Calculation Of Property Taxes

Statute provides that the actual value of property is not the taxable value. Rather, the taxable value is a percentage of the actual value. The percentage is called an assessment rate, and the resulting value is called the assessed value. The assessment rate is 29 percent for all properties except residential. With the repeal of the Gallagher Amendment in 2020, the residential assessment rate was frozen at 7.15%. While the rate is set in statute as 7.15%, it has been temporarily reduced to 6.95% for 2022 and 2023 tax years.

Your property taxes are calculated by multiplying the mill levy or tax rate by the assessed or taxable value of your property. Please keep in mind that tax rates are not finalized until December of each year and are subject to change.

Why Did My Taxes Increase So Much

Tax amounts are not limited to a 3% increase from one year to the next. The Maximum Assessed Value is the only place where a 3% limit applies.

Tax amounts may increase more than 3% due to

-

changes in the tax rate for your Levy Code Area

-

loss of compression savings,

-

combination of any or all of these reasons.

See a graph of the last five years of your property value and taxes.

Vancouver Empty Home Tax Rates

For the 2021 reference year , if your property was declared as empty, you will be required to pay a 3% tax onthe assessed value of your property. For the 2020 reference year, , the empty homes tax rate remained unchanged at 1.25%.

Vancouver Empty Home Tax Rates From 2017 – 2021

| Reference Year | |

|---|---|

| 1.25% | 3% |

For example, a property deemed to be empty with an assessed value of $1M will be subject to a 3%, or $30,000, Vancouver empty home tax for the reference year of 2021.

Vancouver homeowners are responsible for both the Vancouver Empty Homes Tax and theBritish Columbia Speculation and Vacancy Tax.

Don’t Miss: Efstatus Taxact Online

How To Calculate Property Tax: Everything You Need To Know

Knowing how to calculate property tax is very important for both potential and existing homeowners.

When looking for a home, knowing how to calculate property tax will help you know whether you will be able to afford its property tax. Knowing the amount youll pay in property tax for the next year will also be helpful for determining your yearly budget.

Despite its importance, many first time homeowners are unsure how to calculate property tax. But dont worry, you came to the right place! We will walk you through everything you need to know about property tax.

What is Property Tax?

Lets start with what property tax is. Property tax is a tax on property owned by an individual or another entity. The local government uses property taxes for local services, such as school districts, police departments, fire departments, and road construction.

Property tax is calculated by the local government and is paid by the property owner. Those who rent property may also indirectly pay property tax if their landlord factors the cost of property tax into their monthly rent cost.

Property tax varies based on the value of the property and the location of the property.

How to Calculate Property Tax

Property tax is calculated by multiplying the local tax rate by the market value of the property.

Property tax= tax rate x current value of property

The Tax Rate

The Property Value

Property Tax in California

- Los Angeles County- 0.755%

What is a Homestead?

How Your Property Tax Is Calculated

Property taxes are calculated using the assessed value of your property and multiplying it by the combined municipal and education tax rates for your class of property.

Your municipality or local taxing authority will use these taxes to help pay for the services they are responsible for such as:

- police

- waste disposal

- parks and leisure facilities

Education tax rates, set by the Ontario Government, may also be applied using these assessed values.

To learn more about how taxes are calculated, watch the video below.

Read Also: Doordash Payable Account

Citizen’s Guide To Property Tax

What is the purpose of property taxes?

Property taxes are a primary source of funding for local government units, including counties, cities and towns, townships, libraries and other special districts including fire districts and solid waste districts. Property taxes are administered and collected by local government officials. These funds are used to pay for a variety of services including welfare police and fire new construction and maintenance of buildings local infrastructure like highways, roads and streets and the operations, including salaries, of the local units of government.

Property taxes are an ad valorem tax, meaning that they are allocated to each taxpayer proportionately according to the value of the taxpayer’s property. The statewide average revenue distribution for each property tax dollar is as follows:

- County: $0.19

- Library: $0.04

- Special Unit: $0.07

Breakdown is based on average expenditure per dollar of property tax levied in Indiana for taxes payable in 2018.

The Department’s website offers a variety of resources to educate and inform taxpayers on this process. The site also features search tools to provide taxpayers with sales disclosure and assessment information on properties statewide. This information can be used in the appeals process or to allow taxpayers to better understand how assessors determine a property’s assessed value.

Do You Believe Your Property Taxes Are Too High

First, you should consider whether your assessment is accurate. To learn how to determine if youre assessed fairly and what to do if you arent, see Contest your assessment.

If your assessment is fair, but you still believe your taxes are too high, you should:

- examine the scope of your taxing jurisdictions’ budgets and expenditures

- address your concerns to the appropriate forum, such as meetings of the school board, city council, town board, or county legislature.

Also Check: Do You Have To File Taxes With Doordash

Building Categories And Variable Rates

Some taxes, such as the general property tax, have variable rates. For these taxes, the rate depends on the category of your building. In Montréal, there are four building categories:

- Residual buildings:

- Residential buildings with five or fewer dwellings

- Unused vacant lots

Mixed-use buildings

A mixed-use building has both residential and non-residential components. The class attributed to the building defines the proportion of each of these parts.

In this case, each part is taxed according to the rates that apply to its category.

Non-residential buildings and differentiated tax rates

Non-residential buildings, including mixed-use buildings, are subject to differentiated rates for the general real estate tax, the contribution to the Autorité régionale de transport métropolitain and the tax concerning former cities debts.

Different tax rates are charged depending on the buildings value: The first rate applies to the value of your building up to $900,000, and the second, to its value in excess of $900,000.

For example, for a residential building worth $1,000,000, the general real estate tax would be:

- $900,000 x the non-residential rate 1

- $100,000 x the non-residential rate 2

Make A Direct Payment

If youre allowed and choose to pay your taxes yourself, you will pay them in full when they become due. Like we said earlier, some areas allow you to make quarterly or semi-annual payments to decrease the amount youll pay at once.

Either way, youll make the total required payment by the due date or risk paying penalties and facing a tax lien.

Recommended Reading: Doordash Driver 1099

How Can Property Taxes Impact My House Hunt

Great question. Property taxes are extremely localized because different municipalities set their own tax rates. Depending on where a municipality starts and ends, you may find that two homes of roughly the same price, size, and quality can have very different tax rates if theyre on different sides of a municipal border.

An area with a lower property tax rate may give you some extra wriggle room to buy a higher-priced home in that neighborhood. For example, if a home has a 3.5% tax rate and a $300,000 list price, it may have the same monthly mortgage payment as a $350,000 home in an area with a 3% tax rate. By looking at the assessed value and tax information for comparable properties in different neighborhoods youll be able to see which homes come with lower tax implications.

History News And Impact Of The Vancouver Empty Homes Tax

Vancouvers Empty Homes Tax was first launched in 2017 to return vacant homes to the rental market for people who live and work in Vancouver. After the launch of the EHT, more people are choosing to sell or rent out their homes, and this increases the number of homes available for rent. Since then, the City of Vancouver has seen year-over year improvement as the number of empty homes has decreased and the number of homes available for rent have increased. In 2019, the number of properties declared as vacant was 787, down 15% from 922 vacant properties in 2018, and also down 30% from 1131 vacancies in 2017. The number of condos being rented out in 2019 is up 21% from the same metric in 2018.

The City of Vancouver also uses revenue from the EHT to fund affordable rental projects and modular housing programs in Vancouver that help to address the homelessness crisis. In 2019, the Empty Homes Tax brought in $39.4 million in tax revenues for the City of Vancouver.

Recommended Reading: How To Do Taxes Doordash

Example For Vacant Land:

The actual value of Ms. Greens vacant land parcel is $150,000, and the assessment percentage is 29 percent.

Actual Value x Assessment Percentage = Assessed Value$ 150,000 Actual Value x 29% Assessment Percentage = $43,500 Assessed Value

To calculate the property tax for Ms. Greens land, multiply the assessed value times the equivalent of the total mill levy. A mill is equal to 1/1000 of a dollar. A tax rate is the mill levy expressed as a percentage. Thus 98.42 mills = 9.842 percent or .09842 as the decimal equivalent.

If Ms. Green s assessed value is $43,500, her taxes will be:Assessed Value x Mill Levy = Taxes$ 43,500 Assessed Value x .09842 Mill Levy = $ 4,281.27 Taxes

Assessors Office Phone:

Mill Levy Or Millage Tax

The mill levy is the tax rate levied on your property value, with one mill representing one-tenth of one cent. So, for $1,000 of assessed property value, one mill would be equal to $1.

Tax levies for each tax jurisdiction in an area are calculated separately then, all the levies are added together to determine the total mill rate for an entire region. Generally, every city, county, and school district each have the power to levy taxes against the properties within their boundaries. Each entity calculates its required mill levy, and they are then tallied together to calculate the total mill levy.

For example, suppose the total assessed property value in a county is $100 million, and the county decides it needs $1 million in tax revenues to run its necessary operations. The mill levy would be $1 million divided by $100 million, which equals 1%.

Now, suppose the city and school district calculated a mill levy of 0.5% and 3%, respectively. The total mill levy for the region would be 4.5% or 45 mills.

You May Like: Highest Paying Plasma Donation Center Near Me

Table Of Property Rates

This table provides municipal, education and if applicable other tax rates by city.

As of December 24 2022, the rate are those of 2022 , as praticly none of the city as yet showed their new property tax rates. We will try to do our best to get the new rates as soon as they will be published.

Please note that each City/Municipality is clickable and link directly to the property tax rates of the city. If you see any update that is not reflected on this page, don’t hesitate to contact us at

| City/Municipality |

|---|

Property Taxes By State

Overall, homeowners pay the most property taxes in New Jersey, which has some of the highest effective tax rates in the country. The states average effective rate is 2.42% of a home’s value, compared to the national average of 1.07%.

With an average effective rate of 0.28%, the least expensive state for property taxes is Hawaii, surprisingly. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there.

Also of note are Colorado and Oregons property tax laws, which voters put in place to limit large taxable value increases. Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern.

Read Also: Irs Company Lookup

Useful Property Tax Information

Most property tax assessments are done either annually or every five years, depending on the community where the property is located. After the owner has received their assessment with its property valuation, a property tax bill is mailed separately.

The information the assessor has is considered part of the public record. Owners can see how much they must pay by going to the assessors website and entering their address. Sometimes they may be charged a small fee for accessing this material. Another option is to go to the assessors office in the county courthouse. Once you are at the county courthouse, you can look up the information and print out a copy for a nominal fee.

Whats The Difference Between Property Taxes And Real Estate Taxes

Property taxes and real estate taxes are interchangeable terms. The IRS calls property taxes real estate taxes, but they are the same in all aspects. The money collected helps the government fund services for the community.

Sometimes youll also see a special assessment tax. This occurs when your locality needs to raise money to fund a specific project.

Read Also: Www 1040paytax

Your Property Tax Is Proportional To The Value Of Your Property

In this example, a small municipality with three properties worth $125,000, $175,000 and $200,000 has services costs of $2,000 that are paid by property owners through property taxes.

Each property owner in the municipality pays a proportion of that $2,000 based on their property’s assessed value. This is calculated by first adding up the value of all three properties, for a total of $500,000. Since the cost of services is $2,000, the tax rate is 2,000/500,000 = 0.004, or 0.4%. Therefore:

- The owner of the $125,000 property pays $500.

- The owner of the $175,000 property pays $700.

- The owner of the $200,000 property pays $800.

- The total of the property tax paid by the three property owners is $2,000.

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor in your area can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

Don’t Miss: Are Doordash Tips Taxed

How Your Property Taxes Are Calculated

The information on this page will help you understand how your taxes are calculated and answer frequently asked questions about property taxes in Multnomah County. Visit the Property Assessment page to get information about how we determine the value of your home.

You may also contact us with your questions via live chat, phone , or email at .

How To Calculate Your Tax Bill

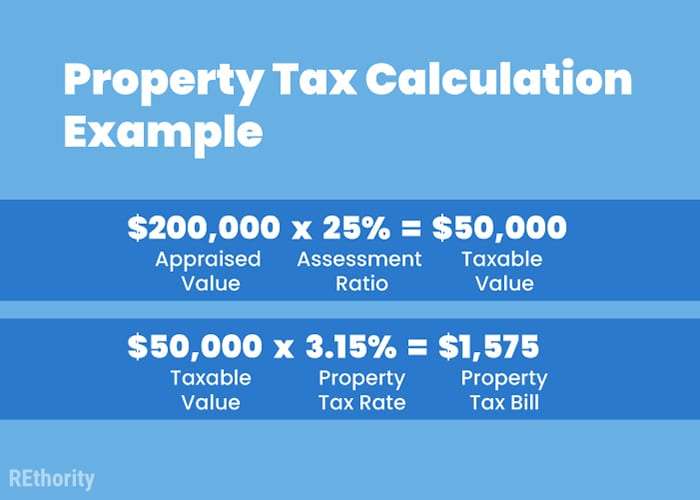

Property taxes in Tennessee are calculated utilizing the following four components:

|

APPRAISED VALUE |

The Appraised Value for each taxable property in a county is determined by the county property assessor. |

|

|

ASSESSMENT RATIO |

The Assessment Ratio for the different classes of property is established by state law . |

|

|

The Assessed Value is calculated by multiplying the appraised value by the assessment ratio. |

||

|

TAX RATE |

The Tax Rate for each county is set by the county commission based on the amount of monies budgeted to fund the provided services. These tax rates vary depending on the level of services provided and the total value of the county’s tax base. |

Don’t Miss: Tax Form For Doordash

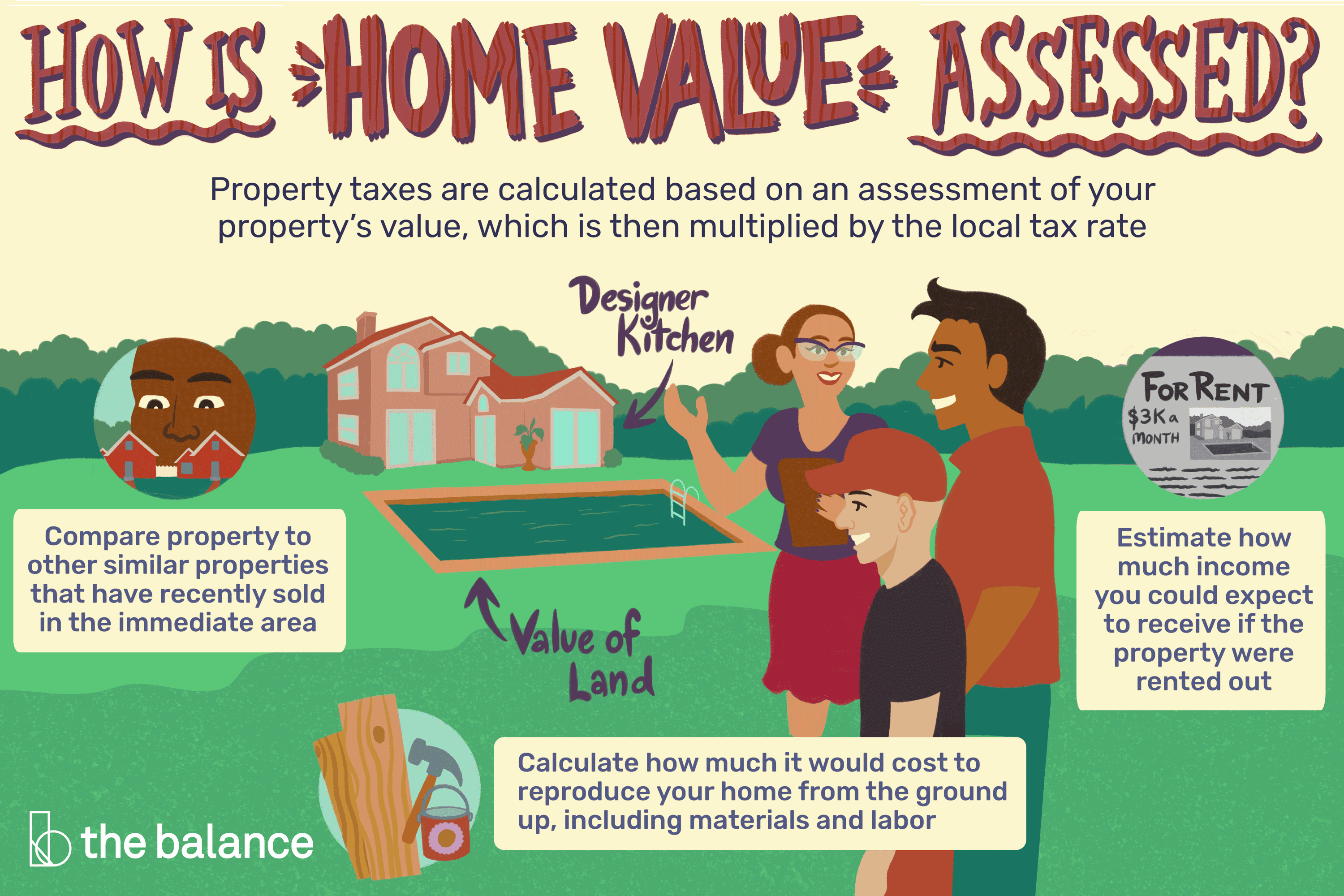

Ways To Assess Property Value

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owner’s property. The assessed value estimates the reasonable for your home. It is based upon prevailing local real estate market conditions.

The assessor will review all relevant information surrounding your property to estimate its overall value. To give you the most accurate assessment, the assessor must look at what comparable properties are selling for under the current market conditions, how much the replacement costs for the property would be, the maintenance costs for the property owner, any improvements that were completed, any income you are making from the property, and how much interest would be charged to purchase or construct a property comparable to yours.

The assessor can estimate the market value of the property by using three different methods, and they have the option of choosing a single one or any combination of the three.