How Bad Are The Overall Taxes In Texas

Its worth noting here that taxes in Texas may not be as bad as you think. In a report by the Tax Foundation, Texas, with a tax burden of 7.6%, ranked 47 out of 50 states. Excluding property tax, here are the taxes being collected in Texas:

- Franchise Tax: Some wholesalers and retailers are required to pay a franchise tax of 0.375%. For other non-exempt companies, the rate goes up to .75%. This franchise tax is based on total business revenues of over $1.18 million.

- Sales Tax: You will pay 6.25% taxes in Texas for everything you buy except groceries and medication. Some localities add their own tax onto this, which can raise the sales tax to as much as 8.25%.

- Other Taxes: The gasoline tax is 20¢ per gallon. Cigarettes will set you back $1.41 per pack. And hotels charge 6% of the price of your accommodations.

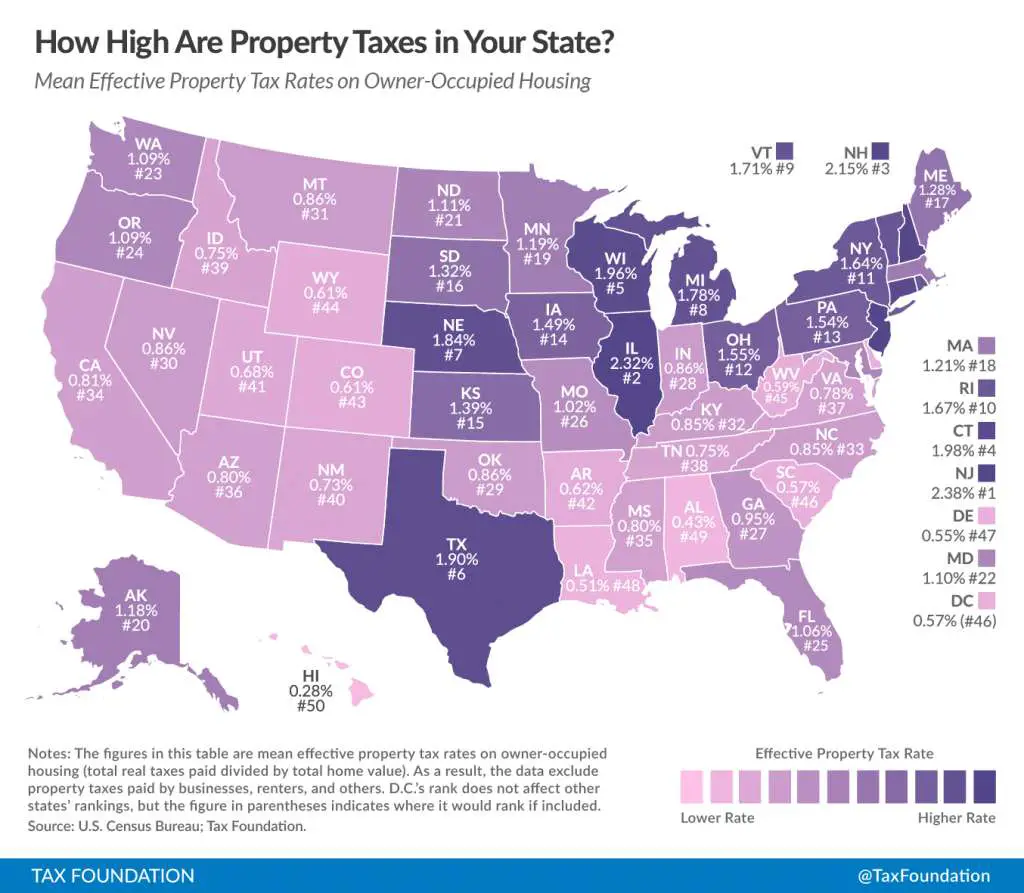

Not only does New Jersey have the highest property tax, but its state median home value is pretty hefty, too, at $335,600. And they pay state income tax.

Reason Number One Texas Is Highly Dependent On Revenue From Property Taxes

Despite having the 6th highest property taxes in the nation, the state of Texas has an average tax burden for its citizens. Sales tax for the state is comparatively low at 6.25% and there are no state income taxes.

However, as taxation is a vital source of revenue for local government, the burden falls squarely on property taxation to make up for the lack of other revenue. This money is utilized for essential resources for Texas citizens, including schools, libraries, emergency services, road maintenance and community safety measures.

If property tax reform occurred, this would likely result in redistributing the tax burden by implementing state income tax or introducing a higher sales tax to make up this shortfall. This is unlikely to occur even though it would mean tax relief on our annual property tax, as many of us enjoy the fact that theres no income tax.

Unemployment Obligation Assessment Rate

The third component of your tax rate is the unemployment Obligation Assessment . The purpose of the OA is to collect amounts needed to pay bond obligations and also collect interest due on federal loans to Texas used to pay unemployment benefits.

The OA is the sum of two parts, the Bond Obligation Assessment Rate and the Interest Tax Rate.

Read Also: Plasma Donation Taxable Income

Other Texas State Taxes

The state’s gas tax has been set at 20 cents per gallon on diesel and unleaded fuels since 1991. That works out to just under $10 per month for the average driver.

Texas taxes cigarettes at $1.41 per pack. Using a hotel, bed and breakfast, or similar short-term stay will cost you another 6% of the cost of the room in taxes. Certain cities, counties, and other districts might impose an additional local hotel tax.

Texas also used to have a fireworks tax of 2%, but this law was repealed effective Sept. 1, 2015.

Texas Property Tax Exemptions

Property tax exemptions reduce the appraised value of your real estate, which can in turn reduce your tax bill. For example, a tax rate of 1.8% applied to an appraised value of $200,000 works out to more than 1.8% of an appraised $175,000 valueit’s a difference of $450.

Texas has several exemptions available.

Don’t Miss: Tax Write Offs For Doordash

What If You Need Help Paying Your Texas Property Taxes

Of course, if you currently have a low income, the fact youre not paying income tax is cold comfort. As the cost of basic essentials rises but your household income does not, you may wonder how youre going to pay your property taxes.

Before you panic, find out if youre eligible for one of six Texas property tax exemptions. If youre over 65 or disabled, check with your tax preparer to see if you qualify. You could save a significant amount of money and discover youre able to manage your taxes in Texas.

If youre not exempt and in danger of becoming delinquent on property taxes in Texas, you could incur debilitating fees and interest. Help is available with property tax assistance from Tax Ease.

Texas Median Household Income

| 2010 | $48,615 |

Payroll taxes in Texas are relatively simple because there are no state or local income taxes. Texas is a good place to be self-employed or own a business because the tax withholding won’t as much of a headache. And if you live in a state with an income tax but you work in Texas, you’ll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. If you’re considering moving to the Lone Star State, our Texas mortgage guide has information about rates, getting a mortgage in Texas and details about each county.

Be aware, though, that payroll taxes arent the only relevant taxes in a household budget. In part to make up for its lack of a state or local income tax, sales and property taxes in Texas tend to be high. So your big Texas paycheck may take a hit when your property taxes come due.

Read Also: Highest Paying Plasma Donation Center Near Me

Reason Number Two Property Values Are On The Increase

How Are Property Taxes Calculated in Texas in Relation to Property Values?

Property tax is determined as a percentage of your homes value, so the more your home increases in value, the higher your property tax bill. For example, a home in Austin that is appraised at a value of $250,000 will pay around $4,933 per year. If this same homes value increases to $275,000, the annual property tax bill will increase to $5,426. This is great for selling your home but is a substantial increase in annual taxation if youre not. If you do find that your home has been overvalued, you can lodge a formal protest to have the property re-evaluated.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Also Check: How Do I Get A Pin To File My Taxes

Exemptions For Seniors And The Disabled

Homeowners who are age 65 or older, or those who are disabled, can qualify for an additional $10,000 exemption for school district taxes and an exemption for other local property taxes that can’t be less than $3,000.

The school district can’t tax any more than what homeowners paid in the first year they qualified, so the tax is effectively frozen. Widows or widowers age 55 or older whose deceased spouse qualified for the 65-or-older exemption can continue to receive the exemption themselves if they apply.

Top Individual Income Tax Rate In Texas Still 0% In 2020

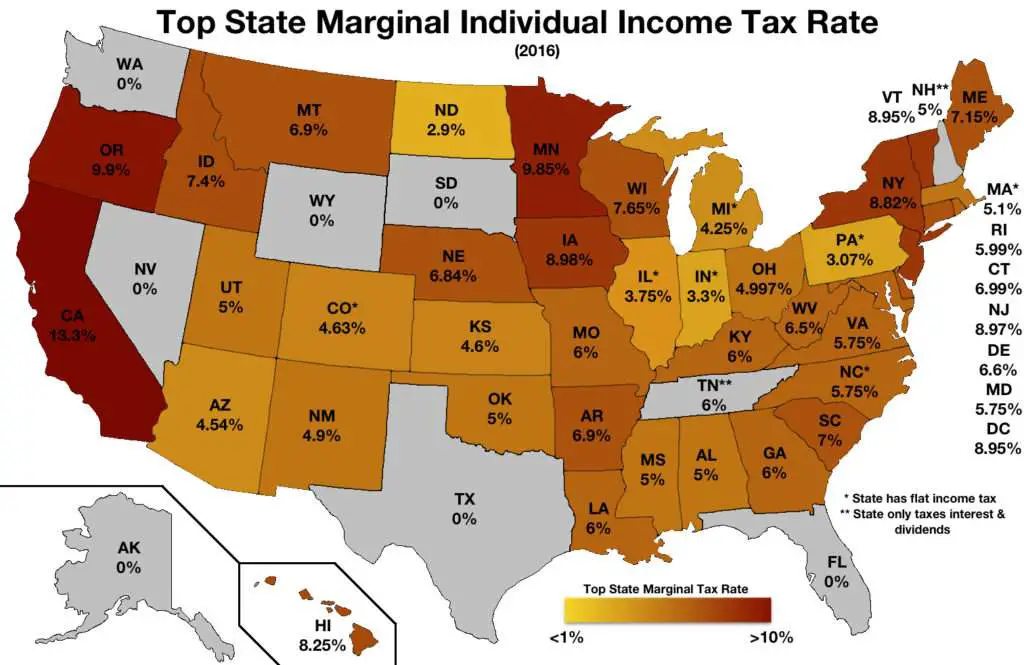

The top marginal income tax rate for residents of Texas remains the lowest in the nation — 0 percent — according to a new study of state individual income tax rates by the Tax Foundation.

The state is among seven states that levy no individual income tax on their residents. Top state income tax rates range from a high of 13.3 percent in California to 1 percent in Tennessee, according to the Tax Foundation study, which was published in February.

Income taxes accounted for 37 percent of state tax revenues in fiscal-year 2017, the analysis said. And among the 43 states that levy income taxes, 41 tax wages or salaries, while two New Hampshire and Tennessee tax only interest and dividend income.

Nine states have single-rate levies on individuals income, while 32 states and the District of Columbia have graduated-rate income taxes.

States with individual income taxes also vary in terms of the number of tax brackets and approaches to deductions and personal exemptions, the Tax Foundation report said.

States Top Marginal Income Tax Rates in 2020

| State |

Read Also: Plasma Donation Taxable

What Is The Tax Rate In Texas

The Texas tax rate is 0% for income taxes.

The states tax revenue primarily is derived from sales taxes and taxes on businesses and industry.

The state does have a property tax, but its collected by cities, counties, and school districts. Learn more about Texas property taxes.

Some additional taxes in Texas include:

- The gas tax, which is 20 cents per gallon on diesel and unleaded fuels.

- The tax on cigarettes at $1.41 per pack.

- Hotel tax is 6% of the cost of the room.

- Franchise tax is .375% for wholesalers and retail businesses and .75% for other non-exempt businesses.

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

Don’t Miss: Irs Forgot Ein

Property Tax Penalties Are Increasing Heres How Property Tax Lenders Can Help

Failing to pay your property taxes on time means facing stiff property tax penalties because the local government is so reliant on this revenue source. Currently, these penalties can amount to around 43% of your current tax bill, which makes it even more challenging for people finding themselves unable to pay on time.

This is a difficult situation to find yourself in, and the last thing you want is to be paying in even more on your bill – fortunately, there is a solution. Property tax lenders can offer you expert advice and services to deliver fast, effective tax relief. At American Finance & Investment Company, Inc, our compassionate and qualified team will settle your bill quickly, your property tax loan and customized repayment plan to help you get back on your feet.

To contact qualified property tax lenders for a property tax loan in Texas, please visit our website today at

What Kind Of Tax Will You Owe On Texas Business Income

Most states tax at least some types of business income derived from the state. As a rule, the details of how income from a specific business is taxed depend in part on the business’s legal form. In most states corporations are subject to a corporate income tax, while income from pass-through entities such as S corporations, limited liability companies , partnerships, and sole proprietorships is subject to a state’s tax on personal income. Tax rates for both corporate income and personal income vary widely among states. Corporate rates, which most often are flat regardless of the amount of income, generally range from roughly 4% to 10%. Personal rates, which generally vary depending on the amount of income, can range from 0% to around 9% or more in some states.

Currently, six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming do not have a corporate income tax. However, four of those states Nevada, Ohio, Texas, and Washington do have some form of gross receipts tax on corporations. Moreover, five of those states Nevada, South Dakota, Texas, Washington, and Wyoming as well as Alaska and Florida currently have no personal income tax. Individuals in New Hampshire and Tennessee are only taxed on interest and dividend income.

The taxable margin, on which the franchise tax is based, is equal to the least of the following four amounts:

Note that various possible state credits and discounts that may apply to your particular business are not covered here.

Don’t Miss: Doordash Driver 1099

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,950 he makes then 12% on anything earned from $9,951 to $40,525 then 22% on the rest, up to $80,000 for a total tax bill of $13,348.

Effectively, this filer is paying a tax rate of 16.69% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 13.28% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

What Is The Texas Corporate Net Income Tax Rate

Texas has a gross receipt tax of 1% on gross income over $1,000,000. You can use the E-Z computation form to get .575% tax if your sales are under 10 million a year. Wholesalers and retailers are automatically at .5% tax.

You must still file the tax return for informational purposes every May 15th. In 2009, Texas passed legislation to move the threshold of gross receipts from 300,000 to 1 million. Finally a state that gets it! Stimulate the economy by lowering taxes and fees Not raising them!

Most Texas businesses will not have to pay anything in tax on the company level or personally.

Don’t Miss: How To Do Taxes On Doordash

Texas Income Tax Rate 2021

Texas state income tax rate table for the 2021 – 2022 filing season has zero income tax brackets with an TXtax rate of 0% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. Texas state income tax rate for 2021 is 0% because Texas does not collect a personal income tax.

Texas income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2021 through December 31, 2021. Outlook for the 2019 Texas income tax rate is to remain unchanged at 0%.

| Single Tax Brackets |

|---|

| 2021 Texas Tax Rate Schedule, published by the Texas Comptroller. |

| $0 |

| 2021 Texas Tax Rate Schedule, published by the Texas Comptroller. |

| $0 |

| 2021 Texas Tax Rate Schedule, published by the Texas Comptroller. |

| $0 |

| 2021 Texas Tax Rate Schedule, published by the Texas Comptroller. | ||

| $0 | 0% |

Please reference the Texas tax forms and instructions booklet published by the Texas Comptroller to determine if you owe state income tax or are due a state income tax refund. Texas income tax forms are generally published at the end of each calendar year, which will include any last minute 2021 – 2022 legislative changes to the TX tax rate or tax brackets. The Texas income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: Doordash Tips Taxable