What States Have The Highest And Lowest Tax Rates

California’s state tax is the highest, but some states with much lower state rates can end up with some of the highest tax rates when local taxes are added in. Louisiana’s state rate is 4.45%, for example, but the average in that state jumps to 9.52% when local sales taxes are added. Tennessee charges a 7% sales tax, but combined with local taxes, it is just behind California with the second highest combined tax rate.

In Alaska, where there are only local sales taxes, the rate is lowest, averaging 1.76%. Other states with the lowest sales tax rates are Hawaii, with a combined rate of 4.44%, and Wyoming, Wisconsin, and Maine, which all have combined rates in the mid-5% range.

Tax laws can change frequently. Make sure you get the most up-to-date information.

Submit Your Sales Tax Return

Your state and local government will also ask you to send them a small business sales tax return to show you paid the right amount. Theyll tell you how often to file . Even if you didnt collect any tax but have a sales tax license, you still need to send in a return, so they can verify that you dont owe anything. Not doing so could lead to a failure-to-file penalty.

What Are Some Common Compliance Pitfalls For Small Businesses

Managing your tax obligations isnt easy and non-compliance unintentional or not can result in serious consequences for your business. Knowing some common compliance pitfalls ensures that you wont be surprised by an unexpected sales tax obligation.

- Falling behind. Falling behind on sales tax legislative updates in various states is a concern for many small business owners. And if youre doing business in multiple states, it can be a monumental task to make sure you know about and understand tax legislation when it gets passed.

- Breaking down rates. Inability to break down rates required by a tax jurisdiction can also be an issue. Sales tax rates include the state rate, plus any local or other taxing jurisdiction at the point of sale. Knowing how to navigate the increasingly dense tax rates, and the ability to track and ensure compliance across your business, is critical to success.

- Understanding nexus. Neglecting to collect tax where you have nexus will quickly become a problem. The first step is understanding and identifying where and when you have a nexus and how that will affect the amount of tax you must remit to the individual state.

- Exemption certificates. Failing to collect exemption certificates on exempt sales is a common problem. In most cases, asking for an exemption certificate immediately is the best course. But it does cause extra work for both you and your customer. However, having the completed forms is necessary and expected during an audit.

Read Also: How To File School District Taxes In Ohio

Collect Sales Taxes From Customers

After you have received your sales tax permit, you can begin collecting sales tax from customers. You must show the tax amount separately, so the customer can see the amount of the tax this typically isnt a problem, since most sales receipts are programmed to show the amounts. If you are selling online, your shopping cart page will show the sales tax calculation. You will need to program the computer for the applicable sales tax amount or amounts or start using the services of an online sales tax service.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Taxjar Reports And Taxjar Autofile Takes Sales Tax Filing Off Your To

Filling out sales tax returns and filing and paying your sales tax every month, quarter or year is a thankless, unprofitable administrative task. With TaxJar, just tell us which online shopping carts, ERPs, or marketplaces on which you sell and well fill out your sales tax forms for you. Better yet, if youd rather not handle sales tax returns at all, TaxJar AutoFile automatically files and pays your sales tax on time, every time.

Ready to automate sales tax? To learn more about TaxJar and get started, visit TaxJar.com/how-it-works.

Related Resources

Also Check: Does Turbotax Do Local Taxes

Canada Sales Tax: A Simple Guide To Pst Gst And Hst

Dealing with sales tax is an inherent part of running a small business. Get the basics down so you can focus on delivering top-notch experiences to your customers without worrying about surprise tax bills later on. We spell out the essentials to help you understand what taxes you need to charge province-by-province, and how to remit them.

How Do You Handle The Paperwork And Filing

Unfortunately, collecting sales tax isnt quite as easy as tacking on an extra charge to your goods or services.

To legally collect sales tax, you need to get a sellers permit or license from your state. In some states, you will obtain a sellers permit on a state level. In others, youll also be required to obtain a license from your city, county, or jurisdiction.

To apply for a sales tax permit, visit your State Departments website. Look for the sales tax or sellers permit application under the Department of Revenue. Youll use that application to submit some basic information about your business, including your location, business type, and types of taxes you intend to collect.

As you collect sales tax, youll be required to remit it with a sales tax return to your state government on a regular basis. This may be required monthly, quarterly, or annually. How often you remit taxes will depend on how many sales youre making, as higher sales volume means more frequent filing.

When your state gives you your sellers permit, they should also let you know your filing frequency. At that same time, its wise to ask about your sales tax due date. Most states expect business owners to file their sales tax return by the 20th of the month following the taxable period, but this date can vary.

Read Also: How To Find Out What You Owe In Taxes

Which States Impose Sales Tax On Services

While services are not subject to sales tax in all states, Its important to note that exclusions are not absolute. It all depends on the state. Heres a quick breakdown of the general services sales tax landscape:

- Five U.S. states dont impose any general, statewide sales tax on goods and services.

- Four U.S. states tax services by default, with exceptions only for services specifically exempted in the law.

- In the rest of the 41 states and the District of Columbia, services are not taxed by default, but services specified by the state may be taxed.

Of course, if you do business in more than one state, that means that you need to understand how each state treats each of your particular products or services.

For example, in Hawaii, services are taxable unless specified otherwise. But in Texas, dry cleaning is taxable while veterinary services are not. Why? Its simply because the state says so.

What Tax Rates Should You Be Charging

The truth is, the IRS themselves likely cant even tell you exactly what tax rates to charge your customers online, but were going to try our best!

Before we get into it, lets define an important term: sales tax nexus.

Simply put, a sales tax nexus occurs when your business has some legal connection to a state. Two of the most prominent ways you establish this connection are through a physical presence or economic connection. First, lets talk about economic connection.

Generally speaking, economic connection is achieved when your business hits a certain dollar amount or percentage of your sales in a state. Second, physical presence can mean many things, but here are a couple good examples of what would further define a physical presence sales tax nexus:

- Having an office

- Having an affiliate*

* If you have a strong presence with one of your affiliates, you may have an additional nexus that you are responsible for. Check out this post from our friends at TaxJar to further understand click-through nexus.

Whether its through economic connection or physical presence if you establish a sales tax nexus in a state, then you must collect sales tax from your customers in those states.

Ultimately, there are a significant number of resources online to further define what a sales tax nexus is so if you suspect you have a sales tax nexus in a specific state, contact that states taxing authority.

You May Like: How Are Home Taxes Calculated

Do I Need To Collect Sales Taxes

If you own, or are starting, a small business, its vital that you understand your tax obligation, or it could lead to serious trouble, including fines. The tax collection and payments should be part of your business plan, and part of the homework you do when you set up your business.

If you sell online and have customers from other states, this can get tricky. It can end up costing you money if you dont know and follow the rules.

To get started on the sales tax journey, and what role your business plays, you should be able to answer these questions:

What is your sales tax nexus? Nexus is where your business has a presence, but like all other things sales-tax related, its not that simple. Its always in the state where you reside and conduct business, even if youre doing it from your kitchen table, but it extends from there. If you have more than one physical location, particularly in different communities or states, affiliates, or more, that is part of the nexus. Some states also count employees who work remotely in another state, or contractors. Warehouses and distribution centers count, too. If your business sells online to other states, it may have an economic nexus .

Does your state or local jurisdiction require you to get a license to sell or sales tax permit? Start by registering with your states taxing agency. Find out, too, if you must register in other states you do business in.

Read The Full Episode Transcript

Today is going to be a quick but VERY important episode for my U.S. based eCommerce friends.

There is still A LOT of confusion when it comes to charging sales tax for eCommerce businesses and rightfully so. Up until a couple of years ago, you were only required to charge sales tax in states where you had a physical business presence, or nexus as its called.

This meant if you had physical presence there, such as an office or fulfillment center, you would be required to collect and remit sales tax. But if you had no physical presence there, you didnt have to charge sales tax at all.

As a consumer, it was pretty awesome. Purchasing a product thats a few thousand dollars from a retailer in NY without getting charged tax equates to large financial savings.

Certain retailers, like Amazon who had fulfillment centers all over the country, were already required to collect sales tax for most, if not all states, so you wouldnt have noticed the benefits as a consumer.

Recommended Reading: How Much Is North Carolina Sales Tax

Determine Where You Have Nexus

Nexus is established when you meet the requirements for a business presence in a state. Prior to 2018, this referred to a physical presence, such as having a warehouse.

But with the precedent set in South Dakota v. Wayfair, where the Supreme Court ruled in favor of the states entitlement to sales tax from the out-of-state seller, many states have updated their definition of nexus to include remote sellers with no physical presence, but who have generated enough sales to qualify as an economic presence.

As a result, nexus can now exist based on either a physical or an economic presence in a state.

A physical nexus, depending on the state, can be anything from:

- Stored inventory

- Temporary physical business in a state, such as at a trade show or craft fair

An economic nexus, on the other hand, is usually triggered when you reach a certain threshold of sales within the state. For example, the state of Illinois considers $100,000 in sales or 200 transactions in a 12-month period as the threshold for economic nexus. Texas, on the other hand, deems you have an economic presence if sales made into the state exceed $500,000 in the past 12 months.

If you suspect you might have a physical or economic presence in a state, you could check with that states taxing authority to determine whether or not you have sales tax nexus.

Avalara has a great state-by-state sales tax guide for learning the sales tax rates, collection rules, and nexus conditions for each state.

Do You Have To Pay Sales Tax On E

Yes. Business owners must assess sales taxes, collect them and remit them to the proper tax authorities within the prescribed time. Except for wholesale items, raw materials and sales made to nonprofits, U.S. retail businesses are required to collect sales tax on the goods they sell. As a small business owner, you must monitor constantly evolving legislation.

Key takeaway: E-commerce businesses are required to assess, collect and pay sales tax.

Also Check: How Many Years Of Tax Returns Should I Keep

How To Stay Compliant With Sales Tax When You Sell Services

Its important for every business to perform a nexus study. A nexus study reviews all your business activities and sales in a state or multiple states and determines if these activities create sales tax nexus.

Youll want to perform a nexus study when you start selling in a new state, or when you start selling a new product or service.

For example, say you are a CPA in Arizona, where CPA services are not taxable. But you open up a second office in neighboring New Mexico. While Arizona doesnt require CPAs to charge sales tax on their services, New Mexico does. This means registering with the state and ensuring you collect and remit New Mexico gross receipts tax at state-specified intervals. If you fail to collect from your New Mexico customers, youre on the hook for paying New Mexico GRT out of your own profits.

Once youve conducted a nexus study, your next steps are:

- Ensure you are registered for a sales tax permit in every state in which you are required to collect sales tax.

- Ensure that you charge the right sales tax rates. Establish rate tables and do your product taxability research, understand jurisdictional boundaries and where those rates apply, and keep up with any changes.

- File your returns. In the states where youre registered, be sure to know your due dates, submit your returns and remit any payments necessary.

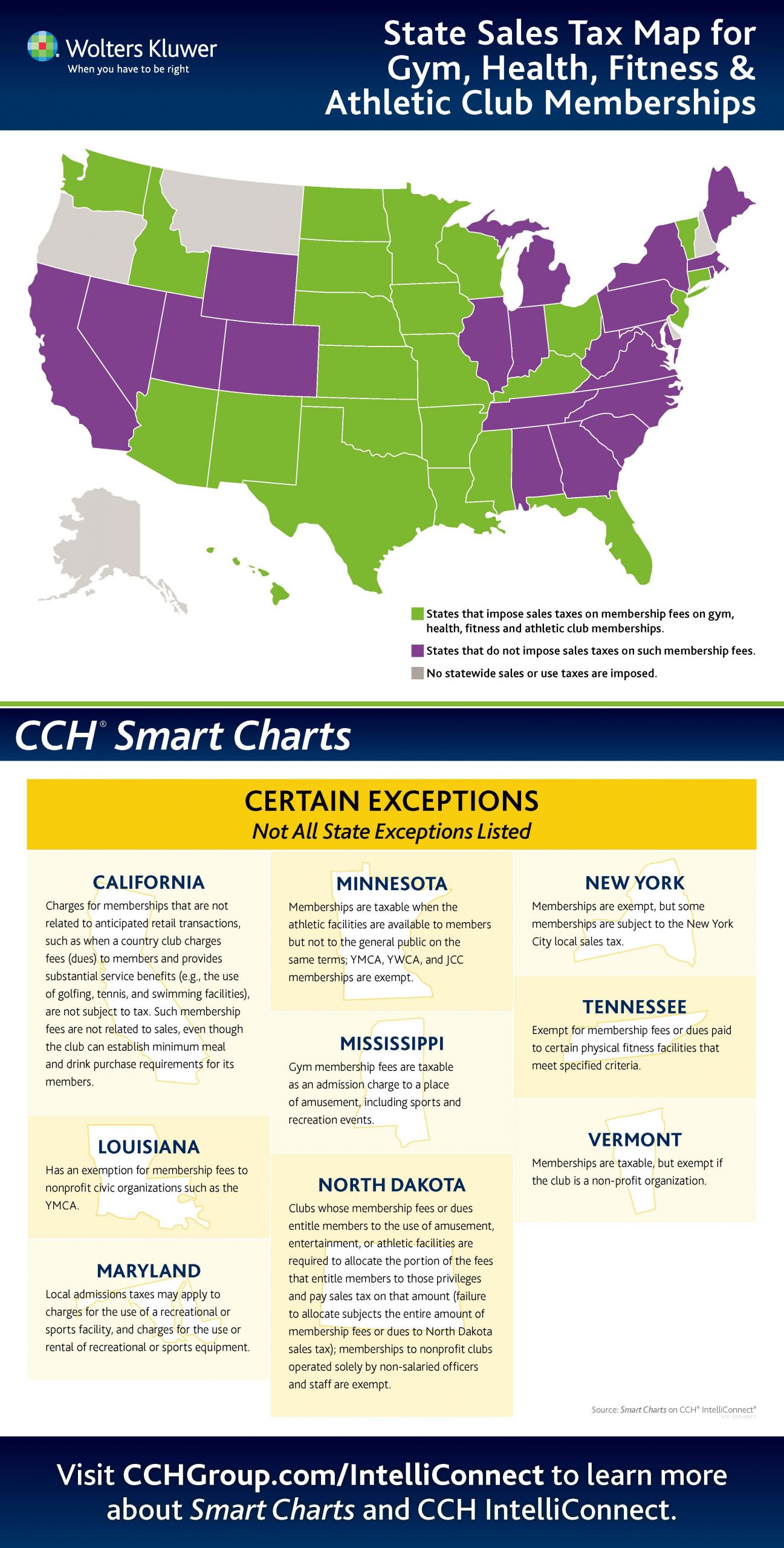

Breaking Down States With Sales Tax

Now that you have a little background on sales tax, lets take a look at which states have sales tax. Again, 45 states and Washington D.C. have sales tax and different laws in place for sales tax.

Because there are so many states with sales tax laws in place, it may be easier to remember the states with no sales tax. The five states that do not have sales tax are:

- Rhode Island

Check out the handy map below to find out if your state has local sales tax. Keep in mind that local sales taxes vary from city to city. So, even if youre located in a state with local sales tax, you might not be responsible for collecting local sales tax.

You May Like: How To Get Tax Form From Unemployment

How To Charge Your Customers The Correct Sales Tax Rates

Written by Mark Faggianoon December 28, 2015Blog, Physical goods.

So you get that as an eCommerce store owner, you need to be sales tax compliant. This means that in the United States specifically, you have to charge sales tax to buyers in states where you have nexus. All states have a slightly different definition of nexus, but most of the time states consider that a physical presence or economic connection, based on sales into that state, creates nexus.

Even after you have done the research to understand where you have nexus, then how much do you charge? Does it vary from customer to customer? And why does this have to be so complicated?

And more importantly, is there a solution that can automate everything so WooCommerce customers dont have to deal with any of this? The good news is, yes there is!

First, well explain a bit about how sales tax works, and then well show you how you can use TaxJar to automate the entire process so you never have to stress about sales tax again.

While determining the right rates to charge can be tricky, a little reading will help you wrap your head around it in no time. Today, well explain the different sales tax rates in the United States, and help you figure out which rates to charge your customers.

If youre a growing eCommerce business with multiple sales channels , and want to take advantage of fully automated sales tax and filing services, we recommend you choose TaxJar.

Lets get started.

What Is Economic Nexus

Nexus is the presence a business has in a specific location . Businesses may have nexus in a state if they sell goods or provide services there. A sales tax nexus determines if a business has a presence in a location and must collect sales tax from customers.

Economic nexus is a type of sales tax nexus for online sales. So, businesses must collect sales tax in the state where the customer is if they earn revenue or meet specific sales thresholds in that state. Companies may also have a physical location in a state for economic nexus, meaning that its not limited to digital commerce.

Say your business is in Anchorage, Alaska. You do not have sales tax at your businesss home location. But, you sell winter coats online to customers in other states. You sell enough coats to customers in Wisconsin to establish economic nexus. You must collect sales tax from your customers.

Don’t Miss: How To Review My Tax Return Online