File By Paying Electronically

If you plan on paying your taxes online, you can get an automatic six-month extension without filling out any other forms. This is by far the fastest, simplest way to get an extension on tax filing. Rather than going through the IRS Free File system , you can just select the âextensionâ option when paying through the IRS payment portal. Itâs as simple as that. Your six-month extension will begin right away, no need to apply for anything.

Also, filing online and setting up direct deposit for your bank account is the fastest way to get your tax refund, even if youâre filing with an extension.

Youâll still need to provide your basic contact and tax information, but you wonât need to file for an extension and pay your taxes as two separate steps.

Hereâs what the process looks like:

If You Owe The Irs Money

Unfortunately, your payment is still due by the initial filing deadline if you owe the IRS. Filing an extension doesn’t normally give you additional time to address any taxes that are owed, and the IRS charges interest and sometimes penalties on tax payments that are made after the deadline.

An extension gives you more time to file, but it doesn’t give you more time to pay.

It’s usually a good idea to go ahead and prepare your tax return, even if you don’t file it yet, so you have a rough idea of what you owe, if anything. It’s best to send a payment for the amount you’ve estimated you’ll owe when you submit your extension form.

You’re entitled to a refund if you miscalculate your estimate and end up overpaying. It’s better to be safe than penalized and sorry. You’ll have cut your penalties and interest to just the portion of the tax debt that you were short if you end up owing more than what you estimated.

If You Need Help Paying

You can often set up an installment agreement with the IRS to pay your tax debt off over time if you can’t afford to pay immediately and in full. You can see whether you qualify, and apply online to set up a payment plan. The IRS will inform you directly whether your payment plan has been approved, after it receives your application.

Read Also: When Will Tax Refunds Be Issued

We Follow Irs Rules For Extensions Of Time For Filing A Return

If you have obtained a Federal Automatic Extension, you do not need to submit an Application for Extension of Time to File. It is not necessary to file a New Mexico Extension of time to file unless you need more time than the Federal Automatic Extension allows.

An extension of time to file your return does NOT extend the time to pay. If tax is due, interest accrues from the original due date of the tax. If you expect to owe tax when you file your return, the best policy is to make a payment. For income taxes use an extension payment voucher.

Estimate How Much You Owe

If you fail to make a payment before the deadline, you will be charged 0.5% interest monthly on what you owe. This interest can quickly compound, so make sure you make an estimated payment before the due date. You can estimate how much you owe in taxes this year by subtracting the total tax withheld from your paycheck and your estimated tax payments from the total amount youve earned according to the percentage indicated in your tax bracket. Remember to reduce your income by all qualified deductibles and dont forget to add calculations for tax credits you qualify for into your final payment. If you owe money and you cannot pay the full amount, you should attempt to pay as much of your outstanding balance as you can.

Read Also: How To Know If My Taxes Were Filed

How Do I File A Tax Extension

When you seek a tax extension deadline, the rules require you to first take a few preliminary steps. The general process to request a tax deadline extension is the same whether you file taxes online or by mail. The tax extension deadline for 2020 returns is the same date as the regular tax deadline: To qualify for a federal tax extension, you must file the appropriate forms by the standard tax filing deadline of April 15, 2021.

Check Out: Tax Year Deadline Dates You Need To Know

Reasons For Filing For An Extension On Your Federal Taxes

OVERVIEW

The IRS grants you an automatic extension to file your taxes every year, as long as you complete Form 4868.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Traditionally, federal tax returns are due on April 15 or the first business day thereafter. However, the IRS does grant you an automatic extension to file your taxes every year, as long as you complete Form 4868. Common reasons for requesting an extension include a lack of organization, unanticipated events or tax planning purposes. Even if you obtain an extension to file, you must still pay your income tax in full by the tax deadline.

Read Also: What Do Tax Accountants Do

Filing An Income Tax Extension

OVERVIEW

If you aren’t able to complete your federal tax return by the filing deadline, find out how and when to file for an IRS extension with these tips from TurboTax.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

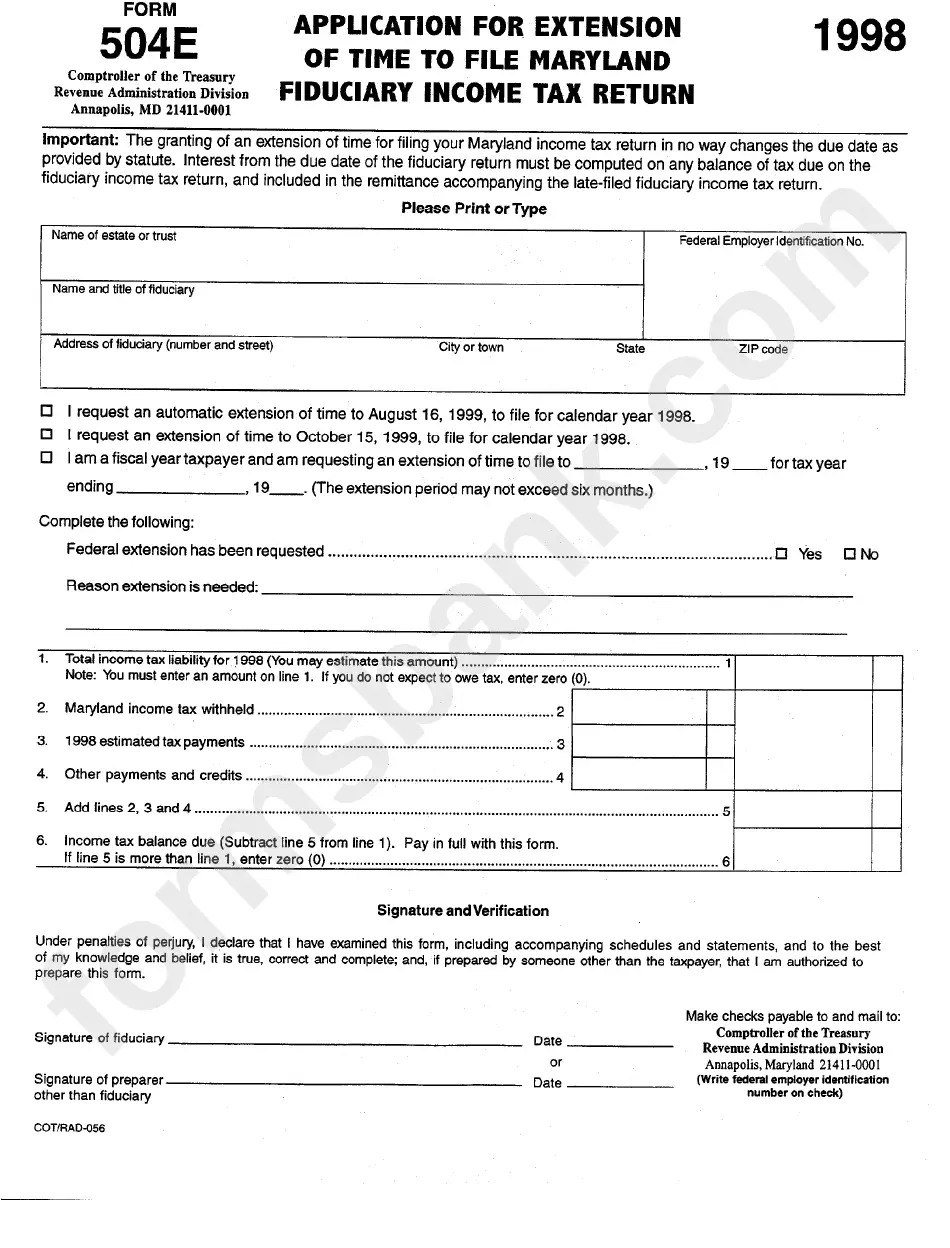

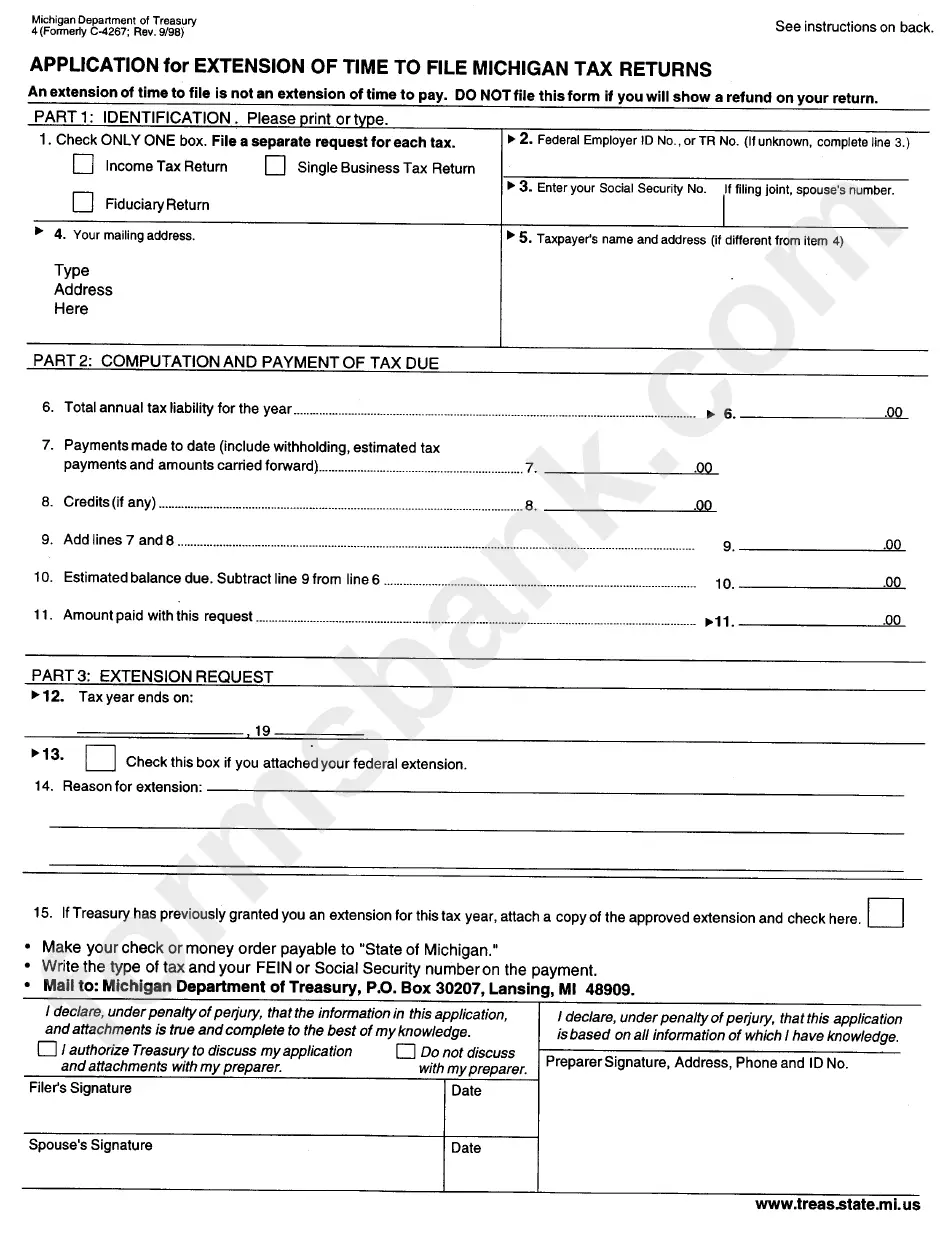

Some Important Points About Extension Applications

- There is only one extension allowed per tax year. You can’t get multiple extensions.

- The extension is automatic for both types of extensions . Just be sure to file the extension by the tax due date.

- Even if you don’t owe any tax, file an extension if you can’t file your return by the due date.

- If you aren’t sure how much to pay when you file your extension application, you can run a calculation of estimated tax due.

- You may also have to file anextension application with your state. Check with your state’s taxing authority to learn about the process for filing an extension for a state tax return.

- The IRS doesn’t reject many extension applications. The most common reason an application is rejected is because of an error. Check to make sure you have filed the extension application correctly.

Also Check: What Can I Write Off On My Taxes For Instacart

How To File A Tax Extension With The Irs

Dont panic if you cant file your taxes by April 15 . The Internal Revenue Service regularly grants extensions to people who need more time. Even though taxpayers commonly need a deadline extension, the actual process of filing an extension for taxes can be confusing. Heres how to get a tax extension and correctly submit your IRS tax extension request if youre filing your taxes at the last minute.

Please note that The IRS has announced that the federal income tax deadline for individuals is May 17, 2021 for the 2020 tax year. State deadlines have not changed, however, so make sure to confirm your states due date before you file.

How To File Tax Extension Traditionally: Use The Tax Extension Irs Form 4868

This is the old-fashioned way of filing an extension. The form has everything you need to know about extensions and instructions for filling out the form.

For a more convenient search for IRS Form 4868, taxpayers can get a Form 4868 copy. Taxpayers can also contact their nearest IRS local branch office.

The first part is the conventional information needed like your name, address, city, state, zip code, and social security number.

On Part II of the form, do your best estimate of the total tax liability and total withholdings or W2. Get the difference and thats how much is owed and the check amount to mail in.

Furthermore, taxpayers who live outside the country should check boxes 8 and 9 and see if it applies to their status.

Here are a few notes to remember in making a payment before sending a check:

- Dont send cash and make sure its payable to the U.S. Treasury. Using the IRS as the recipient makes it easier for criminals to change the name.

- The check must have the social security number and daytime phone number written on it. This requirement may raise some doubts to those who prioritize the secrecy of their SSN.

- Avoid stapling the payment on the form 4868. Some taxpayers just mail an envelope containing the check together with the form, rather than staple the check and the form together.

Considering applying for an IRS tax extension online process? How do you plan to go about it? Let us know in the comments section below.

Up Next:

Recommended Reading: Why Does It Cost So Much To File Taxes

How And When To File An Extension On Business Taxes

If you can’t complete the tax return for your business by the filing date, you can request an extension of time to file. This article discusses how and when to file, what form to use, and other important information about extensions.

An extension of time to file is not an extension on paying taxes due. Even if you file an extension application, you must pay taxes due by deadline, in order to avoid late-payment penalties and fines.

What Is Irs Form 4868

Form 4868 is the “Application for Automatic Extension of Time to File U.S. Individual Tax Return.” It must be filed on or before the usual April 15 filing deadline, unless you are out of the country at that time. You have until June 15 to file for an extension if you live in, and your place of business is outside, the U.S. or Puerto Rico.

The IRS extended the deadline for 2020 tax returns and payment to May 17, 2021. This gives an extra month to file the Form 4868, but that extra extension remains October 15.

Also Check: What Is The Federal Inheritance Tax

Filing Tax Extension Online: Irs E

The second method is the IRS e-file extension. For taxpayers interested in filing a tax extension online, this is the relatively easiest method to use.

Back on the IRS website, go to the Filing tab and click Free File. For some taxpayers, they can just click on the File button on the upper right corner.

Due to the changes in the IRS website, a taxpayer can find Free File on the upper center portion inside the Keep your taxes on the right track box. IRS Free File is usually available until October 15, which is six months after the tax deadline of April 15.

On the next screen click on E-file your extension, which leads to a page with several software packages to choose from. When taxpayers submit tax extension online using e-file, they can minimize the fees from mailing the form.

Depending on when you start to e-file, taxpayers may get a screen stating the tax extension is not available, especially if they opened on October 15.

At this point, choose Taxslayer and youll be directed to a screen to file for free.

This way, taxpayers will be able to file electronically for a free tax extension. The taxpayer can request tax extension online easily.

Understand Any Special Circumstances

Though the vast majority of Americans will have their requests to file an extension approved within six months, there are a few special circumstances that forbid, extend or limit the amount of extra time you will receive to file. If you live outside of the United States, or you are currently an active-duty armed forces member residing in a combat zone or other qualified hazardous area, you may receive more time to file your taxes when you request an extension. On the other hand, if you have been approved for offers in compromise through the IRS, you must file by Tax Day during the five-year probationary period after your approval. If you fail to file on or before the deadline, the IRS may revoke your offer in compromise and reinstate the original balance owed.

You May Like: How To Do Llc Taxes Yourself

In A Nutshell Heres How You File For A Tax Extension

Step 1: Download the tax forms that correspond to your business type

Step 2: Submit your federal tax extension request to the IRS

Step 3: Pay your taxes owed on time

Once complete, the extension is applied automatically.

Simple, right?

The process is the same for all business types in the United States, regardless of tax liabilityâunless youâre a sole proprietor.

Heads up: This covers filing for an extension of federal tax. Getting an extension on state tax differs from state to state contact your Secretary of State for more information.

Out Of Country Extension

If you are required to file a North Carolina individual income tax return and you are out of the country on the original due date of the return, you are granted an automatic four-month extension for filing your North Carolina individual income tax return if you fill in the “Out of Country” circle on Page 1 of Form D-400. “Out of Country” means you live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or you are in military service outside the United States and Puerto Rico. The time for payment of the tax is also extended however, interest is due on any unpaid tax from the original due date until the tax is paid.

If you are unable to file your income tax return within the automatic four-month extension period, an additional two-month extension may be obtained by filling in the circle at the bottom right of Form D-410 or selecting “Y” at the “Out of country on due date prompt” on the Department’s personalized form creator. To receive the additional two-month extension, Form D-410 must be filed by August 15. Importantly, a taxpayer who is granted an automatic extension to file the corresponding State income tax return if they certify on the State return that the federal extension was granted. Consequently, an “Out of Country” taxpayer granted an automatic six-month extension to file the State income tax return will not be required to file Form D-410 to receive the additional two-month extension.

Read Also: How To Pay Back Taxes Online

Nerships S Corps And C Corps: Heres How You File For An Extension Online

Time: < 30 minutes. If you have your information handy.

For all corporations and partnerships, youâll need to complete Form 7004 for an extension on filing your taxes. Rather than filing a paper form, youâre likely better off using the IRSâ e-file service. Just create an account to get started, and the website will guide you through the rest.

For each type of return youâre requesting an extension for, youâll need to submit a separate Form 7004.

IRS Form 7004

Once youâve identified the return that youâre requesting an extension for, youâll need to provide the IRS with some basic information about your company:

- If your organization is a foreign corporation that doesnât have an office or place of business in the U.S.

- If your organization is a corporation, and is the common parent of a group that will be filing a consolidated return.

- If the organization is a corporation or partnership that qualifies under Regulations section 1.6081-5.

- The dates of your calendar and tax years.

- If youâre filing a short tax year, and why.

Finally, youâll also need to include the tentative amount of your total taxes, and your total payments and tax credits.

Choose The Correct Form

For most Americans with simple full-time or part-time employment, Form 4868 will grant an automatic six-month extension for filing as soon as it is received and processed. You can download a copy of Form 4868 from IRS.gov. If you use tax software to complete your return, your software provider may also make this form easily accessible through its website. If you use tax prep software, your system may have a built-in link to help you file an extension. For example, TurboTaxs EasyExtension tool is free to use and eliminates the need to print out and mail your Form 4868.

If you are a business owner, youll want to fill out Form 7004. If you own a corporation, youll need to fill out form 1138. Both of these forms can be accessed and electronically downloaded from the IRSs website.

Don’t Miss: How Much Does The Top 1 Percent Pay In Taxes

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:103 allows a six-month extension of time to file the individual income tax return to be granted on request. The extension request must be made electronically before the state tax filing due date, which is May 15th for calendar year filers or the 15th day of the fifth month after the close of a fiscal year.

The five options for requesting an extension are as follows:

An extension does not allow an extension of time to pay the tax due. Payments received after the return due date will be charged interest and late payment penalty.