How Long Should You Keep Tax Records

The government recommends that you keep tax records for atleast 22 months following your return. But if youre self-employed, thegovernment requires you to keep your records for at least five years followingthe 31 January deadline of each tax return.

You can read our full guide to keepinggood tax records. Our guide lists occasions when you might want to keepyour tax records for longer, along with some advice on what to do if yourrecords are lost, stolen or damaged.

Get A Copy Of Your Notice Of Assessment

- Online:

-

View your notices of assessment and reassessment online. Sign in to access and print your NOA immediately.

Alternative:MyCRA web app

- Get a copy by phone

- Before you call

-

To verify your identify, you’ll need:

- Social Insurance Number

- Full name and date of birth

- Your complete address

- An assessed return, notice of assessment or reassessment, other tax document, or be signed in to My Account

If you are calling the CRA on behalf of someone else, you must be an

- Telephone number

-

Yukon, Northwest Territories and Nunavut:1-866-426-1527

Outside Canada and U.S. :613-940-8495

-

8 am to 8 pm Sat 9 am to 5 pm Sun Closed on public holidays

What If You Do Not Get Your Income Tax Return Copy

If you have been counting on the Income Tax Departments email containing your ITR acknowledgement copy, and havent received the same, worry not! This is exactly where the process for how to get an income tax return copy online comes in handy.

Yes, if you do not receive the email acknowledgement, simply download your ITR copy from the e-filing portal following the steps we previously discussed. Once you manage to get your hands on this document, make sure to organise it along with your previous return copies and maintain these records for at least 10 successive years.

Also Check: How Much Tax Should I Be Paying Per Paycheck

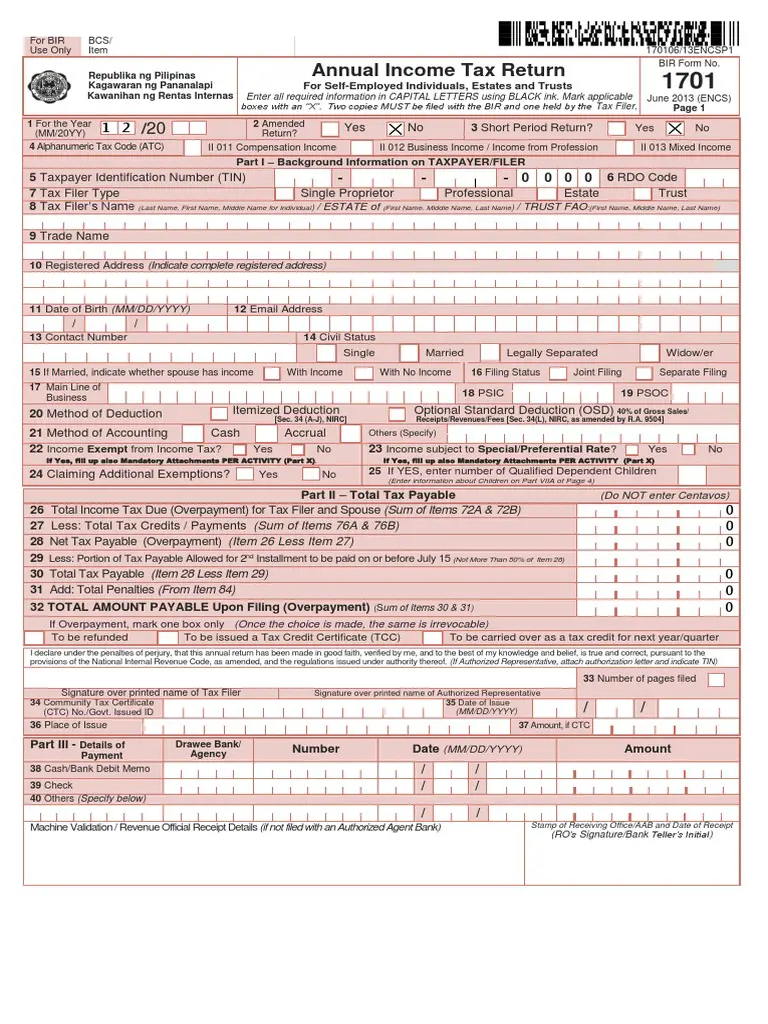

My Employer Refuses Or Forgets To Issue The Bir Form 2316/does Not File My Income Tax What Should I Do

Talk to the HR staff or approach your employer directly to raise your concern about your BIR Form 2316.

If your employer still fails to provide you with a copy, call the BIR hotlineto report the violation and ask about the right course of action.

Erring employers are subject to a penalty fee of PHP 1,000 for each failure to file or submit a BIR Form 2316. If the violation goes on for at least two consecutive years, the employer will be held liable and fined PHP 10,000 and jailed for at least one year, in addition to paying a penalty fee of PHP 1,000 for each failure.

Individual Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free iFile service.

Do Not Send

- Federal forms or schedules unless requested.

- Any forms or statements not requested.

- Returns by fax.

- Returns completed in pencil or red ink.

- Returns with bar codes stapled or destroyed.

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online. You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process.

IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. To do so, you must have the full Adobe Acrobat 4.1 product suite, which can be purchased from Adobe. Maryland fill-out forms use the features provided with Acrobat 3.0 products. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information.

Don’t Miss: Is Doordash Worth It After Taxes

Get Help From A Registered Tax Agent

If you want to use a professional to do your tax return, make sure you use a registered tax agent. You can check if the accountant or agent is registered on the tax practitioner register.

Most registered agents have special lodgment schedules and can lodge returns for their clients later than the 31 October deadline.

Whichever way you choose to lodge your tax return, remember you are responsible for the claims you make. Make sure your deductions are legitimate and you include all your income before you or your agent lodges your return.

Do Tax Transcripts Show Owed

The IRS transcript will also tell us if you filed a return, when it was filed, and if there have been any changes made to your account by audit. The amount of tax owed from your return filing, or from audit, will also be shown. The amount owed in penalties will also be available on an account transcript.

Recommended Reading: How Do I Defer My Taxes

What Is Bir Form 2316 And Why Is It Important

The BIR Form 2316 is an official document that indicates an employees gross income and the corresponding taxes withheld by the employer during the year.

This certificate is enough proof that an employees income was subjected to income tax during a particular year.

Aside from being proof of income and tax withheld, the BIR Form 2316 is also used for other purposes:

- Proof of financial capacity for a credit card, loan, visa, scholarship, and other applications

- Financial document to meet the requirements of government offices and private institutions

- A pre-employment requirement that employees submit to their new employer for accurate computation of their annual income tax for the year

- Reference for employees to verify if their employer has withheld their taxes correctly and paid to the BIR

- Proof of tax payment for availing of tax credits by expats in their home country

Q3 How Long Must I Wait Before A Transcript Is Available For My Current Year Tax Return

If you filed your tax return electronically, IRS’s return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks. If you didn’t pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

Once your transcript is available, you may use Get Transcript Online. You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call . Please allow 5 to 10 calendar days for delivery. You may also submit Form 4506-T, Request for Transcript of Tax Return. The time frame for delivery is the same for all available tax years.

Also Check: How To File Taxes If Married But Living Separately

How To Get One

-

Online copy does not have the section 241 stamp, but the information is being released at the request of an authorized individual in accordance with Section 241 of the Income Tax Act.

-

Order a copy of a proof of income statement to be mailed to you. It can take up to 10 days to receive by mail.

Order a copy through MyCRA web app

Use the MyCRA web app to get a proof of income statement mailed to you.

Order a copy by phone

- Before you call

-

To verify your identity, you’ll need

- Social Insurance Number

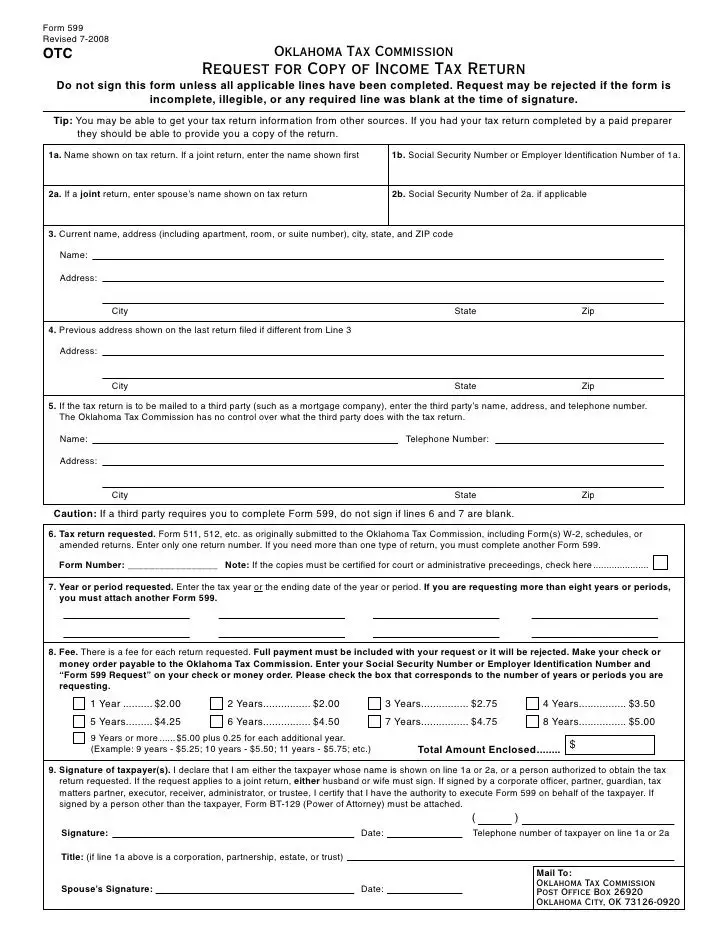

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Don’t Miss: Can I Pay My Taxes In Monthly Installments

How To Get Copies Of Tax Returns

Even though tax transcripts are free of charge and can be delivered much more quickly than copies of your tax return, there may be times when youll want the full return rather than just the transcript. While lenders will accept the transcript, you may prefer having a full copy of your previous returns for your own records.

- If so, you can request a copy of your tax return using IRS Form 4506, Request for a Copy of Tax Return.

- You can obtain copies of your tax returns for the current year and up to the six previous years. However, unlike tax transcripts, obtaining copies of your tax returns comes with a fee of $43 for each year requested.

- If youre filing the request by mail and plan to send a check, youll need to make your check payable to the United States Treasury. However, if youre impacted by a federally declared disaster, the IRS will waive the fee if the copies are needed to apply for disaster relief benefits or to file amended returns claiming disaster-related losses.

- For jointly filed returns, either spouse can request a copy. The signature for only the requesting spouse will be required on Form 4506.

- Heres a major reason why you should request tax transcripts, rather than copies of tax returns, if you can possibly avoid it: It can take the IRS, up to 75 days to provide copies of tax returns.

- If you need your tax information in less time, transcripts will arrive in only a fraction of the time.

Tax Situations Requiring A Specific Return Or Form

In certain cases, you will need to complete a specific tax return. These exceptions may be based on your residential ties or changes to your tax situation.

- You were a Quebec resident on December 31, 2021

You will also need to file a provincial income tax return for Quebec.

- You are filing a return for a person who died in 2021

For details: What to do when someone has died

- You left Canada permanently in 2021

-

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

- You lived outside of Canada on December 31, 2021, but kept residential ties with Canada

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

You may be considered a deemed resident of Canada if you:

Use the Income tax and benefit package for non-residents and deemed residents of Canada.

Don’t Miss: Can I File Taxes Without Working

Copy Of Actual Return From The Irs

Cost: $50 Processing Time: Up to 75 Days

To get an exact copy of your tax return from the IRS with all schedules and attachments , you’ll need to complete Form 4506. You’ll also need to write a $50 check or money order to “United States Treasury”. The IRS mailing address and request instructions are included on the form.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

You May Like: How To File Llc Taxes As S Corp

Obtaining A Copy Of Documents Issued By Iras

You can view or print copies of documents issued by IRAS via mytax.iras.gov.sg. These documents include:

- Notices of Assessment

- Acknowledgement pages of your filing transactions

This service is free, fast and convenient.

For assistance on retrieving the documents, refer to these guides:

Q2 Can I Request A Transcript If I Filed Jointly With My Spouse And My Name And Ssn Was Listed Second On Our Tax Return

Yes, a secondary taxpayer may request any transcript type that is available.

Please note, only the account and the tax return transcript types are available using Get Transcript by Mail. Use Form 4506-T, Request for Transcript of Tax Return, if you need a different transcript type and can’t use Get Transcript Online.

Read Also: What Is Hawaii State Tax

Filing Your Income Tax And Benefit Return On Paper

If you filed on paper last year, the Canada Revenue Agency will automatically mail you the 2021 income tax package by February 21, 2022.

The package you will receive includes:

- a letter from the Minister of National Revenue and the Commissioner of Revenue

- the Federal Income Tax and Benefit Guide

- an information guide for your province or territory

- two copies of the income tax and benefit return

- Form 428 for your provincial or territorial tax

- File my Return invitation letter and information sheet, if youre eligible for the service

- personalized inserts or forms, depending on your eligibility

- a return envelope

If you havent received your package by February 21, you can:

- view, download, and print the package from canada.ca/taxes-general-package

- order the package online at canada.ca/get-cra-forms

- order a package by calling the CRA at 1-855-330-3305

It can take up to 10 business days for publications and forms to arrive by mail.

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

You May Like: How To Get Tax Preparer License

What Is A Sa302 Calculation

This is a much more detailed breakdown of your tax return. Itspecifies the tax rate youre on, the total income on which youve been chargedtax, the amount of income tax you owe, along with any Class2 and Class4 National Insurance contributions. It will also tell you about deductions,balancing payments, and any other income you may have received from othersources.

Self-employed workers can use SA302 documents to provideevidence of their income. So if youre applying for a mortgage, for example,and the bank or building society asks you to prove your income for a givenperiod, you can follow the steps above to access your SA302 documents.

If you didnt submit your tax return online, or if yourestruggling to locate certain older paper documents, then you can try contactingHMRC. Youll need your Unique Taxpayer Reference number to hand, aswell as your National Insurance Number. You should also ensure that all of yourpersonal details are up to date in your personal tax account, sothat HMRC can properly identify you with their screening questions.

How To Get Copies Of Old Tax Returns

To view copies of your old tax returns, follow these steps:

And thats it! You should now be able to view your tax yearoverviews for every year youve previously submitted a tax return.

Recommended Reading: How To File Taxes With Retirement Income

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Ways To Get Transcripts

You may register to use Get Transcript Onlineto view, print, or download all transcript types listed below.

If you’re unable to register, or you prefer not to use Get Transcript Online, you may order a tax return transcriptand/or a tax account transcript through Get Transcript by Mailor by calling . Please allow 5 to 10 calendar days for delivery.

You may also request any transcript type listed below by submitting Form 4506-T, Request for Transcript of Tax Return.

Read Also: Why Do I Owe Taxes When I Make So Little