Qualifying Rules If You Can Be Claimed As A Dependent

You must file a tax return for 2020 under any of the following circumstances if you’re single, someone else can claim you as a dependent, and you’re not age 65 or older or blind:

- Your unearned income was more than $1,100.

- Your earned income was more than $12,400.

- Your gross income was more than $1,100, or $350 plus your earned income up to $12,050, whichever is greater.

Married dependents who are not age 65 or older or blind are subject to these filing requirements plus one more: They must file if their gross income was at least $5, and their spouse files a separate return and itemizes deductions.

Tax Breaks For College Students

One advantage of filing taxes as a student is that you may qualify for education credits or deductions. Two types of tax credits exist for college students or people who claim students as dependents.

AOTC is available to some students or parents of students. To qualify:

- You must be in your first four years of higher education.

- You must be enrolled in a degree, certificate, or another postsecondary program at least half time.

- The filer’s MAGI must be under $90,000.

AOTC offers a credit back for certain education expenses, such as tuition, up to $2,500. In addition, this credit is refundable. That means if the credit covers more than the amount of taxes you owe, you can get some of the remaining credit refunded to you.

If you don’t qualify for the AOTC, you may still be eligible for the LLC. The LLC is for part-time or full-time students enrolled in a degree, credential, or job-skills training program. Plus, you can use it even if you’ve already completed four years of higher education.

The LLC may provide up to $2,000 in credit. Unlike the AOTC, it is not refundable. To see if you qualify for either student tax credit, make sure you complete form 8863.

What Tax Forms Do Students Need

If you’re filing taxes for the first time as a student, it’s a lot to keep track of all the forms you need. Here are some of the key forms for student taxes.

- 1040: This is the basic income-reporting form that nearly everyone uses. You might have to complete multiple add-ons called schedules. You should complete Schedule 1 if you made student loan payments. Complete Schedule 3 if you want to claim credits for education or child care expenses.

- State tax return forms: States have their own rules for who must pay state taxes. State tax websites typically provide forms for residents, nonresidents, and part-year residents.

- 1098-T: This form tells the IRS how much you paid in tuition and fees. Your school completes it and mails it to you or a parent. You need to include it when you file your taxes.

- 1098-E: Did you pay any interest on student loans last year? If so, your loan servicer should mail you this form. Include this with your tax filing to deduct interest payments from your taxes.

- 8863: Download and complete this form to see if you qualify for tax credits for college students.

- W-2: If you made $600 or more at work last year, your employer must provide you with a W-2. This form will show if you had any income tax withheld. Make sure you include it when you file your tax return.

Recommended Reading: Mcl 206.707

Figuring Out Your Dependency Status In College

Your parent, foster parent, or another relative likely claimed you as a dependent on their taxes in the past. As long as you’re in school, a relative can claim you as a dependent until you’re 24 if they provide more than half of your financial support.

Your dependency status matters for a couple of reasons. First, as mentioned above, it affects whether or not you must file taxes as a student. Second, the person who claims you as a dependent may qualify for deductions and education-related tax credits.

Filing To Report Self

Your child can report income from self-employment using Form 1040 and Schedule C . If your child has a net self-employment income of $400 or more , the child must file a tax return.

To determine if your child owes self-employment taxes , use Schedule SE. Your child may have to pay self-employment taxes of 15.3%, even if no income tax is owed.

You May Like: How Much Tax Do You Pay On Doordash

What Happens When Two Or More Taxpayers Claim The Same Dependent

The IRS will step in to straighten things out if two tax returns are submitted claiming the same dependent. It will inevitably flag both returns if its computer finds that the dependents Social Security number has been entered on two or more tax returns. The losing taxpayer will probably have to pay additional taxes, plus penalties and interest.

Your Child’s Investment Income

The rules change when your child receives income from sources other than employment, such as interest and dividend payments. When the 2021 total of this type of income exceeds $1,100, then a return must be filed for your child.

If your childs unearned income only consists of interest and dividends, then you can elect to include it on your own return and combine it with your income. Do this by completing IRS Form 8814 and attaching it to your personal tax return .

However, depending on the level of your income, making this election may result in higher income tax than if you prepare a separate return for your child. This is because it could push you into a higher tax bracket, where higher tax rates may apply. If you decide to prepare a separate return for your child, the same reduced standard deduction rules detailed above will apply.

Don’t Miss: Cook County Appeal Property Tax

Reporting A Childs Unearned Income On Your Return

If your child received $11,000 or less in interest and dividends during the tax year, you can elect to report their income on your tax return rather than having them file their own tax return. This can save time and money for families in which children own investments that generate income. To make this election, report the childs income on Form 8814 and include it with your Form 1040.

Keep the following in mind:

- This election only applies if your child has unearned income. You cant report their earned income on your return.

- Your child must be a) 19 or younger, or b) 24 or younger and a full-time student.

Find Help Filing Taxes On Campus

Some colleges offer free financial education through a student money management center, including guidance for student taxes. If you haven’t already, find out what financial education programs your school may offer.

In addition, the IRS partners with colleges throughout the country as part of the Volunteer Income Tax Assistance program. VITA offers free tax guidance to anyone who lives with a disability, speaks limited English, or earns less than $58,000 a year. You can take advantage of this program or even get trained and become a volunteer yourself.

Recommended Reading: 1040paytaxcom

Should I File A Return Anyway

Even if youre not required to file, sometimes its in your own best interest to do so anyways, for the following reasons

- You want to claim a refund.

- Entries on your tax return determine if youre eligible for certain federal and provincial benefit programs. Even if you had no income, you still may qualify for the GST/HST Credit, or provincial benefits such as the Ontario Trillium Benefit. You can find a complete list of provincial benefit programshere.

- Your RRSP contribution limit starts growing as soon as you earn any income. Even if youre not expecting a refund, the more RRSP contribution room, the better.

- If you want to claim the Canada Workers Benefit or if you want to continue receiving your Canada Child Benefit

- If you attended school and have eligible tuition fees, you must declare the amounts on your tax return, even if you are not using them. You might not need to use the credits this year, but in order to carryforward or transfer them, they must be reported on your current year tax return.

- If you or your spouse want to continue to receive Guaranteed Income Supplement on your Old Age Security payments.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Who Is Required To File An Income Tax Return

If you are new to Canada or if you are just entering the workforce, you may be wondering if filing a Canadian Income Tax return is a necessity, and if so, when do you have to file your first tax return?

The Canada Revenue Agency does require annual filing for most citizens but there are exceptions, so lets have a look at who is required to file a Canadian T1 General tax return and when.

Recommended Reading: Efstatus Taxactcom

Claiming A Qualifying Relative As A Dependent

Qualifying dependent relatives include anyone who satisfies a separate set of guidelines from the IRS.

Note that the key difference between this type of dependent and the qualifying child dependent is that this dependent may not have to have lived with you most of the year. For example, a child can be a qualifying relative to you, even if theyâre not a qualifying child, if he or she lives apart from you.

The IRSâs guidelines for qualification are as follows:

-

Relationship: Neither you nor anyone else is claiming him or her as a qualifying child dependent.

-

Income: They earned a gross income of less than $4,300, for tax year 2020, which you’ll report on your 2021 tax returns. For tax year 2021, the income limit to qualify will remain 4,300. There are some exceptions for dependents who have a disability.

-

Support: You must have provided more than half of their support during the year, unless you have a multiple-support agreement for the dependent with another person, or the dependent is a child of divorced or separated parents, or is a victim of kidnapping.

-

Filing status: If he or she is married and files jointly, you canât claim him or her as a dependent.

-

Legality: Your relationship to the dependent doesnât violate local law.

Additionally, the dependent must have lived with you for the entire year unless he or she falls into one of the following categories, which are considered ârelatives who donât have to live with youâ while receiving your support:

This Guide Can Help Your Child Learn The Process And Build Good Habits

As your child moves toward adulthood, you face several milestone decisions that involve, in part, a desire to help your child become more independent and responsible. But one milestone you may not anticipateeven though it will be part of your child’s growing-up experienceis the filing of that first income tax return in their name.

Don’t Miss: How To Report Plasma Donation On Taxes

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

How Much Do You Have To Make To File Taxes

Every taxpayer is entitled to an annual standard deduction a portion of income not subject to income tax. If your 2021 income is less than the standard deduction for your filing status, you generally won’t owe tax.

The standard deduction is taken before taxable income is calculated and can wipe out your total tax liability if you didn’t earn enough.

However, how much you make isn’t the only factor the IRS uses to decide whether or not you need to file a tax return.

Quick tip: Even if you aren’t required to file a tax return, you’ll need to if you want to get a refund of overpaid taxes or claim refundable credits such as the earned income tax credit or child tax credit .

Read Also: Finding Your Ein Number

Do Teenagers Need To File A Tax Return If They Work Part

By Special to MoneySense on July 19, 2019

Like many milestones, this one can be used as a teachable moment for kids and parents.

Q. I have three children, aged 14, 17 and 18. All have part-time jobs and make less than $3,000 per year, which they receive T4s for. They also all make charitable donations.

I have four quick questions for you: Do I need to file income taxes for them? Can I still claim them as dependents? Do I need to claim their income on my tax return? And can I claim their charitable donations?Brad

A. Before I answer your questions, Id like to congratulate your children. I find that most teens are eager to work, and by doing so, they gain valuable skills that will serve them now and in their future careers.

While you do not need to file returns for them , I always urge parents to get their children into the habit of filing an annual return as soon as possible, as it teaches them to be responsible citizens. And by filing a return, they will start to establish some Registered Retirement Savings Plan* room so they can begin to contribute at age 18.

I also recommend that you file together as a family, as this will allow you to claim all the family credits you are eligible forand so that, yes, you can claim your childrens charitable donations as a family on the return which will provide the best tax result. That means more possible savings for your family as a whole.

What does the * mean?

The Child And Dependent Care Credit

This credit covers some of the costs associated with caring for a child or dependent with disabilities, including after-school programs, babysitters or daycare, if that care enabled you to work.

The American Rescue Plan made this credit fully refundable in 2021 only. The maximum eligible expense for this credit is $8,000 for one qualifying person and $16,000 for two or more.

The exact credit amount you might qualify for depends on a few factors, including income. To find out what you might be owed, use this IRS tool. The claim for this credit is made using Form 2441.

You May Like: Doordash Accounting Method

Although You Might Not Be Required To File A Tax Return It Might Be Wise To File One Today Anyway Here Are A Few Reasons Why

Filling out tax forms is a pain in the you-know-what. So why on earth would anyone file a tax return if they don’t have to? Well, actually, there’s one very important reason why you might get a big, fat check from the government.

People with income under a certain amount aren’t required to file a tax return because they won’t owe any tax. But if you qualify for certain tax credits or already paid some federal income tax, Uncle Sam might owe you a refund that you can only get by filing a return. Think about that for a minute!

If you want to know more, here are 9 reasons why you might want to file a tax return even if you don’t have to. Even though dealing with taxes can be a real drag, it’s probably worth it if you wind up with a much fatter wallet in the end.

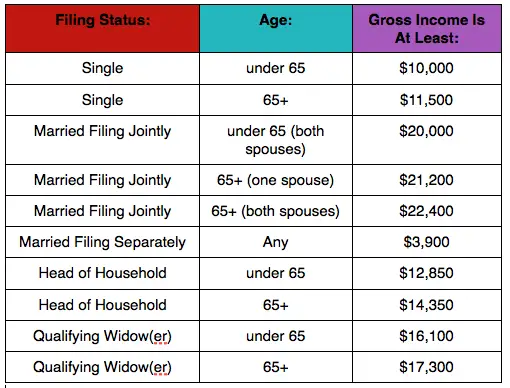

Federal Tax Return Filing Requirements :

|

Filing Status and Age at End of 2020 |

Income Required to File 2020 Return |

|

Single Under 65 |

Can I Claim My Child As A Dependent In Canada

Absolutely. As indicated above, you can claim a child up to age 18 .

Your dependent may be away at school. As long as the child lives with you permanently, you can claim them as a dependent.

In addition, you may be able to claim tuition and education amounts for a dependent child even if they are over 18. Your claim will be reduced by the dependents earnings so if they have any income be sure to complete their tax return first. This will tell you how much you can claim on your own tax return. Normally, students do not earn a lot of money so this can be a valuable deduction to transfer to a parent.

Recommended Reading: Doordash Pay Taxes

Earned Income Tax Credit

The earned income tax credit is a refundable tax credit that helps lower-income taxpayers reduce the amount of tax owed on a dollar-for-dollar basis. Though the credit is available to taxpayers who don’t have children, those with dependents will receive a higher credit. Here’s a look at the EITC AGI limits and maximum credit amounts for 2021:

| EITC for 2021 |

|---|

| $6,728 |