Quarterly Estimated Taxes: What Are They

The United States government, like many other countries around the world, follows a pay as you earn model of taxation. In simple words, it means that you should be paying taxes for each month you make an earning.

While this is something, which is easier to maintain for salaried professionals, the same becomes complicated in the case of self-employed businessmen or freelancers.

If you are earning a salary, your company deducts a certain percentage of your income every month, which is then paid as your income tax. This does not involve a lot of hassles and the company accountant or tax team helps you get everything done.

However, people who are running businesses need to follow the quarterly tax model. They need to estimate their income for the coming months and then pay accordingly. This might be easy if you have regular clients and income month-on-month.

The following are certain categories of individuals who should pay quarterly taxes in 2020-

- Self-employed

- Property Owners

- Investors

In order to qualify for exemptions means that your total taxable income needs to be $0 USD. This is impossible unless you do not have any earnings or are a household.

Send An Estimated Quarterly Tax Payment To The Irs

Now that youve figured out your quarterly tax payment, all you have to do is pay Uncle Sam! You can pay your quarterly taxes several ways:

- Pay online. You can go to the IRS payment page and set up online payments for your taxes using a bank account or a debit card.5

- Pay by phone. You can enroll for free in the Electronic Federal Tax Payment Service and use their voice response system to pay your taxes over the phone.6

- Pay by app. This is the 21st century, so now you can pay your taxes through the IRS2Go app right on your phone or tablet.7 What a time to be alive!

- Pay by cash or check. You can go really old-school and pay in person at your local IRS office or mail in a check or money order.8

And there are a couple more things to remember. First, the taxes above are just an estimate. You still need to file a tax return by Tax Day to show what you actually made during the year. This is also when you can claim credits and deductions that lower your tax bill.

And second, if business is going well and you see that your income is going to be higher or lower than you thought it would be, you can always adjust your estimated taxes each quarter.

How To File Quarterly Taxes: Full Guide For Content Creators And Freelancers

- Pin

Trying to figure out how to file quarterly taxes can be tough. I get it!

Being your own boss has amazing perks. You set your own hours, create your own rules, and the sky is the limit in how much you earn. But, theres a downside youre also responsible for paying your own taxes.

Since you dont work for an employer who would take your taxes out of each paycheck, you must send your tax payments to the IRS yourself, quarterly.

Its a big responsibility, but once you get the hang of paying quarterly taxes, it becomes just another business chore you must handle.

Heres what you must know.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSUREFOR MORE INFO. Which means if you click on any of the links, Ill receive a small commission.

Recommended Reading: Do You Get Taxed On Doordash

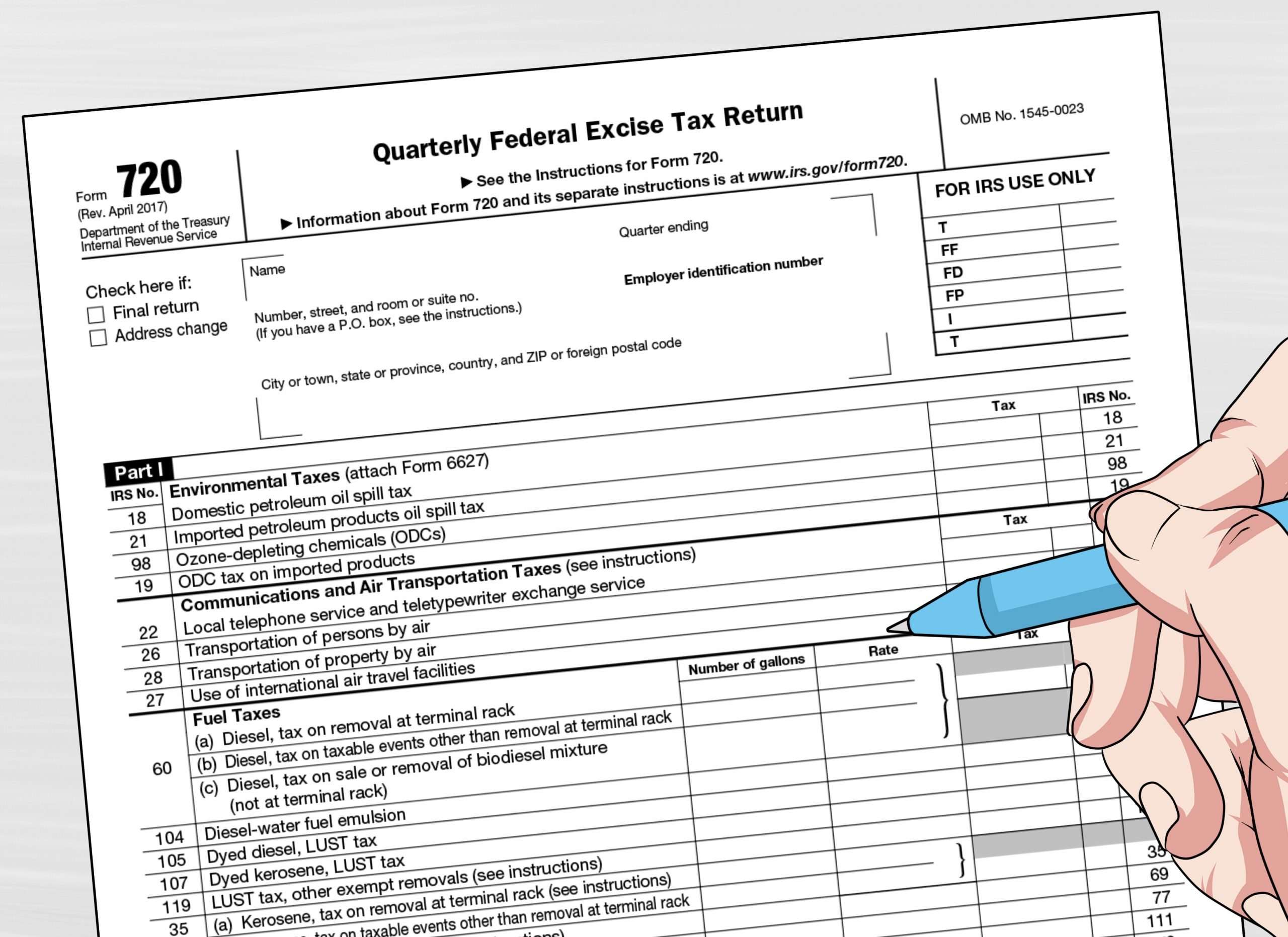

Fill Out A Form 1040 Es

Once youve calculated how much you need to pay in estimated taxes, its time to pay the piper. Youll need to fill out a Form 1040 ES each quarter when you submit your estimated payment. This will clarify what your income is and what your tax responsibilities are. This is also where you can remedy miscalculations.

If your business is doing better than you expected, you can correct your estimated taxes when you fill out your Form 1040 ES. If you arent doing well as youd hoped, you have a couple of options. You can request a refund, but wed recommend you apply the surplus to the next quarters taxes.

What Happens If You Dont Pay Quarterly Estimated Taxes But Should

If you shouldve paid estimated taxes but didnt, you may be subject to a penalty. The IRS will usually calculate the penalty for you, but if youre curious, you can calculate it yourself with Form 2201 Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Tax law is complex and the laws surrounding quarterly estimated tax payments are no exception. You can read the IRSs Publication 505 Tax Withholding and Estimated Tax for additional insight, but its a good idea to talk with a tax professional to make sure you and your business are compliant with applicable laws in order to avoid unwanted penalties.

Read Also: Opi Plasma Center

Other Actions To Take Quarterly

Although filing quarterly taxes may not be a requirement for you, note that you need to pay enough income tax throughout the year to cover your income tax bill. Your bill will include a self-employment tax, which is your contribution to Social Security and Medicare. Filing your quarterly estimated tax returns in advance is wise because you avoid paying interest and penalties in April. Filing quarterly estimated payments also allows you to spread out the payment throughout the year instead of having to make a large, one-time payment, which can be hard on a small business. You will need to use Form 1040-ES to file these estimated tax payments.

For more information about small businesses and their tax obligations, please visit FindLaw’s Business Taxes section.

Deadlines For Annual Taxes

Most small-business ownersincluding members of partnerships, S corporations, and C corporationswill file annual taxes. The exact due date depends on the type of business you own:

- is the tax-filing deadline for partnerships, multi-member LLCs, and S corporations

- May 17 is the tax-filing deadline for sole proprietors, single-member LLCs, and C corporations .

The IRS only recently extended this years tax-filing deadline for individuals to May 17. If you want extra guidance on when your taxes are due, we recommend consulting with an accountant.

If your C corporation ends its fiscal year on a date other than December 31, business taxes are due four months after the end of your fiscal year.

Read Also: Where Is My Federal Tax Refund Ga

You Should Pay Your Small Business Tax

You will need to determine the tax year your small business will operate in the first time you pay taxes. Although it is often easier to keep the year in

You will need to pay a lot oftaxes as a small business owner. The minimum tax payment required by business owners is four times per year. Regular deposits are also required for employment taxes.

Are There Any Penalties For Those Evading Paying Quarterly Taxes

It is important for businessmen to understand that not paying quarterly taxes can make them eligible for penalties. Even if you are paying late, the IRS can charge you a certain percentage of the tax amount as interest and add it to the penalty.

It does not matter if you are eligible for a tax refund after the final calculation. If you miss quarterly payments, you will be fined.

According to the IRS, exemptions are possible but only subject to very stringent regulations. If a self-employed person has been a victim of a natural disaster or has himself or herself been injured in unnatural ways, you can seek exemptions.

The IRS also exempts those that are senior citizens and are retired or suffer from some disability. It interprets such cases as failure to pay because of a reasonable cause.

Also Check: Ein Free Lookup

How Do You File Quarterly Business Taxes

Quarterly estimated tax payments can be mailed using the printable vouchers in Form 1040-ES or use IRS Direct Pay to pay online. State and local taxes may not require quarterly filing, and may have their own procedures for payments, so work with a tax professional to be sure youre paying taxes correctly.

Divvy makes it easy to track all of your business expenses and payments in one seamless platform. Spend smarter by signing up now.

What Taxes Must Self

Like other taxpayers, self-employed individuals will file an annual return. However, they will usually make tax payments every quarter. Tax payments usually fall into two buckets: self-employment tax and income tax on profits from the business.

For 2022, the self-employment tax rate on net income up to $147,000 is 15.3%. This percentage is broken down into 12.4% for Social Security tax and 2.9% for Medicare tax. Also, if your net earnings exceed $250,000 and youre , $125,000 if youre married but filing separately or $200,000 for all other taxpayers, you must pay an extra 0.9% Medicare tax.

Keep in mind, usually only 92.35% of your net earnings are subject to self-employment tax.

Also Check: Plasma Donation Income

How Do I Keep Track Of My Quarterly Tax Payments

After youâve made your payment, make sure to keep records indicating the date and amount that you paid. Youâll need this information to file your taxes.

If you forgot to record how much youâve already paid, don’t worry! You can verify this information by requesting a transcript from the IRS.

Once you’ve jotted down your payment information, you can officially stop stressing out about your quarterly taxes. Think of it this way â you may have just saved yourself thousands in penalties, and that’s something worth celebrating.

Kristin Disbrow, CPA

Kristin Meador is a Certified Public Accountant with over 5 years experience working with small business owners and freelancers in the areas of tax, audit, financial statement preparation, and profit planning. While sheâs not hiking in the Smoky Mountains or checking out new breweries , sheâs working on growing her own financial services firm. Kristin is an advocate and affiliate partner for Keeper Tax.

Find write-offs.

What Are Quarterly Taxes

Whether you should file quarterly taxes or not depends on how your business is structured. The IRS requires independent contractors and sole proprietors to file taxes every three months.

This does not happen with traditional employees, as their employers deduct income taxes directly from their checks.

In other words, anyone who does not have taxes deducted from their salary must file estimated quarterly taxes, as this taxation is also known.

This includes members of companies that operate as Limited Liability Companies, owners of rental properties, and other investors who receive additional income from those derived from their jobs, regardless of whether they are subject to withholdings.

Quarterly taxes fall into two categories: the independent employment tax and the business income tax or any additional income.

Read Also: If I File Taxes Today Will I Get A Stimulus Check

How Much Should I Pay In Quarterly Taxes

This is where Keeper Tax has your back with our free quarterly tax calculator. Just enter in your state, your expected monthly income from self-employment, and your spouseâs details.

From there, our tool will tell you when the next payment is due, and how much youâll owe to both the IRS and your state.

Who Is Required To File Quarterly Taxes

If you work as a self-employed individual or small business owner, you likely need to pay quarterly estimated taxes. You’re considered self-employed if you work as:

- An independent contractor

- A sole proprietor in a trade or field

- A member of a partnership that conducts business, such as an LLC

- A person who runs a business as your own, including part-time

You May Like: Doordash Tax Deductions

What Is The Qualified Business Income Deduction

You may have a chance to reduce your self-employment income further by claiming the qualified business income deduction. This allows you to reduce your pass-through income from self-employment or owning a small business by up to 20% on your tax return.

You can reduce the net amount of qualified items of income, gains, deductions, and losses tied to your trade or business. This means items like capital gains and losses, dividends, interest income, and other nonbusiness gains and losses don’t figure into this calculation.

In general, to claim the QBI deduction, your taxable income must fall below $163,300 for single filers or $326,600 for joint filers in 2020. Tax year 2021 sees the limits rise to $164,900 and $329,800, respectively.

You first must figure out your self-employment or business income using Schedule C and report your adjusted gross income on Form 1040. From there, you can calculate this pass-through deduction.

Who Pays Quarterly Tax Estimates

Your expected taxes at the end of the year should indicate whether you have to pay each quarter. Heres a breakdown of the threshold for owing quarterly taxes:

- If you expect to owe $1,000 or more at the end of the year: Individuals including sole proprietors, partners or S corporation shareholders are generally required to make estimated payments when their expected tax liability is $1,000 or more. The exception is farmers or fishermen, who must follow different rules for estimated tax payments.

- If you expect to owe $500 or more at the end of the year: Corporations fall under a lower threshold for compliance. If you are incorporated and expect to owe at least $500 in taxes when you file your corporate tax return, you are required to pay quarterly estimated tax payments.

Also Check: How Much Is Doordash Taxes

How Much Do I Owe And When Do I Have To Pay

The Estimated Tax Worksheet will also help you calculate your total tax liability for the year. Once figured, the total is divided into quarterly installments that must be paid according to the following schedule:

If the 15th falls on a holiday or a weekend, then the payment is due the next business day. You may pay more often than quarterly as long as youve paid the total owed by each quarterly due date.

End Word Calculate Your Quarterly Tax Payment

However, its important to take care of the due dates when the tax payment season is near. In order to calculate your tax penalities in 2022 accurately, you can use the best AI-based FlyFins IRS penalty calculator, which helps you to figure out the exact amount of penalty you have to pay in the year. By just providing a few details, you are ready to go. You just need to provide the following information-

- Your status while filing the tax return, whether you are single, married and filing jointly, or married and filing separately.

- Your current income details and the taxes paid during the previous year.

- Tax Deduction method: Standard or Itemized

- Quarterly taxes paid in each quarter

Read Also: Plasma Donation Taxable

Failure To File Penalty

The IRS issues a failure-to-file penalty in case you miss the due date in filing the tax.

How much charges need to be paid under the Failure to File Penalty?

- For failure-to-file penalty, the IRS charges 5% of the tax that is unpaid for each month after the due date. The charges never exceed 25%.

- When both the penalties- Failure to File and Failure to Pay fall in the same month, the share for each penalty is- 4.5% for failure to file and 0.5% for failure to pay, making the total penalty charge 5%.

- After five months, if the tax remains unpaid, the Failure to File Penalty will maximize. Yet the Failure to Pay Penalty go on until the tax is paid, up to its limit of 25% of the unpaid tax as of the due date.

- If your tax filing is two months/60 days late, the minimum Failure to File Penalty is $435 or the total tax required on the return, whichever amount is less.

Why Are Quarterly Estimated Taxes Required

Our tax system is a âpay as you earnâ system â taxes have to be paid as you receive income during the year. The government wants steady income, after all. That’s why taxes are paid through withholding and quarterly payments .

If you work for yourself, income taxes won’t be withheld from your paychecks automatically. That’s why the IRS uses quarterly tax payments instead to get what they’re due.

You can think of estimated tax payments as a form of DIY withholding. When you first find out how much you’re expected to owe in taxes â say, by using our 1099 tax calculator, you might feel taken aback. But if you make your payments every quarter, you won’t feel overwhelmed in April.

There’s one more major benefit to paying quarterly: you won’t get hit with a penalty. More on that later!

Also Check: Does Doordash Issue 1099

How To File Quarterly Taxes: A Small Business Guide To Quarterly Estimated Tax Payments

Myranda Mondry,

When you think about tax time, you probably think about the whirlwind of tax forms that occurs between January 1 and April 15. But, in actuality, tax time comes four times a year.

The United States tax system is pay as you go, meaning you pay income taxes as you recieve income rather than all at once at the end of the year. These tax payments are broken up into four installments that occur once every three months called quarterly estimated tax payments. And if you expect to owe more than $1,000 in taxes at the end of the year, you need to make these payments.

But dont worry. More than likely, youve been making these quarterly payments all along and just didnt realize it. If you work for an employer and submit a W-4 form, your employer calculates your quarterly tax payments for you and automatically withholds them from your paycheck. However, for small business owners, the responsibility of calculating and paying quarterly estimated payments falls on you. And it all starts with determining how much youll owe in taxes by the end of the year.