What Is The Income Tax Calculator

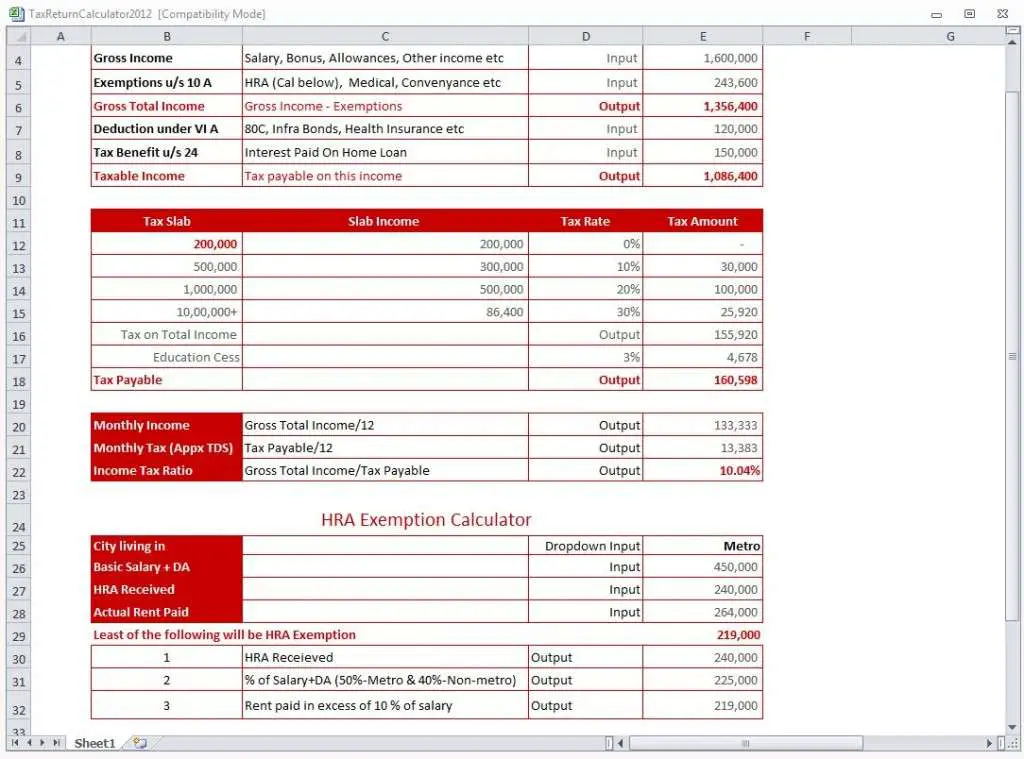

An Income-tax calculator is an online tool that helps to evaluate taxes based on a persons income once the Union Budget for the year is announced. Individuals falling under the taxable income bracket are liable to pay a specific portion of their net annual income as tax. Income tax can be paid either as tax deducted at source while disbursement of monthly salary, or through the income tax returns portal managed by the Central Board of Direct Taxes . The provision for online payment of taxes is to ensure individuals pay their stipulated dues on any earnings generated from other sources.

The IT calculator given on this page is aligned with the updates announced in the Union Budget 2021-22.

How To Arrive At Your Tax Due

After you’ve figured out your taxable income, there are a few more steps to arriving at your actual tax due.

- Subtract any payments and/or credits from your taxes owed.

- On lines 75 and 76, you will determine whether you owe taxes or will receive a refund.

If you’re getting a big refund, you’re probably having too much withheld from your paycheck. In effect, this means you’re giving the government an interest-free loan. On the other hand, if you have too little withheld, you may be charged an underpayment penalty.

Choosing Standard Or Itemized Deductions

Once you know your AGI, you have the opportunity to lower your taxable income even more by subtracting either the standard deduction or your itemized deductionswhichever is greater.

When to consider the standard deduction

If your financial situation is straightforward, the standard deduction might be the best and simplest choice. The standard deduction for 2014 is $6,200 for single filers, $12,400 for married filing jointly and $9,100 for head of household.

When to consider itemizing deductions

If you pay a lot in state income taxes, have a mortgage on your home, give a lot to charity, have paid extensive medical bills or manage a lot of investments, you might be better off taking the extra time to itemize your deductions.

Examples of legitimate itemized deductions:

- Property taxes

- State and local income taxes

- Specified medical and dental expenses that exceed 10 percent of your AGI , including limited amount of premiums paid for long-term care policies

- Mortgage interest on first and secondary residences , plus interest on home equity loans

- Charitable contributions to tax-exempt organizations

- Casualty and theft losses

- Investment interest expense

- Miscellaneous expenses, including impairment-related expenses for persons with disabilities and gambling losses to the extent of gambling winnings

- In addition, the following can be itemized if the cumulative total is more than 2 percent of your AGI:

- Business expenses not paid by your employer

You May Like: How To Buy Tax Lien Properties In California

British Columbia Income Tax Calculator

This is income tax calculator for British Columbia province residents for year 2012-2019. Current BC personal tax rates in British Columbia and federal tax rates are listed below and check .

IMPORTANT: This tax calculator is used for income tax estimation. Please use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. It is free for simple tax returns or gives you 10% discount for more complicated tax returns.

Here is list of netfile software to file your tax return.

Line 840 Tax Instalments Paid

On line 840, report all instalment payments you made for the tax year.

You can view your interim balance and if needed, you can transfer payments within a program account and between program accounts of the same nine-digit business number and immediately view updated balances, by using the “View and pay account balance” service through:

- My Business Account, if you are the business owner

- Represent a Client, if you are an authorized representative or employee

If there is a discrepancy between the amount you report on the return and the interim balance in your business account, we will use the amount in your business account for the tax year being assessed when we process the return.

For information on how to make payments, go to Making payments for businesses or see Guide T7B-Corp, Corporation Instalment Guide. For more information on calculating instalments, go to My Business Account and use the “Calculate instalment payments” or see Guide T7B-Corp, Corporation Instalment Guide.

Note

Even if you elected to report in a functional currency, you still have to complete line 840 in Canadian currency.

Also Check: How Much Does H & R Block Charge For Taxes

Lines 800 And 801 Tax Withheld At Source

This is the amount shown as “income tax deducted” on any information slips, such as NR4, T4A, or T4A-NR, you may have received. You do not have to file these information slips with your return, unless you are a non-resident corporation. However, keep them in case we ask for them later.

On line 800, enter the total amount of income tax deducted from all your information slips. On line 801, enter the total payments on which tax has been withheld.

ReferencesIC75-6, Required Withholding From Amounts Paid to Non-Residents Providing Services in Canada

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2020 tax year than you did for 2019. If your income changes or you change something about the way you do your taxes , its a good idea to take another look at our tax return calculator. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Recommended Reading: How Can I Make Payments For My Taxes

The Most Accurate Tax Calculator

At Etax, after you register and log in, then start a tax return, the tax refund calculator shows your tax refund estimate at the top of the screen.

The tax refund calculator shows your ATO tax refund estimate. The more details you add to your tax return, the more accurate the tax calculator becomes

It is accurate to the cent, based on the information you add to your return and it updates as you go.

Etax includes the all tax cuts and tax rebates in your refund estimate, for 2021.

Each time you add a new detail to your return, the tax refund calculator re-calculates your tax estimate. You can see how each number and each tax deduction affects your overall tax refund.

This happens automatically, helping you see how different items in your return can affect your refund. Thats not possible with most tax calculators!

Work Out How Big Your Tax Refund Will Be When You Submit Your Return To Sars

INCOMEOTHER INCOMETAX PAIDTo get this refund you need to fill out your tax return 100% correctly.Please note that this is only an indicator of an estimated refund.TaxTim cannot be held liable for this refund not being received.Get SARS Tax Dates and Deadlines in your InboxDo your Tax Return in 20 minutes or less!TaxTim will help you:

Don’t Miss: Where’s My Tax Refund Ga

What Is Total Or Gross Income

Your total or gross income includes:

- Earned income, which comes from employment and can take the form of wages, salary, tips, commissions and bonuses. Earned income may be subject to both income and payroll taxes.

- Unearned income, which comes from sources other than employment, such as dividends, interest, capital gains or U.S. savings bonds. Most unearned income is subject to income taxes.

Important things to remember

- Other sources of taxable income include alimony, unemployment compensation, gambling winnings or lottery winnings.

- Income that’s not taxable include: a gift or inheritance, child support, life insurance proceeds following the death of the insured, interest from municipal bonds , disability income if you paid the premium with after-tax dollars, and certain employee fringe benefits.

- If you have stocks, bonds or other investment assets in a taxable account your profit or loss is known as a capital gain or a capital loss. Capital gains are currently taxed at a maximum rate of 20 percent, but only for people in the highest tax brackets. Otherwise, long-term capital gains are taxed at 15% or 0%, depending on your marginal tax bracket.

How To Calculate Your Net Tax If You Are A Public Service Body

You must calculate your net tax for each GST/HST reporting period and report this on your GST/HST return. Use the following amounts when calculating your net tax:

- GST/HST you collected or that is collectible on your taxable supplies made during the reporting period

- the input tax credits you can claim for the GST/HST you paid or that was payable on your business purchases and expenses.

In addition, you can claim a public service bodies’ rebate for the GST/HST paid or payable on your eligible purchases and expenses for which you cannot claim ITCs or any other rebate, refund or remission. This includes GST/HST that relates to taxable and exempt activities.

What is the special quick method of accounting for public service bodies?

To help reduce your paperwork and bookkeeping costs, your organization may qualify to use the special quick method of accounting for public service bodies to calculate your GST/HST net tax.

You May Like: File Missouri State Taxes Free

Line 712 Part Iv Tax Payable

Dividends subject to Part IV tax

The following types of dividends are subject to Part IV tax:

- taxable dividends from corporations that are deductible under section 112 when you calculate taxable income

- taxable dividends from foreign affiliates that are deductible under paragraphs 113, , , or , or subsection 113 when you calculate taxable income

Taxable dividends received are only subject to Part IV tax if the corporation receives them while it is a private or subject corporation. Taxable dividends received from a non-connected corporation are subject to Part IV tax.

Taxable dividends received from a connected corporation are subject to Part IV tax only when paying the dividends generates a dividend refund for the payer corporation.

The Part IV tax rate is 38 1/3%.

Definitions

A private corporation is a corporation that is:

- resident in Canada

- not controlled by one or more public corporations

- not controlled by one or more prescribed federal Crown corporations

- not controlled by any combination of prescribed federal Crown corporations and public corporations

ReferenceSubsection 89

Subject corporation

A subject corporation is a corporation, other than a private corporation, that is resident in Canada and is controlled by or for the benefit of either an individual other than a trust, or a related group of individuals other than trusts.

ReferenceSubsection 186

Connected corporation

References

The following types of corporations are exempt from Part IV tax:

ReferenceSection 186.1

Will I Get A 2020 Tax Refund

Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe. This most commonly occurs if too much is withheld from your paychecks. Another scenario that could create a refund is if you receive a refundable tax credit that is larger than the amount you owe. Life events, tax law changes, and many other factors change your taxes from year to year. Use the refund calculator to find out if you can expect a refund for 2020 .

Don’t Miss: Can You File Missouri State Taxes Online

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000, but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

An Alternative Roi Calculation

If, for example, commissions were split, there is an alternative method of calculating this hypothetical investor’s ROI for their Worldwide Wicket Co. investment. Assume the following split in the total commissions: $50 when buying the shares and $75 when selling the shares.

IVI = Final value of investment \begin& \text = \$10,000 + \$50 = \$10,050 \\& \text = \$12,500 + \$500 – \$75 \\& \phantom } = \$12,925 \\& \text = \frac \times100 \\& \phantom } = 28.75\% \\& \textbf\\& \text = \text \\& \text = \text\end IVI=$10,000+$50=$10,050FVI=$12,500+$500$75FVI=$12,925ROI=$10,050$12,925$10,050×100ROI=28.75%where:IVI=Initial value of investmentFVI=Final value of investment

In this formula, IVI refers to the initial value of the investment . FVI refers to the final value

Annualized ROI helps account for a key omission in standard ROInamely, how long an investment is held.

Also Check: Efstatus Taxact Com Return

Filing Status & Dependents

The filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow. If you support a child or relative, they may qualify as your dependent. There are different requirements for qualifying children and qualifying relatives, but both types of dependents must be a U.S. citizen, U.S. national, or U.S. resident alien. You must be the only taxpayer claiming them, and they must be filing single or married filing separately if they’re required to file their own return. For more, see Who Can I Claim as a Dependent?

Line 750 Provincial Or Territorial Jurisdiction

On line 750, give the name of the province or territory where you earned your income. Usually, this is where the corporation has its permanent establishment.

If you earned income in more than one province or territory, write “multiple” on line 750 and file Schedule 5, Tax Calculation Supplementary Corporations, with your return. See instructions on how to complete Schedule 5.

Note

The Newfoundland and Labrador offshore area and the Nova Scotia offshore area are considered provinces.

Reference Subsection 124

Recommended Reading: How To Buy Tax Lien Properties In California

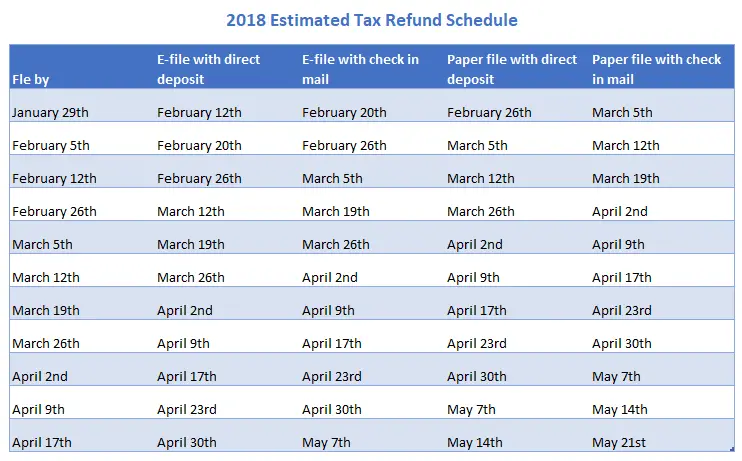

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

What Is The Pretax Rate Of Return

The pretax rate of return is the return on an investment that does not include the taxes the investor must pay on this return. Because individuals’ tax situations differ and different investments attract varying levels of taxation, the pretax rate of return is the measure most commonly cited for investments in the financial world.

The pretax rate of return can be contrasted with an after-tax return.

Read Also: How To Buy Tax Lien Properties In California

What Records To Keep

Doing your taxes will be a lot easier if you keep the right recordsand keep them easily accessible. It’s wise to keep:

- All of your tax returns for seven years. This includes all supporting documents such as forms that show your income and validate your deductions: W-2, 1099s, canceled checks, receipts for charitable contributions, etc.

- All home ownership documents, including records of home improvements.

- Investment records, including what you paid and when you sold.

- Statements for retirement accounts. In particular, you will need to have records of after-tax contributions.

How To Use The Tax Return Calculator And See Your Accurate Tax Refund Estimate:

- Start your 2021 tax return. .

- Enter your income in the relevant fields.

- As you go, watch the top part of your return your estimate is right there.

- Next, go ahead and add more details like income or deductions.

Keep an eye on the calculator your tax refund estimate changes with each new item you add to your return. The Etax system re-calculates your refund estimate based on the latest details youve entered.

Also Check: How Much Does H And R Block Charge To Do Your Taxes

Scientific Research And Experimental Development Tax Credit

Bill 20, the Fiscal Measures and Taxation Act, 2019 received Royal Assent on December 5, 2019, and Alberta’s Scientific Research and Experimental Development Tax Credit has been eliminated. For more information, see Special Notice Vol. 5 No. 54, Budget 2019 Elimination of Corporate Tax Credits.

Alberta’s Scientific Research and Experimental Development Tax Credit program provides a refundable tax credit to corporations for SR& ED expenditures carried out in Alberta by the corporations.

More information and forms:

Line 798 Canadian Journalism Labour Tax Credit

The Canadian journalism labour tax credit is a refundable tax credit that was introduced as of January 1, 2019. The credit is set at 25% of qualifying labour expenditures for a tax year, for an eligible newsroom employee of a qualifying journalism organization .

The maximum credit available is $13,750 for each eligible newsroom employee per year. The credit amount will be reduced by the amount received from the Aid to Publishers component of the Canada Periodical Fund.

To be eligible for the credit, the corporation must be a QJO, as defined in subsection 125.6. Under this definition, a QJO must be a qualified Canadian journalism organization , as defined in subsection 248, and must also meet additional specific criteria:

- it does not hold a licence, as defined in subsection 2 of the Broadcasting Act

- if it is a corporation having share capital, it meets the conditions in subparagraph of the definition of Canadian newspaper in subsection 19

Several legislative amendments relating to the Canadian journalism labour tax credit have been proposed. When passed, the legislative amendments will be effective as of January 1, 2019. The proposed amendments include changes to:

For information on the current legislation relating to the tax credit and the proposed changes, go to Canadian journalism labour tax credit and Draft Legislative Proposals 2020-04-17.

To claim the credit, file a completed Schedule 58, Canadian Journalism Labour Tax Credit, with your return for the year.

You May Like: Where’s My Tax Refund Ga