How Many Years Can You File Back Taxes For

If the IRS owes you a refund, you have 3 years to file a return and claim your money. Otherwise, the IRS will let you go back as far as 6 years to file missing returns. You can go back further if necessary, but doing so requires approval from an IRS manager.

Note that although the IRS generally doesnt go back further than 3 to 6 years, skipping a tax filing and waiting for it to get old enough to go away isnt a viable solution to tax problems. The IRS doesnt make it a point to go back more than a few years, but they can go back as far as they like if they suspect fraud.

Taking care of old tax problems is a smart move, but it can be a complicated one. Getting all the old forms and instructions right can be tricky, as can determining the best payment plan for your situation, if applicable.

The professionals at Picnic Tax are ready and able to help you navigate the rules for dealing with back taxes and a past due return. Well help you complete your return, file it and devise a way to work out payments with the IRS if necessary.

The task at hand may seem daunting, but with a little patience and help from us, you can get back on track and stop worrying about your overdue taxes or returns. Sign up today and get help from knowledgeable professionals who will help you without judging your past tax mistakes.

How To Check When You Will Receive Your Tax Return

IRS2Go is the official mobile app of the IRS, which you can use to check your refund status, make a payment, find free tax preparation assistance, sign up for helpful tax tips and more. The app is available in Spanish and English, and you can download it from Google Play, the Apple App Store or Amazon.

You can also use the “Where’s My Refund” tool on the IRS website. To check your refund status, you will need your social security number or ITIN, your filing status and the exact refund amount you are expecting.

The IRS updates the tool’s refund status on a daily basis, usually overnight, so check back in routinely for the most up-to-date information.

If it’s been more than 21 days since you e-filed your federal tax return, you should you call the agency directly.

If you haven’t filed your taxes for the 2021 tax year yet, consider going with a tax prep software that offers expert tax assistance. Speaking with a tax-prep expert may help ensure that your return is accurate, which can help facilitate a timely return.

Here are Select’s top picks for best tax filing software:

- Best overall tax software: TurboTax

Get A Copy Of Your Notice Of Assessment

- Online:

-

View your notices of assessment and reassessment online. Sign in to access and print your NOA immediately.

Alternative:MyCRA web app

- Get a copy by phone

- Before you call

-

To verify your identify, you’ll need:

- Social Insurance Number

- Full name and date of birth

- Your complete address

- An assessed return, notice of assessment or reassessment, other tax document, or be signed in to My Account

If you are calling the CRA on behalf of someone else, you must be an

- Telephone number

-

Yukon, Northwest Territories and Nunavut:1-866-426-1527

Outside Canada and U.S. :613-940-8495

-

8 am to 8 pm Sat 9 am to 5 pm Sun Closed on public holidays

Read Also: How Are Qualified Dividends Taxed

You Claimed Certain Tax Credits

Tax credits reduce your tax liability on a dollar-for-dollar basis. Certain tax creditsincluding the Earned Income Credit and the Additional Child Tax Creditoften draw scrutiny from the IRS due to taxpayers claiming these credits fraudulently. If you claimed either credit, that could be the reason your refund hasnt arrived yet.

What Do I Use For My Original Agi If My Filing Status Has Changed From Last Year

If your filing status changed from the previous year to “Married Filing Joint”, then each taxpayer will use their individual original AGI from their respective prior year tax returns.

If the change is from “Married Filing Joint”, then both taxpayers will use the same original AGI from the prior year’s joint tax return.

You May Like: How To Apply For Tax Exemption

View Your Annual Tax Summary

View your Annual Tax Summary and find out how the government calculates and spends your Income Tax and National Insurance contributions.

- From:

- 5 February 2021 See all updates

Use this service to view your Annual Tax Summary. The summary shows:

- your taxable income from all sources that HMRC knew about at the time that it was prepared

- the rates used to calculate your Income Tax and National Insurance contributions

- a breakdown of how the UK government spends your taxes – this makes government spending more transparent

The summary might be different from other HMRC tax calculations. This could be because:

- your circumstances have changed

- some sources of income are not included

The summary is for information only. You do not need to contact HMRC or your employer.

Sign in using your Government Gateway user ID and password, if you do not have one, you can create one when you view your summary.

First Check Your Refund Status Online

If you are wondering where your refund is, you can start by checking its status on the Internal Revenue Services Wheres My Refund? page.

To do that, the IRS says you will need:

- Your Social Security Number or ITIN

- Your filing status

However, the IRS says you should not call unless:

- It has been 21 or more days since you e-filed, or

- The Wheres My Refund? online tool tells you to contact the IRS.

Don’t Miss: How To Pay Ny State Income Tax Online

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

You May Like: Do I Need To File Federal Taxes

Q2 How Do I Get A Transcript Online

Upon successful registration, we give you the option to continue and use Get Transcript Online. Well ask you the reason you need a transcript to help you determine which type may be best for you. Get Transcript Online provides access to all transcript types and available years for you to view, print, or download from your browser. If we dont list the transcript and tax year you need, you must use Form 4506-T instead. Refer to What if Im unable to verify my identity and use Get Transcript Online below.

You may also log in with your username and password any time after youve registered by clicking on the Get Transcript Online button. If you verified an account number and your mobile phone number before, well simply text you a security code to enter and you can immediately proceed to get a transcript.

How To Obtain Old Tax Documents

Do you need old tax documents from the IRS? Here’s the difference between a tax return transcript and an exact copy of your tax return. Learn which one is right for your situation and what steps you need to take to obtain them from the IRS.

Certain situations may require you to have access to your previously filed tax returns. The most common is during a loan application process when your lender requests prior years’ tax information to verify your stated income. You may also need old tax information to amend a prior-year tax return, compare it to your current year tax return, or defend yourself in the case of an Internal Revenue Service audit.

While you should save a copy of your business tax returns for a minimum of seven years, if a situation arises and you need to access an old tax document you do not have in your possession, what should you do?

Recommended Reading: How To View Your Last Year Tax Return

How Do I Get A Copy Of My T4a P

If you have misplaced your copy of your T4A slip, you should be able to get a copy of it from CRA. These slips were to be issued by the end of February, if you are signed up for CRAs My Account service, you can sign in and print it out from there.

Can you file multiple years of taxes together Canada?

As long as you have filed a tax return in the past with the CRA and we have the correct information on file for you, for example, your correct address, depending on the software product you use, you may be able to file returns for tax years 2017 and after using certified tax software.

Is CRA processing paper returns?

Due to COVID-19, the CRA may take 10 to 12 weeks to process paper returns. The CRA will process them in the order they are received. Taxpayers who file electronically and who are signed up for direct deposit may get their refund in as little as eight business days.

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2021 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

Read Also: How To Use Pay Stub For Taxes

What Happens If You Dont File

If youre tempted to just let a missed tax return slide, you should know that doing so can cause a host of issues. Although potentially significant, the most minor issue a missed filing can cause is trouble getting a loan. Getting a mortgage, refinancing your home, obtaining a business loan or requesting student financial aid all require you to submit a copy of your filed tax return. You wont get far if you dont have one.

Possibly more problematic is the possibility of a substitute return. If you dont file a return on your own, the IRS may gather the tax information they have and prepare one for you. Simply letting the IRS do the work for you may sound like an easy solution, but they may not be aware of or overly concerned about any deductions or credits you could take. Theyll simply prepare a basic return and send you a copy. If you dont take any action in 90 days, that return and any tax you owe on it becomes binding.

Once the IRS files a return for you, youll need to pay any tax due. If you dont, the IRS will take collection action. This may include taking extra payments from your paycheck or filing a federal tax lien against you. Note that if you fail to file your taxes several times, the IRS may take criminal action against you as well as collection action.

You Amended Your Return

Amending a tax return can also create a delay. Though the IRS recently changed the rules to allow for electronic filing of certain yearsamended returns , if youre trying to amend an older return, you have to mail it. In that situation, it can take up to three weeks for it to show up in the IRS system, and another 16 weeks to be processed, meaning you may be waiting several months for your refund.

If you owe certain kinds of debts, your tax refund may have been taken, or offset, by the IRS to pay them.

Also Check: Where Can You Get Tax Forms And Instructions

Tax Transcript Vs Exact Copy Of Tax Return

You can obtain an exact copy of your previously filed tax return by filing Form 4506, Request for Copy of Tax Return with the IRS. You can request many types of tax returns on the Form 4506, including:

In some cases, a tax return transcript may satisfy the person or entity requesting your tax information. Most mortgage lenders are satisfied with the information provided on a tax return transcript.

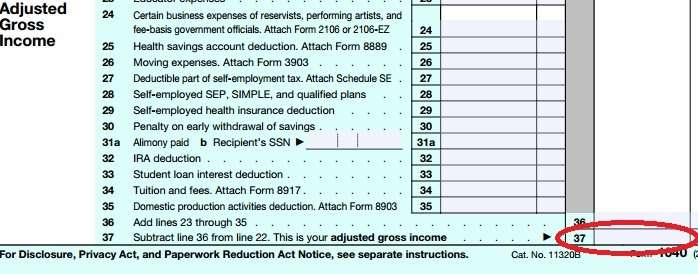

A tax return transcript is a shorter printout of the information on your previously filed tax return. It lists most line items including your adjusted gross income from your original tax return as filed. It does not show any changes made in an amendment to your return. A tax return transcript is only available for the current year and previous three years.

There are several advantages to the tax return transcript. It is free, while there is a small fee for an exact copy of your tax return. The fee for an exact copy of your tax return is $43 as of 2021.

Please note, if you file a tax return jointly with your spouse, only the primary spouse listed on the tax return can request a tax return transcript via the telephone. Either spouse can request a tax return transcript via the website or complete and mail the Form 4506-T. Similarly, either spouse can complete and mail the Form 4506 to request an exact copy of the tax return.

Why You Should File Your Past Due Return Soon

Avoiding penalties and interest is perhaps the most compelling reason to file late tax returns sooner rather than later. When youre struggling and short on cash, your tax bill may feel so overwhelming that $50 in interest and $500 in interest both feel like equally insurmountable obstacles. Eventually, however, the taxman will come calling and when he does, youll want to have yourself in the best position possible. Your tax bill isnt going away, so act today to keep it as low as you possibly can. We promise you that there is light at the end of the tunnel, so keep that tunnel as short as you can.

Youll also need to file previous year taxes if youre due a tax return. This works in two ways. The IRS wont process your tax refund if you dont file your taxes. If you were due a tax refund in 2018 but never filed your taxes, you wont get your 2018 refund until you do. You have three years in which to file your taxes and claim any money youre due. As the kids are fond of saying, if you snooze, you lose. Wait too long and youll forfeit your refund and any tax credits you could have taken.

A missed return in the past can also foul up your refund this year. The IRS pays attention. If you missed filing a return in the past, youre not getting this years tax refund until you either correct the problem or give them a valid reason for skipping out on the missed filing.

Don’t Miss: How Much Tax Do You Pay On Cryptocurrency

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Read Also: How To Pay Ny State Taxes