What Does It Mean To Be Chronically Ill

Chronically ill in this context means that the person is unable to perform at least two activities of daily living without assistance for at least ninety days. Activities of daily living are the basic daily tasks every person needs to be able to perform to live: eating, using the restroom, moving from one location to another, bathing, and dressing.

A person can also qualify as chronically ill if they suffer from significant cognitive impairment and require significant supervision or protection as a result.

Special Rules When Claiming The Disability Amount

There are special rules when claiming the disability amount and attendant care as medical expenses. For information on claiming attendant care and the disability amount, see the chart.

Calculate your net federal tax by completing Step 5 of your tax returnto find out what is more beneficial for you. You can also see the examples.

If you claim the fees paid to a nursing home for full-time care as a medical expense on line 33099 or 33199 of your tax return , no one can claim the disability amount for the same person.

You can claim the disability amount together with the portion of the nursing home fees that relate only to salaries and wages for attendant care . However, you must provide a breakdown of the amounts charged by the nursing home showing the portion of payments that relate to attendant care.

For more information on the disability tax credit and how to claim the disability amount, go to Disability tax credit.

Requirements For Assisted Living Tax Deductibility

To deduct certain medical expenses, an assisted living resident must meet the following criteria:

- A licensed health care practitioner, doctor, or nurse must certify that the resident is chronically ill unable to perform a minimum of two activities of daily living on their own or if they need substantial supervision because of dementia, Alzheimers disease, or another severe cognitive impairment for 90 days.

- A plan of care must be prescribed by a social worker, doctor, or nurse. Most assisted living communities develop a plan of care using a medical evaluation from a licensed healthcare provider, a needs assessment, and input from the resident or caregiver.

However, even if a resident does not meet the definition of chronic illness, they may still be able to deduct medical expenses, including entrance fees. Assisted Living Communities and tax advisors are aware of these deductions and can provide specific information to help you or a loved one.

You May Like: Do I Pay Tax On Selling My House

Calculating Your Total Medical Expense Deduction

For the tax year 2019, any qualifying medical expenses that make up more than 7.5%% of an individuals adjusted gross income can be deducted.

To calculate your total medical expense tax deduction, start by determining your qualifying assisted living expenses per the above information. Then add that to the rest of your qualifying medical expenses for the tax year. Your medical expense deduction is the sum of all your qualifying medical expenses minus 7.5% of your adjusted gross income. If this number is negative, you do not qualify for a medical expense tax deduction.

Common Medical Expenses You Cannot Claim

There are some expenses that are commonly claimed as medical expenses in error. The expenses you cannot claim include the following:

- athletic or fitness club fees

- birth control devices

- blood pressure monitors

- cosmetic surgery expenses for purely cosmetic procedures including any related services and other expenses, such as travel, cannot be claimed as medical expenses. Both surgical and non-surgical procedures purely aimed at enhancing ones appearance are not eligible. Non-eligible cosmetic surgery expenses include:

- liposuction

- filler injections

- teeth whitening

A cosmetic surgery expense may qualify as a medical expense if it is necessary for medical or reconstructive purposes, such as surgery to address a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease

- diaper services

- over-the-counter medications, vitamins, and supplements, even if prescribed by a medical practitioner

- personal response systems such as Lifeline and Health Line Services

- provincial and territorial plans such as the Alberta Health Care Insurance Plan and the Ontario Health Insurance Plan

- the part of medical expenses for which you can get reimbursed, such as reimbursements from a private insurance

Recommended Reading: How Much Taxes Do You Pay On Slot Machine Winnings

Other Options To Cover The Cost Of Assisted Living

Most Assisted Living communities provide information on ways to save residents money. Some of the most common include:

- Long-term care insurance

- Veterans programs

Many states also offer programs to help residents. For example, in Massachusetts, MassHealths Program of All-Inclusive Care for the Elderly , Personal Care Attendant , and Group Adult Foster Care programs may help with funding.

Some communities also offer opportunities for residents to share apartments to cut costs.

Medicare And Nursing Home Expenses

Under some circumstances, Medicare Part A does cover a short-term stay in a skilled nursing facility such as a nursing home. For instance, your mother’s doctor might prescribe a stay in a nursing facility to facilitate her recovery from a stroke or a serious injury. In this case, the original Medicare plan pays a portion of the skilled nursing facility costs for as many as 100 days.

However, the Medicare program stipulates that a doctor admit the patient to the facility within 30 days following a hospital stay. In addition, the origin of the admission must be the same illness, injury or condition that led to the original hospital stay. In this case, your mother’s portion of the costs should be totaled and considered when you calculate your medical expenses as you complete your tax return.

Don’t Miss: Are Charity Donations Tax Deductible

How Can Seniors Claim The Medical Expense Tax Deduction

After you’ve compiled your medical expenses and confirmed the costs fall under the IRS medical expense approved deductions, it’s time to claim your expenses.

Did You Know: You may qualify to receive an IRS credit for the elderly or disabled.

Your next step is to complete an IRS Itemized Deductions Schedule A form. This form is where you’ll list expenses for medical, dental, taxes and interest paid, charitable contributions, and other deductions. Once this form is completed, attach it to your Form 1040 or 1040-SR.

Attendant Care And Care In A Facility

Attendant care is care given by an attendant who does personal tasks which a person cannot do for themselves. This includes care in certain types of facilities.

You can claim amounts paid to an attendant only if the attendant met both of the following criteria:

- They were not your spouse or common-law partner.

- They were 18 years of age or older when the amounts were paid.

An attendant who is hired privately will probably be considered an employee. For more information, see Guide RC4110, Employee or Self-employed?

Don’t Miss: How Do I Get My Tax Return Transcript

What You Can Deduct

According to IRS Publication 502, in general, only medical services performed by a home care worker can be deducted. Some examples of qualifying services include giving medication, wound care and help with the management of diseases and long-term conditions. Personal care and household maintenance services arent usually eligible for deduction, with some exceptions. Chronically ill patients may deduct these expenses if a licensed health care practitioner has certified that the person meets either or both of the following conditions:

Youre also able to deduct part of a home care workers food costs if you paid for their meals. If you had to move to a larger home to accommodate the worker, you can also deduct part of the increased rent and utilities.

Can You Claim A Tax Deduction For Assisted Living

If your parent needs help with activities of daily living , you have few options. One of the best is Assisted Living.

Assisted Living offers trained, caring help with ADLs, such as getting dressed or remembering to take medications. If your parent has Alzheimers or another form of dementia, Assisted Living offers a safe environment.

Read Also: How Much Federal Income Tax Do I Pay

Cost Of Skilled Nursing Facilities Vs In

In-home care providers include options like homemaking service providers and can help you manage everyday activities like cleaning, cooking, and running errands. You may also consider home health aides who can offer more extensive care and also serve as reliable companions. However, skilled nursing care is ideal if you need professional help to administer medication and regularly monitor your vitals. Although it may cost you more to move to one of these facilities, it is beneficial that they have excellent amenities and offer intense medical care.

What Does Medicare Offer

Traditional Medicare Parts A and B don’t cover the cost of long-term care. Also, Medicare managed-care plans offer only limited support when it comes to extended care. For instance, the latter might limit its coverage to a weekly visit to an adult day program. Consequently, most long-term support and service costs are paid by a senior’s family.

Your mother may be one of the lucky ones with additional medical insurance that significantly reduces the medical charges with which a patient’s family must deal long after the parent’s illness subsides, but it’s likely that you’ll still have to shoulder some out-of-pocket expenses.

To make matters worse, you can’t assume that you can write off all of the unexpected and unavoidable out-of-pocket expense for your mother’s medical care on your tax return. For the 2021 tax year, your deduction is limited to medical expenses that exceed 7.5 percent of your adjusted gross income.

You May Like: How Do I File My Missouri State Taxes For Free

Tax Cuts And Jobs Act Of 2018

There were sweeping reforms to the tax code that came into effect in 2018 that have changed the way deductions are calculated. Many caregivers and seniors have been completing their taxes for years, even generations following the previous tax rules, which can make the new changes difficult to understand. If you are at a loss about the Tax Cuts and Jobs Act of 2018, we are here to help. We will detail the changes to medical deductions for seniors and tax deductions for caregivers to help you make sense of the current tax code.

The 2018 tax season and beyond brought with it many changes for both seniors and the caregivers of those seniors. This will apply to those filing for their returns for 2018 and later depending on when you file. Some of the changes include the elimination of the personal exemption, higher standard deductions, a new $500 dependent credit and new modified itemized deduction rules.

It was estimated by the IRS that over 400 forms will need to be generated from scratch or modified from their current form in order for taxpayers to be able to file correctly during the 2019 season. This also includes publications detailing the changes and instructions on how to properly file with the new changes put into effect. Some important changes to note we will explain in further detail below.

What Percentage Of Assisted Living Is Tax Deductible

The Internal Revenue Code does not provide definitive guidance on a formal method for computing the deductible portion of monthly service fees and entrance fees. This means that the deductible portion or your fees will be determined by how your community itemizes charges. If part of your fee goes directly toward non-medical costs such as housing and meals, these expenses are not deductible. Your community should provide information about which portion of your charges are medical, and therefore how much of your assisted living fees are tax deductible.

Read Also: Where To File Georgia State Taxes

Tax Deductibility Of Long

Long-term care insurance is a specialty insurance policy that helps cover care expenses such as hospital care, senior living services, and in-home care. LTCI policies are purchased through private insurance companies, and they generally must be acquired by a certain age or before a senior experiences any severe health concerns. Premiums for qualified long-term care insurance may be deductible if they exceed 7.5% of the insureds AGI.

Deduct A Dependent’s Medical Expense

You can deduct the money you paid to cover your loved one’s unreimbursed medical costs if the qualified medical expenses of everyone claimed on your taxes totals more than 7.5 percent of your adjusted gross income for that year and if your total itemized deductions are more than your standard deduction.

Check IRS Publication 502 to see what is and isn’t deductible. Here is a sample of acceptable deductions:

- Activities for older people with special needs

- Acupuncture

- Prescribed medicines and equipment, such as a cane or walker

- Professional health aide costs during respite care

- Transportation for medical appointments or services

Not deductible: Items and services that benefit the household.

Read Also: Are Contributions To Political Campaigns Tax Deductible

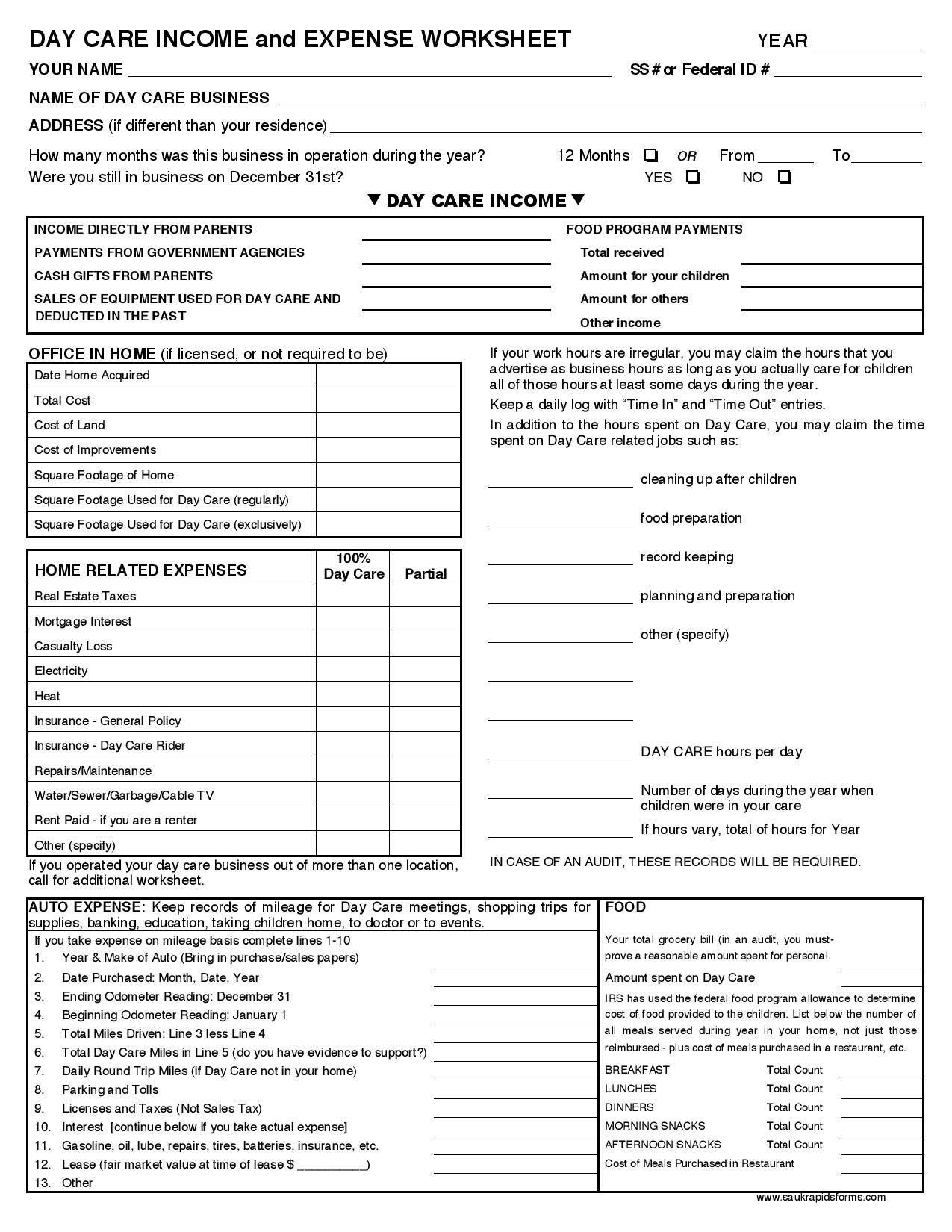

To Claim These Expenses:

- You need to include a detailed statement of the nursing home costs.

- Only the portion of your monthly bill used to pay attendant care salaries can be deducted.

- You also need a completed Form T2201 from a qualified medical practitioner to claim attendant care costs.

Not all nursing home expenses can be claimed. Administrative costs and operating costs cant be deducted. Most rent expenses cant be claimed either, with the exception being any portion of the rent that goes to services that help a person with daily tasks, such as laundry and housekeeping.

Top Rated Assisted Living Communities By City

Home care can be expensive nearly $4,500 per month, on average but there are ways to help make it more affordable. Certain home care services youve paid for yourself, your spouse or another dependent can qualify as a deductible expense on your taxes.

To qualify for this tax break, expenses need to be itemized, and youre only allowed to deduct the amount of expenses that exceeds your adjusted gross income by 7.5%.

Helpful Resources

Recommended Reading: How To Calculate Sales Tax Percentage From Total

A Portion Of The Gain From The Sale Of Your Parents Home May Be Tax

If your parent sells his or her home, up to $250,000 of the gain from the sale may be tax-free. To qualify for the $250,000 exclusion, the seller must generally have owned the home for at least two years out of the five years before the sale and used the home as their primary residence for at least two years out of the five years before the sale. However, an exception exists where if the seller becomes physically or mentally unable to care for him or herself during this five-year period. In that instance, the parent does not need to meet the two-out-of-five-year test to qualify for the home sale gain exclusion.

Having a parent move into a nursing home can be both stressful and expensive time. Hopefully, a few of these tax benefits can help mitigate the burden these expenses may cause on you or your loved ones. Please contact your Wegner CPAs tax advisor to discuss any further questions you may have on deducting retiree medical expenses.

Is Alzheimers Care A Tax Deductible Expense

Over the years I have been asked countless times by families Are the costs associated with the care they receive at Dodge Park tax deductible? While much of the tax code is subject to varied interpretations, and each individual should seek competent advice from their own professionals, to my opinion, and this is only my opinion, it appears that the answer to this question is likely. As tax season approaching fast, please plan a visit to your accountant, attorney or planner and discuss this subject with them in details.

Section #213 of the publication Selected Federal Taxation Statutes and Regulations 2000 Edition states There shall be allowed as a deduction the expenses paid during the taxable year not compensated for by insurance or otherwise for medical care of the taxpayer, his spouse or a dependent to the extent where that expense exceed 7.5 percent of adjusted gross income. The exact definition of medical care has been further explained in Section 1016 If an individual in a nursing home or a home for the aged because of his physical condition and the availability of medical care is a principal reason for his presence there, the entire cost of maintenance, including meals and lodging is deductible.

Don’t Miss: How Do You File Taxes On Social Security Disability

Is Memory Care Tax Deductible

If your loved one is receiving memory care for Alzheimers or dementia, part or all of the cost of their care may qualify for a medical expense tax deduction. Memory care falls under the category of long-term care services, which are deductible expenses under the 1996 Health Insurance Portability and Accountability Act .

The cost of memory care should be added to a sum total of all of an individuals qualifying medical expenses. The portion of this total that can be deducted from taxes is that which makes up over 7.5% of their adjusted gross income.

Requirements For Memory Care To Be Tax Deductible

A person must meet the following requirements for their memory care expenses to be tax deductible:

- They must be considered chronically ill. This is defined as meeting one of the following qualifications:

- They are unable to perform at least two activities of daily living on their own. The six activities of daily living are eating, dressing, bathing, transferring, toileting, and continence.

- They require substantial supervision due to a cognitive impairment such as Alzheimers or another form of dementia.

- Their care must be provided by a licensed medical professional, under a specified plan of care. Care plans are written outlines of the daily services an individual receives, and they often include assistance with the activities of daily living. For Alzheimers and dementia patients, care plans may be administered by an in-home memory care provider or at a memory care community.

If someone receives care for Alzheimers or dementia, it is highly likely that they meet the above requirements. However, it is important to contact both a tax advisor and their care provider to confirm that this is the case.

Don’t Miss: Can I Pay 1099 Taxes Online