Attend Informal Hearing At Appraisal District Office

An informal hearing typically takes less than 10 minutes and is held at the county appraisal districts office. The appraiser will provide evidence supporting the districts appraisal, and you will provide evidence that supports your appeal. Your supporting evidence may include sales data, listing information, and appraisals of comparable properties, as well as any photos that support your request for a lower appraisal.

These informal hearings rarely result in a substantial reduction in appraised property values, and most reductions that are approved are small.

In addition, participating in an informal hearing will prevent you from having the right to request a formal hearing or continue with your protest.

What Is Fair Market Value

Section 5 Hearing Type

As for formal hearing type, youhave three options:

1) in person

2) telephone conference call or

3) written affidavit.

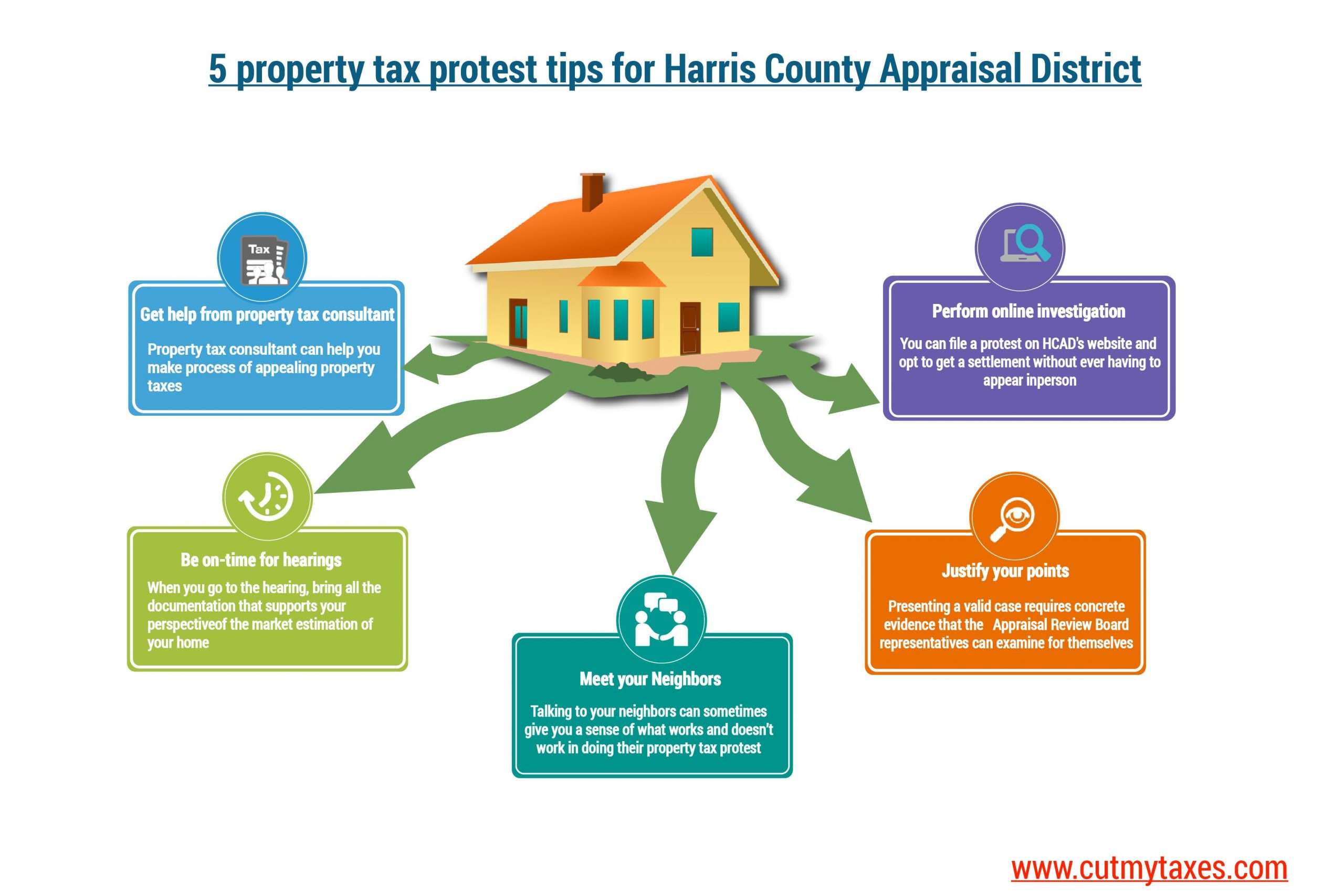

The topic of written affidavits and telephone conference calls is beyond the scope of this article, so I wont get into them here. If you are reading this, you want to win your protest. If you want to win your protest, you should appear in person! If you cant attend your formal hearing, you are allotted one reschedule without having to show cause, BUT you must request the reschedule prior to your scheduled hearing date and time. Now, if for some reason you wont be able to attend, I recommend you hire a property tax consultant. If you cant find a consultant to take your case, investigate filing a written affidavit. I do not recommend the telephone conference route, as you cant discuss anything that hasnt already been sworn to in writing, and everyone involved is quite annoyed and confused about the whole process to begin with, which was just implemented in the 2018 Tax Year. As with most cases in Bexar County, showing up to your formal hearing greatly increases your chances of getting a reduction.

Also Read: How to Appeal a High Property Tax Bill

Don’t Miss: How Much Do You Make To Have To File Taxes

What Happens If I Am Not Satisfied At The Informal Meeting Or With The Arb’s Decision

If you are not happy with your Informal Meeting results you can go in front of the Appraisal Review Board to show and explain your evidence. If you do not agree with the ARBs decision, you may request binding arbitration if you qualify. You can also appeal the decision to the state district court in the county in which your home is located. In either case, you will have to make a partial payment of taxes before the delinquency date, usually the amount of taxes not in dispute. The cost of litigation is generally higher than any savings you might get if you win your lawsuit. We do not generally recommend pursuing anything beyond the ARB.

How To Protest Your Appraisal

Each district has an appraisal review board, which is a board of residents that hears disagreements between property owners and the appraisal district about the proposed value of the property. The administrative district judge in Tarrant County appoints members of the board.

The notice of appraised property will include the date and place the appraisal review board will begin hearing protests. If a taxpayer is dissatisfied with the appraised value or the appraisal records are wrong, they can file a notice of protest with the appraisal review board.

The Tarrant Appraisal District has a website where taxpayers can file a protest if:

- The appraised value of the property is too high.

- The district denied a special appraisal, like open-space land or denied your exemption application.

- The district failed to provide you required notice.

Residents are required to file a notice of protest with the appraisal district review board no later than 30 days after the appraisal district mailed the notice of appraised value, or May 16 whichever comes later. The board will notify the taxpayer 15 days ahead of the date, time, and place of the hearing. The board begins hearings around May 16 and generally completes them by July 20.

Recommended Reading: How Do I Track My Tax Refund

Allow A Firm To Protest On Your Behalf

Texas homeowners should review their assessed value annually and consider filing an appeal. NTPTS has outlined the steps you need to take to file an appeal. Use these steps if you want to complete the process on your own.

Alternatively, you can choose to hire a property tax consultant who can review your case and file an appeal on your behalf. NTPTS is a residential property tax reduction firm serving clients in Tarrant, Collin, Dallas, and Denton counties. We work on a contingency fee basis. There is no charge to you if we dont achieve a reduction in value.

For more information on how NTPTS can help lower your property taxes, register your property with us.

Meet With Appraisal Review Board

If you take your case to the appraisal review board, come prepared and expect a rapid-fire proceeding. The entire hearing will likely take 15 to 30 minutes. In that time you will be placed under oath and given a chance to present any evidence or witnesses supporting your case. You must conclude by stating the figure you believe your property is worth. Someone from the appraisal district will likely question you and provide additional evidence. Then you can question the appraiser or any witnesses presented by the appraisal district. Members of the appraisal review board can ask clarifying questions, too. Finally, each side gets to make a closing statement, so once again youll want to reiterate what you believe your property is worth and why. The three-member panel will discuss the case and reach a recommended value.

The full appraisal review board will review the recommendation of the three-person panel and approve your final assessed value. Youll get a certified letter in the mail with the decision.

Also Check: Do You Have To Pay Taxes On Workers Comp

Damage From The Winter Storm In February There’s An Exemption For That Too

People can apply for a Temporary Exemption for Disaster Damage

The damage has to be at least 15 percent of the improvement value, to the structure, not the land.

“If you have a $200,000 home for instance and $100,000 is land and $100,000 is improvement, then you would have need to incurred $15,000 dollars worth of damage to qualify,” explained Wiggins.

People have to apply by May 28th and that is through their county’s appraisal district.

How To Make Your Case For A Lower Property Tax Appraisal

So, the latest installment of How to in 22: How to make your case for a lower property tax appraisal. And you should think of it as building a case and gathering evidence. You want to tell them the story of your individual homes value.

Remember, mass appraisals are done with computer programs. Appraisers didnt exactly study your individual house in detail. Lauer points out that they used sales of comparable homes around you.

They say, well this area went up X amount and so your house went up X percent,” he said.

Don’t Miss: How To Calculate Tax From Total Amount

What Do I Put In The Protest

This is where you back up your argument on why you believe the value should be lowered. They don’t see the inside of a home, which could have a very different story from the outside.

Taking pictures of floors, walls, foundation, windows, kitchen, bathrooms etc., that need repairs or renovations can help build ones as to why the value given doesn’t match.

Some suggest getting estimates for how much it would cost to fix these issues and include that in the protest.

Upload all this documentation to your filling.

“I always advise people to stay on topic and the topic is unfortunately not taxes, the topic is value, thats how you help yourself is to really discuss the appropriate value. Suggested Will Wiggins, a consultant with North Texas Property Tax Service.

His phone has been ringing off the hook as he helps property owners navigate through this process.

Whenever it comes to a protest, youre actually protesting your market value and not your taxes, so when it comes to considering what your value should be, youre looking at other appraisals and you want to look at other sales in the market and you want to make sure that youre making and calculating the appropriate adjustments,” he said.

Use Comparables With Adjustments

This is all about choosing the right properties for your analysis. Texas law requires adjustments to comparable properties. Using a price per foot carries less weight than using comparables with adjustments.

This means you need to select properties that are similar enough to yours so ideally the adjustments required are minimal. Such factors include age and condition of the property, land size, construction quality, etc.

Simply using homes that sold at a similar price per square foot will likely not be enough to help your case.

Don’t Miss: What Does Property Tax Mean

How Can I Make Sure I Protest On Time Next Year

The annual right to protest your homeâs property taxes is a critical way to protect Texans from runaway tax bills. Even if your attempt to file a late protest for this year is unsuccessful, you can begin preparing for the next tax season now.

Securing a reduced tax-assessed value for your home as soon as possible is critical to paying less over the long term. Because Texas law caps the annual raise in primary homeâs appraisal to no more than 10%, a lower value now can pay dividends for every future year you own the house.

Sign up with Watchtower Protest now to ensure you have our professional team on your side next year. Simply fill out the form on our website. Our services cost nothing out of your pocket, so thereâs no risk to enrolling today.

What Should I Do With The Photos Of My House

It is important you bring as ‘many’ photos of repairs needed and any disrepair of your home as possible, inside and out. Little things and big things, you are not trying to sell your house, you are doing the opposite. You can also include the area and neighbors, construction, industry, or anything that could reduce your home’s value. When you upload your photos to PropertyAxe they are included with your Evidence Packet BUT we highly suggest, because of quality and quantity, you print at least 2 copies to bring with you to your informal meeting or your ARB hearing to show and to explain them to the appraisers. We recommend Walgreens or CVS for your prints .

You May Like: How Do I File My Taxes With Turbotax For Free

How To Protest Your Property Taxes

Owning property is a dream-come-true for many people, and home ownership can provide many benefits to individuals, from a tax perspective and beyond. However, with ownership comes the responsibility to pay annual property taxes. You have some options to potentially lower your property taxes and one way is to protest them.

Strategies That Win Property Tax Protests

If you believe your local appraisal district has over-valued your home, you can challenge that valuation through a property tax protest. You have the right to a hearing in front of the local Appraisal Review Board . During an ARB hearing, you want to present evidence that your tax-assessment value is greater than the market value of your home.

Before your ARB hearing, you can use the following strategies to collect evidence that shows the appraisal district over-valued your property.

Read Also: How Do I Estimate Taxes For Self Employment

What Is A Homestead Exemption

Texas homestead exemption applies to a homeowner if you: Owned the property on January 1st, Occupied the property as your principal residence on January 1st, The homeowner or their spouse have not claimed a residence homestead exemption on any other property. The typical deadline for filing a county appraisal district homestead exemption application is April 30th. You can download the Homestead Exemption Form, and mail to your County Appraisal District. The exemption will remove $25,000 off the value of your home for school taxes. Win!

What Is An Improvement

Read Also: Do I Have To Pay Taxes On Bitcoin

Does The Value Determined By The County Appraisal District Impact The Sales Price Of My Home

No, your appraised tax value does not impact the market value of your home. If you plan to sell your home in the future, the appraised tax value doesnt impact the price that potential buyers will offer for your home.

The value of your home can be evaluated in two different ways:

- Appraised Tax Value is the value determined by the county appraisal district for state property tax purposes.

- Fair Market Value is determined by a licensed appraiser during the mortgage process to ensure that the home purchase price is comparable to similar homes recently sold in the neighborhood.

In fact, Texas homeowners can take advantage of the growth in market value of their homes with a home equity cash out refinance. Accessing the equity in your home can help you pay off higher interest debt, pay for home improvements, or to use cash in other ways.

The market conditions in 2022 are unique for Texas homeowners.Making the effort to protest your property tax value with the county appraisal district can help steady your costs as a homeowner.

We are here to help you understand your best financial options when it comes to your mortgage. Reach out to our team of mortgage experts with your mortgage questions.

Hire A Property Tax Protest Company

If youre a resident of Texas, and you believe that your property taxes are too high, you have the right to protest your appraised value. If you decide to file an appeal to lower your property taxes, use the steps and information above to do so.

If you want help with handling your protest, a Texas property tax firm can file an appeal on your behalf. You dont have to spend your valuable time wading through the Tax Code, collecting data on comparable properties, and preparing an argument for reducing your property taxes.

At NTPTS, we help homeowners in Dallas, Collin, Denton and Tarrant counties reduce their property value and lower their taxes. We specialize in high-end residential properties, but represent properties valued at $250,000 or more.

We will review your propertys appraised value, perform research to form an argument, and file an appeal on your behalf. Our knowledgeable tax consultants will file any paperwork and attend all hearings so you dont have to.

We operate on a contingency basis, so when you work with us, you wont owe anything upfront. If we get you a reduction, our fee is 40% of the amount.

Work with a trusted firm that understands tax valuations and appeals in North Texas.

Read Also: What Happens If You File An Extension On Your Taxes

The Watchdog: The 2022 Strategy To Win Your Property Tax Protest Without Going To A Hearing

- May 1, 2022

My obsession with teaching Texas property owners how to protest your property taxes began in 2011 when my county appraisal district debuted online protesting. One Saturday night, in a matter of minutes, I entered my ideal home value, and the computer accepted it.

I called it The Price Is Right, and I won.

Phase two began in 2017 when I launched my Everybody File a Protest campaign. I even created a flag to support my little revolution.

As I explained, Appraisal districts will be overwhelmed with workloads like never before. Theres nothing wrong with this. Its your legal right as a Texan to file a protest every year, even if your taxes dont go up, and even if your school taxes are frozen because youre a senior or disabled.

Overload the system like never before, and in return, appraisers would have to settle cases in greater numbers than ever to clear their calendar by the states July deadline.

I know it worked because Denton County Chief Appraiser Rudy Durham blamed me in 2019 for his problems.

Theres a consumer watchdog that is encouraging people to file a protest, he complained. He wants to mess up the system and shut it down and prove a point.

Here now comes Phase 3 of my Watchdog Nation revolution. With the help of Glenn Goodrich of PropertyTax.io , we unveil a new plan.

One part is to use open records to request from the appraisal district its evidence they plan to use against you ahead of time.

How To Protest Your Property Taxes In Texas

Your property tax appraisal arrived in the mail. You opened it up, and nearly passed out. Texas home values are going up, but how could your property value have increased so much? This might be great for the economy, but youre a homeowner. Is it the best thing for you?

Now youre mad and ready to fight. You need a simple plan that will protect your homeowner rights and lower your Texas property taxes.

Recommended Reading: How To Organize Tax Documents For Accountant