What Is The Itemized Deduction

An itemized deduction can be defined as an eligible expenditure that is incurred by the individual taxpayers on various types of products or services for claiming these expenditures on FIT returns solely for the purpose of reducing their tax implications, or in other words, these are various sorts of tax-deductible expenditures that are incurred throughout the year.

Internet And Phone Costs

Cellphone costs may be deducted for the portion used for business. If you are using your phone or internet for both personal and work use, make sure to deduct only the portion of the phone or internet used for work.

For example, if you use your phone for work only 50% of the time, you can deduct half of your phone-bill costs. A basic home phone or residential phone line cannot be deducted, but a second phone line at home used for business can be deducted.

Home Mortgage Interest Expenses

As a homeowner, if you took out a mortgage to buy a home, you can claim the interest youve paid on that loan as an itemized deduction. The Form 1098 that your mortgage lender sends you records the amount of your deductible interest and points from payments youve made each year. If youve bought or refinanced your mortgage during the tax year, you can also claim the points youve paid as deductibles following certain guidelines.

The mortgage interest deductible is allowed up to the first $750,000 borrowed for a mortgage and applicable for two residences for each taxpayer. Before the enactment of the TCJA, the deduction allowed was on the first $1,000,000 of mortgage debt. However, this higher limit still applies if you refinance the debt, and the amount stays the same.

Any home equity loan interest or line of credit interest youve paid on a home equity debt also qualifies as a deduction, as long as the loan was used to buy, build, or improve the home that was used as collateral.

Also Check: How Can I Make Payments For My Taxes

Standard Deduction Vs Itemized Deductions: Whats The Difference

When you file your tax return, you generally have two options:

Claiming the standard deduction is easier because you dont have to keep track of what you spent, or hold on to supporting documents like receipts, bank statements, medical bills and tax forms.

However, if your total itemized deductions are greater than the standard deduction available for your filing status, itemizing can lower your tax bill.

For 2021 tax returns , the standard deduction numbers to beat are:

- $12,550 for single taxpayers and married individuals filing separate returns

- $18,800 for heads of household

- $25,100 for married couples filing jointly or qualifying widow

Taxpayers age 65 or older or blind can claim higher standard deductions. A worksheet in the IRS Instructions for Form 1040 can help you calculate this amount.

Salaries Benefits And Education

The salary paid to employees can be deducted as long as it is reasonable and paid for the work performed. Salary even includes sick and vacation pay for employees, but the business owners salary cannot be deducted. Work benefits are included, such as health insurance, company discounts, and education fees and reimbursements, as long as the education is relevant to your industry.

Education expenses can be deducted, even by the owner, if the coursework or degree is relevant to their field of work. Items that can be deducted include books, tuition, and travel costs.

Don’t Miss: Prontotaxclass

Common Types Of Above

Some above-the-line deductions are especially useful to aging taxpayers. These include deductions for contributions to health savings accounts from your personal funds, as well as contributions to IRA accounts in many cases. If you withdrew your savings early from accounts at banks or other financial institutions, you can deduct any related penalties. If you are self-employed, you can claim a deduction for your contributions to your retirement plans and another deduction for your health insurance premiums. You also can claim a deduction for half of your self-employment taxes related to Social Security and Medicare, up to an annual maximum amount.

Certain deductions may be helpful to people who are pursuing or who have pursued higher education. If your adjusted gross income does not reach a certain threshold, you can deduct a certain amount of the interest on your student loans. You also may be able to deduct a certain amount in tuition and fees for higher education. This deduction also applies to higher education for your spouse or a dependent. If you take either the American Opportunity tax credit or the Lifetime Learning tax credit, though, you cannot use this deduction.

Home Equity Loan Interest

A home equity loan is essentially a second mortgage on your house. With a home equity loan, you can access the equity youve built in your home as collateral to borrow funds that you need for other purposes.

Like regular mortgage interest, you can deduct the interest youve paid on home equity loans and home equity lines of credit. However, you can only make this deduction if you used the borrowed funds to pay for a home improvement. Prior to the Tax Cuts and Jobs Act of 2017, you could deduct the interest on these loans regardless of how you spent the funds.

You May Like: How Can I Make Payments For My Taxes

Itemized Deductions Vs Standard Deductions

The standard deduction is an amount set by the IRS that you can use to lower your tax bill. Every year, you can apply the standard deduction to lower your taxable income or itemize your deductions. You can only choose one and not both.

Choosing the standard deduction means youll be taking a fixed-dollar amount reduction in your AGI. The amount of the standard deduction you can subtract depends on your age, filing status, and whether you are disabled or claimed as a dependent by another person on their tax return.

The standard deduction does not apply to all taxpayers, such as nonresidents. But many people use it to calculate their tax since it doesnt require keeping track of eligible expenses or keeping records and receipts. Its also easier and beneficial for taxpayers who dont have qualifying itemized spending to opt for the standard deduction.

The Benefits Of Itemized Deductions

Personal exemptions were eliminated when the Tax Cuts and Jobs Act , or tax reform, was enacted in 2017. This change framed deductions as the primary way for individuals to decrease their taxable income. The decision to apply the standard deduction or itemized deductions also became an important consideration for taxpayers.

Some benefits of itemized deductions include:

- Itemized deductions could equal more than the standard deduction amount.

- You can qualify for a number of possible deductions.

- You can potentially save money on taxes by itemizing your deductions.

Don’t Miss: How Does H And R Block Charge

The 6 Types Of Itemized Deductions That Remain After Tcja

Notwithstanding the curtailment of itemized deductions after the Tax Cuts and Jobs Act, there are still 6 core types of itemized deductions that remain available for households to claim.

Per the delineation of Schedule A of Form 1040, the 6 types of Itemized Deductions are:

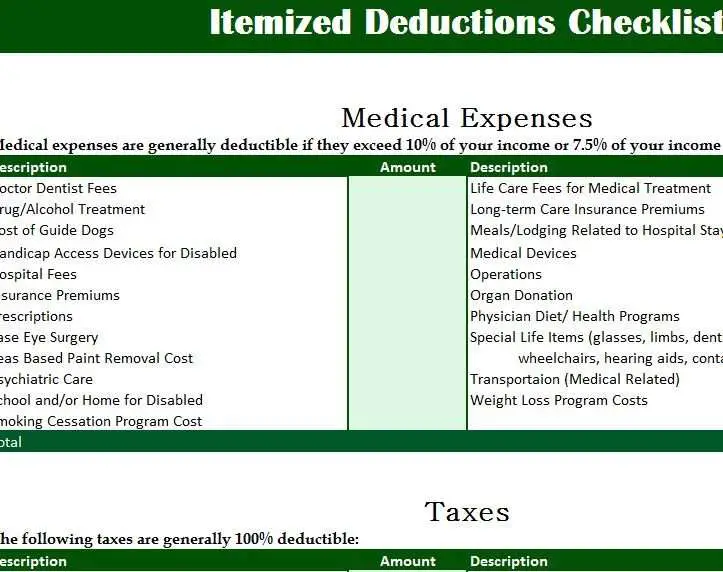

– Medical Expenses. IRC Section 213 allows for the deduction of a wide range of medical expenses, including payments for medical care , health insurance premiums, and even a portion of long-term care insurance premiums. However, medical expenses are only deductible to the extent they exceed 10% of Adjusted Gross Income in 2019 .

– Taxes Paid To Other Governmental Entities. IRC Section 164 allows taxpayers to deduct for Federal tax purposes any taxes that were paid to other governmental entities . In practice, the deduction for taxes paid applies broadly to real estate taxes, personal property taxes, and income taxes, whether paid to a state or local municipality, or even to a foreign government , foreign real estate taxes are not deductible), though it is commonly known as the State And Local Taxes deduction. However, the taxes-paid SALT deduction is limited under IRC Section 164 from 2018 through 2025 to only a $10,000 maximum deduction .

Lifetime Learning Credit Education Credits

The Lifetime Learning Credit allows people to take credits for taking classes at a community college, university or other higher education institutions. The maximum amount of expenses you can deduct is up to $10,000 for an unlimited number of years. However, the maximum you can receive as a credit is $2,000 per tax return.

The credit allows for a dollar-for-dollar reduction on the amount of taxes owed. The expenses can include tuition, fee payments and required books or supplies for post-secondary education for yourself, spouse or dependent child. The credit is not refundable, which means the credit can be used to pay any taxes you owe, but you cant receive any of the credit back as a refund.

The credit amount begins to decrease if your modified adjusted gross income is over a certain threshold . The credit is not available once your income exceeds certain amounts Note: this credit cannot be claimed in the same year as the American Opportunity Tax Credit if the expenses are claimed as the Lifetime Learning Credit.

Read Also: How Much Does H& r Block Charge To Do Taxes

Examples Of Allowable Itemized Deductions

Allowable deductions include:

- Medical expenses, only to the extent that the expenses exceed 10% of the taxpayer’s Adjusted gross income . . Allowable medical expenses include:

- Capital expenditures that are advised by a physician, where the facility is used primarily by the patient alone and the expense is reasonable

- Payments to doctors, dentists, surgeons, chiropractors, psychologists, counselors, physical therapists, osteopaths, podiatrists, home health care nurses, cost of care for chronic cognitive impairment

- Premiums for medical insurance

- Premiums for qualifying long-term care insurance, depending on the taxpayer’s age

- Payments for prescription drugs and insulin

- Payments for devices needed to treat or compensate for a medical condition

- Mileage for travel to and from doctors and medical treatment

- Necessary travel expenses

- Health club memberships

- Cosmetic surgery

Ask For Professional Help If You’re Unsure

As a final point, although the Tax Cuts and Jobs Act did simply the U.S. tax code, there’s still quite a bit of grey area and potentially confusing tax topics. For example, does a computer cart in the corner of your dining room qualify for the home office deduction? Can you pay some of your 2021 mortgage interest in 2020 in order to maximize that deduction?

The answer to both of these questions is “maybe” and that’s the point. If you’re unsure about your ability to take any of these tax deductions, it’s a smart idea to seek the help of a qualified and experienced tax professional to be sure you’re doing it right.

Also Check: Can Home Improvement Be Tax Deductible

Tips To Get You Through Tax Season

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Keeping all of your tax documents organized will help you ace your tax filing. If you choose to itemize, staying organized includes keeping all your receipts. You should keep receipts for at least a few years after you file. It isnt uncommon for the IRS to also look at returns from three to six years prior to the return they are actually auditing. And depending on which deductions you take, like the home office deduction, your return may be more likely to trigger an audit.

- When you file your taxes, there are quite a few tax filing services to choose from. Two of the most popular, H& R Block and TurboTax both offer a user-friendly design with good explanations of the filing process. Heres a breakdown to help you decide which service may be better for you.

The 2020 Mortgage Interest Deduction

Mortgage interest is still deductible, but with a few caveats:

- Taxpayers can deduct mortgage interest on up to $750,000 in principal.

- The debt must be “qualified personal residence debt,” which generally means the mortgage is backed by either a primary residence, second/vacation home, or by home equity debt that was used to substantially improve one of these residences.

- Investment property mortgages are not eligible for the mortgage interest deduction, although mortgage interest can be used to reduce taxable rental income.

- Home equity debt that was incurred for any other reason than making improvements to your home is not eligible for the deduction.

Don’t Miss: Buying Tax Liens In California

American Opportunity Tax Education Credit

The American Opportunity Tax Credit gives credits for the first four years of higher education. The maximum annual credit is $2,500 for each eligible student. If the amount of taxes that you owe is zero because of this credit, the IRS says 40% of any remaining amount of the credit can be refunded to you. The credit is worth 100% of the first $2,000 of qualified education expenses paid for each eligible student and 25% of the next $2,000 of qualified education expenses.

If you, your spouse, or child are in school, make sure to look deeper into education credits, Fan says. For students who are in the first four years of college, this credit could provide a greater tax savings than the Lifetime Learning Credit.

Qualifying expenses include tuition, fee payments and required books or supplies for post-secondary education for yourself, spouse or dependent child. The credit is reduced if the modified adjusted gross income is between $80,000 but less than $90,000 for a single filer and $160,000 but less than $180,000 if married filing jointly. This credit can not be claimed the same year that the Lifetime Learning Credit is claimed.

Dependent Care Fsa Contributions

In addition to the healthcare FSA discussed in the previous section, there’s another type of flexible spending account designed to mitigate the high costs of child care. Known as a dependent care FSA, parents can set aside as much as $5,000 if filing a joint tax return that can be spent on qualifying dependent care expenses.

One major caveat. There’s a tax credit for dependent care expenses , and you can’t use both the credit and money from your dependent care FSA for the same expenses. However, with annual child care costs exceeding $10,000 per child in many parts of the country, it’s safe to say that many parents will be able to take advantage of both.

You May Like: What Does Locality Mean On Taxes

Tax Deductions That Are No Longer In Place Since 2018

Here are some of the tax deductions that were eliminated with the tax law change in 2018:

Moving expenses It is no longer possible to deduct moving expenses when you relocate for a job or self-employment unless you are an active duty member of the military moving due to a military order.

Home equity loan interest for non-home related use The interest on home equity loans cannot be deducted unless you used the loan to buy, build, or make significant improvements on your home . This applies to home equity loans already outstanding that you may have used to consolidate debt or pay for other things. If you have outstanding home equity debt that was partially used to update or remodel your home, then only the interest attributed to the portion used to do the work can be deducted.

Miscellaneous itemized deductions The IRS no longer allows you to claim miscellaneous deductions on Schedule A that were previously subject to a 2 percent floor. Examples of these miscellaneous deductions include:

- Investment fees

Medical And Dental Expenses

As we mentioned previously, to benefit from claiming itemizing medical expenses, your total out-of-pocket medical and dental expenses must exceed 7.5% of your AGI in 2021.

For Mark and Sara, that means they would need more than $7,500 in expenses to benefit from deducting medical expenses. Mark and Sara have health insurance, are generally healthy, and donât have any major medical or dental procedures scheduled for 2021, so they estimate they wonât have more than $7,500 in medical expenses for 2021.

Itemized medical expenses: $0

Don’t Miss: How To Buy Tax Lien Properties In California

Standard Vs Itemized Deductions

Prior to the passage of TCJA, millions of taxpayers were able to claim a larger deduction on their tax returns by itemizing their deductions. Thanks to the higher standard deductions, this may no longer be necessary.

To make the most out of your tax return, read on to learn when to itemize your deductions and when to stick with the standard deduction.

Between the 2018 and 2025 tax years, a change in the tax law nearly doubling the standard deduction has made itemizing tax deductions less advantageous for many taxpayers.

Between the 2018 and 2025 tax years, when the TCJA will be in effect, the number of taxpayers for whom itemizing will pay off is likely to drop significantly due to the much bigger standard deduction.

The new law also eliminated a number of deductions taxpayers could take previously and changed some others.