Are Unemployment Benefits Tax

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Receiving unemployment benefits is no different from earning a paycheck when it comes to income taxes, at least under normal circumstances when the U.S. isnt struggling with a pandemic. Unemployment income is considered taxable income and must be reported on your tax return. It is included in your taxable income for the tax year.

While the federal government tweaked this rule in 2020 in response to COVID-19, those who collected unemployment income in 2021 should expect to pay the full taxes on those benefits. As of Nov. 29, 2021, the federal government and the Internal Revenue Service did not say that the rule would be tweaked again.

Heres what to know about paying taxes on unemployment benefits in tax year 2021, the return youll file in 2022.

How To Calculate Your Unemployment Benefits

The Balance

Unfortunately, theres no easy way to calculate exactly how much money youll receive through unemployment benefits or for how long youll be able to collect those benefits unless your state has an online unemployment calculator. However, there are calculators you can use to estimate your benefits.

Each state has a different rate, and benefits vary based on your earnings record and the date you became unemployed. Once you find out whether you are eligible, you can file a claim for unemployment benefits. If youre not sure about your eligibility, check with your state unemployment office. You dont want to lose out on unemployment compensation because you didnt think you would qualify.

Do I Get An Extra $600 On My Unemployment

If you collected unemployment between March 27 and July 31, 2020, you may have been eligible to receive an additional $600 per week in Pandemic Additional Compensation on top of the weekly benefit amount your state would normally pay. That extra benefit expired on July 31, 2020, and the federal government has not yet renewed or replaced it.

But the federal government is also allowing states to extend the period of eligibility for unemployment benefits. So you may be able to claim unemployment for up to 39 weeks, which is about three months longer than would be allowed under normal circumstances.

You May Like: What Tax Form Does Doordash Use

How Long Can I Receive Unemployment Benefits

Typically, you can receive unemployment benefits for up to 26 weeks or until you find another job.

But it can be extended to 39 or even 46 weeks during periods in your state when the unemployment rate is high.

Ultimately, the length of time you may claim unemployment benefits varies by state, so its important to check with your state for more information.

Reporting Unemployment Income For Taxes

Your states unemployment agency will report the amount of your benefits on Form 1099-G. The IRS gets a copy, and so do you. The form will also show any taxes you had withheld.

You must report these amounts on line 7 of the 2020 Schedule 1, then total all your sources of additional income in Part I of the schedule and transfer the number to line 8 of the 2020 Form 1040.

The economic impact payment or stimulus checks that you might have received are not considered to be unemployment compensation. You do not have to pay taxes on this money.

Recommended Reading: Unemployment Office Contact

You May Like: How To Find Employer Ein Number Without W2

Stimulus Checks And Expanded Unemployment Benefits

The COVID-19 pandemic has led to severe economic hardship, with millions of Americans losing their jobs. As a response, Congress passed three key legislation that expanded unemployment benefits and delivered direct stimulus payments to provide economic relief. As more and more people about 20 million people since November 2020 are claiming unemployment benefits, these are the key things to know:

How Much Money Is Withheld From A Paycheck For Unemployment Insurance

The Federal Unemployment Tax Act authorizes the Internal Revenue Service to collect unemployment tax or insurance. The State Unemployment Tax Act mandates the respective state agency to collect state unemployment insurance. In most cases, an employer is not supposed to withhold unemployment insurance from employee paychecks.

You May Like: Stripe Doordash 1099

Unemployment Compensation Is Taxable Many Are Just Figuring This Out As They Sit Down To Do Their 2020 Taxes Even Though They Remain Out Of Work

Erika Rose was shocked this month when she sat down to do her taxes and realized she owed $600 to the federal government. She has been on unemployment since April and has spent much of the winter stretching every penny to pay rent and to keep the lights on. On a recent trip to the grocery store, she had only $20 in her bank account.

I was so upset. How do I owe over $600 in taxes? said Rose, 31, who lives in Los Angeles. I have never been so fearful in my life of how Im going to pay my bills.

Rose is among millions of unemployed workers facing surprise tax bills, ranging from several hundred to several thousand dollars, and many say they just cannot pay. For tax purposes, weekly unemployment payments count as income just like wages from a job. But few people realize the money they get from the government is actually taxable. Fewer than 40 percent of the 40 million unemployed workers in 2020 had taxes withheld from their payments, according to the Century Foundation, a left-leaning think tank.

For people who have been without a job for nearly a year, finding money to pay their tax bills is yet another financial burden coming at a fraught time. Advocates for the poor as well as some Democratic lawmakers are trying to get these tax bills waived entirely or at least reduced.

Getting Started With The W

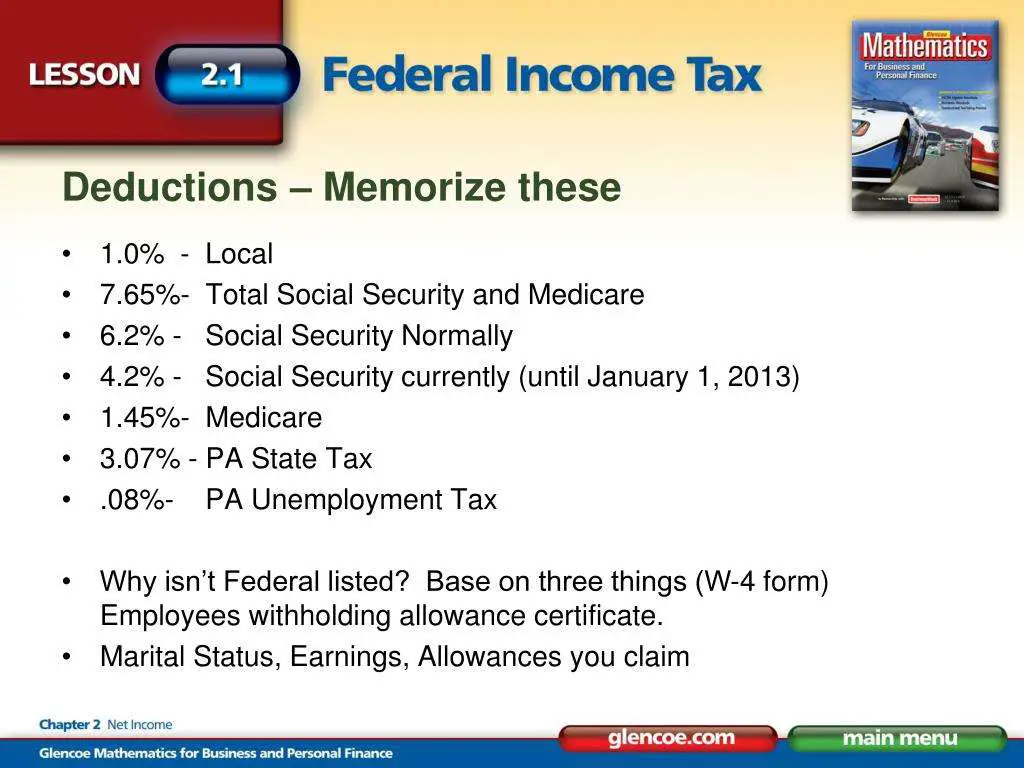

When you begin employment and at certain times thereafter, you fill out a federal Form W-4 withholding form, which is provided by your employer. Prior to the new tax law in 2018, you would also state the number of withholding allowances you wished to claim these were the personal exemptions you took, and they reduced your taxable income.

The new tax law eliminates exemptions, though it also raises the standard deduction. Your employer uses your W-4 form to determine what percentage of federal and state income taxes to withhold from your paycheck.

Recommended Reading: Where Do I Go To File For Unemployment

Also Check: Doordash Stripe 1099

Ask To Have Taxes Withheld

When you apply for unemployment benefits through your state agency, ask to have 10% of your payments withheld to cover federal income taxes, said Oscar Vives Ortiz, a certified public accountant based in Tampa, Florida. If you have the ability to do so, get the withholding in there as youre signing up.

If youre already receiving benefits, you can fill out an IRS Form W-4V, Voluntary Withholding Request, to adjust your withholding. You may also make changes to this on a biweekly basis when youre asked to recertify your unemployment claim, Lin said. Check with your states unemployment insurance program to make sure you follow the appropriate steps. The U.S. Department of Labors CareerOneStop website has links to every states program.

How Taxes On Unemployment Benefits Work

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for unemployment income you received in 2021. The full amount of your benefits should appear in box 1 of the form. The IRS will receive a copy of your Form 1099-G as well, so it will know how much you received. You dont have to include the form when you file your return.

Unemployment benefits arent subject to Medicare or Social Security taxes, only to income tax. This may help reduce your overall tax burden in the year you claim them.

When youre ready to file your tax return for 2021, write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1, Additional Income, and Adjustments to Income. You must file Schedule 1 with your Form 1040 or 1040-SR tax return. Line 7 is clearly labeled, Unemployment compensation. The total amount from the Additional Income section of Schedule 1 is then entered on line 8 of your tax return.

You must report your unemployment benefits on your tax return even if you dont receive a Form 1099-G. Go to your states website if you didn’t receive one and think you should havesome states may not mail out paper versions of the form. The form is usually available electronically, but you can also call your state unemployment office.

If you receive a Form 1099-G but did not collect unemployment benefits in 2021, report it to the paying authority as soon as possible.

Also Check: Doordash File Taxes

Child Tax Credit: July 15 Deposits

Some families received another form of stimulus aid on July 15 when the IRS deposited the first of six monthly cash payments into bank accounts of parents who qualify for the Child Tax Credit . Families on average received $423 in their first CTC payment, according to an analysis of Census data from the left-leaning advocacy group Economic Security Project.

Eligible families will receive up to $1,800 in cash through December, with the money parceled out in equal installments over the six months from July through December. The aid is due to the expanded CTC, which is part of President Joe Bidens American Rescue Plan.

Families who qualify will receive $300 per month for each child under 6 and $250 for children between 6 to 17 years old. Several families that spoke to CBS MoneyWatch said the extra money would go toward child care, back-to-school supplies and other essentials.

Families may enjoy more of a tax break in coming years, if Mr. Bidens American Families Plan moves forward. Under that plan, the Child Tax Credits expansion would last through 2025, giving families an additional four years of bigger tax breaks for children.

Read Also: File For Unemployment Tn

Unemployment Income Isnt Automatically Taxed

Unemployment benefits are considered taxable income by the Internal Revenue Service . However, that doesnt mean taxes are automatically taken out on unemployment payments like a regular paycheck. Youre responsible for accounting for the taxes on these benefitsor else you could face a big tax bill next April.

Like other forms of compensation, unemployment benefits are subject to federal taxes. But state taxes on the benefits will vary depending on which state the recipient lives. For example, states like Alabama, California, Montana, New Jersey, Virginia and Pennsylvania dont include jobless benefits as taxable income.

The nine states without a broad income tax also dont tax jobless benefits. Those states are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

There is no requirement to have taxes withheld from unemployment checks, but doing so could prevent a large tax bill next year.

Read Also: Reverse Ein Search

Your Best Option: Have Taxes Withheld

Upon request, you can have taxes withheld directly from your unemployment check. This is the preferred strategy, because it’s automated and the estimated taxes never hit your checking account. The state will hold back a percentage based on how it taxes unemployment, plus another 10% to cover your federal taxes.

Unfortunately, the 10% federal withholding may be more or less than your actual tax rate. If 10% is higher than necessary, you’ll have lower cash flow today, but you will get a refund next year. If the 10% is too low, you may need to make quarterly tax payments to supplement those withholdings.

You can evaluate the 10% by using the IRS tax withholding calculator or IRS Form 1040-ES to estimate your tax liability. You’ll have to make a few assumptions about your income for 2020, but you can run several scenarios to see how those assumptions change what you owe. If it looks 10% withholding on the unemployment isn’t enough, plan on picking up the slack with quarterly tax payments.

A Good Option: Make Quarterly Tax Payments

If you don’t want taxes withheld from your unemployment checks, or if the withholding is insufficient, you can make direct tax payments to the IRS and your state. These direct payments are called quarterly tax payments, and they’re due four times a year as follows:

- For income from Jan. 1 to March 31, the tax payment is due April 15.

- For income from April 1 to May 31, the tax payment is due June 15.

- For income from June 1 to Aug. 31, the tax payment is due Sept. 15.

- For income from Sept. 1 to Dec. 31, the tax payment is due Jan. 15.

This year only, the IRS and all states have extended the April 15 and June 15 deadlines to July 15, 2020.

You can send in federal tax payments by mail using Form 1040-ES, or make your payments online. Your state should have similar options. Be aware that online payments generally incur some type of transaction fee, which you can avoid by mailing a check.

Recommended Reading: Paying Taxes With Doordash

How Much Will Your Benefits Be

Once you file for unemployment and are approved, you will begin to receive benefits. Your benefits might come in the form of a check, but more often they will come in the form of a debit card or direct deposit to your bank account. It varies by state. You typically can file weekly online, by email, or by phone.

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum.

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available.

Regardless of how much you make, you never can collect more than the state maximum.

Do I Have To Claim My Severance Pay On My Tax Return If I Already Paid Taxes

- Severance pay is a lump-sum payment received from a company when you are terminated due to job closings, company reductions, or even company closures. These payments are typically based on time in service and/or job performance, and as such are taxable as wages. This payment will have the usually Social Security, Medicare, federal and state taxes withheld, which will be reflected on your W-2.

Don’t Miss: Is Freetaxusa Legitimate

How Much Is Unemployment Tax In Hawaii

It was announced by Hawaiis Department of Labor & Industrial Relations that the state unemployment insurance tax rates for 2021 will rise dramatically, ranging from 2.75 percent to 3.75 percent. 4% to 6. There is an increase of 6% on Rate Schedule H, up from zero. 0% to 5. For 2020, the rate will be 6% on Rate Schedule C.

Recommended Reading: How To File For Unemployment In Tennessee

Refunds For Unemployment Compensation

If youâre entitled to a refund, the IRS will directly deposit it into your bank account if you provided the necessary bank account information on your 2020 tax return. If valid bank account information is not available, the IRS will mail a paper check to your address of record. The IRS says it will continue to send refunds until all identified tax returns have been reviewed and adjusted.

The IRS will send you a notice explaining any corrections. Expect the notice within 30 days of when the correction is made. Keep any notices you receive for your records, and make sure you review your return after receiving an IRS notice.

The refunds are also subject to normal offset rules. So, the amount you get could be reduced if you owe federal tax, state income tax, state unemployment compensation debt, child support, spousal support, or certain federal non-tax debt . The IRS will send a separate notice to you if your refund is offset to pay any unpaid debts.

Don’t Miss: Do I Have To File Taxes For Doordash

What Is Unemployment Tax And How Much Are You Going To Pay

Unemployment taxes can be challenging for new and small business owners to understand. Read this guide to navigate the terminology and potentially reduce your tax rate.

No account yet? Register

When employees are out of work through no fault of their own, unemployment insurance provides monies to tide an individual over until they can find another position. Were all familiar with unemployment compensation and how it helps workers bridge the gap between jobs.

From a business owners point of view there are some basics that apply to unemployment taxes that can help you understand the taxes and potentially reduce your rates. There are two main types of unemployment taxes federal and state.

The Federal Unemployment Tax Act is administered by the Department of Labor. All businesses must pay FUTA taxes unless they are government or educational organizations or are exempt as a qualified 5013 charitable or religious organization under IRS guidelines. FUTA taxes are paid to the federal government.

Each state has a State Unemployment Tax Act . Organizations that are exempt under FUTA will also be exempt from SUTA taxes. Each state sets its own guidelines for unemployment taxes, which are paid directly to the state by the employer.

Who pays unemployment taxes?

What are unemployment tax rates?

The current FUTA rate is 0.6% of the first $7,000 of wages: this $7,000 cap is called the taxable wage base. Any wages over $7,000.00 per year are not subject to federal unemployment tax.