Will The Irs Notice If You File Late

Even though there are multiple reasons to file your taxes early, the IRS still receives millions of tax returns at the last minute. So you may be wondering if they’ll even notice that yours is a day late.

The real question you should be asking yourself is: Why risk it? Plus, if you mail in your return, the IRS can see the postmarked date on the envelope, so you could very well receive a bill for a small amount if you’re a few days past due.

So if youâre going to be late , make sure to file for an automatic extension. While you’ll still have to fill out and file as much of your 1040 as you can , you’ll have until mid-October to finish the tax-filing process.

This publication is not intended as legal or tax advice. Taxpayers should seek advice based on their particular circumstances from an independent tax advisor.

Recommended Reading

Failure To Report Federal Changes

When a taxpayer fails to report federal changes within six months from the date the taxpayer is notified by the Internal Revenue Service of the correction or final determination, the taxpayer is subject to the failure to file penalty and forfeits the right to any refund as the result of the federal changes. The failure to file penalty begins at the expiration of the six-month period.

Don’t Fall Back On A Tax Extension

So say you’ve prepared your tax return and see that you owe money you can’t pay. Your first inclination might be to request an extension and push your personal filing deadline all the way back to October. It’s a good idea in theory, but what you need to realize is that tax extensions simply give you more time to file your return they don’t actually buy you extra time to pay your tax debt. This means that if you file an extension by April 17 but don’t pay your tax bill by then, you’ll start to accrue the aforementioned late payment penalties. You will, however, avoid the failure to file penalty that’s far more substantial than the penalty for being late with your payments.

Recommended Reading: Donating Plasma Taxes

With So Much Going On In Life Its Not Always Easy To File Your Taxes On Time So What Happens If You File Your Taxes Late

Before we dive into the details, keep in mind that thereâs a distinct difference between paying your taxes late and filing your taxes late â a difference that may have a profound effect on your bank account.

If you file your taxes on time but donât have the cash to pay the balance owing, youâll be subject to interest.

âHowever, if you miss the filing deadline and file late, youâll automatically be subject to a late filing penalty in addition to any interest on the tax balance owing.Itâs this late filing penalty that can make filing your taxes late a real nightmare.

âLetâs take a look at what would happen if you filed a few common tax returns one month late with a 10K balance outstanding.

Relax If Youre Abroad Or In The Military

For virtually anyone who files late taxes, forgetting to request an extension is a huge no-no. But if youre a U.S. citizen or resident who lived and worked outside of the country on the tax-filing deadline, you automatically get two extra months to file your return and pay any amount due without having to request an extension. People affected by certain natural disasters may automatically get more time as well . Some members of the military also get more time, depending on where they are and what theyre doing .

Read Also: Www.1040paytax

What Happens If You File Taxes A Day Late

Northwestern Mutual

While taxes are one of the few certainties in life, youâre only human if youâve ever looked at the calendar and realized Tax Day is just around the corner â and youâre nowhere near prepared. And in a year like 2021 when the tax deadline has been pushed back to May 17, it can throw off your schedule even more.

But what happens if you file taxes a day late? Here’s what to know.

Assuming Tax Is All You’ll Owe

Paying later means paying more, because youll owe interest on any amount outstanding after the tax-filing deadline, even if you get an extension.

-

The IRS may also assess a late-payment penalty, which normally is 0.5% per month of the outstanding tax not paid by the deadline . You might be able to catch a break if youve paid at least 90% of your actual tax liability by the deadline and you pay the rest when you send in your return.

-

The bottom line is that if you owe taxes, it may be a good idea to pay as much as you can when you request the extension.

» MORE:Estimate your tax burden with our free tax calculator

Also Check: Do You Pay Taxes On Plasma Donations

Prepare To Pay A Tax Penalty Too

The IRSs late-payment penalty normally is 0.5% per month of the outstanding tax not paid by the tax-filing deadline. The maximum penalty is 25%.

You might catch a break on the penalty if youve paid at least 90% of your actual tax liability by the tax-filing deadline and you pay the rest with your return. The IRS also might let you off the hook if you can show reasonable cause for why you didnt pay on time though youll need to attach a written statement to your return.

» MORE: How to get rid of your back taxes

Being Out Of Time Impact On Claims And Elections

There are many tax claims and elections and all have time limits. They cover such issues as claiming Blind Persons Allowance a higher amount of tax free pay to making loss relief claims. In general, the default time limit for such claims is four years from the end of the tax year but some claims and elections, in particular, some loss relief claims, are on a shorter time scale. This means that being in arrears with your tax returns could mean that you potentially miss making a valuable claim or election.

There is technical guidance on claims and election time limits on the HMRC website at

Recommended Reading: Tax Preparation License

Filing Outstanding Tax Returns

For current Year of Assessment

e-File your outstanding Income Tax Return via mytax.iras.gov.sg.

If the online tax return is not available, please chat with us or call 1800-356 8300 to obtain paper forms via post.

For previous Year of Assessment

Please chat with us or call 1800-356 8300 to obtain paper forms via post.

Why File For An Extension

Filing an extension automatically pushes back the tax filing deadline and protects you from possible penalties. Late-filing penalties can mount up at a rate of 5% of the amount due with your return for each month that you’re late.

- For example, if you owe $2,500 and are three months late, the late-filing penalty would be $375. x 3 = $375

- If you’re more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less.

- Filing for the extension wipes out the penalty.

TurboTax Easy Extension is a fast and easy way to file your extension, right from your computer.

Read Also: Www 1040paytax

If Your Paper Tax Return Is Going To Be Late

If you were planning to file a paper tax return, but don’t think it will reach HMRC by the 31 October deadline, don’t send it off late. If you do, you’ll incur the fines explained above.

Instead, you can complete an online tax return, which means you’ll have an extended deadline of 31 January the following year.

You cannot submit a late paper return followed by an on-time online tax return – HMRC will fine you according to the return it receives first.

You Make An Overdue Payment: Late

If you do not pay your transfer tax on time, you must pay interest. In 2021, the interest rate is 7%. It is your responsibility to add the interest, on your initiative, to the transfer tax that you are paying after its due date. If you pay in MyTax, the interest is included in the sum automatically. Use the late-payment calculator to work out the exact amount.

Another situation where you must pay interest is if you applied for registration of your title or lease in time but you paid the transfer tax late.

Note: If you have any questions about payments, call our service number 029 497 026 . If you have any other questions about transfer tax, please contact the Finnish Tax Administrations transfer tax service number on 029 497 022 .

You May Like: 1040paytax.com Official Site

Assuming You Have 6 Extra Months To Get It Together

The standard extension can buy you an extra six months to file, which gets you to the middle of October. But if youre one of the few who get an automatic extension, dont assume you have the same amount of time.

-

That out-of-the-country crowd mentioned earlier gets just two extra months to file, for instance the amount of extra time varies for people affected by certain natural disasters.

-

Members of the military could get more than six months in some situations.

Prepare Your Taxes Ahead Of Time

One way to ensure that you’re not late in paying your taxes is to prepare your return well in advance of the April 17 deadline. This way, you’ll know what sort of tax debt you’re dealing with, and you’ll have an opportunity to come up with that money over the next couple of months.

For example, say you find that you owe the IRS $600 as a result of having underpaid your taxes during 2017. If you don’t have the money in savings and realize you owe that much in early April, you’ll have just a week or so to scrounge up the cash, thus putting yourself at risk for the late payment penalties we talked about earlier. But if you get your paperwork in order this month and find that you owe that money, you’ll easily have six weeks to come up with a plan. That might mean taking on a side job that pays you $100 a week, or significantly cutting back on expenses to free up that cash in time.

Owing money to the IRS is no fun, but if you give yourself time to prepare for a tax bill, you’ll minimize the extent to which you rack up penalties. And that’ll help you avoid giving the IRS even more of your hard-earned cash.

Also Check: Claiming Home Improvement On Taxes

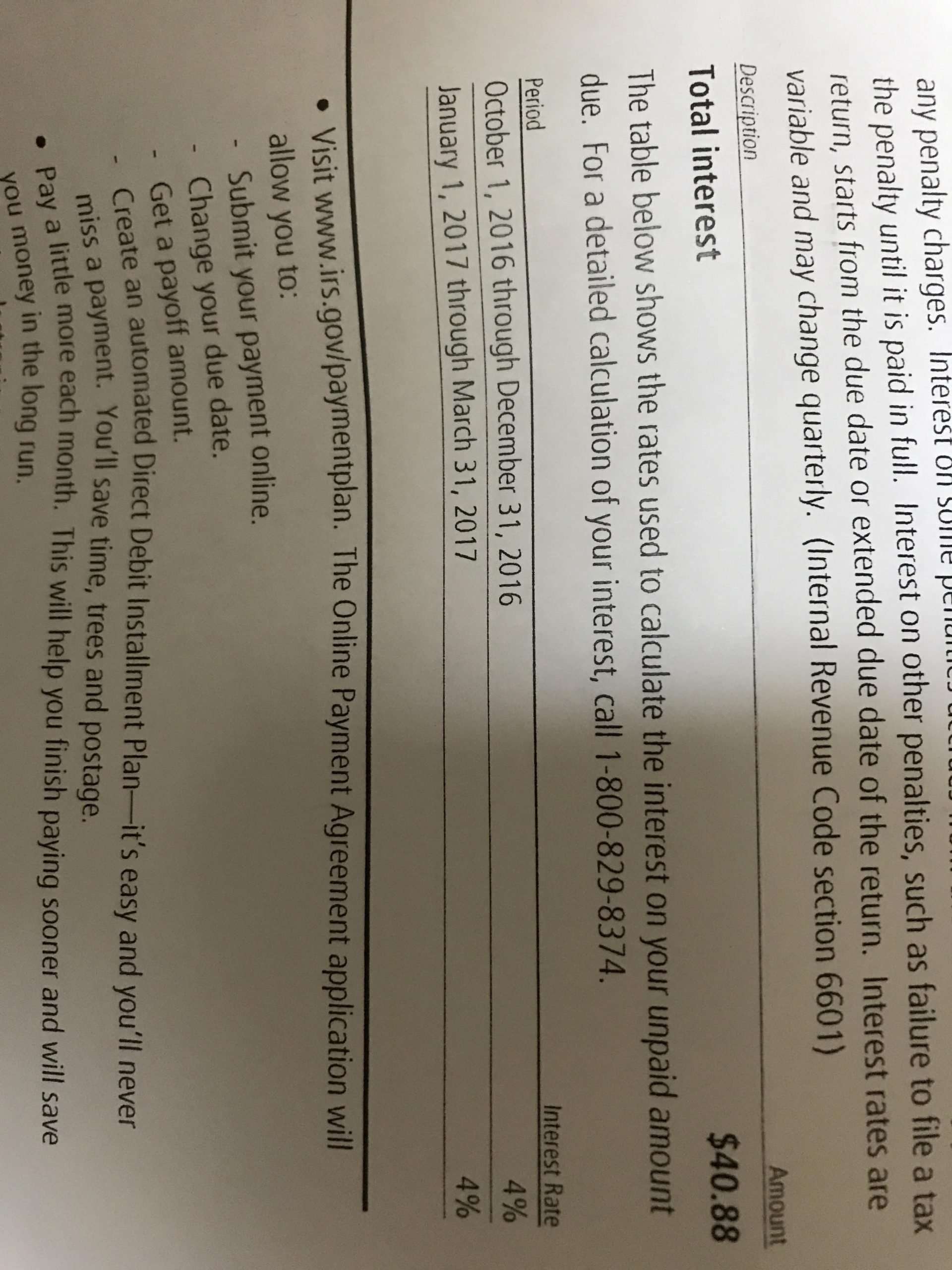

Getting Out Of Tax Debt

You may find that you owe the IRS money when you’ve finished your returns. You’ll avoid any further fees or penalties if you can pay what you owe immediately, but fees may be charged if you pay by credit card. The IRS can work with you to arrive at a payment plan to help you get out of tax debt if you need a little more time.

Approval of an installment plan to pay your tax due will depend on whether you’re caught up on your filings and how much you owe. You’ll still accrue penalties and interest until the balance is paid in full, even if the IRS agrees to the plan. Long-term payment plans will incur setup fees as well, which may be waived if certain conditions are met.

Can I Pay My Tax In Installments Over Time

If you find yourself owing more than you can afford, you should still file a return.

- Even if you don’t enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole.

- Attach a Form 9465 Installment Agreement Request to your tax return asking the IRS to set up a monthly payment plan to pay off what you owe.

About 2.5 million taxpayers are paying off their bills under such an arrangement and recently the IRS made it easier to qualify. In the past, before the IRS would okay an installment plan, the agency demanded a look at your financesyour assets, liabilities, cash flow and so onso it could decide how much you could afford to pay.

- That’s no longer required in cases where the amount owed is under $10,000 and the proposed payment plan doesn’t stretch over more than three years.

- You can also now apply online for the installment agreement. More details are available on the IRS website

Don’t think the IRS is a patsy, though. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS.

Read Also: Pay Taxes On Plasma Donation

Deadlines For Business Owners

If your business is a sole proprietorship or partnership your business income is declared on form T2125, which is part of the T1 Personal Income Tax Return. The penalties for these types of business owners who file taxes late are the same as they are for individuals, although, as you see above, these business owners have until June 15th to file their taxes.

How Much Does It Cost To File Taxes Late

Technically speaking, you dont have to pay anything by filing electronically. There may be some small amounts for postage and delivery if you go the paper route. What you should be wary of are the stiff penalties and interest levied against the taxpayer.

Remember the list of tax deductions available for you to lower your taxes legally? Well, the IRS can file your taxes for you and conveniently leave out all those benefits. That means more unpaid taxes and bigger penalties.

Read Also: Payable Doordash 1099

Penalties For Filing And/or Paying Late

As it turns out, the penalty for failure to file is much steeper than the penalty for a late payment. Thus, if you cant afford the amount due, you should still file your return in a timely manner and then explore alternative payment options.

To be a bit more specific, the penalty for late payment is typically 0.5% of your unpaid taxes per month after the deadline that your taxes go unpaid. This penalty can wind up being as much as 25% of your total amount due, so dont let it slide any longer than absolutely necessary.

In contrast, the penalty for filing your return late is typically a whopping 5% of your unpaid taxes per month after the deadline that they receive your return, topping out at 25%. And if you file more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the taxes that you owe.

Keep in mind that, as long as you request an extension and pay in at least 90% of your actual tax liability by the original due date , youll avoid any underpayment penalties as long as the balance if paid no later than the extended due date.

Assuming The Irs Will Hate You

Theres no need to risk making big mistakes on your tax return or missing valuable deductions because youre rushing to meet the filing deadline and think the IRS will blacklist you for seeking an extension. Filing late is common. In fact, extensions are a fact of life for many investors who dont get their K-1s, which are statements of income from partnerships, until after the tax-filing deadline.

Theres no scarlet letter for filing late as long as you get an extension. If anything, deciding to keep your tax return on your to-do list may warrant a badge of courage.

Recommended Reading: Buying Tax Liens In California

Failure To File Your Tax Returns For 2 Or More Years

If you fail to file your tax returns for 2 years or more, you may be issued with a summons to attend Court. On conviction in Court, you may be ordered to pay:

Failure to pay the penalty or fine to the Court may result in imprisonment of up to 6 months.

What To Do If Youre Filing Your Taxes Late

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Persuading the IRS to give you more time after the tax-filing deadline to file your tax return is fairly easy. But there are several other things you’ll need to do if you’re filing taxes late.

Don’t Miss: Tsc-ind

Claiming A Late Refund

You have three years to claim a tax refund in most cases. The three-year period begins with the tax year’s original filing deadline. The IRS can’t send you a refund after that period has expired.

A refund for tax year 2021 would expire on April 18, 2025, three years past the original tax day deadline of April 18, 2022.

What Happens If I File My Taxes Late

I have a distinct memory of driving to the post office with my mom when I was about 9 years old. I remember it well as I was allowed to stay up late that night and my mother was in a bit of a panic, something Id rarely seen. It was April 30th.

In those days, we didnt have the option to Netfile. That tax return had to be stamped as received by Canada Post by midnight or else. I didnt learn exactly what that meant until many years later but not much has changed since then. Heres the 2020 version of or else.

You May Like: Tax Deductible Home Improvements