Doordash 1099 Tax Basics

DoorDash, like other delivery services such as GrubHub, Postmates, and Instacart and ride-share services such as Lyft in the gig economy, employs delivery drivers as independent contractors.

No state or federal taxes are removed from payments from DoorDash to drivers, and, as independent contractors, drivers are responsible for paying these taxes each year.

As independent contractors, DoorDash dashers are treated more like business owners than employees.

As such, they must pay into Social Security and the Federal Insurance Care Act, or FICA.

After paying FICA taxes, also known as self-employment tax, DoorDash drivers pay federal and state income taxes.

The exact percentages vary depending on your income level, tax bracket, and state.

DoorDash dashers will receive form 1099-NEC forms annually that will note their incomes during the previous tax year.

While paying taxes can be painful, there are plenty of deductions that DoorDash delivery drivers can take to make the tax bill easier to bear.

What Is Schedule C

As independent contractors, couriers are sole proprietors of their own business and must report their earnings by filling out a Schedule C tax form. This form is used to claim profit or loss from your business expenses as an independent contractor.

Schedule C has six sections :

- Identity section. This is where you describe your business activities. Most important is when filling out this section, on Line B, the six-digit business code for food deliveries businesses is 492000 . If you also drive for Uber and Lyft, the code is 485300 .

- Part I is for Income. This is how much you earned from your delivery gigs . The information youll need to fill this section out is found on the 1099-Misc or 1099-K form, which would be sent to you by the companies you drive for.

- 1099-MISC Explained: If you made more than $400 delivering food, youd receive this form. Postmates would not mail you one if you made less than $600. If you made less than $400, you still have to report the earning. Not receiving this form doesnt mean you dont report that earning.

- 1099-K Explained: This is the form for third-party payment transactions. Youd receive this form if you made more than $20,000 and over 200 transactions for the year. Youre more likely to get this in the mail if you drive for Uber or Lyft.

- Part 2 is for Expenses. This includes all the costs you accumulated during the year as an independent contractor. Below, I answer more questions on what you can report as deductible expenses.

Tracking Miles For Doordash Taxes

The IRS introduced an easy way to deduct vehicle expenses so they wouldnt have to hoard or track their receipts.

This method is called the Standard Mileage Deduction. Its really simple to calculate your deduction. All you need to do is track your mileage for taxes. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate.

In 2020, the rate was 57.5 cents. So, if you drove 5000 miles for DoorDash, your tax deduction would be $2,875.

Also Check: Doordash 1099 Example

Am I Eligible For Tax Deductions Working For Doordash

Yes. But like any painstaking math problem, you have to show your work.

You can deduct many expenses to pay less in taxes for income earned through DoorDash. The big one is mileage. You can deduct your mileage for the miles that you drive to your first delivery pickup, between deliveries, and back home at the end of the day.

How much? You can deduct 57.5 cents per mile driven for DoorDash. Why this number? Well the IRS calculated how much on average it costs to use your car. Think of this number as the bulk for gas, maintenance, and car insurance, among other things. Remember this number. Instead of keeping tabs of gas receipts and repair costs, track mileage. Its a lot simpler, and may actually save you more in taxes.

Can I deduct anything else? You bet. You need to use your phone and quite a bit of data. Your phone is deductible. But theres a catch: You can only deduct the expenses based on the percentage of business use. Its tricky to know how much of your phone usage is for work, but figure your best guess. You can deduct the percentage of your phone bill, based on how much is used for work.

Keep a log of these deductibles and have them ready when you file. Remember, a tax deductible lowers the amount of income subject to taxes. Tax credits, on the other hand, reduces the total amount you owe.

S To Create An Invisible Investor Strategy

The greatest mistake that people make when it comes to asset protection for real estate is not understanding the risks that are waiting out there for them. This eBook reveals the structure you should follow to ensure your hard earned money is protected from frivolous lawsuits and costly tax mistakes.

Don’t Miss: Efstatus Taxact Com 2016

What Does This Mean For My Connected Accounts And Contractors

The difference is that the 1099-K lists your total income for the year and then breaks that income down monthly as well. There are many available deductions for the self employed, and you can take as many as apply to you. As a DoorDash driver, however, some are especially helpful and that you absolutely dont want to miss. Welcome to compsmag.com an online Tech Publisher based on technology and reviews. Is there anyone else who hasnt gotten their 1099 yet? I have contacted DD support multiple times and still havent gotten a concrete answer.

Silver Tax Group Can Help With Your Doordash Taxes

Working as a delivery driver gives you a lot of freedom and the chance to make good money, but it can be challenging to figure out your tax obligations. Silver Tax Group has an experienced team that can assist you in preparing your DoorDash taxes and taking advantage of any deductions available to you.

Our expert tax attorneys have a long record of success in getting the best tax outcomes for our clients and defending them in any disputes with the IRS. Contact our office today for a quick consultation about DoorDash taxes or any other taxation questions.

Ready to secure your financial future? Subscribe Today For Tax Knowledge Tomorrow

Read Also: 1040paytax.com

What Deductions Can I Claim For Doordash

Here are the most common business tax deductions for dashers: Your phone & accessories used for work. Car loan payments. Gas is deductible using the standard mileage rate. Car maintenance. Parking fees while working. Tolls when picking up or delivering. Vehicle depreciation over time. Car insurance & registration.

Fica Taxes For Dashers

FICA stands for Federal Income Insurance Contributions Act. Your FICA taxes cover Social Security and Medicare taxes â 6.2% for Social Security, and 1.45% for Medicare.

Technically, both employees and independent contractors are on the hook for these. The bill, though, is a lot steeper for independent contractors.

That’s because employers match their W-2 employees’ FICA tax payments. If you’re self-employed, though, you’re on the hook for both the employee and employer portions, bringing your total self-employment tax rate up to 15.3%.

Thanks to that 15.3%, first-time freelancers can be pretty shocked when they see their tax bills. To avoid being taken by surprise, check how much youâll owe using our 1099 tax calculator. That way, you’ll know how much to set aside.

There is some good news here: you’re allowed to write off the employer portion of your FICA taxes on your income tax return. And, of course, there are other write-offs you can use to bring your tax bill down to a manageable level. More on that later!

Recommended Reading: Do I Have To Claim Plasma Donations On My Taxes

Subtract Deductions And Adjustments

As I noted at the end of Step 1: Your business expenses don’t go here. You don’t need to itemize to claim those business expenses. What we’re talking about here are your personal tax deductions.

For the sake of simplicity, this calculator is going to do three things:

Requirements For A 1099

If you receive deposits from a partner platform like PayPal, you may receive a tax form 1099-K.

A Dasher would need to have conducted 200 transactions and have a gross volume of $20,000 to meet the 1099-K requirements.

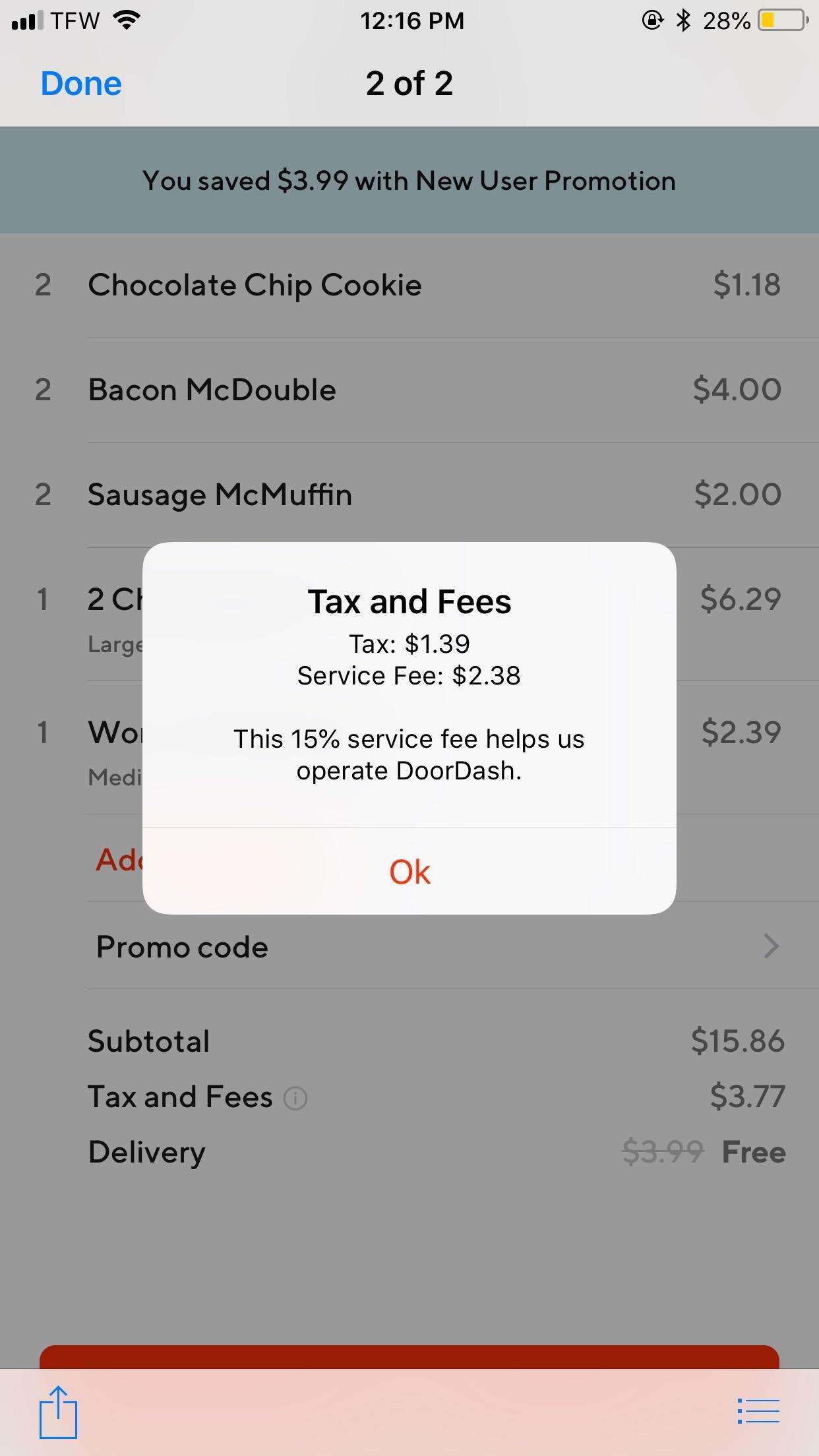

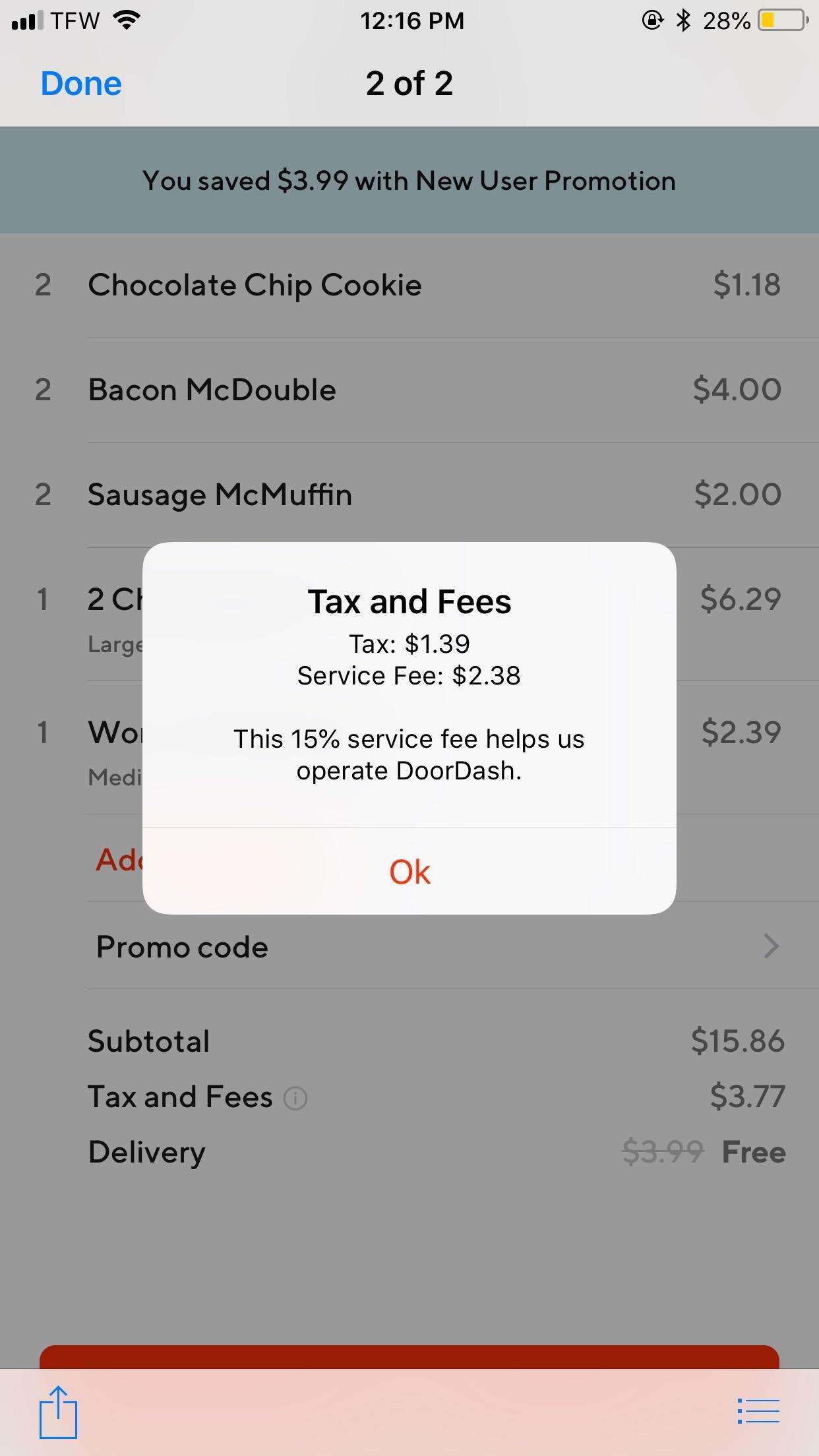

Gross Volume, which in DoorDashs case is the subtotal of payments and tax on processed orders.

However, there is one exception to this rule. If you made more than $600 in total earnings from deliveries in Vermont or Massachusetts, you will receive a 1099-K regardless.

Recommended Reading: When Is Sales Tax Due

Also Check: 1040paytax Irs

What Defines A Verbal Contract

A verbal contract refers to an agreement between two parties that’s made âyou guessed itâ verbally.

Formal contracts, like those between an employee and an employer, are typically written down. However, some professional transactions take place based on verbally agreed terms.

Freelancers are a good example of this. Often, freelancers will take on projects having agreed on the terms and payment via the phone, or an email. Unfortunately, sometimes clients don’t pull through on their agreements, and hardworking freelancers can find themselves out of pocket and wondering whether a legal battle is worth all the hassle.

The main differences between written and oral contracts are that the former is signed and documented, whereas the latter is solely attributed to verbal communication.

Verbal contracts are a bit of a gray area for most people unfamiliar with contract law âwhich is most of us, right?â due to the fact that there’s no physical evidence to support the claims made by the implemented parties.

Can They Deliver This Form Another Way

The 1009 form is delivered to you by the method of your choice. You can change the delivery preference any time, as long as its a week before the due-date. This is how you can do it via your Payable account:

You should select a delivery preference at least seven days before the 1099 form needs to be sent. If you dont, its automatically sent to your home address, as stated in your account.

Don’t Miss: How Does Taxes Work With Doordash

Don’t Be Afraid To Cancel Accepted Orders

It helps to know which orders to reject right out of the gate. But sometimes, you’ll need to cancel once youâve already accepted.

Don’t do this too often, of course. Low completion rates can get you kicked off the platform, so it’s in your best interest to keep your completion rate high.

Hereâs when you should cancel: if you’ve arrived at the restaurant, the order isn’t ready, and you’ll have to wait 15 to 20 minutes before it’s done.

Since youâre not getting paid when you wait, you’ll be better off doing anything else.

If this happens to you, send the customer a message. Let them know that you’re at the restaurant, their order isn’t ready, and you’re canceling so another dasher can deliver it when it’s ready.

From the customer’s point of view, thereâs no harm done â you’re just keeping them informed.

Social Security And Medicare For Dashers

A lot of it is very much the same, and a lot is different.

Here’s where it’s the same for us as it is for employees:

Social Security and Medicare are taxed on every dollar you earn. If you’ve ever had a small paycheck as an employee, you may have noticed that no federal income tax was withheld, but Social Security and Medicare taxes still came out of your check.

This is true as an independent contractor. All those tax deductions ? They don’t reduce your Social Security or Medicare taxes. You owe on the first dollar of taxes.

But here’s where things are very different:

One reason we don’t think about Social Security and Medicare as employees is, we never have to file any tax forms. They just take it out. You get paid, and Uncle Sam just gets 7.65% of every dollar you earn. No deductions, no forms. It just comes out.

We’re not employees. So there’s no employer taking that out and sending it in. We actually have to calculate our income, then fill out a form to figure out our Social Security and Medicare. Then we pay that when we pay our income tax.

But here’s the biggest difference: As independent contractors, we pay double.

It’s not that Uncle Sam gets any more money. They get 15.3% of our income whether we’re employees or we are self-employed.

The difference is that an employer pays half of that FICA. 7.65% comes out of your check and your boss has to match that. When you’re self-employed, you pay both the employer’s portion and the employee portion.

You May Like: How Much Is Sales Tax On A Car In Nc

Doordash Tips For Top Earners: How To Make More In 2022

George is a freelance writer who provides valuable content, one article at a time. With a background in B2B writing, Georgeâs key ability is creating engaging solutions in response to customer needs.

Knowing the right DoorDash tips can make a big difference in your income.

DoorDash has blown up in recent years, and its still profitable in 2022. But if you just follow the official advice, you might end up working for less than minimum wage.

Letâs not do that.

You can get a great hourly wage by dashing â around $20 per hour. These insider tips will show you how to maximize your payout like the top dashers in the game.

Contents

What Deliveries To Avoid And What To Prioritize

Be selective. Driving 8 miles for $3-$4 orders isnât worth your time.

As a rule of thumb, aim for base pay at $2 per mile or more. If its a really quick order that you can complete in minutes, $1 per mile is okay but not otherwise.Try to go for orders above $7.

- Go ahead and start your dash 10 minutes before you leave. The first few dashes youll get are very likely the ones that have been bounced around and declined by multiple dashers before you.

- Be careful with Walmart grocery deliveries ALWAYS check how many items youâll deliver. There could be 58 items, 4 cases of water that must be carried to the 5th floor complex with no elevators.

- Be cautious of drive-through fast-food restaurants. Even if youâre running a delivery, youâre going to wait in line with every other customer and waste your time. Unless the base pay or tips make up for it, skip them.

- Watch out for orders that take you far away from hotspots or popular areas. Youâre getting paid when youâre delivering, not on the way back to hotspots. Only do this, if the payout compensates for the time it takes to drive back or leads you to a different hotspot.

- Prioritize popular restaurants. They are most likely to be busy and have a higher chance of giving you multiple dashes.

Also Check: Doordash Tax Percentage

How To Get Your 1099 Tax Form From Doordash

Jessie RichardsonRead more March 6, 2020

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. When youre a Dasher, youre employed as an independent contractor, so youre responsible for keeping track of what you earn. Your employer cant give you any professional tax advice, so if you need help, youll need to talk to an expert.

If youre not sure what a 1099 form is and how you can get it, this article may help remove your doubts. However, keep in mind that its only informative, and only a tax professional can give you accurate legal advice.

Take Advantage Of Fast Pay

Getting paid instantly can be a lifesaver. It’s nice to have the option to withdraw your earnings right away, if you need to pay for gas or something else that just can’t wait.

Good news: DoorDash has a service called Fast Pay that lets you transfer your earnings instantly to your account.

There’s a $2 fee for every transfer. But your earnings typically get deposited into your account in a matter of minutes, so you donât have to wait for the next weekly payment.

George Poullo

George is a freelance writer who provides valuable content, one article at a time. With a background in B2B writing, Georgeâs key ability is creating engaging solutions in response to customer needs.

At Keeper Tax, weâre on a mission to help freelancers overcome the complexity of their taxes. That sometimes leads us to generalize tax advice. Please if you have questions.

Find write-offs.

Read Also: How To Get A Pin To File Taxes

Know Which Deliveries To Avoid

This goes hand-in-hand with the tip above. To maximize your time, you’ve got to be selective. Driving eight miles for $3- or $4-orders isnât worth your gas money.

Rule of thumb: Aim for a base pay of at least $2 per mile.

Ideally, you should try to go for orders above $7. Your best bet for those? Popular restaurants. Theyâre more likely to be busy and have a higher chance of giving you multiple dashes.

Of course, itâs also important to avoid bad orders. One tip for doing this: go ahead and start your dash 10 minutes before you set off. The first few orders you’ll get are probably the ones that have been bounced around and declined by multiple dashers.

Here’s your cheatsheet of deliveries to avoid