What Is The Marginal Tax Rate

The marginal tax rate is the rate charged on taxable income for every additional dollar earned. It is a federal tax system known as a progressive taxProgressive TaxA progressive tax is a tax rate that increases as the taxable value goes up. It is usually segmented into tax brackets that progress to. The progressive tax system uses a structure in which individuals with higher taxable income pay more in taxes, while those in the lower tax bracket pay less. The system uses different tax rates at each tax bracket.

How Tax Brackets Add Up

In 2019, the IRS collected more than $3.5 trillion in Federal taxes paid by individuals and businesses individuals accounted for about 56% of that total.

The agency processed more than 253 million individual and business returns a whopping 73% of returns were filed electronically. Of roughly 154 million individual tax returns, 89% were e-filed.

Individuals and businesses claimed nearly 121.9 million refunds totaling more than $452 billion. The vast majority of these totals 119.8 million refunds amounting to more than $270 billion went to individuals.

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The new tax plan signed by President Trump in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

How Tax Brackets Work

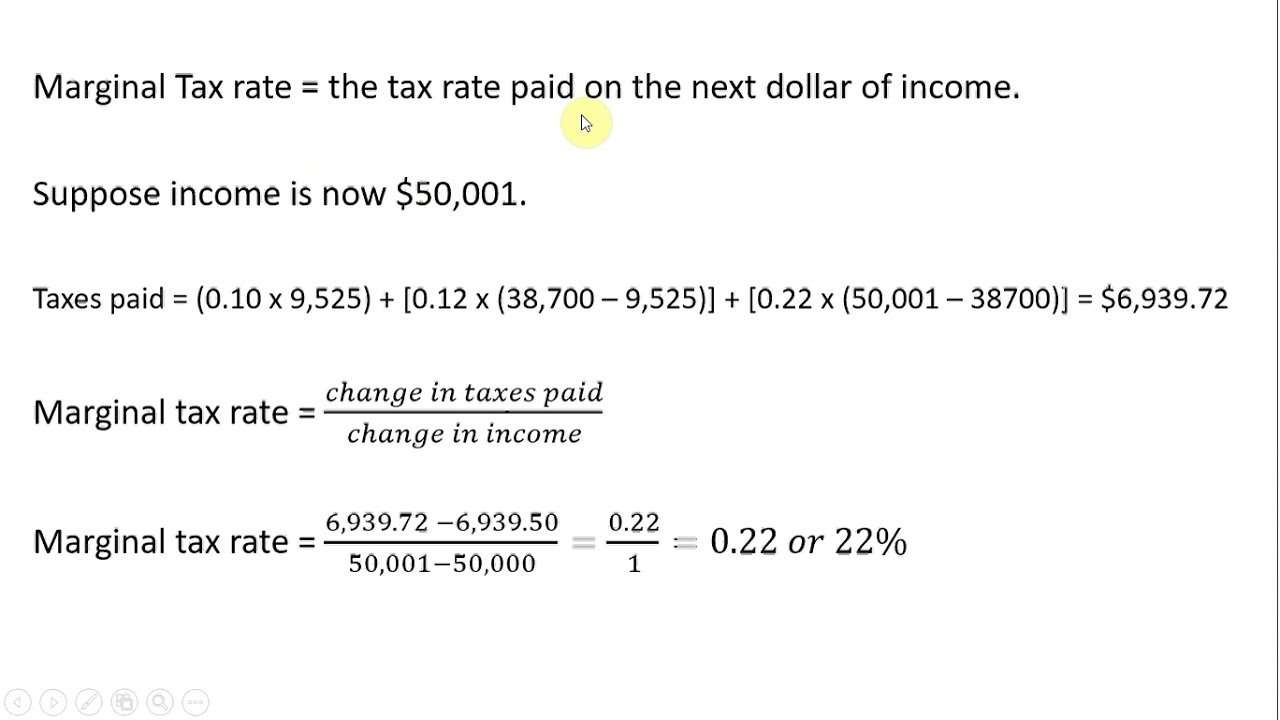

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

Example #1: Lets say youre a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2020. But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,875 you pay 12% on the rest.

-

Example #2: If you had $50,000 of taxable income, youd pay 10% on that first $9,875 and 12% on the chunk of income between $9,876 and $40,125. And then youd pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill would be about $6,800 about 14% of your taxable income, even though you’re in the 22% bracket. That 14% is called your effective tax rate.

» MORE:See state income tax brackets here

Calculating Your Annual Property Tax

taxable valuecurrent tax rateExample

| 1. Enter the Taxable Value from the Notice | $16,000.00 |

| 2. Multiply Taxable Value by the Tax Rate | X .20385 |

| $3,261.60 |

| Calculating Your Taxes with a Veteran’s Exemption Homeowners with a Veterans’ Exemption are required to pay tax to support public schools. Further reductions may be added if the veteran served in a combat zone or was disabled. | |

| 1. Enter the Taxable Value from the Notice | $16,000.00 |

| 2. Multiply Taxable Value by the Tax Rate | |

| Your Taxes | $1,362.56 |

Calculating the Taxable ValueStep 1Step 2For Class 1 Properties and Class 2 Properties with 10 Units or Less

| Class 1: | Assessed Value cannot increase more than 6 percent each year or more than 20 percent in five years. |

| Class 2: | Assessed Value cannot increase more than 8 percent each year or more than 30 percent in five years. |

Step 2a:

| Example: |

Recommended Reading: Do Roth Ira Contributions Need To Be Reported On Taxes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Do I File An Eht Return

The Ministry of Finance will mail you a personalized annual return. If you did not receive a return, you should contact the Ministry of Finance. You should also contact the ministry when your Ontario payroll for the year exceeds your allowable exemption amount.

If you receive an annual return, you must complete it and send it to the ministry, even if no EHT is payable. Once you submit a nil return, the ministry will stop sending you annual returns automatically. It is the employers responsibility to contact the ministry when changes occur that affect your requirement to file an EHT return.

You May Like: How Much Does H& r Block Charge To Do Taxes

Relevance And Uses Of Effective Tax Rate Formula

The effective tax rate is one of the measures which investors use as a profitability indicator for a company. This value can change in any direction and sometimes the changes are very drastic. But it cannot be interpreted immediately why it has happened. Sometimes this happens due to operational efficiencies or limitations. But sometimes companies can indulge in activities like asset manipulation so that they can reduce their tax burden. So one should keep a close eye on that.

It can also help us in comparing the actual tax liability of the company. For example, Let say there are 2 companies A & B who are in the same bracket of a marginal tax rate of 25%. But this will not give us a clear picture of the tax exposure of these businesses. We need to see what the effective tax rate is and then compare. So if company B has more money which is taxed at 25% than A, it will have to pay a higher effective tax rate compared to A. So if we say effective tax rate of company A is 18.5% and B is 21.3%, this will be a more accurate reflection of a companys tax liability.

How To Calculate Sales Tax

If your state, county, and city impose a sales tax, you must add all the rates together to get the total rate. For example, you want to find the sales tax rate for Scottsdale, Arizona. Arizona has a state sales tax of 5.6%, Maricopa County has a county sales tax rate of 0.7%, and Scottsdale has a city sales tax rate of 1.75% .

Once you know the sales tax rate you need to collect at, use the sales tax formula to calculate how much to charge the customer.

The amount you collect for sales tax depends on the percentage you collect at and how much your customer spent on products or services. For example, a customer who bought $1,000 worth of products will pay more sales tax than a customer who bought $100 worth of products.

Use the following formula to calculate sales tax:

To determine how much sales tax to charge, multiply your customers total bill by the sales tax rate.

You May Like: Tsc-ind Ct

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

Average Tax Rate Example

Chris earned $70,000 in 2017. According to that years tax brackets, he paid 10 percent on the first $9,325, 15 percent on every dollar between $9,325 and $37,950, and 25 percent on every dollar between $37,950 and $70,000. He estimates his total tax liability at $13,238.75, which would make his average tax rate 18.9 percent before accounting for deductions that could lower his actual taxable income.

You May Like: How Can I Make Payments For My Taxes

Get More With These Free Tax Calculators

-

See if you qualify for a third stimulus check and how much you can expect

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

See which education credits and deductions you qualify for

* Important offer details and disclosures

Additional Example Of The Sales Tax Calculation

Now let’s assume that total amount of a company’s receipts including a 7% sales tax is $32,100. The true sales will be S, and the sales tax will be 0.07S. Therefore, S + 0.07S = 1.07S = $32,100. The true sales, S, will be $30,000 . The sales tax on the true sales will be 0.07 X $30,000 = $2,100. Our proof is $30,000 of sales + $2,100 of sales tax = $32,100. In general journal form the accounting entry to record this information is: debit Cash $32,100 Sales $30,000 Sales Tax Payable $2,100.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

How To Deduct Sales Tax In The Us

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

How To Calculate An Average Tax Rate

Taxpayers don’t pay just one percentage rate on all their incomes, at least not at the federal level. The United States uses a progressive tax system. Different portions of income are taxed at different rates.

Calculating your average tax rate tells you the percentage of your income that you’re paying overall. And here’s a bit of good news: It’s never as much as the tax rate you pay on your highest dollar of income.

Also Check: Www Michigan Gov Collectionseservice

What Is Sales Tax

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax or goods and services tax , which is a different form of consumption tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. In other countries, the listed prices are the final after-tax values, which include the sales tax.

How Have Average Tax Rates Changed Over Time

Average tax rates faced by the top 0.1 percent of U.S. households have fluctuated over time. This results from changes to U.S. tax laws at the federal, state, and local levels. While the average rates for total taxes on the top 0.1 percent have fallen 10.8 percentage points from the 1950s , average income tax rates have remained relatively stable . In the 1950s, the top 0.1 percent of households faced average effective income tax rates of 21.0 percent, versus 20.7 percent as of 2014.

The 91 percent top marginal income tax rate of 1950 only applied to households with income over $200,000 . Only a small number of taxpayers would have had enough income to fall into the top bracketfewer than 10,000 households, according to an article in The Wall Street Journal.

Even among households that did fall into the 91 percent bracket, the majority of their income was not subject to that top bracket. After all, the 91 percent bracket only applied to income above $200,000, not to every single dollar earned by households. So despite a top bracket with a very high rate, the average tax rate was much lower.

Also Check: How Much Does H& r Block Charge To Do Taxes

Do I Need To Register For Eht

You need to register with the province if you are an employer and you are:

- not eligible for the tax exemption

- eligible for the tax exemption and your Ontario payroll exceeds your allowable exemption amount, or

- a member of an associated group and the groups cumulative Ontario payroll exceeds the EHT exemption amount.

Calculating The Sales Tax Percentage Of A Total:

If we are given the total cost of an item or group of items and the pre-tax cost of the good, then we can calculate the sales tax percentage of the total cost. First, we need to subtract the pre-tax value from the total cost of the purchase. Next, we need to create a ratio of the sales tax to the pre-tax cost off the items. Last, we need to create a proportion where the pre-tax cost is related to 100% and solve for the percentage of the sales tax. Let’s start by working through an example. If a person pays $245.64 for groceries that cost $220.00 pre tax, then what is the sales tax percentage for the items.

First, subtract the pre-tax value from the total cost of the items to find the sales tax cost.

Next, create a ratio of the sales tax to the pre-tax cost of the items.

Last, create a proportion where the pre-tax value is proportional to 100% and solve for the percentage of sales tax.

Cross multiply and solve.

Isolate the sales tax percentage to the left side of the equation by dividing each side by the pre-tax value.

Round to two decimal places since our answer is in dollars and cents.

Last, we can check this answer by calculating the sales tax percentage of the total as seen previously.

First, we need to convert the sales tax percentage into a decimal by moving the point two spaces to the left.

Now, we need to multiply the pre-tax cost of this item by this value in order to calculate the sales tax cost.

Round to two decimal places since our total is in dollars and cents.

You May Like: How Much Does H& r Block Charge To Do Taxes

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the IRS annually.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

The tax system in the U.S. is progressive, which means your income is taxed at different levels. For example, if your taxable income is $50,000 for 2020, not all of it is taxed at 22% some of it will be taxed in lower brackets.

You can calculate the tax bracket that you fall into by dividing your income that will be taxed into groups the tax brackets. Each group has its own tax rate. The bracket you are in also depends on your filing status: if youre a single filer, married filing jointly, married filing separately or head of household.

The tax bracket your top dollar falls into is your marginal tax bracket. This tax bracket is the highest tax ratewhich applies to the top portion of your income.

For example, if you are single and your taxable income is $75,000 in 2020, your marginal tax bracket is 22%. Since your entire taxable income is not taxed at 22%, some of your income will be taxed at the lower tax brackets, 10% and 12%. As your income moves up the ladder, your taxes will increase. Take a look at this example for someone who has $75,000 in taxable income: