File A Superseding Return If The Filing Deadline Hasn’t Passed

What if you just filed a tax return and then discovered a mistake the very next day. If the filing deadline, including extensions, hasn’t passed, then you don’t want to file an amended return. Instead, you can file what’s called a “superseding return.” Basically, if you file a second return before;the filing deadline, the second return “supersedes” the first return and is treated as the original return.

A superseding return must be filed on a paper Form 1040; e-filing is not allowed. We also recommend writing “Superseding Return” at the top of the form.

Since 2019 tax returns aren’t due until July 15, 2020;, there’s still time to file a superseding return this year. Say, for example, you filed a 2019 return back in February and, instead of getting a refund, elected to apply your overpayment against your 2020 tax liability. But then you lost your job in April because of the coronavirus pandemic and now wish you were getting a refund. If you file a superseding return before July 15, you can get the refund this year. It might take a while before the IRS is able to process your superseding return, since they’re behind on tackling paper returns, but at least you won’t have to wait until next year to benefit from the overpayment.

Keep An Eye On The Calendar

Generally, the IRS audits only returns from the previous three tax years though there are major exceptions. So although it might be tempting;to wait and see if the IRS will catch you in an error, it might be cheaper to fess up sooner rather than later.

The IRS charges interest and penalties on outstanding tax liabilities going all the way back to the original due date of the tax payment. So the longer you wait to fix a mistake, the more expensive that mistake can get.

Should I File An Amended Tax Return

Some tax return mistakes are caught and corrected by the IRS when it reviews your return. Other times, you may come across new information or realize an error , which you’ll need to correct by filing an amended tax return. It’s important to fix a mistake on your taxes, even if it leads you to owe more money than plannedit’s better to update your return now than chance an IRS audit or steep fines later.

Consider filing an amended return if you need to make any of the following changes:

- Adjusting the filing status on your tax return

- Claiming a different income amount

- Correcting the deductions you claimed

- Correcting the tax credits you claimed

- Changing the status of your dependents

For some errors, you might not need to file an amended return. Mistakes that may not require you to file an amended tax return include:

- Mathematical errors: Per the IRS, many mathematical errors are caught when tax returns are processed. When math errors are detected, the IRS typically handles them.

- Missing forms: Did you forget to attach a tax form to your original return, like a W-2 or 1099? If so, the IRS may mail you a request for this missing information when it processes your return.

Read Also: What Receipts Can I Claim On My Taxes

Disaster Victims Can Amend Return To Deduct Losses

If you’re the victim of a hurricane, wildfire or other natural disaster, you might be able to file an amended return to claim a casualty loss deduction for the tax year before the disaster. Alternatively, you can claim the loss in the year of the disaster: Pick whichever year is more favorable to you. However, the loss must be attributable to a federally declared disaster that occurred in an area warranting public and/or individual assistance. Otherwise, this special rule doesn’t apply.

If you decide to claim the loss for the year before the disaster, you must file your amended return no later than six months after the due date for filing your original return for the year in which the loss took place. So, for example, if the disaster occurred in 2020 and you want to claim your loss on your 2019 return, you must file an amended 2019 return by October 15, 2021.

Also note that a casualty loss deduction is generally subject to a $100-per-casualty limit. It also can’t exceed 10% of your adjusted gross income, and you have to itemize to claim it.;

What Information Goes On A 1040

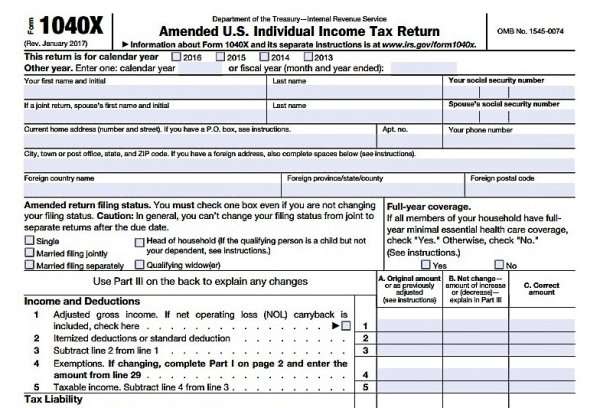

Since the purpose of the 1040-X is to correct a previously filed 1040, a lot of the information requested on the two federal forms is the same.

For example, at the top of the 1040-X, youll check a box to tell the IRS what calendar years return youre amending. Youll also provide or change your name , address and Social Security number. Take note that you cant amend multiple years on a single 1040-X. You must file a different 1040-X for each year you want to amend.

The form also gives you a chance to change your filing status if needed but if you filed your original tax return as married filing jointly, you cant switch to married filing separately.

;The most current version of the form includes three columns to complete.

- Column A provides space for amounts from your original return or a prior amended return.

- Column B is the difference between Column A and Column C and shows the net increase or decrease for each line you change.

- Column C is where you input corrected information.

On the back of the form, theres a section where you should explain why youre filing the form. And if other schedules or forms change, youll include those with your 1040-X form when you submit it to the IRS, along with any new forms you received after you originally filed .

Also Check: Can You File Missouri State Taxes Online

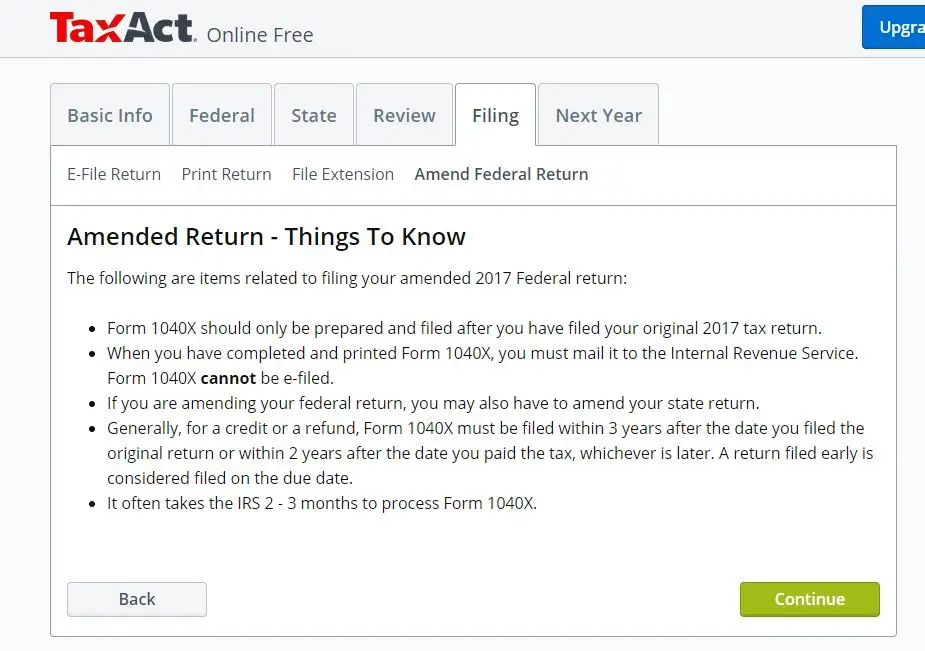

How Can I Amend My Tax Return

Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return,;do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents; If you need to amend your provincial return, please click;here;for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA;My Account;and click;Change my return.; You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

If You Need To Change Your Return

You can make a change to your tax return after youve filed it, for example because you made a mistake. Youll need to make your changes by:

- 31 January 2022 for the 2019 to 2020 tax year

- 31 January 2023 for the 2020 to 2021 tax year

If you miss the deadline or if you need to make a change to your return for any other tax year youll need to write to HMRC.

Your bill will be updated based on what you report. You may have to pay more tax or be able to claim a refund.

Theres a different process if you need to report foreign income.

Don’t Miss: How Fast Can You Get Your Tax Refund

When Do I Need To File An Amended Tax Return

If youve discovered an error on tax forms submitted to the IRS, your first step is to figure out whether the mistake is one the IRS will correct for you or if you need to act.

The purpose of an amended return is to correct an error on the original return, or to include additional information not previously reported, says Cindy Hockenberry, director of Tax Research and Government Relations at the National Association of Tax Professionals, in Appleton, Wisconsin.

This doesnt mean you need to notify the IRS of every little error or omission. If you simply forgot a form or made a basic math error, the IRS will either correct it for you or;send out a request;for missing info.

But you do need to notify the IRS right away if the error or new information affects your tax liability. Examples of mistakes that should prompt you to submit an amended federal return include any of the following:

- Submitting taxes with the incorrect filing status

- Misreporting your income

- Forgetting to claim tax credits or deductions

You may also need to file an amended return if you receive revised information after submitting your taxes.

You Can File An Amended Tax Return On Your Own

People with simple tax situations and small changes might be able file an amended tax return on their own.;Many major tax software packages;include modules that will file an amended tax return. Many tax preparers are happy to file amended returns as well.

And note: Amending your federal tax return could mean having to amend your state tax return too.

You May Like: What Is Tax Liabilities On W2

Fill Out And Submit The Necessary Forms To The Irs

Instructions for form 1040-X tell you exactly how to complete your forms and where to send them, so read through them carefully.

The IRS suggests the easiest way to make the entries for Form 1040-X is to add the changes directly in the margins of your original tax return. From there, you can transfer the numbers to your Form 1040-X. Remember to check the box at the top of the form to show which year you are amending.

Ask If Your Preparer Charges For An Amended Tax Return

If you used a human tax preparer, dont assume;he or she will amend your tax return for free or pay the extra taxes, interest or penalties from a mistake. If you forgot to give the preparer information or gave incorrect;information, for example, youll likely have to pay for the extra work.

If the error is the preparers fault, who pays for an amended tax return may depend on the wording in your client agreement.

» MORE:;How to get rid of your back taxes

Don’t Miss: How To Register For Tax Id

Submit Online Or By Mail:

- Online

- Through your tax representative or tax preparation software

File a California Fiduciary Income Tax Return for estates and trusts:

- Check the amended tax return box

- Complete the entire tax return

- On a separate paper, explain all changes

- Include the estate or trust name and FEIN with each item

Make sure to give a copy of the amended 541 Schedule K-1 to each beneficiary.

Fill Out The Correct Form For Your Business

| Business type | |

|---|---|

|

|

|

|

| Limited Liability Company : |

|

Recommended Reading: Where Can I Find My Agi On My Tax Return

Does An Amended Return Result In Fees Or Penalties

The IRS does not charge a fee for amended returns.

You may have to pay interest and late payment penalties on any additional tax that you owe if youre amending and paying after the original return due date. However, this will almost always be less than the interest, failing to pay, and accuracy penalties the IRS will impose if you dont amend and it discovers you owe additional tax.

Claim Missed Deductions Or Credits

Now let’s get into some of the more common reasons why you might want to file an amended return. Many people file one to claim an overlooked tax deduction or credit. The tax code is chock full of tax breaks, so it’s easy to miss one that applies to you. If you discover a deduction or credit that you qualify for after filing your original return, simply file an amended return within the three-year period described above to claim it now and get a refund. It might not be worth the effort if it’s only going to reduce your taxes for that year by a few bucks, but you do have the option.

Also, if you’re amending an older return, remember that the recent tax-reform law changed many tax breaks beginning with the 2018 tax year. Several deductions and credits were eliminated or reduced, but others were added or expanded. So just because you’re entitled to a tax break now doesn’t mean you were entitled to it on your pre-2018 return.

You May Like: What Age Do You Have To File Taxes

Tax Transcript Codes: 971 846 776 290

Some taxpayers who’ve accessed their transcripts report seeing different tax codes, including 971 , 846 and 776 . Others are seeing code;290;along with “Additional Tax Assessed” and a $0.00 amount. Since these codes could be issued in a variety of instances, including for stimulus checks and other tax refunds or adjustments, it’s best to consult the IRS or a tax professional about your personalized transcript.;

Filing An Amended Tax Return

Federal Income Tax Return

If you made a mistake on your tax return or forgot to claim a credit or deduction, you can fix the return by filing an amended return. You should amend your return if you need to correct filing status, the number of dependents you claimed, or your total income. The IRS generally corrects math errors when processing your return and will send you a letter if you forgot to include a schedule or other item.If you have to file an amended tax return because you realized that a previous return was not filed correctly or you received corrected forms W-2, 1042S, etc., you usually have to use Form 1040X . For a short introduction on what is needed see this IRS Article.

Recommended Reading: Do You Pay Income Tax On Unemployment

Common Reasons Why You Need To Amend A Return

| Reason | |

|---|---|

|

|

| Update credits |

|

| Update deductions |

|

| Report federal income tax adjustments | You amended your federal tax return or recently audited by the IRS |

How To Use Tax Refund Trackers And Access Your Tax Transcript

The first way to get clues about your refund is to try the IRS online tracker applications: The;Where’s My Refund;tool can be accessed here. If you filed an amended return, you can check the;Amended Return Status tool.;

If those tools don’t provide information on the status of your unemployment tax refund, another way to see if the IRS processed your refund is by viewing your tax records online. You can also request a copy of your transcript by mail or through the IRS’ automated phone service by calling 1-800-908-9946.;

Here’s how to check your tax transcript online:

1. Visit IRS.gov and log in to your account. If you haven’t opened an account with the IRS, this will take some time as you’ll have to take multiple steps to confirm your identity.

2. Once logged in to your account, you’ll see the Account Home page. Click;View Tax Records.

3. On the next page, click the Get Transcript button.

4. Here you’ll see a drop-down menu asking the reason you need a transcript. Select Federal Tax and leave the Customer File Number field empty. Click the Go button.

5. The following page will show a Return Transcript, Records of Account Transcript, Account Transcript and Wage & IncomeTranscript;for the last four years. You’ll want the 2020 Account Transcript.;

6. This will open a PDF of your transcript: Focus on the Transactions section. What you’re looking for is an entry listed as Refund issued, and it should have a date in late May or June.;

Recommended Reading: How Much Income To File Taxes

Get Instant Access To Your Cra Records Sign Up For Online Mail

You can have instant access to your tax records anytime, anywhere. Register for online mail and you’ll receive an email notification that your notice of assessment or reassessment is available online. Provide us with an email address on your T1 return or register directly online at www.cra.gc.ca/myaccount.

-30-

What To Know About The 2020 Unemployment Tax Break

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021. The tax break is for those who earned less than $150,000 in;adjusted gross income;and for unemployment insurance received during 2020. At this stage, unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.;

The $10,200 tax break is the amount of income exclusion for single filers,;not;the amount of the refund . The amount of the refund will vary per person depending on overall income, tax bracket and how much earnings came from unemployment benefits. So far, the refunds are averaging more than $1,600.;

However, not everyone will receive a refund. The IRS can seize the refund to cover a;past-due debt, such as unpaid federal or state taxes and child support. One way to know if a refund has been issued is to wait for the letter that the IRS is sending taxpayers whose returns are corrected. Those letters, issued within 30 days of the adjustment, will tell you if it resulted in a refund or if it was used to offset debt.;

Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return. A direct deposit amount will likely show up as;IRS TREAS 310 TAX;REF. Otherwise, the refund will be mailed as a paper check to whatever address the IRS has on hand.;

Read Also: How Much Is Sales Tax In New Mexico