I See An Irs Treas 310 Transaction On My Bank Statement What Is It

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Common Errors That May Cause Delays

- We found a math error in your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return.

Recommended Reading: Do You Get Taxed For Donating Plasma

Interest On Income Tax Refund

Section 244A deals with interest on income tax refund and provides for interest at the rate of 0.5% per month or part of the month on refund amount. Such interest shall be calculated from 1st April of the assessment year till the date of grant of refund, if the refund is due to excess advance tax paid or TDS deduction.

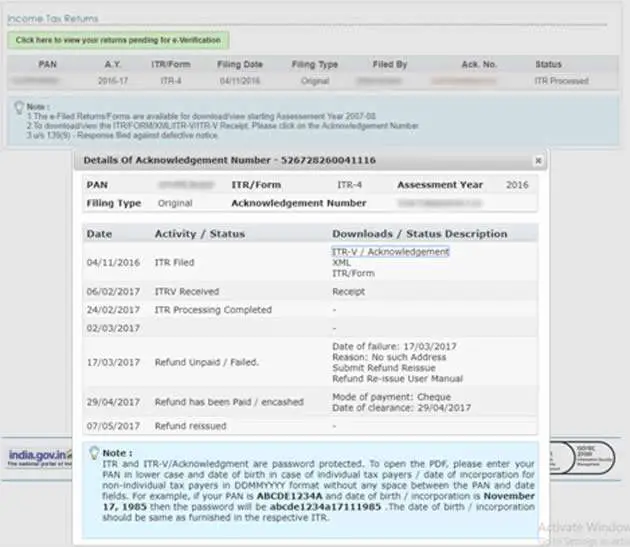

How To Request For Refund Reissue

The steps to request for refund issue are given below:

- Click on the link https://portal.incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html and enter your User ID, Password, date of birth, and the captcha code to login.

- Go to My Account and then click on Service Request.

- A screen will appear which will contain the acknowledgment number for every financial year during which you filed your Income Tax. Click on Submit under the Response section for the year you want the refund.

- Fill in details such as your Bank Account Number, Account Type, IFSC Code, Bank Name, and then click on Submit.

- The amount will then be refunded to your bank account after a few days.

Recommended Reading: How To Get Tax Form From Doordash

Check Status Of A Tax Refund In Minutes Using Wheres My Refund

IRS Tax Tip 2018-35, March 7, 2018

The Where’s My Refund? tool gives taxpayers access to their tax return and refund status anytime. All they need is internet access and three pieces of information:

- Their Social Security number.

- Their filing status.

- The exact whole dollar amount of their refund.

Taxpayers can start checking on the status of their return within 24 hours after the IRS received their e-filed return, or four weeks after they mail a paper return. Wheres My Refund? includes a tracker that displays progress through three stages: the IRS receives the tax return, then approves the refund, and sends the refund.

Wheres My Refund? updates once every 24 hours, usually overnight. Taxpayers should remember that checking the status more often will not produce new results. Taxpayers on the go can track their return and refund status on their mobile devices using the free IRS2Go app. Those who file an amended return should check out the Wheres My Amended Return? tool.

Generally, the IRS issues most refunds in less than 21 days, but some may take longer. IRS phone and walk-in representatives can research the status of refunds only if it’s been 21 days or more since a taxpayer filed electronically, or more than six weeks since they mailed a paper return. Taxpayers can also contact the IRS if Where’s My Refund? directs them to do so.

My Address Has Changed I Want To Change The Address/ E

Login in the Income Tax e-Filing website and go to My Profile Settings Update Contact details. Provide the new Address/ e-mail ID/ Mobile Number and submit. Once submitted, your Address / e-mail ID / Mobile number is updated in your profile and also sent to the CPC to update on the Income Tax Return.

Not Determined

What does this mean?

This means that the Income Tax Department has still not processed your Income Tax Return or determined the refund yet.

Please check your refund status after a month to see if it has been updated.

Refund Paid

Step 1. What does this mean?

This means:

-

The Income Tax Department has sent the refund to you .

Step 2. What do I do now?

-

If you received your refund, congrats! See you again next year

-

If your refund status is Refund Paid, and you havent received it yet, heres what you need to do:

If you had opted for direct debit to your bank account while filing and you havent received your refund, you need to immediately contact your own bank or the State Bank of India to check for any errors.

You can contact SBI

b. On phone at 1800 425 9760

c. By post at Cash Management Product, State Bank of India, SBIFAST, 31 Mahal Industrial Estate, Off: Mahakali Caves Road, Andheri , Mumbai 400093

If you opted for refund via cheque while filing, but havent received the cheque check out the Speed Post tracking reference number for your cheque on the Refund Bankers website.

No demand no refund

Step 1. What does this mean?

This could mean either:

Read Also: Does Doordash Take Taxes Out For You

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

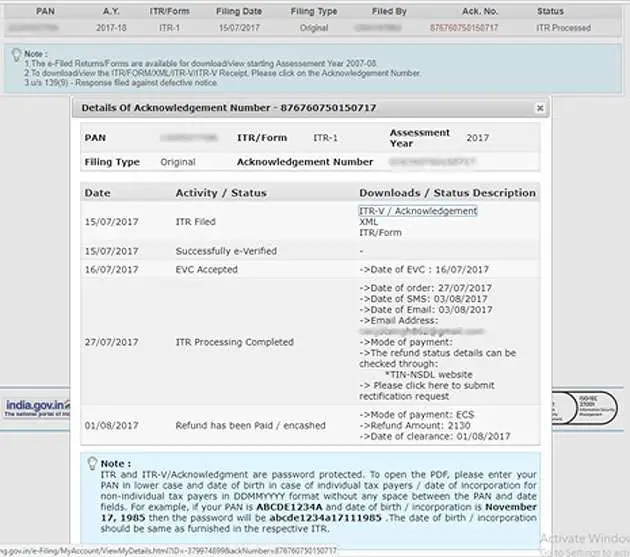

How To Check Income Tax Refund Status

There are two ways to check income tax refund status such as follows

1. The Income Tax e-filing Portal

2. The NSDL website

Follow below procedure to check status of income tax refund

Step 1: Visit the income tax e-filing portal by clicking here

Step 2: Log into your account by entering the user id, password, captcha and then click on login.

Step 3: Click on View Returns / Forms

Step 4: Enter Income Tax Returns against Select an option and the relevant Assessment Year and click on Submit.

Step 5: Click on the acknowledgement number.

After following all the above procedure, the income tax refund status will appear at the last.

Read Also: How To File Taxes From Doordash

How Long Will It Take For My Federal Refund Check To Arrive

The IRS usually issues tax refunds within three weeks, but some taxpayers could have to wait a while longer to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to the IRS website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

How To Check The Income Tax Refund Status Online In 2021

There are two methods for checking your Income tax refund status online for AY 2020-21:

1. :

- Visit , Income Tax Refund statuss online checking portal.

- Enter your PAN details and choose the applicable assessment year and enter the Captcha code.

Under this category, there aretwo ways of checking the status of your income tax refund:

- Checking the income tax refund status on e-Filing site by Logging in

- Visit and log in to your account with your User ID and Password.

- On the dashboard, click on the 2nd option i.e., View Returns/Forms.

- Select the option Income Tax Return.

- This option will generate the list of all income tax returns filed by you.

- Now, click on the Acknowledgement Number.

- This number will generate all the information regarding your Income tax returns, including the status of your income tax refund application.

- It takes up to 10 days for your income tax refund status to be updated after the IT department has processed the refund to your bank account.

- Checking the income tax refund status on e-Filing site without Logging in

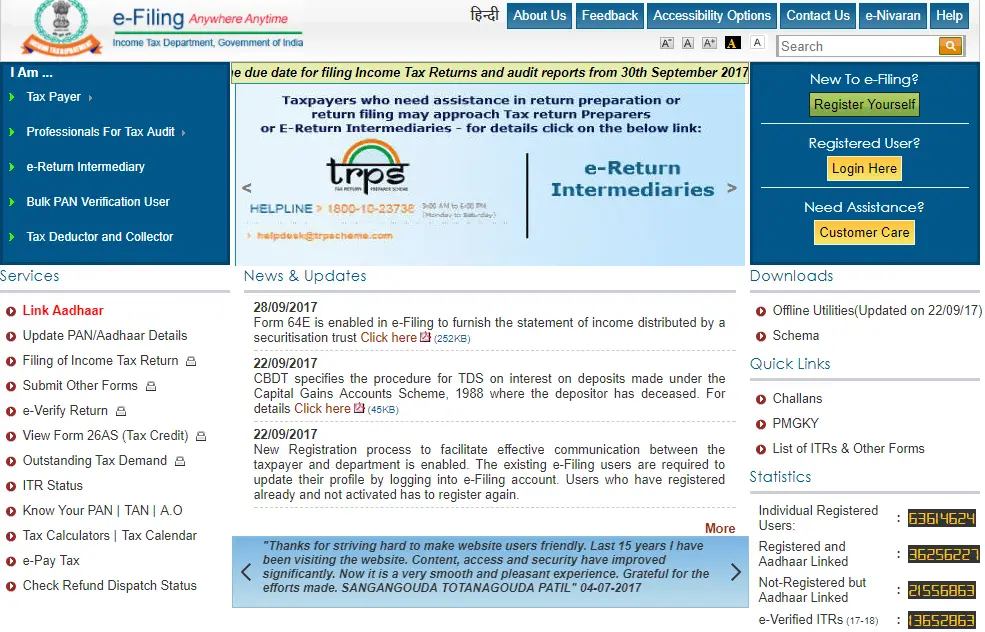

- Visit https://www.incometaxindiaefiling.gov.in/home

- Select the ITR Status option under Quick Links on the left side of the websites home page.

- Enter the required details ITR Acknowledgement Number, PAN, and Captcha Code and click on Submit to generate your latest income tax refund status.

Learn More:

Recommended Reading: Do I Have To File Taxes For Doordash

What Do These Irs Tax Refund Statuses Mean

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

When Can You Claim Income Tax Refund

Following are the instances, where you can claim income tax refund

· When you failed to furnish investment proofs to your organisation and then employer deducts excess taxes as compared to actual tax liability in a particular financial year.

· Excess TDS was deducted on your interest income from bank FDs or bonds.

· The advance tax paid by you on self-assessment, exceeds the actual tax liability.

· In case of DTAA , you can claim income tax refund whenever it occurs.

Read Also: Does Door Dash Take Out Taxes

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

Can I Rectify The Mistakes Before Placing A Request For Re

If you have received an intimation from the Income-tax Department or Refund Banker that the refund processing has failed due to in-correct bank details, you need to follow the below guide. You will have to submit a refund re-issue request in your Income-tax Departments website login and update your Correct or New bank Account Number.

You May Like: Do You Get Taxed For Doordash

What Are These Irs Tax Refund Statuses

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

When & How To Apply For Refund Reissue

First verify your Income Tax Return, then track the status of your income tax refund with the department. In case, you have still not received your refund then one of the reasons for the ITR refund delay could be due to a problem in your bank account or address details.

In such a situation, you can make a refund reissue request to the Income Tax Department but only after receiving an “Intimation”

Simple steps to apply for Refund Reissue:

- Step 1: Go to

- Step 2: Log in with your PAN card details and password.

- Step 3: After logging in, you will see a dashboard

- Step 4: Click on the pending action tab and refund reissue

- Step 5: When you click on refund reissue, you will see a window with a tab refund reissue.

- Step 6: Once you select the Refund Reissue tab visible on your screen, you will be redirected to the refund reissue page where you need to create a refund reissue request.

- Step-7: Select the bank account in which you want your refund and click proceed to move to the verification stage.

- Step 8: For successful submission of Refund Reissue request, users must have EVC. (Users must authenticate the refund reissue request through Aadhaar OTP & EVC code.

- Step-9: Click on the submit Button

Once all these steps are done successfully, you can then check the refund status on the dashboard.

Read Also: Is Freetaxusa A Legitimate Company

Wheres My State Tax Refund California

Track your state tax refund by visiting the Wheres My Refund? page of the California Franchise Tax Board. You will need to enter the exact amount of your refund in order to check its status.

According to the state, refunds generally take up two weeks to process if you e-file. If you file a paper return, your refund could take up to four weeks. Businesses can expect processing times of up to five months.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return . Businesses should reach out if they havent heard anything within six months of filing.

Amended returns for both individuals and businesses can take up to four months for processing.

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct deposited or mailed your refund.

The turn around time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

Don’t Miss: Doordash Self Employment Tax

Can You Transfer Your Refund To Another Person

No, you cannot ask the CRA to transfer your refund to pay another persons amount owing. This includes your spouse or common-law partner.

Residents of Quebec can transfer their Revenu Quebec refunds to their spouse. For more detailed information on how to proceed, please review the following link from Revenu Quebec: REFUND TRANSFERRED TO YOUR SPOUSE

What Is The Income Tax

An income tax is a type of charge the Government is authorized to impose on the annual income of businesses and individuals. Taxpayers are bound by the law to file annual tax returns to ascertain their tax obligations. Tax obligation is usually proportionate to the income of an individual i.e., higher the income, higher the income tax is payable, and vice versa.

Income tax is a source of revenue for the Government to fund its various obligations, operate public services, and provide goods to its citizens. However, there are certain investments, as decided by the Government, that is exempt from income taxes.

Also Check: Ein Look Up Number

Request Electronic Communications From The Department

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

Once you’ve logged in to your Online Services account:

Sample of Individuals account type in Online Services

Sample of Bills and Related Notices screen in Online Services.