How H& r Block Compares

Promotion: NerdWallet users get 25% off federal and state filing costs. |

|

Promotion: NerdWallet users can save up to $15 on TurboTax. |

Where Do I Find My Pdf Tax Return

If you want to see your tax return before you file it, you can view your PDF tax return summary on the SUMMARY page under the WRAP-UP tab. This document provides you with an overview of the amounts that were used to calculate your refund or tax owing.

To see your PDF tax summary:

You can open the downloaded PDF by clicking the icon that appears at the bottom of your screen or by searching the folder of your computer. The downloaded file will be named similarly to one of the following examples:

John_CRA_2016_summary.pdfJohn_RQ_2016_summary.pdf

Note: Remember, you can always go back and make changes to your return by clicking the Back button on the SUMMARY page or by using the tabs at the top of the page to navigate to a previous section.

I want to see my detailed tax return before I file

The detailed version of your tax return shows you line-by-line, the federal and provincial forms and schedules youve completed so that you can be confident that you havent missed anything before you send your return to the government.

If you want to make any changes to your return, you can always go back to a previous section by clicking the Back button on the SUMMARY page or by using the tabs at the top of the page.

Extra Fees Will Apply If

- You need state filing. If you live in one of the majority of states that require you to do state income taxes as well, you’ll have to pay an additional $36.99 per state. If you lived or worked in more than one state, you may have to pay for multiple state returns.

- You upgrade to Online Assist. Nearly identical to the online filing options mentioned above, but you can chat instantly and share your screen with a tax expert. The all-in cost is between $69.99 and $194.99 for a federal return.

- You upgrade to full-service preparation: Hand off your tax documents to a professional, either in a physical office or virtually, who will prepare and file your return. These services start at $69.99 for a federal return.

- You pay H& R Block from your refund. If you’re expecting a tax refund, H& R Block will ask if you want to use part of it to pay for its tax prep services. It sounds more convenient than pulling out a debit or credit card on the spot, but beware: a $39 processing fee applies.

Not sure which package is right for you? Go to H& R Block’s website, navigate to the online filing page , and click the “Help me choose” button. Complete the short questionnaire to see which option is best suited for your needs. If you realize you need to add other income or deductions later, you can upgrade to another product while preparing your return.

Recommended Reading: How To File Quarterly Taxes For Business

H& r Block Online: Summary

H& R Block Online is the online division of tax preparation company H& R Block. H& R Block was originally founded in 1955 by Henry and Richard Bloch as a brick-and-mortar tax preparation agency. H& R Block was one of the first tax preparation companies to begin to use computers in the 80s and by the early 2000s, they released consumer-facing tax software called H& R Block Signature which eventually turned into the H& R Block Online filing service we know today.

H& R Block Onlines main consumer-draw is how it streamlines the tax preparation and filing process. With H& R Block, you can either manually enter your tax info or upload tax documents, and the software will calculate your federal return or how much you owe. When you are done, the service will e-file your federal and state taxes.

That means you dont have to go to a tax professional to prepare your documents. H& R Blocks proprietary service will do it for you and help you find the maximum return you are owed. Add in some great convenience features like picture uploads and automatic importation of previous tax information, and you have yourself an extremely easy-to-use service for taxes.

How Much Does H& r Blocks Tax Service Cost

H& R Block offers a free online tax-filing program that includes simple federal and state tax returns. If you need to upgrade based on your tax situation, youll pay $49.99 to $109.99 to complete a federal return, and $36.99 for each state tax return.

At the time of publishing, the company is offering a temporary discount. Filing a federal return costs just $29.99 to $84.99 during the promotion, which brings the pricing more in line with TaxSlayer, the lowest-cost provider we reviewed.

H& R Block also offers in-person tax filing starting at $69 per federal return plus an additional fee for state returns. Its desktop software, which downloads to your computer, ranges from $29.95 to $89.95 for federal returns, and $19.95 for each state return. The in-person and downloadable software options arent included in our review.

You May Like: Can I Still File Taxes

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

How Can I Avoid Tax Penalties In The First Place

File before April 30! Why put off filing and prolong the stress that comes with missing the deadline when theres help at your fingertips.

Overall, if youre unsure about anything when it comes time to file, know that were here to help. If you file with H& R Block online or in an office, you have the option of purchasing Audit Protection or Peace of Mind, which gives you personalized assistance from one of our tax experts for a full year. Theyll be able to explain why youre being audited, ensure you are prepared with all the documents youll need as well as assist you when it comes to communicating with the CRA. H& R Block Tax Experts are available year-round and can answer any questions you may have as well as help you manage any penalties and interest youre faced with. Find anoffice near you, or visit www.hrblock.ca.

Don’t Miss: How Much Does Unemployment Take Out For Taxes

H& r Block File Extension

H& R Block files use the extension format “.tXX,” where XX is the last two digits of the year of the tax return. For example, a tax return for the year 2018 has a “.t18” extension. These files can be opened using H& R Block online or H& R Block software for Mac or Windows and can usually be printed directly.

Diy Tax Options For Expats

Last tax season, H& R Block debuted a package designed specifically for US citizens living abroad.

A federal return covering simple employment income costs $99, and a federal return covering investment and self-employment income runs $149. State returns are an additional $99 each. Reporting of non-US bank and financial accounts is an extra $49.

There’s also an option to file with a tax advisor, starting at $199 per federal return.

Recommended Reading: What If I File Taxes Late

How Much Does H& r Block Cost

Tax prep companies frequently offer discounts on products. The prices listed in this article do not include any discounts. Check the site »

The cost of filing with H& R Block is less than TurboTax, but more than TaxSlayer, TaxAct, or Credit Karma.

H& R Block offers four main ways to prepare and file taxes: do-it-yourself online packages, the option to add Online Assist , full service from a tax preparer, and downloadable computer software.

Each of these categories offers different price points, which are determined by which tax forms you need. With all versions except the computer software, you can prepare your return for free you only pay when it’s time to file.

|

$54.95 – $89.95, plus $19.95 to e-file |

Prices do not include any discounts.

How Does H& r Block Work

H& R Block may be most recognized for its offices scattered throughout the US, but the company offers online filing and downloadable computer software, too. If you choose an online package, you can work on your taxes with the mobile app for Android and iOS devices.

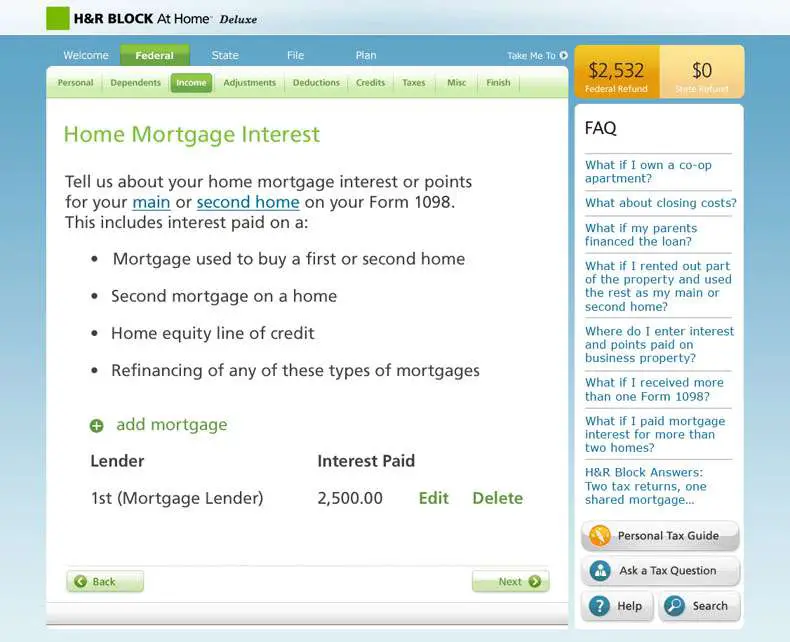

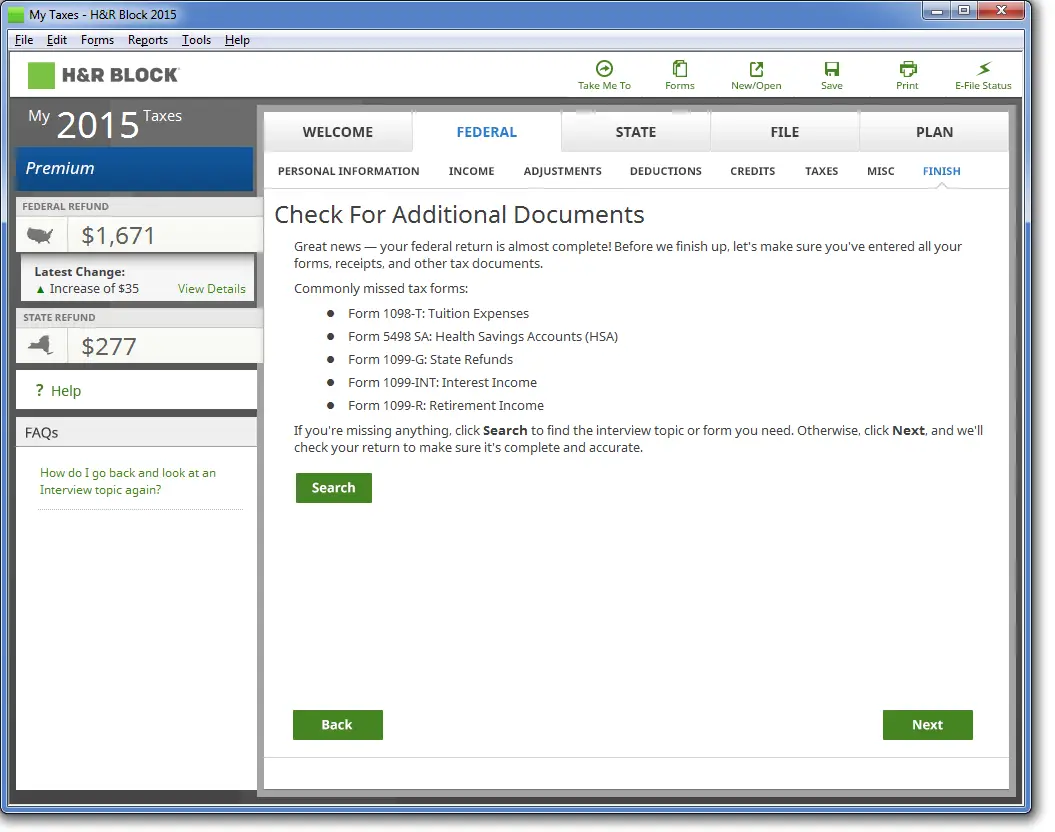

H& R Block caters to the vast majority of tax filers with a modern and easy-to-navigate interface. Like other tax-preparation services, the platform walks users through a series of questions about their household, income, and opportunities for deductions and .

In addition to answering these questions, you’ll need to add information from your employer, other income sources, and 1099, 1098, W-2, and other tax forms that may show up in your mailbox or inbox.

If you’re concerned about making mistakes, missing deductions, or getting lost amidst the tax forms, H& R Block can connect you with a professional in its network for an additional fee.

You May Like: What Is The Tax Percentage Taken Out Of My Paycheck

When Should I Pay Extra To Get Live Assistance From Online Tax Software

The beauty of well-designed tax software is that most filers won’t need to pay extra for expert help. All of the answers you need should only be a few clicks away, and if you need technical assistance , support should be easily accessible.

If you find yourself constantly wanting to speak with a human tax expert or if you know your tax situation is complicated, you may be better off selecting tax software with tax expert support or simply hiring a CPA, or certified public accountant, on your own.

Flaws But Not Dealbreakers

More than any other tax-prep software we reviewed, TurboTax kept prompting us to add services such as more advanced support or identity-theft insurancethings that are unnecessary for the majority of households that have basic returns covered by TurboTax Free Edition. This means you need to be vigilant as you click through each screen in order to avoid falling for the unnecessary upsell.

As reported in The Washington Post, TurboTax now asks for additional permissions when setting up your account, which it claims will enrich your financial profile, communicate with you about Intuits services, and provide insights to you and others. In reality, its a way for Intuit to use your tax information to offer you more personalized ads. We strongly urge you to decline this request in order to keep your data as safe as possible. If youve inadvertently accepted and want to prevent Intuit from using your data, you can email [email protected] and let them know that youd like to revoke your consent for use of tax return information.

You May Like: How To Claim Gas On Taxes

Claim The Caregiver Amount:

If your parent are dependent on you by reason of mental or physical infirmity you may be eligible to claim the Canada caregiver amount. You will need a note from their doctor describing their condition. The Canada caregiver amount is worth $6,986 less their net income in excess of $16,405. This means that the amount is reduced to zero if their income is in excess of $23,391.

What Services Does H& r Block Provide

In-person services

If you choose to use H& R Blocks in-person services, then you can make an appointment with a tax professional to look over your taxes and prepare them for filing. In keeping with the times, H& R Block offers you the option of uploading all of your documents and having a professional prepare and file them virtually, or going into an office and doing it the old-fashioned way. You also have the option of simply dropping off your files at a branch. Once youve gathered everything you need, the professional assigned to you will prepare your return. If additional documents are required, youll be notified.

In addition to these very straightforward services, H& R Block also offers tax resources for U.S. citizens living outside of the U.S. You also have the option of purchasing audit protection, which means H& R Block will review any official tax-related correspondence you receive and represent you in case you get audited.

Online

While you have the option of having your taxes reviewed and your return prepared online by a professional, H& R Block also offers you the option to file your taxes yourself online, thanks to their filing software.

This service can cost as little as $0, provided that your taxes are relatively straightforward. Autofill features help guide the process along. And you can easily upload any necessary documents and forms into the software system.

You can also add audit protection and get an additional expert to review your return.

Don’t Miss: How Do I Qualify For Child Tax Credit

What Does H& r Block Offer

H& R Block states that its tax professionals have access to its Tax Institute, which is staffed primarily by certified public accountants , enrolled agents, tax attorneys, and former IRS agents. This is a good thingthere’s lots of experience there.

However, this may raise a question for you: What’s the expertise of the individual who will be preparing your tax return? When and why should this person reach out to the professionals who are manning the Tax Institute?

H& r Block Vs Turbotax: User Friendliness

Both of these services are known for their ease of use, but TurboTax is generally the more user-friendly of the two. This is generally true for both desktop and mobile users.

TurboTaxs interview-style approach will guide you through the filing process with simple and straightforward questions. There is minimal tax jargon. H& R Block is also user-friendly, but its questions and explanations are not always as clear as you would hope.

The filing process with TurboTax also includes encouraging phrases throughout. This isnt a necessary feature, but taxes are stressful for many people. Seeing, You can do this, throughout the process may help to reduce some anxiety.

Another important consideration is how easy it is to upload documents. Both services do well on this front. H& R Block and TurboTax both let you upload your W-2 by taking a picture of it. Both services allow you to import your previous returns no matter which tax service you used . They also make it easy to fill out your state return after going through your federal return. Your information quickly transfers so you dont waste time retyping everything.

Read Also: How To Report Tax Evasion

How To File Taxes With H& r Block

Can I access my W-online? Yes, you can request a copy of your W-be sent to you by mail by completing and submitting the W-Duplicate . Give us a call for further information. A paper copy of your W-form from Walmart will be available by January 31.

Pay account to get your W2.

The easy solution is often to ask your employer or human resources department for . Form W-, Wage and Tax Statement , is printed and mailed to the residence address of record for each employee receiving wages from an organization . If you used our mobile . After I filed my income tax return I received another Form W-2.

Current Employees Your Electronic W-will be available by logging into CIS, in the Employee section, click the Payroll, . to myHR . How do I get my Form W-? Enter Last Digits of SSN and . Requests for copies of your W- must be made to your employer. Follow these instructions to access your Form W-2. Like asking for your pay stubs, you can get your W-by calling or sending an e- mail to your payroll administrator.

Check if they have your . The IRS will offer to complete a form and send it to your employer requesting that a W-be sent to you. What If My W-Arrives Late? Get Your W-Statement Electronically. Current City employees of Mayoral Agencies, the Department of Education, the New York City Housing Authority . As a Disney Program employee, your W-will be mailed to your mailing address or, if you.

Claim Nursing Home Expenses:

For full-time care in a nursing home, theres no limit on the total that your parents can claim as medical expenses. If you pay your parents nursing home fees, you might be able to claim them as a medical expense, however youll be subject to limits. Its important to know that you cant claim both nursing home fees and the Disability Tax Credit, so it might make more sense to restrict your claim to the attendant care portion of the fees, as long as they dont exceed $10,000.

Want more cash in your pocket for making memories? If youre in your golden years or taking care of a family member who is, take a minute to review what credits and deductions you could both be eligible for.

Read Also: How To Do Taxes For Doordash