Filing Requirements For Dependents

Taxpayers who are claimed as dependents are subject to different rules for filing taxes.

Dependents include children under the age of 19 , or who are permanently disabled along with qualifying relatives .; When their earned income is more than their standard deduction, taxes have to be filed. A dependent’s income is unearned when it comes from sources such as dividends and interest.

Single, under the age of 65 and not older or blind, you must file your taxes if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Gross income was more than the larger of $1,050 or on earned income up to $11,650 plus $350

If Single, aged 65 or older or blind, you must file a return if:

- Unearned income was more than $2,650 or $4,250 if youre both 65 or older and blind

- Earned income was more than $13,600 or $15,200 if youre both 65 or older and blind

If youre married, under the age of 65 and not older or blind, you must file a return if:

- Unearned income was more than $1,050

- Earned income was more than $12,000

- Your gross income was at least $5 and your spouse itemizes deductions

- Your gross income was more than the larger of $1,050 or your earned income was $11,650 plus $350;

Do You Have To File Taxes If You’re A Student

Your parents can claim you as a dependent up to age 19 unless you continue your education in which case they can claim you as a dependent through age 24. If you’re being claimed as a dependent, check the aforementioned requirements of dependents to see if you fit them. If so, you’ll have to file a tax return.

Even if you don’t have to file a tax return, you may still want to look into it. Depending on your situation, you may be able to deduct a limited amount of higher education expenses or claim education-specific tax credits like the American Opportunity Credit.

- Tags

Income Tax Filing Requirements

In the state of Arizona, full-year;resident or part-year;resident;individuals must file a tax return if they are:

- Single;or;married filing separately;and gross income; is greater than $12,400;

- Head of household and;GI is greater than $18,550; or

Note: For non-resident individuals the threshold numbers above are prorated based on the individual’s Arizona gross income to their federal adjusted gross income.

The filing requirements are explained at the beginning of the instructions on all Arizona income tax returns. All tax forms and instructions are available to download;under Individual Forms, or by visiting ADOR offices.

To expedite the processing of an income tax return, ADOR strongly encourages taxpayers to use the fillable Arizona tax forms or electronic file .;Fillable Forms;and e-file;information are available. Each year, ADOR provides opportunities for taxpayers to file their individual income tax returns electronically at no cost to those who qualify.

Don’t Miss: Where Do I Get Federal Tax Forms

Tax Tips For Independent Contractors

- Consider working with a financial advisor to better manage your independent contractor income.;SmartAssets free tool matches you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now

- Develop a good record-keeping system for your business. Make sure you have accurate records of both your income and expenses for the year. Consider using an expense app to keep tabs on receipts, charitable donations and other deductible expenses. When you receive your 1099 forms, be sure to check them for accuracy.

- A financial advisor who specializes in tax planning can help lower your 1099 income taxes by;harvesting your losses. This means that you will be able to use your investment losses to reduce taxes on 1099 income.

- Figuring out your taxes can be overwhelming. SmartAssets;income tax calculators;will help you calculate federal, state, and local taxes.

When A Dependent May Need To File A Tax Return

Taxpayers who are claimed as a dependent on someone’s tax return are subject to different IRS filing requirements, regardless of whether they are children or adults. A tax return is necessary when their earned income is more than their standard deduction.

The standard deduction for single dependents who are under age 65 and not blind is the greater of:

- $1,100;in 2020

- Or the sum of $350 + the person’s earned income, up to the standard deduction for an unclaimed single taxpayer which is $12,400 in 2020.

A dependent’s income can be “unearned” when it comes from sources such as dividends and interest. When a dependent’s unearned income is greater than $1,100 in 2020, the dependent must file a tax return.

Also Check: Can I Check My Property Taxes Online

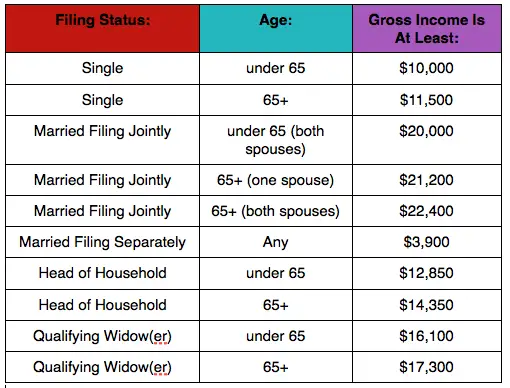

Minimum Gross Income Thresholds For Taxes

The IRS defines “gross income” as anything you receive in the form of payment that’s not tax-exempt. Gross income can include money, services, property, or goods. The thresholds cited here apply to income earned in 2020, which you must report when you file your 2020 tax return in 2021.

In a practical sense, the limits are equal to the years standard deduction, because you can deduct this amount from your gross income and only pay income tax on the difference. You would owe no tax and would not be required to file a return if youre single and earned $12,400 in 2020, because the $12,400 deduction would reduce your taxable income to $0. But you would have to file a tax return if you earned $12,401, because youd have to pay income tax on that additional dollar of income unless you had applicable tax credits you could use.

As of the 2020 tax year, these figures are:

| Single under age 65 | |

| Qualifying widow age 65 or older | $26,100 |

Making Money In Canada

Your Canadian residency status doesnt affect whether or not you have to file a Canadian income tax return, however, it does affect how you file your taxes, what income you need to report, and the availability of certain credits or deductions.; If you meet any of the CRAs criteria listed above, for example, you have to file a tax return regardless of your residency status.

If you live in another country but receive income from a business you own in Canada, or from investments you have in Canada or if you have property in Canada, then you will need to file an income tax return.

You May Like: How To Register For Tax Id

Are You A Dependent

Parents can claim their children as dependents until age 19. If they are continuing their education, parents can claim them until age 24.If you are a single dependent under the age of 65 and not blind, your tax filing will depend on unearned income, earned income, and gross income:

- Unearned Income: $2,200

- Earned Income: $12,400

- Gross Income: Was more than the larger of either $1,100 or your earned income up to $11,650 plus $350

Even if you could be claimed as a dependent and dont need to file a return, you may still want to in order to claim a tax refund.;

How Do I Make My Quarterly Payments

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior years annual tax return in order to fill out Form 1040-ES.

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax.

Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System . If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

See the Estimated Taxes page for more information. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

Don’t Miss: How To Buy Tax Lien Properties In California

Who Is Required To File An Income Tax Return

If you are new to Canada or if you are just entering the workforce, you may be wondering if filing a Canadian Income Tax return is a necessity, and if so, when do you have to file your first tax return?

The Canada Revenue Agency does require annual filing for most citizens but there are exceptions, so lets have a look at who is required to file a Canadian T1 General tax return and when.

Who Should File A Tax Return

Canada’s tax system is based on the self-assessment principle:

-

Anyone who earns money has to complete a tax return each year to report their income and calculate whether they owe tax or receive a refund.

-

It must be submitted to the Canada Revenue Agency .

-

The Income Tax Act states that the deadline for most Canadians to;file their income tax and benefit return is April 30. It’s important to file your return on time because you may be entitled to a refund, benefits, or credits.

You May Like: How To Calculate Net Income After Taxes

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The credit can be up to $6,660 per year for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $3,000 or $6,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Pros And Cons For Each Kiddie Tax Filing Option

The key benefit of having a parent opt to include a childâs income on their tax return is that it can simplify a familyâs tax situation. A separate return for a young child means filling out more forms and probably paying higher prices to file . However, if the child has earned income and must file a tax return anyway, including unearned income on their tax return may be simpler than reporting it on a parentâs return.

Having a child file their own tax return can sometimes result in lower overall taxes, too. For example, a child could itemize deductions if they have them . A child could claim an additional standard deduction of $1,650 if theyâre blind. A child is also eligible to pay capital gains rates on their unearned income between $1,100 and $2,200 . This would likely mean a 0% tax rate, but a parent would need to pay a flat rate of 10%. Additionally, if a parent files and the child has investment income, itâs added to the parentâs overall investment income, which could push the parent closer to the threshold for paying a 3.8% net investment income tax . See IRS Topic No. 559 for more information on NIIT.

If youâre unsure which filing option you should choose, you may want to go through the process using both to see which results in less tax. For more help deciding which method is best for you, speak with a tax professional.

Recommended Reading: How Are Property Taxes Calculated In Texas

What Are My Self

As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly.

Self-employed individuals generally must pay self-employment tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax .

Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business. You do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of Form 1040 or 1040-SR. If your expenses are more than your income, the difference is a net loss. You usually can deduct your loss from gross income on page 1 of Form 1040 or 1040-SR. But in some situations your loss is limited. See Pub. 334, Tax Guide for Small Business for more information.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR;instructions.

How To Calculate Your Ei Contributions

I want to make it clear that contributing to the EI program is not mandatory when youre self-employed. It is 100% voluntary. However, by not contributing to EI, that means you are ineligible to take advantage of all the benefits EI has to offer, such as maternity/parental leave or being a caregiver to a family member who is ill or injured. Then again, it may not be worth it to you and instead you may prefer to just have a very cushy Emergency Fund.

But if you are interested in it, heres how much it costs. As of 2021, the EI rate is 1.58% for self-employed individuals. This means that for every $100 you earn, you need to pay $1.58, to a maximum of $889.54/year . And for insurable earnings, this refers to your gross salary, or your business revenue after youve deducted business expenses but before youve paid income tax and CPP.

Using my earlier example:

Hi Jessica,Thank you so much for this informative post.I registered my business, as to avoid anyone from taking my name. I definitely wont be making more than 30k, Im thinking 10k-15k however I do work for a company with an annual salary of $42 500. With that said, since Im operating my business as a sole proprietorship, when doing my taxes I will need to combine both incomes together correct? How much taxes would I need to pay on that amount? I currently only pay about ~1000/year since I contribute to my RRSP, and I am located in Quebec.Thank you!

Read Also: Can You Change Your Taxes After Filing

Age And Status Requirements For Dependents

Being claimed as a dependent on someone elses taxes changes the rules a bit, and it does not rule out the possibility that you will still be required to file. If you are an adult, working dependent, you will likely be required to file your own return.

| Under 65 | $12,400 earned | |

| Single Dependents | 65 or older OR blind | $14,050 earned |

| Single Dependents | 65 or older AND blind | $15,700 earned |

| Under 65 | $12,400earned OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions. | |

| 65 or older OR blind | $13,700earned income OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions | |

| 65 or older AND blind | $15,000earned OR Your gross income was at least $5 andyour spouse files a separate return and itemizes deductions |

Why Do I Need To File My Income Tax

After paying your income taxes monthly for a full year , you will need to prepare to file your taxes basically to report to the LHDN that you have paid your taxes for that year, and to submit receipts that you can claim for tax relief or tax exemption if applicable.

The LHDN assesses your submission and checks to see if you need to be refunded . Or if you need to pay more . The LHDN will then do the calculations and, if you have any tax relief or tax exemptions, factor those in, and then inform you of what you can claim from them, or need to pay.

Read Also: How To Get Tax Exempt Status