How To Claim A 529 Plan Deduction

If youre interested in deducting 529 plan contributions on your taxes, the first step is determining whether you live in a state that allows it. If you do, the next step is estimating how much of your contributions you can get deduct. Again, this can vary based on the state deduction limits or requirements and your filing status.

Youll need to add up the amount you contributed to each 529 plan you own. You should be able to get this information from your plans annual statement. If youre filing your state taxes using an online tax software program, there should be a question about 529 plan contributions included. You can then enter in the amount you contributed so the program can calculate what amount, if any, is deductible.

Quick Primer What Is A 529

A 529 plan allows people to sock money away to help pay for college down the line. While the money is in the account it grows tax-free. And heres the best part as long as people use the money to pay for college related expenses, withdrawals are also tax free. The one minor snag is that typically you can only fund this account with after-tax dollars.

Thats all about to change for you and Ill explain how in a minute. But lets not lose sight of how powerful it can be to make deductible contributions to a 529. Assume you are in the 30% marginal tax bracket and use tax deductible dollars to fund a 529. Thats just like getting a 30% discount on college. Can I get an amen?

The 529 is one of the best college savings plans available. And if you start funding this account early, it can be a great way to cut your education expense big time.

Its also very important to understand that anyone can establish a 529 plan. There are no age or income restrictions. You can even open a 529 plan for yourself. And that means your child can contribute to her or his own 529 plan too. This is the key to funding a 529 with tax deductible contributions. Let me show you how its done.

1. Discover the Joys of Being Self-Employed

2. Hire Your Kid

3. Have Your Child Open & Fund Her Own 529

This is legit. You have to make sure that your child really does work for you, but once you have that covered, the IRS will not have a problem with this arrangement.

Many States Have 529 Tax Deductions For Contributions

Although you cant receive 529 tax benefits on your federal income tax return, you might be able to on your state tax return.

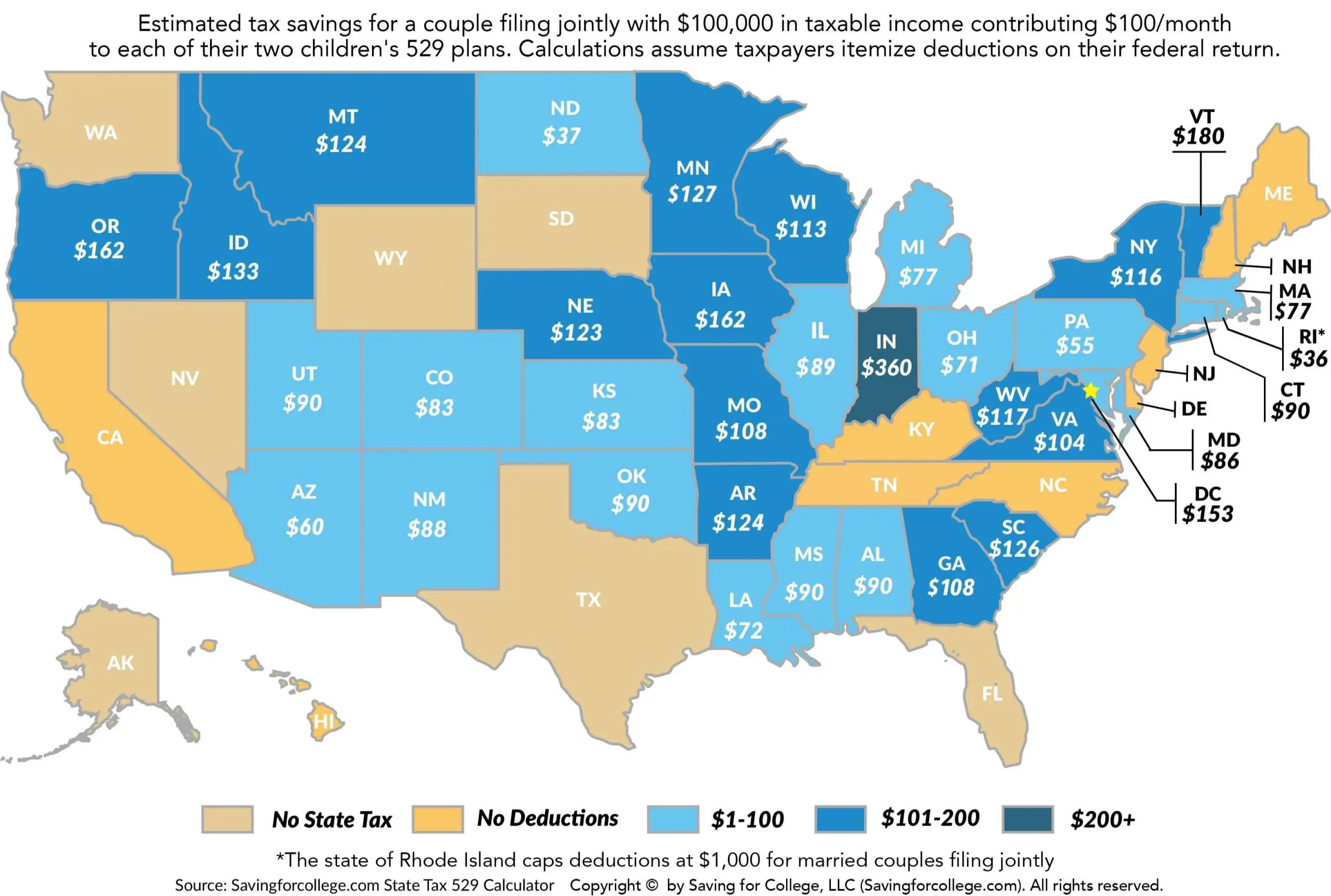

More than 30 states, plus the District of Columbia, offer a 529 tax deduction or credit, allowing you to write off 529 contributions and lower your state income tax burden. That can free up more money to save for your childs education.

Deductions vary by state, and some are more generous than others. Indiana, for example, offers a 529 tax credit equal to 20% of contributions up to $5,000, which means a maximum credit of $1,000. Vermont provides a 10% tax credit for contributions up to $2,500 with a maximum $250 credit per taxpayer for each beneficiary.

You May Like: How Does H& r Block Charge

Taxation And Deduction Rules

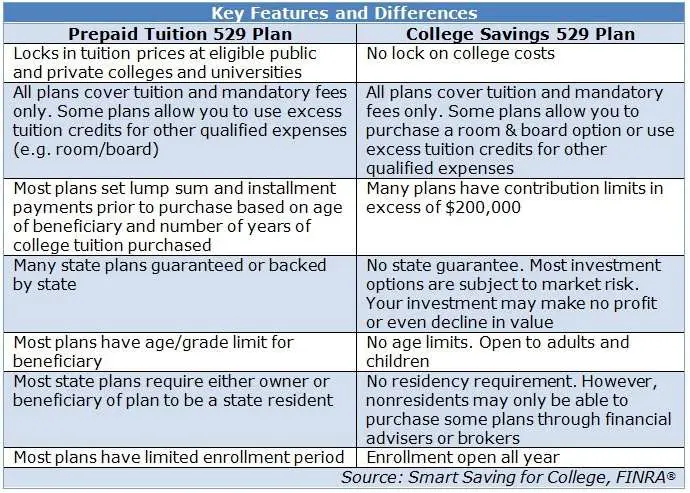

State rules for 529 contributions and withdrawals aren’t complex, but they vary considerably from state to state. Some states allow you to contribute to a 529 plan even if you’re not the plan owner others do not. Although the federal government doesn’t allow you to deduct your contributions from income, some states do. Most states do not allow you to contribute to another state’s plan. Most states have contribution limits that are considerably lower than the federal governments — you can contribute more, but amounts in excess of the state limit will not be deductible from your income in the year of contribution. It’s best to check with your own state’s taxation and deduction rules when you initiate the plan.

You The Donor Stay In Control Of The Account

- With few exceptions, the named beneficiary has no legal rights to the funds in a 529 account, so you can assure the money will be used for its intended purpose.

- This differs from custodial accounts under UGMA/UTMA, where the child takes control of the assets once he or she reaches legal age.

- A 529 account owner can withdraw funds at any time for any reason but keep in mind that the earnings portion of non-qualified withdrawals will incur income tax and an additional 10% penalty tax.

Read Also: What Does Agi Mean In Taxes

What You Can Pay For With A 529 Plan

Where can I spend my 529 subscription? Tuition and fees. Tuition and fees for full-time and part-time students can be paid with 529 plans. Room and board. Whether you live on-campus or off-campus, you can spend your 529 subscription on room and board. Manuals and supplies required. Technology. Special needs and adapted equipment.

Who Is Eligible For A 529 Plan State Income Tax Benefit

States typically offer state income tax benefits to any taxpayer who contributes to a 529 plan, including grandparents or other loved ones who give the gift of college. However, in 10 states only the 529 plan account owner may claim a state income tax benefit.

Eligible taxpayers may continue to claim a 529 plan state income tax benefit each year they contribute to a 529 plan, regardless of the beneficiarys age. There are no time limits imposed on 529 plan accounts, so families may continue to make contributions throughout the childs elementary school, middle school, high school, college years and beyond.

State income tax benefits should not be the only consideration when choosing a 529 plan. Attributes such as fees and performance must always be taken into account before you enroll in a 529 plan. In some cases, better investment performance of another states 529 plan can outweigh the benefits of a state income tax deduction.

Don’t Miss: Where’s My Refund Ga State Taxes

Hunt For 529 Tax Deductions But Plan For Contribution Limits

As you choose a 529 plan, pay attention to the 529 contribution limits. According to the IRS, contributions cannot be more than the amount needed to provide for the student beneficiarys qualified educational expenses.

Each state might interpret this rule differently when it sets 529 contribution limits, so the limits may vary. But typical 529 contribution limits allow savers to accrue up to $300,000 in savings per beneficiary, according to wealth management firm AXA.

Consider limiting annual 529 contributions to $14,000 or less per beneficiary. According to the IRS, a gift tax might apply to any 529 contributions that exceed that amount.

No matter the ways you plan to help your child cover college costs, educational tax deductions and credits can make a big difference. Learning about tax benefits that can help lessen the financial burden of college is one element in deciding how much to save for your childs education.

Andrew Pentis and Marty Minchin contributed to this report.

Annual 529 Contribution Limits

In 2021, many families are trying to make the most of their tax-advantaged savings accounts. Those saving for retirement may deposit up to $6,000 to an IRA or Roth IRA and up to $19,500 to an employer-sponsored 401. But what about college funds? Thats where it can get tricky, since the IRS doesnt specify annual 529 contribution limits and many 529 plans offer high total contribution limits.

Most families wont have to worry about hitting their 529 plans contribution limit this year. However, there are some rules to be aware of if youre considering making a large deposit.

Wondering how your 529 plan may impact financial aid? Use our Financial Aid Calculator to estimate the expected family contribution and your financial need.

Also Check: How To Get Tax Preparer License

Qualifying For The Tuition And Textbook Credit

Taxpayers who have one or more dependents attending grades K-12 in an Iowa school may take a credit for each dependent for amounts paid for tuition and textbooks. The credit is 25% of the first $1,000 paid for each dependent for tuition and textbooks. Dependents must have attended a school in Iowa that is accredited under section 256.11, not operated for a profit, and adheres to the provisions of the U.S. Civil Rights Act of 1964. If expenses qualify for both the tuition and textbook credit and 529 Plan, taxpayers may claim both.

Tax Benefits For Nebraskans

Account owners are eligible to receive a Nebraska state income tax deduction of up to $10,000 for contributions made to their own NEST accounts.2 Contributions made beyond the $10,000 mark cannot be carried over to a future year.2

For minor-owned or UGMA/UTMA NEST accounts, the minor is considered the account owner for Nebraska state income tax deductions. The minor must file a Nebraska tax return for the year their contributions are made to be eligible for a tax deduction for their contributions. In the case of a UGMA/UTMA NEST account, contributions from the parent/guardian listed as the Custodian on the UGMA/UTMA NEST account are also eligible for a Nebraska state tax deduction.

Both the contribution and earnings portion of funds that were deposited into a NEST account from a non-Nebraska 529 plan are eligible for the tax deduction.

Read Also: Can You File Missouri State Taxes Online

Plan Tax Benefit And Advantages

Regardless of how much you invest, these tax advantages help you maximize your college savings:

- Tax-Deferred Growth Contributions grow free of federal and state income taxes while in the account.

- Tax-Free 529 Withdrawals No income tax is paid on the growth of your account when withdrawals are used for qualified expenses.

- State Tax Deduction Deduct your contributions from your taxable income. Check with your state for specific tax benefits. For example, Kansas taxpayers receive an annual adjusted gross income deduction of up to $3,000 for contributions per child. The availability of tax or other state benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors.

- Estate Planning & Accelerated Gifting Reduce your personal taxable estate through accelerated gifting . This means you can make five years’ worth of gifts up to $75,000 to your 529 account in a single year without being subject to gift taxes. This benefit is unique to 529 plans.

The difference between tax-free growth and taxable growth can be significant. Using these tax benefits means you are putting your money to work for you!

The availability of tax or other state benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors.

Basic Provisions And Benefits

The primary benefits of a 529 plan are its relative simplicity and that withdrawals, including contributions and earnings, are generally not subject to income taxes if made for “qualified” expenses. While the Code does not allow deductions for contributions, approximately 30 states allow some deduction for state income taxes .

Another benefit is that the owner may change the beneficiary with important limitations if the intended beneficiary dies or otherwise does not use the funds. The money can also be used for trade schools. In 2018, the legislation known as the Tax Cuts and Jobs Act , P.L. 115-97, added qualified expenses of K-12 public, private, and religious schools to those of higher education institutions as eligible for tax-free plan distributions , as amended by the TCJA). Then, in 2019, the Setting Every Community Up for Retirement Enhancement Act, P.L. 116-94, added to qualified expenses those of registered apprenticeships, as well as student loan principal and interest incurred by the designated beneficiary or the beneficiary’s sibling, up to an aggregate $10,000 limit over the recipient’s lifetime.

Recommended Reading: Www.1040paytax

Your Guide To The New York 529 Tax Deduction

Saving for college with 529 College Savings Plans has a lot of advantages. One of them is that you can get state tax benefits when you join the New York 529 College Savings Plan. Today, were going over everything you need to know about the New York 529 tax deduction program. We will show you just how much money you can save through state tax deductions, tax-free growth, and tax-free withdrawals. Keep reading to learn more.

What Are Qualified Education Expenses

Remember, only qualified withdrawals are tax-free. That means you should only use your 529 plan to pay for qualified educational expenses.

Qualified expenses for college include tuition and fees, books and materials, room and board , computers and related equipment, internet access and special needs equipment for students attending a college, university or other eligible post-secondary educational institutions.

However, there are some costs that you may believe are necessary, but the IRS does not consider a qualified expense. For example, a students health insurance and transportation costs are not qualified expenses, unless the college charges them as part of a comprehensive tuition fee or the fee is identified as a fee that is required for enrollment or attendance at the college.

In recent years, the IRS has expanded the definition of qualified education expenses to include K-12 tuition expenses and student loan repayments. There is a $10,000 annual limit on qualified K-12 withdrawals and a $10,000 lifetime limit on student loan repayments

The funds in a 529 plan are yours, and you can always withdraw them for any purpose. However, the earnings portion of a non-qualified distribution will be subject to ordinary income taxes and a 10% tax penalty, though there are exceptions.

Don’t Miss: 1040paytax.com Safe

What Is The New York 529 Plan

New Yorks 529 College Savings Plan is a special account that helps you pay for your childs higher education. It is offered by Vanguard Group Inc and has Ascensus Broker Dealer Services as its program manager. Although it is based in New York state , its open to all U.S. residents, but we will get into that in a bit.

Whats special about this plan is that, unlike other savings accounts, you can watch your balance grow more rapidly. Thanks to several mutual funds investment options you can choose from, your contributions get invested wisely. Really, your money is working for you thanks to this 529 plan.

Moreover, New Yorks 529 College Savings ProgramDirect Plan carries very low fees, so you can save money faster.

Besides helping you save for college, New Yorks 529 College Savings Program allows you to reap rewards every day. When you link it to a Upromise account, you get cashback rewards on purchases. And did we mention you also get the chance to enter your child for scholarships?

Can 529 Plan Be Claimed On Taxes

You cannot claim a tax deduction for contributions you make to your 529 plan. However, some states offer tax deductions for contributions to 529 plans.

Car insurance in California is legally required just like other states but it is much more expensive, although California is considered as the 5th most expensive state in the US with average annual rates of $1,970.Importance of Car InsuranceCar insurance, aside from being legally important, is also necessary for you and your family too in several other ways which are as follows:1. PROTECT OTHERS: Having right type of car insurance can protect you, and your passen

You May Like: How Much Does H And R Block Charge To Do Your Taxes

What Are 529 Plan Qualified Expenses

- Travel costs: Going to college and coming home can be expensive.

- Student Loan Cost: As tough as it may be for the average college graduate, it’s not an acceptable cost to the plan.

- Insurance and Medical Expenses – Although offered by the school, medical insurance bills are not included in 529 eligible expenses.

Lifetime Gift Tax Exemption Amount

Does this mean if you contribute more than $15,000 in one year or $75,000 over five years youll have to pay gift tax? Not necessarily. As mentioned above, any gifts above the annual exclusion amounts will have to be reported on the federal tax Form 709, and these will be counted against the $11.7 million lifetime gift tax exclusion. Any amounts that exceed the exclusion could trigger gift taxes of up to 40%, but individuals within the $11.7 million limit will not be subject to gift taxes.

You May Like: Can You File Missouri State Taxes Online

How Are 529 Plan Distributions Taxed In Montana

In Montana, 529 non-credit plan distributions are taxed at the highest marginal income tax rate in Montana within 3 years of opening an account. Changes to the federal tax code since 2018 have expanded the definition of qualified college fees to $10,000 per year for qualified K12 schools.

Report 529 Plan Contributions On Your State Income Tax Return

If you use a 529 plan and pay state income tax, you may be eligible for an additional benefit. Currently, over 30 states including the District of Columbia offer a full or partial tax credit or deduction on 529 plan contributions. Most states only offer this benefit to residents who use their home states plan, but residents of Arizona, Arkansas, Kansas, Minnesota, Missouri, Montana and Pennsylvania offer taxpayers a state income tax deduction when they contribute to any states 529 plan.

You May Like: Cook County Assessor Deadlines

Are There Any 529 Savings Plans In Texas

Texas sponsors three 529 college savings plans, an instant offer, a consultant option, and a prepaid education. The Texas Direct Selling College Savings Plan allows you to invest in multiple low-cost investment portfolios and choose between actively or passively managed funds, which is rare with direct plans in other states.