Can I Contribute To An Ira If I’m Over The Ira Income Limit

If your income exceeds these limits, you are still allowed to contribute money to a traditional IRA. However, the contribution that you make will not be tax deductible.

You may still wish to make a non-deductible contribution, either because you would prefer to allow your investments to grow tax-free and defer taxes on gains or because you want to make a backdoor Roth IRA contribution by contributing to your traditional IRA and then converting it to a Roth account.

Remember, you are also not subject to income limits when you make contributions to either a SIMPLE IRA or a SEP IRA — options only available if your employer offers them, if you own a small business, or if you are self-employed and can open one for yourself.

The ability to make non-deductible contributions regardless of income level makes traditional IRAs a valuable retirement savings account for conversion into a backdoor Roth IRA. Alternatively, some high earners may simply prefer to wait and pay taxes on investment gains in their retirement years, rather than owing the IRS as investments are sold throughout your career.

What Iras Are Eligible

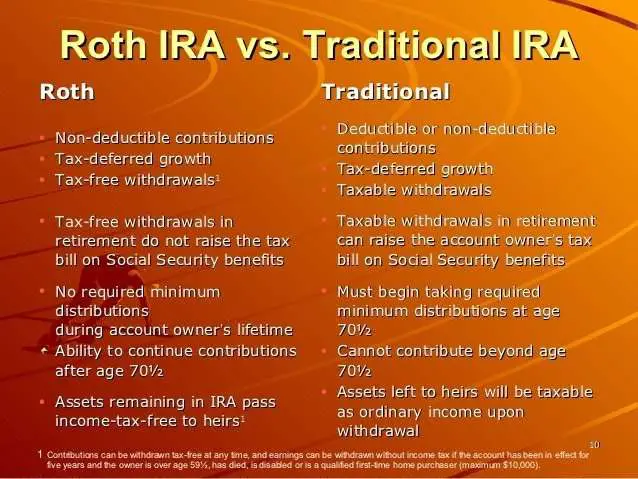

There are two main types of IRA accounts that cover the majority of people: the traditional IRA and the Roth IRA. Its incumbent on all taxpayers to learn the differences between the two and choose the one thats right for them. You can make contributions to both a Roth IRA and a traditional IRA at any age. And its easy to use your IRA to get a last-minute deduction, but only if its a traditional IRA. Contributions to Roth IRAs are not eligible for tax deductions.

Other types of IRA accounts you might have heard of, such as a SEP IRA, a SARSEP or a SIMPLE IRA, are set up and administered by employers. Although they provide tax benefits, they are not appropriate for last-minute contributions by individual taxpayers.

Back to top

The #1 Traditional Ira Tax Break Mistake

But there is a big mistake that trips up many people when trying to claim the deduction.

This mistake can be summarized by not understanding the IRA deduction limits.

A lot of people do not know this but your deduction can be limited if you meet certain criteria.

The first criteria is if you are covered by a retirement plan at work.

The IRS specifically says that your deduction may be limited if you are covered by a retirement plan at work, and your income exceeds certain levels.

Well discuss those income levels in a second, but basically, if you or your spouse is employed by a company that offers a retirement plan, your deduction may be limited.

If you or your spouses employer contributes to a profit-sharing, 401k, stock bonuses, or any IRA-based plan, then you are considered covered.

This means that your deduction may be limited if your income surpasses a certain amount.

So lets take a look at those income limits.

Here are the 2021 income limits.

As you can see, your deduction is phased-out once you start earning over a certain amount of money.

Remember, these phase-outs only apply if you or your spouse is covered by a retirement plan at work.

So lets say youre single and your employer contributes to your 401k.

If your income is less than $66,000, then you can enjoy the tax benefits of your 401K and your Traditional IRA.

But if your income exceeds $66,000, but is less than $76,000, then you will only receive a partial deduction for your IRA contribution.

Recommended Reading: Have My Taxes Been Accepted

You Got Thisall You Have To Do Is Start

We make filing taxes delightfully simple with one, flatrate price. Every feature included for everyone.

If you have a traditional Individual Retirement Account , the rules for reporting your contributions are pretty simple. You can deduct your IRA contributions on Form 1040, Schedule 1, Part II Adjustments to Income.

However, traditional IRA contributions are not always deductible. Lets talk about what makes a contribution nondeductible and how to report those contributions on your tax return.

If You Are Married Filing Separately

For taxpayers who are married and filing separately, the tax deduction limits are drastically lower, regardless of whether they or their spouses participate in an employer-sponsored retirement plan. If your income is less than $10,000, you can take a partial deduction. Once your income hits $10,000, you do not get any deduction.

Recommended Reading: Can Property Taxes Be Deducted From Income Tax

Strict Rules On Withdrawals From Traditional Iras

Generally, any distribution you receive from an IRA before the day you reach age 59½ is subject to a 10% penalty tax imposed by the IRS, in addition to federal and state income tax. Beginning at age 59½, you can withdraw money from your IRA without penalty, whether or not you are still employed.

Distributions before age 59½ are not subject to the penalty tax under certain circumstances:

- You become permanently disabled.

- You die before age 59½ and distributions are made to your beneficiary or estate after your death.

- You make withdrawals to pay unreimbursed medical expenses that exceed 7.5% of your adjusted gross income.

- You make withdrawals for a qualified home purchase .

- You make withdrawals to pay qualified higher education expenses for yourself, a spouse, children, or grandchildren.

You must begin withdrawals from your IRA by April 1 following the year in which you reach age 70½. A great advantage of taking only the required minimum distribution is that the balance continues to compound tax deferred. However, if your distributions in any year after you reach age 70½ are less than the required minimum, you will be subject to a penalty tax equal to 50% of the difference.

Why Save For Retirement In An Ira

Traditional IRAs are best for people “who need an immediate tax deduction or want to defer income in the hopes that their bracket will be lower in the future,” according to Mari Adam, a certified financial planner in Boca Raton, Fla. The latter category includes people expecting to retire shortly and those who believe their income will go down in future years, she says. Eventually, you will have to pay taxes on your traditional IRA. Your withdrawals will be subject to ordinary income tax. On top of that, if you take the money out before turning age 59 1/2, you can be hit with a 10% penalty. You will also be obligated to take required minimum distributions after you turn age 72, so you won’t be able to avoid the IRS forever.

Recommended Reading: Can You Claim Rent On Your Taxes

Possible Benefits Of Tax

As you evaluate the potential benefits of an IRA, consider the advantage of tax deferral. This chart shows the result when a hypothetical $100 monthly investment is made for 30 years in a tax-deferred plan versus the same investment taxed at 25% annually, assuming an 8% average rate of return compounded monthly. If the final tax-deferred amount is withdrawn at retirement and taxed at 25%, it exceeds the taxable final amount by nearly $12,000.

Deductions Allowed For Contributions To A Traditional Ira

OVERVIEW

The contributions you make to a traditional IRA account may entitle you to a tax deduction each year.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Traditional individual retirement accounts, or IRAs, are tax-deferred, meaning that you dont have to pay tax on any interest or other gains the account earns until you withdrawal the money. The contributions you make to the account may entitle you to a tax deduction each year. However, the Internal Revenue Service restricts who can claim a tax deduction for contributions to traditional IRAs based on various factors.

Also Check: How To Calculate Paycheck After Taxes

Roth Ira Contribution Rules

In addition to restrictions around income, there are a few other rules around Roth IRA contributions that you should be aware of. For example, its definitely possible to own both a Traditional IRA and a Roth IRA, but the yearly contribution limit applies collectively to both types of IRAs. For example, if Mary is younger than 50 years old, files her taxes as a single and reports a MAGI level below $125,000, she can deposit up to $6,000 and split the amount in any manner between her Traditional and Roth IRA. She just cant exceed $6,000 in total contributions. It should also be noted that Mary might not want to contribute to her Traditional IRA in this scenario due to her high income level and deductibility rules.

Contributions to Roth IRAs can be made until the federal tax filing day of the following year. Using our above example for Mary, she will be able to contribute to her Roth IRA for 2021 until the federal tax deadline of April 15, 2022.

If You Have Extra Money To Invest In Retirement It May Be The Answer

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Does it make sense to fund a non-deductible individual retirement account ? Many people who are not eligible to fully fund a deductible IRA or Roth IRA often overlook this easy opportunity to sock away additional dollars for retirement where they can grow tax-free. And unlike a 401 or other salary deferral plan, you can make contributions up through the April 15 tax filing deadline.

Also Check: Can You Change Your Taxes After Filing

Borrowing Money From An Ira

A loan from an IRA is prohibited. It is considered a prohibited transaction and the IRS may disqualify your plan and tax you on the assets. Some use the 60-day rollover as a way to temporarily take funds from an IRA. A participant will take a distribution and, in turn, all or some of the distribution that the participant takes may be rolled back into the same IRA plan within the allowed period to retain its tax deferred status. One 60-day rollover is allowed every rolling 12 months, per IRA. For instance, if you withdraw any amount from IRA-1 and deposit it into IRA-2 , you cannot make another tax-free rollover of any funds from IRA-1 or IRA-2 for 365 days. However, this would not prevent you from making a tax-free rollover from another IRA.

Traditional Ira Deduction Limits

If you are covered by a retirement plan at work, you can make a full or partially deductible contribution to a Traditional IRA, based on your modified adjusted gross income .

And starting in 2020, as long as you are still working, there is no age limit to be able to contribute to a Traditional IRA. The Secure Act, signed into law on December 20, 2019, removed the age limit in which an individual can contribute to an IRA. The top age prior to the law was 70½.

Find out which IRA may be right for you and how much you can contribute. Calculate your IRA contribution limit

Recommended Reading: How To Calculate Payroll Tax Expense

Ira Contributions After Age 70

For 2020 and later, there is no age limit on making regular contributions to traditional or Roth IRAs.

For 2019, if youre 70 ½ or older, you can’t make a regular contribution to a traditional IRA. However, you can still contribute to a Roth IRA and make rollover contributions to a Roth or traditional IRA regardless of your age.

Which Type Of Ira Do You Have

Contributions to a traditional IRA, which is the most common choice, are deductible in the tax year during which they are paid. You won’t owe taxes on the contributions or their investment returns until after you retire.

For 2020 and 2021, there’s a $6,000 limit on taxable contributions to retirement plans. Those aged 50 or over can contribute another $1,000.

In the eyes of the IRS, your contribution to a traditional IRA reduces your taxable income by that amount and, thus, reduces the amount you owe in taxes.

A contribution to a Roth IRA is not tax-deductible. You pay the full income taxes on the money you pay into the account. However, you will owe no taxes on the contributions or the investment returns when you retire and start withdrawing the money.

In December 2019, President Trump signed the Setting Every Community Up for Retirement Enhancement , which is designed to improve retirement security for Americans. Under the act, the tax deduction amounts and basic rules are unchanged.

You May Like: What Documents Do You Need For Tax Return

Roth Ira Contribution Limits

Roth IRAs have the same annual contribution limits as traditional IRAs: $6,000 or your taxable compensation, whichever is lower. If you will be 50 or older by the end of a year, you may contribute up to $7,000 for that year to a Roth IRA.

However, not everyone is allowed to contribute to a Roth IRA. If your income is above certain thresholds, you may be ineligible for a Roth IRA or your contributions may be limited. Here are the Roth IRA income thresholds for 2020 and 2021:

Contribution Limits For Traditional And Roth Iras

The maximum contribution limit in 2021 for both traditional and Roth IRAs is either 100% of earned income, or $6,000, whichever is less. Investors may contribute an additional $1,000 each year once they reach 50 years old.

Note that these are combined limits across traditional and Roth IRAs. If investors make the maximum contribution to a Roth IRA, they may not invest another $6,000 in their traditional IRA. The $6,000 limit applies to the sum of their contributions to traditional and Roth IRAs.

Recommended Reading: How Do I Do My Taxes

Change Jobs Without Losing Any Retirement Benefits

IRAs can also come in handy when you’re about to leave jobs and need to move your retirement plan assets. If your former employer permits you to withdraw your retirement money, you can move these funds to an IRA account and postpone the payment or move them from your former employer’s qualified retirement plan into a rollover IRA and avoid owing current income tax on the distribution.

If you choose to physically receive part or all of your money and do not replace the entire amount within 60 days, you may be subject to an early withdrawal penalty tax and income taxes on the amount you don’t rollover to an IRA or other plan. Some exceptions may apply.

The Ira Tax Break Explained Traditional Ira Tax Deduction

Sherman-May 25, 2021

The IRA tax break can put $6,000 into your retirement account, and lower your taxable income by $6,000.

And anyone can take advantage of the IRA tax break, regardless of if youre self-employed or employed at another company.

Still, many people are not taking advantage of this simple tax break.

And some of the people who are, are being surprised by a huge mistake they are making that is preventing them from taking this tax deduction.

So keep reading to find out how all of this works, how to avoid the mistake many people make, and ultimately knock off $6,000 from your taxable income.

In some of our past posts, weve covered things like the SEP IRA and the Solo 401K to help self-employed individuals deduct up to $58,000 from their tax bills.

Those plans, while beneficial, had some rules and regulations attached to them that may not be applicable to everyone.

Thats why todays post is all about the traditional IRA tax break, which anyone reading this article can take advantage of.

With that being said, lets discuss the IRA tax break. Lets run through the basics and get to the fun stuff.

Also Check: Are New York State Tax Refunds Delayed

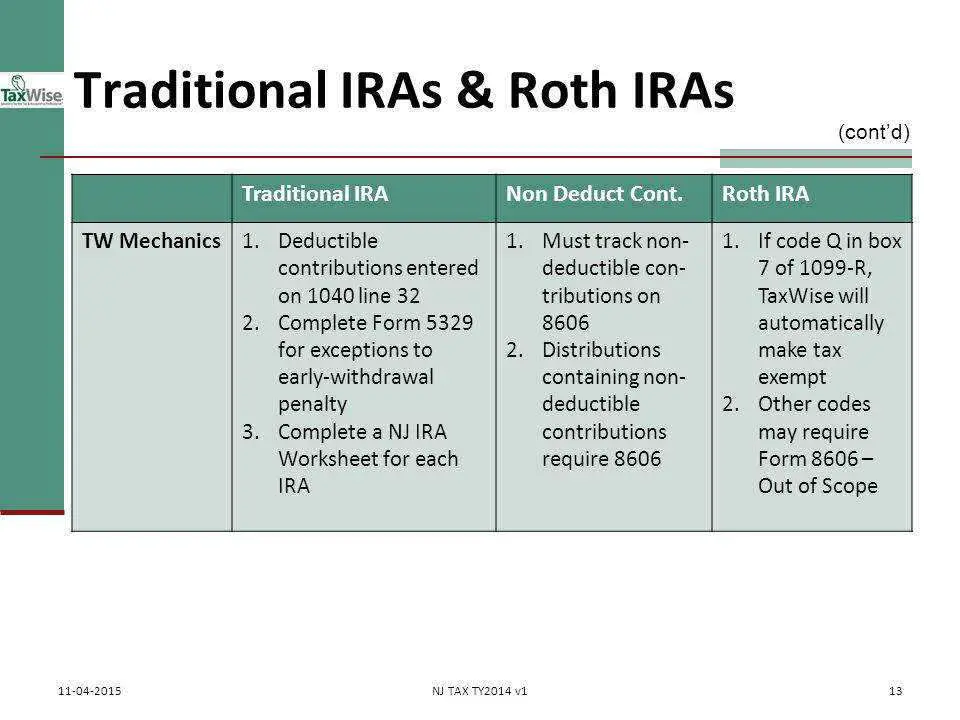

Tax Reporting When Making Non

When making after-tax contributions to an IRA, you must inform the IRS that you’ve already paid tax on those dollars. This is done using Form 8606. If you don’t report, track, and file the form, you’ll lose the ability to shield part of your IRA withdrawal from tax when you take the money out. In another words: you’ll pay federal income tax on the same dollar twice. This is the double tax trap.

If You Do Have A Work Retirement Plan

If you do have a retirement plan at work, or if your spouse does, then your ability to deduct contributions depends on whether your income is above the traditional IRA income limits.

-

If your income is under the limits, youre eligible to claim a tax deduction for your contributions to a traditional IRA.

-

If youre in the income phase-out range, you can deduct a portion of your contributions.

-

If your income is higher than the maximum income limit, then you cant deduct your IRA contributions.

You May Like: Where Do I Report 1099 Q On My Tax Return

What If You’ve Previously Made Non

The good news is this can be an easy problem to fix. From a tax reporting standpoint, you can simply file a Form 8606 with your next tax return to reflect historical non-deductible IRA contributions. No penalty, no problems.

Unfortunately, in reality, few taxpayers maintain records of making non-deductible contributions. As your income, job, or marital status changes, you may cross between deductible and after-tax IRA contributions, perhaps skipping some years altogether or finding yourself in the middle of the phase-out. Sometimes, the financial institution doesn’t accurately reflect your additions on statements.

Flexibility Estate Planning Benefits Better With Taxable Assets

Moreover, taxable accounts carry other important advantages relative to IRAs–namely, no contribution, income, or withdrawal limits. Taxable accounts also have an important advantage in that heirs receive a step-up in cost basis upon the death of the account owner, effectively washing out the tax burden associated with the appreciation of the investment.

On the flip side, there are creditor protections that come along with the IRA wrapper those aren’t to be taken lightly, especially for people who work in careers where there’s a risk that they may be sued. But if high-income savers can only make aftertax IRA contributions beginning in 2022, that increasingly seems like a niche strategy that won’t add up for most.

Recommended Reading: How To Look Up Employer Tax Id Number