Turbotax Live Tax Experts

Looking for expert tax help? TurboTax Live offers real tax experts and CPAs to help with your taxesor even do them for you. You can get a final review of your tax return before you file to ensure your taxes are done right, or you can even have a dedicated tax expert do your taxes for you, from start to finish, with TurboTax Live Full Service. You get unlimited tax advice year round, so you can be 100% confident your return is done right, guaranteed.TurboTax Live experts are highly knowledgeable, with an average 12 years experience in professional tax preparation. Their tax advice, final reviews, and filed returns are guaranteed 100% accurate. Learn more about How TurboTax Live Works.

Save The Right Paperwork All Year Long

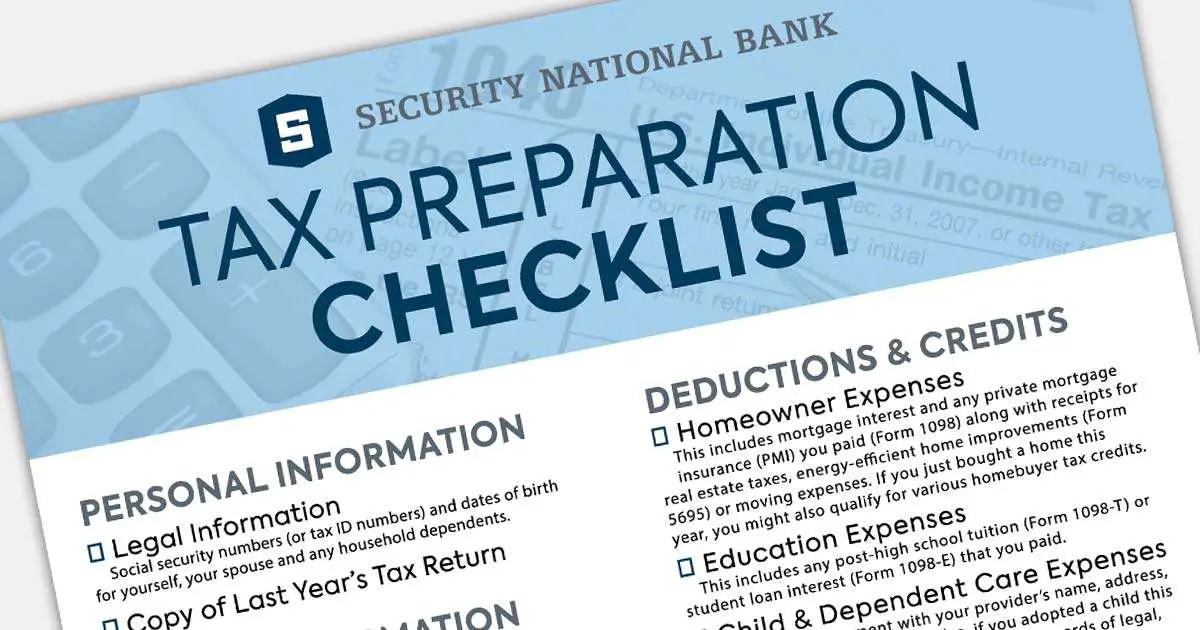

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Documentation Required To Complete Your Return

- IRP5/IT3 Employees Tax Certificate

- Certificates received for local interest income, foreign interest income and foreign dividend income

- If you are married in community of property, the certificates received by both you and your spouse are required

- If you married out of community of property, only the certificates that you receive are required.

Read Also: When Are Irs Taxes Due

Donations Pension Contributions And Seis/eis Investments

- Donations: the amount, date, and charity of donation either in document form or a spreadsheet

- Pension contributions: spreadsheet or other documents that show them

- SEIS/EIS investments: your SEIS3/EIS3 certificates or your share certificates. Check out our guides on how to claim your SEIS and how to claim your EIS.

This sounds like a long list of tax return documents.

However, in most cases, a simple spreadsheet of your income, expenses, or even a bank statement might be sufficient.

Ask our support team if they can help.

See more on:

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Recommended Reading: How Much Taxes To Pay On Stocks

Income And Investment Information

- Form W-2 Wage and Tax Statement -Your W-2 shows how much you earned and how much was withheld for taxes. Your employer has until February to send you your form. If you havent received yours, go ahead and request it.

- Bank or financial institution statements Did you make contributions to an IRA? Youll need a Form 5498. Are you paying down student loan debt? Be sure to grab your Form 1098-E. Did you take out a home mortgage? Be sure to have your Form 1098 Mortgage Interest Statement.

- Last years state refund amount If you itemize your deductions, then your state refund is considered income for tax purposes.

- Other miscellaneous income records This could include award money, gambling winnings, lottery pay-outs, etc.

- Any Form 1099s There are several different types of 1099. Some of the common ones include:

- 1099-NEC if you are self-employed and received $600+ from a client

- 1099-DIV if you received dividends

- 1099-G if you received money or benefits from the government

- 1099-K if you made third-party transactions

- 1099-R for distributions from a retirement plan, IRA, pension, annuity, etc.

- 1099-MISC if you have paid at least $600 in rent, prizes and awards, medical and healthcare payments, or other income payments.

Reporting Deductions And Credits

Various tax credits are available that directly reduce the amount of tax you’re responsible for paying. Some frequently claimed tax credits include the child tax credit, residential energy credits and the earned income credit. Each has its own eligibility criteria you must satisfy.

Tax deductions, on the other hand, only lower the amount of your taxable income and do not provide a dollar-for-dollar reduction of taxes owed like the credits do. Still, all taxpayers qualify for certain deductions, such as the standard deduction. In order to claim any deduction or credit, you will need some basic information, such as your filing status, the number of dependents you have and a list of your deductible expenses. You may need other documentation to support your deductions and credits as well, such as receipts for charitable donations you made during the year.

Read Also: How Much Taxes Do You Pay On Slot Machine Winnings

Late Or Missing Slips

If you dont receive a T slip on time, file your return before the deadline and include a note that includes the payers name and address, the type of income, such as employment income or CPP benefits, and what steps you are taking to get the late slip. You should receive most slips by the end of February. Keep all copies of your documents plus a copy of the note you sent. Estimate the income, deductions and credits using other T slips and information, and report it on the appropriate line of your return.

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Recommended Reading: What Will My Property Taxes Be

What Do I Need To Bring To My Tax Appointment

This is one of the most frequently asked questions we receive at Tax On Wheels, LLC.

Regular customers have been through our process before and may have a pretty good idea about what we will need to get your tax return completed quickly and accurately. But regardless of whether you are a new or returning client you still may be confused about which documents to gather for your tax appointment. Thats why we have created this list to help you put your documents together, to make sure your appointment goes smoothly.

Many of the needed documents may trickle into your mailbox one by one. So we recommend that you establish a folder in a central location to accumulate tax documents until they all arrive and you are ready for your tax appointment. As always, please give us a call at 803 732-4288 if you have any questions.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Also Check: Where Do I Get Federal Tax Forms

What Is The Best Way To File Taxes

Previously, individuals and businesses had to fill out all of their tax information by hand. However, these days, thanks to technology, many individuals opt to use software to fill out their taxes as it makes the whole process easier and accounts for human errors.

There are typically three main options to choose from when filing your taxes. These include using tax software and submitting your taxes online, using software and filing through the mail, or using a professional service to file them on your behalf.

How Long Should I Keep Records

The length of time you should keep a document depends on the action, expense, or event which the document records. Generally, you must keep your records that support an item of income, deduction or credit shown on your tax return until the period of limitations for that tax return runs out.

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or the IRS can assess additional tax. The information below reflects the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Note: Keep copies of your filed tax returns. They help in preparing future tax returns and making computations if you file an amended return.

Read Also: What If I File Taxes Late

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Adjustments To Your Income:

The following can help reduce the amount of your income that is taxed, which can increase your tax refund or lower the amount you owe.

- Student loan interest

- Medical Savings Account contributions

- Moving expenses

- Keogh, SEP, SIMPLE and other self-employed pension plans

- Alimony paid that is tax deductible

- Educator expenses

Read Also: How To Pay Federal And State Taxes

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2021 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $33,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $66,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

You May Like: Is Nursing Home Care Tax Deductible

Paperwork You May Need

Help with your Tax Return guide

It will make things much easier if you have the right papers before you try to fill in your return. It you intend to file on-line, it often helps to fill in a paper copy of the return first, so that you know you have all the right figures.

The type of records you need for various sorts of income are listed below. Do not send any of this paperwork to HMRC, unless you are specifically asked to do so.

Employment Income : Form P60 for employments held at 5 April in the tax year Form P45 for any jobs you have left during the tax year Form P2 PAYE notice of coding . You may also want to have payslips and bank statements available.

Rental income: A summary of your rental income and expenses, bills for expenses, bank statements, letting agreements. Take particular care to separate repairs, replacements and improvement expenses.

Savings income: a summary of interest received from your statements or passbook be careful to note if the interest has been paid with deduction of tax at source. For dividend income you will need the dividend statements. Note that from 6 April 2016, most sources of interest will not have tax deducted at source. They way savings income is taxed also changes from the 2016-17 tax year.

Social Security Benefits: A letter from the DWP showing the amount of your state pension or other taxable benefit. For Jobseekers Allowance there should be a form P60U.

Example:

What To Bring To Your Local Vita Or Tce Site

-

Proof of identification

-

Social Security cards for you, your spouse and dependents

-

An Individual Taxpayer Identification Number assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

-

Proof of foreign status, if applying for an ITIN

-

Birth dates for you, your spouse and dependents on the tax return

-

Wage and earning statements from all employers

-

Interest and dividend statements from banks

-

Health Insurance Exemption Certificate, if received

-

A copy of last years federal and state returns, if available

-

Proof of bank account routing and account numbers for direct deposit such as a blank check

-

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

-

Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

-

Forms 1095-A, B and C, Health Coverage Statements

-

Copies of income transcripts from IRS and state, if applicable

Also Check: What Is K 1 Tax Form

What Do You Include With Your Return And What Records Do You Keep

If you are filing your return electronically, keep all receipts and documents in case the CRA ask to see them later. If you are filing a paper return, the information in your paper return will tell you which supporting documents need to be attached, such as certificates, forms, schedules, or receipts. Keep all receipts and documents for at least six years after you file your return as the CRA may request a review.

Medical Expense Receipts And Records

- Receipts for unreimbursed medical expenses These could include exams, surgeries, and preventative care. It could also be braces, glasses, hearing aids, prescriptions even transportation to and from treatment.

- Form 1095: Health insurance coverage forms If you are enrolled through the Marketplace, youll receive Form 1095-A. Insurance providers will send a 1095-B for individuals they cover. If your employer offers coverage, they should send you a 1095-C.

- Social Security benefits If you receive Social Security, youll receive an SSA-1099 in January showing the total amount of benefits you received for the year.

Read Also: How Can I Make Payments For My Taxes