

One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

These letters are sent out within 30 days of a correction being made and will tell you if you’ll get a refund, or if the cash was used to offset debt.

Sadly, you can’t track the cash in the way you can track other tax refunds.

Another way is to check your tax transcript, if you have an online account with the IRS.

This is available under “View Tax Records”, then click the “Get Transcript” button and choose the federal tax option.

After this, you should select the “2020 Account Transcript” and scan the transactions section for any entries as “Refund issued”.

If you don’t have that, it likely means the IRS hasn’t processed your return yet.

This summer, frustrated taxpayers spoke out over tax refund delays after the IRS announced the cash for unemployed Americans.

Households who’ve filed a tax return and are due a refund get an average of $2,900 back – we explain how to track down the cash.

Don’t Miss: Do I Have To Claim Plasma Donation On Taxes

Other Reasons Individuals Could Be Experiencing Delays

Those who did not receive the first or second stimulus check could claim the funds through the Recovery Rebate Credit. If errors were made while the credit was claimed, individuals should expect a delay in receiving their returns. Additionally, if the return was incomplete, affected by identity theft or fraud, or Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income, the return may take longer to process.

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Also Check: Pay Taxes On Plasma Donation

Details About The Irs Sending Unemployment Tax Refunds

The IRS started sending refunds to taxpayers who received jobless benefits last year and paid taxes on the money. After some frustration with delays in the rollout, many single filers began seeing deposits in their checking accounts starting May 28, with 2.8 million refunds going out the first week of June. The IRS said the next set of refunds for single filers will go out in mid-June, but those payments have not yet been confirmed.

Heres what to know:

Now playing:

Irs Issued 430000 More Unemployment Tax Refunds What To Know

After waiting three months, thousands of taxpayers finally received the money they were owed for the unemployment tax break.

The IRS has sent 8.7 million unemployment compensation refunds so far.

After more than three months since the IRS last sent adjustments on 2020 tax returns, the agency finally issued 430,000 refunds on Monday to those who qualify for the unemployment tax break. In total, over 11.7 million refunds have been issued, totaling $14.4 billion. The IRS says it plans to issue another batch by the end of the year.

Here’s a summary of what those refunds are about: The first $10,200 of 2020 jobless benefits was made nontaxable income by the American Rescue Plan in March, so taxpayers who filed their returns before the legislation and paid taxes on those benefits are due money back.

We’ll tell you how to access your IRS tax transcript and why you should look out for an IRS TREAS 310 transaction on your bank statement. If you’re a parent receiving the child tax credit this year, check out how it could affect your taxes in 2022. This story has been updated recently.

Recommended Reading: Irs Forgot Ein

Irs Sending Out 4 Million More Tax Refunds To Those Who Overpaid On Unemployment

WASHINGTON The Internal Revenue Service will be sending out millions of additional refunds this week to taxpayers who are due money for overpaying on unemployment benefits.

Who are getting these refunds? Americans who took unemployment in 2020, but filed their taxes before passage of the American Rescue Plan on March 11.

Tax filing season had been open for about a month when the relief bill was signed into law. The legislation made it so Americans wouldn’t need to pay taxes on jobless benefits they received last year, up to a certain amount.

The IRS said Tuesday the third round of refunds going out this week will be sent to nearly 4 million taxpayers, with an average refund of $1,265, which means some will receive more than that and others less.

“For taxpayers who overpaid, the IRS will either refund the overpayment, apply it to other outstanding taxes or other federal or state debts owed,” the agency said in a news release Tuesday.

The IRS previously said it estimated around 13 million Americans may be eligible for an additional refund.

With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The $10200 Unemployment Compensation Tax Exemption

If you received unemployment benefits last year and filed your 2020 tax return relatively early, you may find a check in your mailbox soon . Since May, the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American Rescue Plan.

The tax agency recently issued about 430,000 more refunds averaging about $1,189 each. That brings the total count to over 11.7 million refunds totaling $14.4 billion for the 2020 unemployment compensation exclusion.

Don’t Miss: Pastyeartax Com Review

‘surprise’ $8000 Cash Boosts To Be Sent Out As $1000 Payments On Way This Week

She added that there are still about 436,000 returns yet to be processed, as they were waiting in the Error Resolution System as of September 11.

This means they have to be manually reviewed by the IRS, after which the refund is either released or the error confirmed.

She also said that the IRS also won’t be able to determine if a tax adjustment or refund is appropriate until this processing is complete.

It’s important to note that the $10,200 figure is the amount taxpayers can exclude from their earnings, not the amount of the refund.

The latter will vary between households, depending on overall income, your tax bracket and how much of your earnings came from the benefits.

According to the IRS, the average refund for those who overpaid taxes on unemployment compensation $1,265.

When Will I Receive My Refund

You may check the status of your refund using self-service. There are two options to access your account information. Account Services or Guest Services

Also Check: Tax Deductions Doordash

Most Don’t Have To File An Amended Return

Most taxpayers don’t need to file an amended return to claim the exemption. If the IRS determines you are owed a refund on the unemployment tax break, it will automatically correct your return and send a refund without any additional action from your end.

The only reason to file an amended return is if the calculations now make you eligible for additional federal credits and deductions not already included on your original tax return, like the Additional Child Tax Credit or the Earned Income Tax Credit. The IRS said it will be sending notices in November and December to people who didn’t claim the Earned Income Tax Credit or the Additional Child Tax Credit but may now be eligible for them.

If you think you’re now eligible for deductions or credits based on an adjustment, the most recent IRS release has a list of people who should file an amended return.

The average IRS refund for those who paid too much tax on jobless benefits is $1,686.

Refunds For Unemployment Compensation

If you’re entitled to a refund, the IRS will directly deposit it into your bank account if you provided the necessary bank account information on your 2020 tax return. If valid bank account information is not available, the IRS will mail a paper check to your address of record. The IRS says it will continue to send refunds until all identified tax returns have been reviewed and adjusted.

The IRS will send you a notice explaining any corrections. Expect the notice within 30 days of when the correction is made. Keep any notices you receive for your records, and make sure you review your return after receiving an IRS notice.

The refunds are also subject to normal offset rules. So, the amount you get could be reduced if you owe federal tax, state income tax, state unemployment compensation debt, child support, spousal support, or certain federal non-tax debt . The IRS will send a separate notice to you if your refund is offset to pay any unpaid debts.

You May Like: How To Look Up Ein Numbers For Tax Purposes

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

What Are The Unemployment Tax Refunds

The American Rescue Plan Act, which was signed on March 11, included a $10,200 tax exemption for 2020 unemployment benefits.

The exemption, which applied to federal taxes, meant that unemployment checks sent during the pandemic weren’t counted as earned income.

But because the change happened after some people filed their taxes, IRS is issuing refunds for overpayments or it may use it to pay other taxes owed.

It’s important to note that the $10,200 figure is the amount taxpayers can exclude from their earnings, not the amount of the refund.

The latter will vary between households, depending on overall income, your tax bracket and how much of your earnings came from the benefits.

You May Like: Appeal Property Tax Cook County

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Unemployment Compensation Refund Checks

The IRS hasnt made an announcement on whether or not there will be checks. For the time being, its too early to say, as it only has been a day since the refunds were issued. As soon as the IRS makes a statement about checks, well keep you updated. In the meantime, you can check the refund status online through the Wheres My Refund tool.

One side note to keep in mind is that the refunds are sent automatically to taxpayers that the IRS has their payment information. If you dont have your bank account information with the IRS, youll get a refund check.

Don’t Miss: Harris County Property Tax Protest Services

What If I Haven’t Filed A Tax Return

TAXPAYERS had until May 17 to file an extension if they needed more time to submit their returns.

If you didnt file a tax return or an extension, but should have, you need to take action – or the penalties you face may increase.

If you file your return over 60 days late, youll have to pay a $435 fine or 100% of the tax you owe – whichever is less.

However, there is no penalty for filing a late return after the tax deadline if a refund is due, said the IRS.

If you didn’t file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest.

You won’t have to pay the penalties if you can show “reasonable cause” for the failure to do so on time – we explain how in our guide.

Waiting For Your Unemployment Tax Refund About 436000 Returns Are Stuck In The Irs System

- 13:04 ET, Sep 24 2021

HOUSEHOLDS waiting for unemployment tax refunds will be unhappy to know that 436,000 returns are still stuck in the IRS system.

Millions of people are getting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became law.

The American Rescue Plan Act, which was signed on March 11, included a $10,200 tax exemption for 2020 unemployment benefits.

The exemption, which applied to federal taxes, meant that unemployment checks sent during the pandemic weren’t counted as earned income.

But because the change happened after some filed their taxes, the IRS is issuing refunds for overpayments or it may use it to pay other taxes owed.

Unemployment tax refunds started to land in bank accounts in May and have continued throughout summer, as the IRS processes the returns.

However, the IRS has remained quiet on the payments schedule since the end of July – and summer ended in mid-September.

The same day it ended, Erin Collins, of the independent Taxpayer Advocate Service within the IRS, revealed that 13million accounts have been processed so far.

Don’t Miss: Appeal Cook County Taxes