Search Disclaimer And Online Payment Information

Our office makes every effort to produce and publish the most current and accurate information possible. Searches may be conducted without making an online payment. No warranties, expressed or implied, are provided for the search return data, its use, or its interpretation. Utilization of this search feature indicates understanding and acceptance of this statement by the user. This search feature should not be relied upon for a title search. The search feature may be used without having to make a tax payment.

Taxpayers may use a credit/debit card or an E-Check to facilitate online property tax payments. Payment amounts vary by transaction type and payment methods . Also, once your online transaction has been confirmed, you may print a hard copy receipt for your records.

To access the Search & Pay feature, .

Why Do I Have To Pay Property Taxes

In all 50 U.S. states, the majority of property owners are required to pay real estate taxes. These taxes are vital to making sure local governments can provide the infrastructure and public services their communities need. Most citizens in the community rely on the government to provide at least one important public service.

Additionally, in many areas of the country, local property taxes make up the lions share of funding for public schools.

Claiming Property Taxes On Your Tax Return

OVERVIEW

If you pay taxes on your personal property and owned real estate, they may be deductible from your federal income tax bill. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas, and some agencies also tax personal property. If you pay either type of property tax, claiming the tax deduction is a simple matter of itemizing your personal deductions on Schedule A of Form 1040.

Apple Podcasts | Spotify | iHeartRadio

Read Also: Oregon Tax Preparer License Renewal

Getting Tax Information From Lender

If youve looked through your records and cant find the information, the next step will be to directly contact your mortgage company for the information. You should be able to easily find the mortgage department of your lender, but once you get through, youll probably need to have your account number. If you cant find a payment coupon book or a bill, the information should be in your closing paperwork from the date you bought your home.

You should also look back in your emails to see if you have information on getting your account information online. Most lenders now allow you to set up an account and access updated information online. Using this method, you can get a better handle on your finances without having to pick up the phone or wait for a monthly bill to arrive.

A Right To Know How Your Property Tax Dollars Are Being Spent

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. While taxpayers pay their property taxes to the Lake County Treasurer, Lake County government only receives about seven percent of the average tax bill payment. School districts get the biggest portion .

- See how your individual property taxes are distributed and how to contact those taxing bodies on Lake County’s Tax Distribution website.

You May Like: Www.1040paytax.com

Can I Deduct Property Taxes

Generally, you can deduct real estate taxes paid on a property in the year you pay them.

Real estate taxes are deductible if:

- Based on the value of the property.

- Levied uniformly throughout your community.

- Used for a governmental or general community purpose.

- Assessed and paid before the end of the tax year.

You can deduct up to $10,000 of state and local taxes, including property taxes.

To Make An Escrow Payment Click Here Escrow Payments Will Only Be Accepted On Accounts With Zero Balance Due For Previous Years To Pay: First Search For Your Account Number Click On The Selected Account And Add To Shopping Cart By Clicking On The Blue Box On The Top Left Of The Screen From There Follow The Prompts

OFFICE CLOSURE: ALL Fort Bend County Tax office locations will close at 12:00 pm on November 17th and December 15th for our annual Holiday celebrations.

POST-DATED CHECKS: The Tax Office deposits all checks upon receipt, regardless of the date written on the check.

CONTACT THE TAX OFFICE VIA PHONE OR EMAIL: Please feel free to call us at 281-341-3710 or email us at with any auto or property tax questions.

You May Like: Do You Have To Do Taxes For Doordash

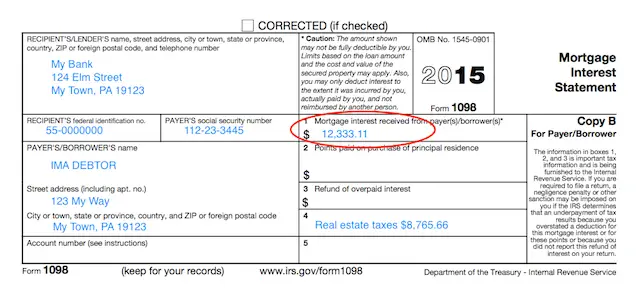

Mortgage Tax Statement: Form 1098

Mortgage companies commonly handle property tax payments on behalf of homeowners. That’s because it’s in the lender’s interest to make sure that the property taxes get paid, because if a government places a lien on a home for unpaid taxes, it makes it harder for the lender to recover its money in the event of a sale or foreclosure.

Usually, homeowners’ monthly mortgage payments include a portion designated for property taxes. The lender sets aside this amount in a special account, called “escrow,” and pays the tax bill when it’s due. At the end of each tax year, lenders must provide homeowners with a copy of IRS Form 1098, the “Mortgage Interest Statement.” If taxes have been paid out of escrow, Box 5 of this form usually lists the amount paid for the year.

Owing Back Property Taxes

As with any taxes, if you fall behind on your debt to your county offices, it will become a problem. If you know you wont be able to pay, the best thing to do is get in touch with your county assessors office and ask to make an arrangement to pay what you can. Simply ignoring your obligation will only lead to penalties added on top of your existing debt.

Eventually, your county offices may put a lien on your property, which will keep you from being able to sell it until youve paid off the tax debt. In some cases, the county may choose to sell your property as a foreclosure and use the money to take care of the taxes you owe. If it gets to that point, work with your county assessors office to try to get the back taxes paid before the house is actually sold.

If youre concerned that your taxes may not be up to date, go straight to your county assessors office to straighten things out. They should be able to provide a report showing a monthly accounting of any payments that have been made. If your mortgage company hasnt been following through on paying property taxes out of your escrow, this is something to take up with them. There may be a disconnect at some point, especially if your mortgage has changed hands recently.

Also Check: Turbo Tax 1099q

Pay Your Local Tax Office

If you dont pay your property tax as part of a monthly mortgage payment, youll pay the tax office directly. You should receive a bill in the mail that includes payment directions. Depending on where you live, you may have several payment options:

- Online using a credit or debit card

- Online using an electronic check payment

In addition to the different payment options, you may get to choose if you want to pay the bill all at once or split it into monthly, quarterly, or biannual payments. Pay attention to any prepayment discounts offeredsome municipalities provide a discount if you pay early.

If you use a , you may be charged a convenience feea flat dollar amount or a percentage of the bill, typically 2% to 3%.

What Is A Homes Fair Market Value

The market value of a home is basically the amount a knowledgeable buyer would pay a knowledgeable seller for a property, assuming an arms-length transaction and no pressure on either party to buy or sell. When a property sells to an unrelated party, the sales price is generally assumed to be the fair value of the property.

Read Also: Where Is My State Refund Ga

Your Check Register Records

If you pay your property taxes yourself, the quickest way to find out how much you paid is simply to go back through your check registers, bank account statements or credit card statements. Look for a payment to the treasurer or revenue department in whatever jurisdiction levies property taxes. If you don’t have such records, or you don’t pay property taxes directly, you have a couple of options.

Where Can I Find How Much I Paid In Property Taxes

If you own property, youre taxed on the value of that property. In most cases, its an amount you pay as part of your mortgage, but if you own your home or land outright, youll pay those taxes to the city rather than to a financial institution. Whether your taxes go through a mortgage company or directly to the government, though, youll probably occasionally be interested in finding out just how much tax youre paying. You can get information on property taxes you paid through your mortgage company or the county assessors office.

Read Also: Www.1040paytax

Property Tax Payment Dates

Payments for annual bills and the first installment for semiannual bills must be received on or before September 30th to avoid penalties and interest. The second semi-annual installment payment must be received on or before December 31st to avoid penalties and interest.

All taxpayers living in their principal residence pay their real estate property tax bills on a semi-annual schedule unless they choose to make both payments on or before September 30 of each year. Homeowners who escrow their tax payments may choose to pay annually, but must notify their lenders by May 1st of their intent to pay annually.

Homeowners who do not escrow taxes with a lender will receive a tax bill that will permit them to pay on either a semi-annual or annual basis. Semi-annual bills include two payment coupons, while annual bills include only one coupon. Payments on partial year levies are due 30 days after the bill is mailed.

Certain personal property taxes, taxes on residential rental units and taxes on commercial real property are not eligible for payment on a semi-annual basis.

How To Pay Taxes

Taxpayers have many options for paying their property taxes as follows:

You May Like: Www.1040paytax.com.

If Youre Overpaying Taxes

When you get the total amount the county thinks your property is worth, you dont have to accept the finding. If you find that the amount is high, you can appeal the assessment and have the county look into it. Youll need to gather documentation to state your case and go through the appeals process outlined by your local authorities. If property values in your neighborhood have dropped quickly in recent years due to an outbreak of crime, for instance, bring evidence of local home sales and current real estate listings to back up your claims.

The county assessor is the one who makes the final decision and, unfortunately, that decision is one youll probably have to accept. Chances are, the overage will need to be significant before the assessor will agree to make an adjustment. If your case is approved, though, youll see a change in your property tax bill, which will help lower your monthly mortgage payment until the next assessment.

Who Pays The Property Taxes

Property taxes are paid by homeowners of their own real property. However, the homeowner is not always the entity sending in the payment. A homeowner who has a mortgage escrow account might be paying a monthly amount toward the property tax bill. When the bill is due, the escrow company is responsible for paying it.

Whether you send the check in yourself or have an escrow company managing the property taxes, you should check a week after the check clears. Confirm the bill payment was properly recorded.

Additionally, if you are new homeowners or if your home has been reassessed for any reason due to improvements, you will receive a supplemental property tax bill. This is in addition to anything you pay to the county directly or through escrow. If you receive a supplemental tax bill, review it and confirm that it is indeed a new bill and pay it to avoid being delinquent.

Also Check: When Do We Start Filing Taxes 2021

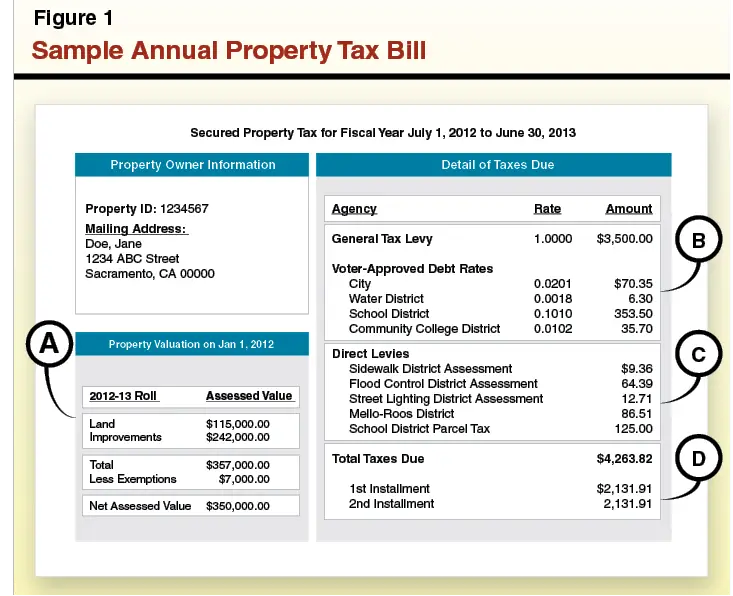

How Property Tax Is Calculated

Your property tax is calculated by first determining the taxable value. The taxable value is your assessed value less any exemptions. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes. Ad valorem taxes are added to the non-ad valorem assessments. The total of these two taxes equals your annual property tax amount.

Your propertys assessed value is determined by the Palm Beach County Property Appraiser. The millage rate is set by each ad valorem taxing authority for properties within their boundaries.

Non-ad valorem assessments are determined by the levying authority using a unit measure to calculate the cost of services. For example, Solid Waste Authority fees are based on the type of property producing the waste.

Allow The Assessor Access To Your Home

You do not have to allow the tax assessor into your home. However, what typically happens if you do not permit access to the interior is that the assessor assumes you’ve made certain improvements such as added fixtures or made exorbitant refurbishments. This could result in a bigger tax bill.

Many towns have a policy that if the homeowner does not grant full access to the property, the assessor will automatically assign the highest assessed value possible for that type of propertyfair or not. At this point, it’s up to the individual to dispute the evaluation with the town, which will be nearly impossible unless you grant access to the interior.

The lesson: Allow the assessor to access your home. If you took out permits for all improvements you’ve made to the property, you should be fine.

Read Also: How Do I Amend My State Tax Return

Real Property/bid Tax Online Bill Payment

We are pleased to announce the implementation of the eCheck payment system for property owners who want to pay real property taxes online.

Our new online payment system is:

- Convenient and easy-to-use: No more need to write checks or pay postage. You can make your tax payments 24 hours a day, seven days a week.

- Free: We do not charge you to use the online payment system.

- Reliable: When you pay, you will get a reference number as proof of your payment.

All payments made before 5 pm EST are effective the same day they are authorized. Payments may not be scheduled for a later date.

To use the MyTax.DC.gov online payment system:

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor in your area can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

Also Check: Harris County Property Tax Protest Services

What Are Property Tax Exemptions

Here’s a breakdown of some of the most common property tax exemptions:

- Homestead

- Senior Citizens

- Veterans/Disabled Veterans

Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. These specialized exemptions are usually a reduction of up to 50% of taxable value. However, rates can vary by location.

Some states offer exemptions structured as an automatic reduction without any participation by the homeowner if your property is your primary residence. Other states and counties require applications and proof for specific exemptions such as a homeowner whos a disabled veteran.

Lets look at an example with regard to the homestead exemption, which safeguards the surviving spouse and protects the value of a home from property taxes and creditors in the event a homeowner dies.

Say your state offers a homestead exemption for a homeowners primary residence that offers a 50% reduction of the home’s taxable value.

This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000. The millage rates would apply to that reduced number, rather than the full assessed value.

Its worth spending some time researching whether you qualify for any applicable exemptions in your area. If you do, you can save thousands over the years.