How Can Capital Losses Affect Your Taxes

As previously mentioned, different tax rates apply to short-term and long-term gains. However, if your investments end up losing money rather than generating gains, those losses can affect your taxes as well. However, in this case, you can use those losses to reduce your taxes. The IRS allows you to match up your gains and losses for any given year to determine your net capital gain or loss.

- If after fully reducing your gains with your losses and you end up with a net loss, you can use up to $3,000 of it per year to reduce your other taxable income.

- Any additional losses can be carried forward into future years to offset either capital gains and up to $3,000 per year in ordinary income.

- Since you don’t generate capital gains or losses in a retirement account, you can’t use losses in IRAs or 401 plans to offset gains or your other income.

Criticism Of Capital Gains Tax

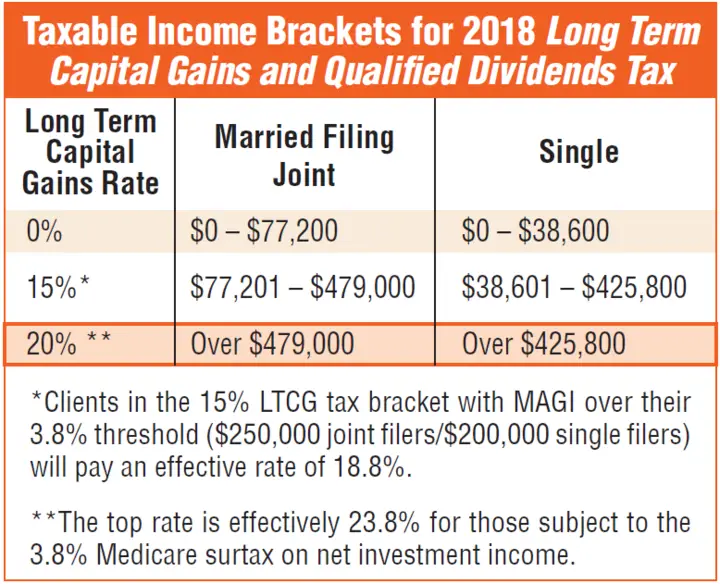

One of the biggest criticisms of the capital gains tax is that it is simply a way for the wealthy to pay less in taxes. An ultra-wealthy investor who’s entire income stems from their stocks can only have a 20% tax rate instead of a 37% rate. The ability of someone in the highest possible tax bracket to pay 20% in taxes on a major gain while someone in the middle-class pays 24% on their general taxes can easily create further wealth inequality in America.

Donate Assets To Charity

When you make a donation to a registered charitable institution, you receive a tax receipt which allows you to deduct a portion of your donation from income tax owing. Instead of making a donation in cash, you can transfer ownership of stocks to the registered charity. . It’s a way of rebalancing your portfolio without triggering a capital gain because you are not selling the stock, you are simply transferring ownership. You will receive a tax receipt for the current fair market value . Consult a tax professional before you do this so you follow the correct procedure.

Recommended Reading: How Can I Make Payments For My Taxes

If Youre Reporting On Behalf Of Someone Else Or A Trust

You need to use your own Capital Gains Tax on UK property account to report on behalf of someone else.

Youll need proof youre allowed to report on their behalf, such as a lasting power of attorney. If the person has died, youll need to give their date of death.

If youre reporting as a trustee of a registered trust, youll need the trusts registration number or unique tax reference.

Theres a different way to report your clients Capital Gains Tax on UK property as an agent.

Selling Or Donating Certified Canadian Cultural Property

You do not have to report a capital gain when you sell or donate certified Canadian cultural property to an institution or public authority designated by the Minister of Canadian Heritage. The Canadian Cultural Property Export Review Board certifies this property as cultural property and will give you a certificate for tax purposes. Cultural property can include paintings, sculptures, books, manuscripts, or other objects.

Donations of cultural property made on or after March 19, 2019, no longer require that property be of national importance to claim the exemption from income tax for any capital gains arising on the disposition of the property.

If you sell or donate certified cultural property to a designated institution, you may have a capital loss. The tax treatment of the loss will depend on what type of property you sold or donated. For example, the certified cultural property may be listed personal property. If this is the case, the rules for listed personal property losses will apply. For information on how to apply capital losses, see Chapter 5.

For more information, see Interpretation Bulletin IT-407R4-CONSOLID ARCHIVED – Dispositions of Cultural Property to Designated Canadian Institutions, or Pamphlet P113, Gifts and Income Tax.

Recommended Reading: Where’s My Tax Refund Ga

Small Business Stock And Collectibles: 28 Percent Capital Gains Rate

Two categories of capital gains are subject to the 28 percent rate: small business stock and collectibles.

If you realized a gain from qualified small business stock that you held for more than five years, you generally can exclude one-half of your gain from income. The remaining gain is taxed at a 28 percent rate. You can get the specifics on gains on qualified small business stock in IRS Publication 550.

If your gains came from collectibles rather than a business sale, youll also pay the 28 percent rate. This includes proceeds from the sale of:

- A work of art

- Wine or brandy collections

Determining The Sale Of Home Exclusion Amount

Now, once you decide you are eligible to sell and meet the exclusion rule, you have to do some math, so you can avoid pulling out your checkbook after you sell. First, keep in mind you have to think about more than the money that you received during the sale. It is important, but other numbers play a factor too.

You have to consider your gain. It is what decides whether you will have a tax bill. You could sell your home for $750,000 and not owe any money because you didnt gain more than $250,000 .

1. To get to your gain amount, establish your basis in the home. 2. Compare the basis amount to what you received from the sale . This number provides you with the gain on the sale.

Usually, you will find that you got some profit, but it isnt large enough for you to have to pay taxes on it.

Keep in mind that improvements increase your basis, so a smaller portion of the selling price is considered a gain. The American Relief Act is 20% for higher-income taxpayers and 15% for many individuals and 0% for some sellers.

You May Like: How Much Does H & R Block Charge To Do Taxes

Capital Gains Tax Strategies

The capital gains tax effectively reduces the overall return generated by the investment. But there is a legitimate way for some investors to reduce or even eliminate their net capital gains taxes for the year.

The simplest of strategies is to simply hold assets for more than a year before selling them. That’s wise because the tax you will pay on long-term capital gains is generally lower than for short-term gains.

Are There Specific Exemptions For Investment Property

Yes. Investors can look to Tax Code Section 1031 to profit on business or investment properties without paying capital gains tax.

Section 1031 allows you to trade like-kind properties to avoid paying taxes on the initial profit. These like-kind properties must be similar: You can trade a retail space for another retail space, but you cant trade a retail space for a rental property.

If the value of one property is greater than the other, you can add cash to the deal. The person who owns the property of lesser value can pay any difference at the time of sale.

Can I avoid the tax by moving into my investment property?

Yes. If you live in your property for at least two years, it changes the nature of your property from an investment property back to your primary residence. Youre then eligible for the capital gains tax exemption of up to $250,000 .

Say you live in New York City with your spouse. You decide to sell your place in the city, where youve lived for the past two years, and move into your vacation home upstate. Since your city apartment was your primary residence, you take your $500,000 profit tax-free.

Your move upstate doesnt have to be permanent. If you want to ultimately move back to the city, stay in your vacation home at least two years. After two years, that property becomes your primary residence, and you can sell it and pocket another tax-free profit of up $500,000.

Also Check: How Much Does H& r Block Charge To Do Taxes

Capital Gains Tax Calculation

Total Capital GainTotal Capital GainTaxable Capital GainTaxable Capital GainCapital Gain Tax

Olivia is a student living in Ontario and her taxable income for 2019 is $30,000. She bought stocks at the beginning of 2019 using $100,000 of inheritance and sold these stocks at the end of the year for $107,020. How much does Olivia pay in capital gains tax?

Oliviaâs trading fees were $20, so her proceeds of disposition less outlays and expenses is $107,000. Oliviaâs total capital gain is $7,000. Since the inclusion rate is 50%, her taxable capital gain is $3,500. This would bring her to a taxable income of $33,500. Olivia is in the lowest income tax bracket, so she will pay 15% in federal income tax and 5.05% in provincial income tax for a total of 20.05% as her income tax rate. Therefore, her capital gain tax will be $702.

Use Capital Losses To Offset Gains

If you experience an investment loss, you can take advantage of it by decreasing the tax on your gains on other investments. Say you own two stocks, one of which is worth 10% more than you paid for it, while the other is worth 5% less. If you sold both stocks, the loss on the one would reduce the capital gains tax you’d owe on the other. Obviously, in an ideal situation, all of your investments would appreciate, but losses do happen, and this is one way to get some benefit from them.

If you have a capital loss that’s greater than your capital gain, you can use up to $3,000 of it to offset ordinary income for the year. After that, you can carry over the loss to future tax years until it is exhausted.

You May Like: How Can I Make Payments For My Taxes

Exempt Capital Gains Balance

When you filed Form T664 for your shares of, or interest in, a flow-through entity, the elected capital gain you reported created an exempt capital gains balance for that entity.

Note

Generally, your ECGB expired after 2004. If you did not use all of your ECGB by the end of 2004, you can add the unused balance to the adjusted cost base of your shares of, or interest in, the flow-through entity.

For 2004 and previous tax years, if you received property from a trust in satisfaction of all or a part of your interest in the trust , you could elect to use the ECGB for the entity to increase the cost of property you received from the trust. For 2005 and future years, the election is no longer necessary because any unused ECGB can only be added to the cost of your interest in the flow-through entity.

Example

Andrew filed Form T664 for his 800 units in a mutual fund trust with his 1994 income tax and benefit return. He designated the fair market value of the units at the end of February 22, 1994, as his proceeds of disposition. Andrew claimed capital gains reductions of $500 in 1997 and $600 in 1998. At the end of 2003, his exempt capital gains balance was $2,250. In 2004, he had a $935 capital gain from the sale of 300 units. This left him with an unused balance of $1,315 at the end of 2004. In 2005 and future years, he can only add the unused ECGB to the cost of any remaining units:

1. ECGB carryforward to 2004

6. Unused ECGB at the end of 2004

6

Selling A House Avoid Taxes On Capital Gains On Real Estate In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

It feels great to get a high price for the sale of your home, but watch out: The IRS may want a piece of the action. Thats because capital gains on real estate are taxable sometimes. Heres how you can minimize or even avoid a tax bite on the sale of your house.

You May Like: Tsc-ind Ct

What Happens If You Have A Capital Loss

If you have a capital loss in 2020, you can use it to reduce any capital gains you had in the year, to a balance of zero. If your capital losses are more than your capital gains, you may have a net capital loss for the year. Generally, you can apply your net capital losses to taxable capital gains of the 3 preceding years and to taxable capital gains of any future years.

For more information on capital losses, see Chapter 5.

Capital Gains Tax On Financial Instruments

If your realized capital gain was made from selling:

- Mutual fund trust units

You will have to report the capital gain to be taxed. In some cases, your tax can be deferred or deducted from yourLifetime Capital Gains Exemptionif you purchased qualified shares of family farm corporations, fishing corporations, or qualified small business corporations.

Don’t Miss: 1040paytax.com Official Site

What Is The Net Investment Income Tax

For people earning income from investments above certain annual thresholds, the net investment income tax comes into play. Net investment income includes capital gains from the sale of investments that havent been offset by capital lossesas well as income from dividends and interest, among other sources. The net investment income tax an additional 3.8% surtax.

Adjusted Cost Base For Financial Instruments

For financial instruments such as stocks, the adjusted cost base is calculated as the number of shares multiplied by the share price at the time the shares were bought. For instance, if 100 shares of XYZ Company were purchased at a price of $30 each, then the ACB would be $3,000. If more shares of the same corporation are purchased in the future, the adjusted cost base would be the total cost of all the shares purchased at their respective prices. The adjusted cost base per share would be the average purchase price for all the shares. For instance, if you purchased 50 more shares of XYZ Company at a price of $35, the ACB per share would be $31.67. The adjusted cost base also includes any costs incurred to acquire the stock, such as trading commissions.

You May Like: How Does H& r Block Charge

Do You Have To Report The Sale Of Inherited Property

All property sales must be reported properly. If you are selling an inherited property that was a primary residence, you will need to report it and pay 50% of the capital gains tax. The tax will be charged based on the difference in the value of the property from when you received it to when you sell it.

How To Avoid Capital Gains Tax On Real Estate

There are a number of actions you may be able to take to minimize your exposure to capital gains tax or avoid it altogether. For instance, if you are able to do so, live in a house for at least two years out of five before selling it. While its typical for that time to be consecutive, it doesnt need to be, just so it totals at least two years within the five-year period. . Some periods of absence from the home, such as vacations, may still count toward the two-year requirement. If you cant manage to live in a house for two years, try to hold on to the house for at least one year before selling it so that you wont have to pay the more burdensome short-term capital gains tax.

You must meet both the two-year ownership and residence tests to qualify for the exclusion from capital gains taxes, but there are some exceptions. For instance, if the home was transferred to you by a spouse or ex-spouse, in a divorce or otherwise, you can count their ownership time toward the ownership requirement. However, you must meet the residence requirement on your own. If you are widowed and have not owned and lived in the house for the required two years, you can count any time that your late spouse owned and lived in the house without you toward the ownership and residence requirements. However, you must not be remarried as of the time you sell the house.

You May Like: Where’s My Tax Refund Ga

Lifetime Capital Gains Exemption

The lifetime capital gains exemption is also known as the capital gains deduction and is on line 25400 of your tax return. Canadian residents have a cumulative lifetime capital gains exemption when they dispose of eligible properties. The capital properties eligible for the LCGE include qualified small business corporation shares and qualified farm or fishing property . The lifetime limit refers to the total amount of LCGE you can claim throughout your lifetime. Last updated in 2019, the lifetime capital gains exemption for qualified small business corporation shares is $866,912 and the lifetime capital gains exemption for qualified farm or fishing property is $1,000,000. This means that in the years prior to 2019, if you have already claimed $866,912 in lifetime capital gains exemption for QSBCS, you cannot claim any further amounts.

Letâs say you have earned $10,000 in capital gains on a QSBCS in 2019 and you have not reached the lifetime capital gains exemption limit. Upon claiming the LCGE exemption, you will have used up $5,000 of your LCGE for QSBCS as the capital gains inclusion rate is 50%. You will still have $861,912 left in your lifetime capital gains exemption for qualified small business corporations as of 2019 limit amounts.