Income From Us Territories

If you are a U.S. citizen or resident alien and you own and operate a business in Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, American Samoa, or the U.S. Virgin Islands, you must pay tax on your net earnings from self-employment from those sources. You must pay the self-employment tax whether or not the income is exempt from U.S. income taxes . Attach Schedule SE , Self-Employment Tax to your U.S. income tax return.

If you do not have to file Form 1040 with the United States and you are a resident of any of the U.S. territories listed in the preceding paragraph, figure your self-employment tax on Form 1040-SS, U.S. Self-Employment Tax Return .

Residents of Puerto Rico may file the Spanish-language Form1040 , Planilla para la Declaración de la Contribución Federal sobre el Trabajo por Cuenta Propia .

How To Calculate The Home Office Deduction

You have two choices for calculating your home office deduction: the standard method or the simplified option, and you dont have to use the same method every year. The standard method requires you to calculate your actual home office expenses and keep detailed records in the event of an audit.

The simplified option lets you multiply an IRS-determined rate by your home office square footage. To use the simplified option, your home office must not be larger than 300 square feet and you cannot deduct depreciation or home-related itemized deductions.

The simplified option is a clear choice if youre pressed for time or cant pull together good records of your deductible home office expenses. However, because the simplified option is calculated as $5 per square foot, with a maximum of 300 square feet, the most youll be able to deduct is $1,500.

If you want to make sure youre claiming the largest home office deduction youre entitled to, youll want to calculate the deduction using both the regular and simplified methods. If you choose the standard method, calculate the deduction using IRS form 8829, Expenses for Business Use of Your Home.

You Likely Wont Go To Jail

One thing you probably donât have to worry about is going to jail. Failing to pay your past-due taxes is technically a misdemeanor. If youâre prosecuted, you can get jail time up to one year and must pay a fine up to $25,000 for each delinquent tax year.

Yet, the IRS is much more interested in collecting what you owe than sending you to prison. It rarely prosecutes non-filers who voluntarily come forward to fix the problem.

The only likely exceptions are if there are signs of fraud or if youâre a public figure whoâs drawn attention to your tax delinquency, a tax protester, drug dealer or involved in organized crime.

Don’t Miss: How To File Missouri State Taxes For Free

How Much To Set Aside For Taxes

There is no accurate way to determine the amount of money to set aside during the year so that you can pay your taxes in full upon filing. There are, however, some key factors to include when determining how to stay on top of your tax obligations.

The general rule is to set aside between 25% and 30% of the income earned for taxes. That range makes up the need to pay for the following taxes

This number will change as your income fluctuates and as tax rates change.

Keeping One Step Ahead Of The Taxman

By and large, being self-employed is great. Now that youre the boss, you get to call the shots: you pick your projects, set your hours, and when business is booming you reap 100% of the reward. You can also learn investing with Learnbonds guide to investing in stocks so wealth keeps on multiplying.

But every rose has its thorn. And for the self-employed, tax time can be pretty thorny.

When you plant your flag as a freelancer, contractor, or self-employed small business owner, the IRS sits up and takes notice.

As a self-employed individual you are required to file an annual return and pay estimated tax quarterly IRS

When you worked for a wage, you hated those little lines of numbers at the bottom of your paycheckwhy are they withholding so much!but now that youre responsible for keeping track of all your income taxes , you actually miss the good old days of having taxes withheld by your boss.

Keep your head up! You left the rat race for a reason, and paying taxes as a solopreneur doesnt need to be any more complicated than it was when you were working for a paycheck. Yes, paying taxes means paying attention, and saving all your receipts is a pain, but in just a few minutes you can learn everything you need to know to keep the taxman off your back.

The first step? Finding out if you need to pay quarterly or annually.

You May Like: How Much Does H& r Block Charge To Do Taxes

How To Receive A Large Tax Return If You Are Self

Filing taxes when self-employed can lead to a heavier tax burden due to having to pay the employer’s share of Medicare and Social Security tax along with your own. However, you have many ways to lower your taxes through subtracting your business expenses, taking advantage of business income tax deductions and looking into general credits and deductions that may be available. How you pay your estimated quarterly taxes can also lead to a refund or additional taxes due.

Review All Of Your Paperwork

Assuming youve been organizing and recording your expenses and revenue all year long, this next step should be simple. Collect all of your records and 1099s, and double-check that everything matches up. Even if you dont receive a 1099 from a client, youll still need to report your revenue from them to the IRS.

Read Also: How To Look Up Employer Tax Id Number

How To File 1099 Taxes When Youre Self

So youve recently become self-employed, or perhaps are creating a business, or maybe youre still doing your research. If so, youve no doubt come across the term 1099, and youve probably wondered yourself how to file 1099 taxes.

In 2015, 15 million Americans were self-employed, that is 10 percent of the adult population!

If youve been working as an employee for your whole working life, youve likely always had your taxes dealt with for you. It can be really intimidating to start having to monitor and manage on your own.

Dont worry, its relatively easy to take care of your own taxes when you know what to do. So this is how to file 1099 taxes when youre self-employed!

Whats A Rich Text Element

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

Static and dynamic content editing

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

How to customize formatting for each rich text

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the “When inside of” nested selector system.

You May Like: Do I Need W2 To File Taxes

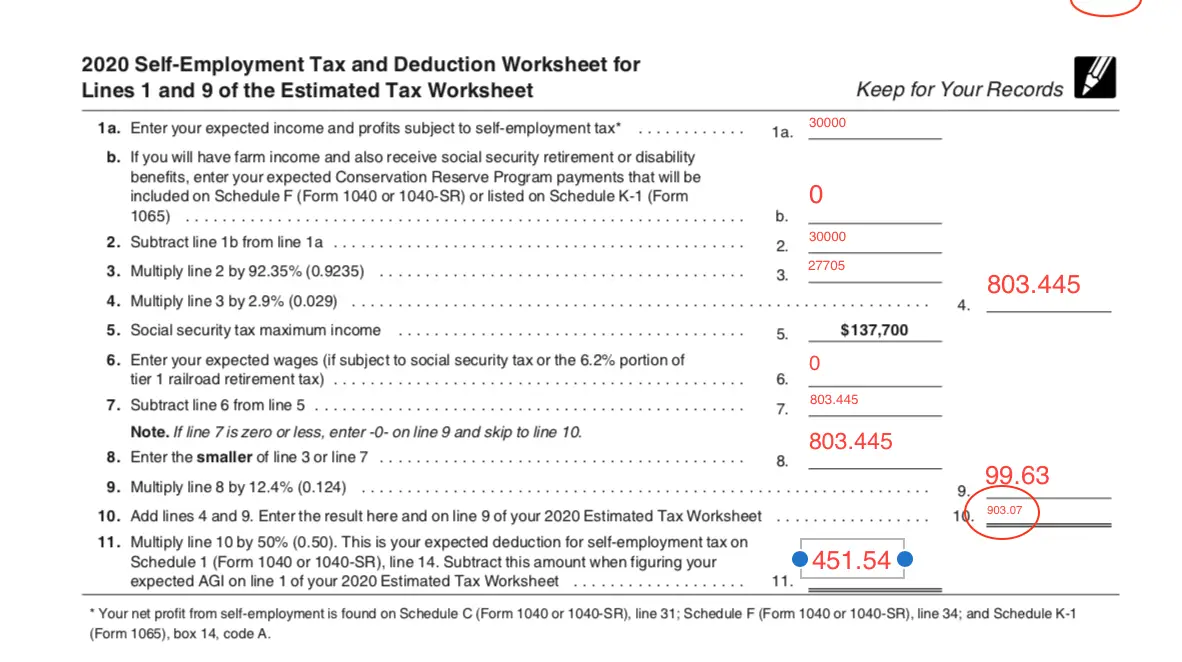

How To Calculate Your Self

The self-employment tax rate for 2019 is 15.3%, which encompasses the 12.4% Social Security tax and the 2.9% Medicare tax. Self-employment tax applies to your net earnings. For 2019, only the first $132,900 of your earnings is subject to Social Security tax , but a 0.9% additional Medicare tax may also apply to your self-employment earnings if they exceed $200,000 if you’re a single filer, or $250,000 if you’re filing jointly.

As mentioned earlier, to accurately calculate your self-employment tax, you need to calculate your net self-employment earnings for the year which is your self-employment gross income minus your business expenses. Typically, 92.35% of your self-employment net earnings is subject to self-employment tax. Once you have your total net earnings from self-employment that are subject to tax, apply the 15.3% tax rate to determine your total self-employment tax.

If you’ve had a loss or just a little bit of income from self-employment for the year, there are two optional methods to calculate net earnings in the IRS Schedule SE.

Business Income Vs Employment Income

Business incomeBusiness income includes money earned from a:

-

Profession

-

Trade

-

Manufacturer, or

-

An undertaking of any kind, an adventure or concern in the nature of trade, or any other activity you carry on with the intention to earn a profit, provided there is evidence to support that intention.

Employment incomeEmployment income includes money earned from:

-

Wages, or

-

Salary received from an employer.

Also Check: How Can I Make Payments For My Taxes

Who Must Send A Tax Return

You must send a tax return if, in the last tax year , you were:

- self-employed as a sole trader and earned more than £1,000

- a partner in a business partnership

You will not usually need to send a return if your only income is from your wages or pension. But you may need to send one if you have any other untaxed income, such as:

- money from renting out a property

- tips and commission

- income from savings, investments and dividends

- foreign income

Internet And Phone Bills

Regardless of whether you claim the home office deduction, you can deduct the business portion of your phone, fax, and internet expenses. The key is to deduct only the expenses directly related to your business. For example, you could deduct the internet-related costs of running a website for your business.

If you have just one phone line, you shouldn’t deduct your entire monthly bill, which includes both personal and business use. According to the IRS website, “You cant deduct the cost of basic local telephone service for the first telephone line you have in your home, even if you have an office in your home.” However, you can deduct 100% of the additional cost of long-distance business calls or the cost of a second phone line dedicated solely to your business.

Read Also: Buying Tax Liens In California

What Are My Self

As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly.

Self-employed individuals generally must pay self-employment tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording “self-employment tax” is used, it only refers to Social Security and Medicare taxes and not any other tax .

Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business. You do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of Form 1040 or 1040-SR. If your expenses are more than your income, the difference is a net loss. You usually can deduct your loss from gross income on page 1 of Form 1040 or 1040-SR. But in some situations your loss is limited. See Pub. 334, Tax Guide for Small Business for more information.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructions.

Form T2125 Statement Of Business Or Professional Activities

Form T2125, Statement of Business or Professional Activities is where you will record your personal and business income. This document is also where you will record your business expenses and will be able to deduct the costs of cell phone bills, office rent, and other operating expenses. The CRA allows tax deductions to help lower Canadians overall taxable income.

If your income is generated through farming or fishing activities, you will need to complete further documentation, specifically, Form T2042, Statement of Farming Activities for farming income, or form T2121, Statement of Fishing Activities for fishing income.

Don’t Miss: How Much Does H And R Block Charge To Do Your Taxes

What To Do If Youre Missing Information

No one is perfect, and losing a piece of paper, such as a T4 slip, can happen. Rest assured, all hope is not lost, and there is a way to recover your information.

A T4 slip indicates how much you were paid before deductions by an employer, in addition to your Canada Pension Plan , Québec Pension Plan , Employment Insurance contributions, and other amounts deducted from your paycheque during the tax year.

Each employer should give you a T4 slip if you worked for them within the last tax year no matter if youre a salaried or hourly-paid employee. Depending on how many companies you worked for, you may have multiple T4s that youll need to submit as part of your tax return.

Employers are required to send out T4s to all employees by a deadline each year . Even if youre not with the same employer, they are still obligated to send you a T4 slip. But sometimes addresses and contact information change, things slip through the cracks, and youre stuck without a T4 as the tax deadline looms.

Luckily, the Canada Revenue Agency featuresMy Account, an online portal for individuals and businesses. This service allows you to access slips that have been processed. You can also check any balances and forward unused credits from the year before, such as tuition credits and your registered retirement savings plan contribution limits.

Take The Home Office Deduction

If you’re like many self-employed people, you have part of your home that you use as a main place of business regularly. For example, you might do all your work there on the computer or at least use the space to handle management and administrative tasks.

As long as you can meet its criteria, the IRS allows you to deduct this usage to lower your tax bill. For an easy deduction, measure your home office space in square feet, and if it’s a max of 300 square feet, just multiply the area by $5 to get a home office deduction. If it’s larger, consult Form 8829 to enter relevant home office expenses such as utilities, rent, mortgage interest and insurance in proportion to your home’s size and calculate your home office deduction.

You May Like: How Much Time To File Taxes

Pay Quarterly Estimated Taxes

As a sole proprietor, its great when you get paid in full by your clients.

However, Uncle Sam doesnt want you to hold onto that money all year. You have an obligation to pay taxes on earnings from self-employment as you collect revenue from your clients.

Once per quarter, youre required to make estimated tax payments on your tax liability.

Estimated means you have to determine how much tax you might ultimately owe. It can be a bit tricky if your taxable income fluctuates during the year.

Simply do the best you can to calculate accurate amounts of your income and expenses. You can adjust the amount for the following quarter if you under- or over-estimated your tax liability.

Always pay your quarterly estimated taxes even if you expect a tax refund when you file your annual return. Otherwise, the IRS might charge you an underpayment or late payment penalty.

Could You Owe Expat Self

What are you doing abroad? Are you just traveling and seeing the sights, or are you earning a living? If youre traveling or living in retirement abroad, there is no need to declare foreign self-employment income. If you work for yourself as a freelancer, independent contractor or sole proprietor either full-time or part-time while living in another country, and you meet the tax filing threshold, you are required to file U.S. self-employment tax on your foreign income.

Need help? Let the CPAs at Expat CPA come to your rescue! Find out whether you earn enough income to meet the threshold for self-employment tax for U.S. citizens abroad and the penalties of not paying self-employment tax.

Read Also: How To Buy Tax Lien Properties In California

How To Take Advantage Of Tax Deductions

Sadly, itâs illegal to skip paying taxes outright. However, there are ways you can minimize how much of your money goes to the IRS.

Thatâs where deductions come in handy. When you spend money on certain business expenses, the IRS will cut you a break on how much you have to pay in taxes.

Your tax deductions are reported on Schedule C of Form 1040, which you use to report your personal income. Form 1040 is filed at the end of the year, with your final quarterly estimated tax payment.

Further reading:Tax Credit vs Tax Deduction: Whatâs the Difference?

How Much Control Do You Want

As we dont know what Social Security benefit payments will look like in the futuremany people expect them to be lower because of how the system is fundedyou may want to go with the sure thing and take the lower tax liability today. After all, one way to lower your tax liability is to take money out of your business and put it in one of the available retirement plans for the self-employed. Thats money youll have a lot more control over than Social Security benefits.

“The great thing about Social Security is you cannot access it until retirement age,” says Kevin Michels, CFP, EA, financial planner and president of Medicus Wealth Planning.

“You cant make early withdrawals, you cant skip payments, and you are guaranteed a benefit,” Michels adds. “However, you have only a small say in the future legislation of Social Security and how it will be affected by the mismanagement of government funds.”

Michels continues to say the following:

If you have trouble saving for retirement already, then paying into Social Security may be the better option. If you are confident you can stick to a savings plan, invest wisely, and not touch your savings until retirement, it may be a better idea to minimize what you pay into Social Security and take more responsibility for your retirement.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes