New York City Taxes On Certain Services

New York City imposes local sales tax on certain services performed or delivered in New York City, including:

- beautician, barbering, and hair restoring

- tanning

You must file Schedule N with your sales tax return to report sales and remit the sales tax due on the above services that fall within the special rules for New York City sales. Note: Interior decorating and design services performed within New York City are subject to the state portion of the sales tax only and are not subject to the New York City local sales tax. For more information see Tax Bulletin Interior Decorating and Design Services .

New York Updates Estimated Tax Payment Instructions

The New York Department of Taxation and Finance has issued a bulletin alerting taxpayers of updated instructions for Forms IT-2105, Estimated Tax Payment Voucher for Individuals, and IT-2106, Estimated Tax Payment Voucher for Fiduciaries. The updates reflect recently enacted increased personal income tax rates for the following taxpayers: married taxpayers filing jointly with income over $2,155,350 single filers, married taxpayers filing single, and estates and trusts with income over $1,077,550 and heads of household with income over $1,616,450.

May 26, 2021

New York Is Casting A Much Bigger Net Fishing For Remote Taxpayers Under The Office Of Convenience Rule

In recent months, New York has started issuing desk audit notices , basically as soon as returns are filed, to taxpayers who have claimed a change of residency or who have reported less income attributable to New York sources than in prior years. New York is issuing desk audit notices, assigning taxpayers case numbers, and requiring a response. Failure to respond promptly with sufficient information will result in an assessment of additional tax along with associated penalties and interest.

Taxpayers receiving these notices related to a reduction in income allocated to New York State will be required to prove that any days allocated outside of New York were for their employers necessity to the Departments satisfaction. The Department will assess additional tax under the Office of Convenience Rule if the taxpayer is unable to substantiate to the Departments satisfaction that the days worked outside New York was not for the individuals convenience. Please note that the Department is taking the position that any day worked from home due to COVID is for the employees convenience and not the employers necessity.

Taxpayers receiving notices related to a claimed residence change will be required to prove to the Departments satisfaction that they:

Don’t Miss: Efstatus Taxact Com Login

New York State Extends Income Tax Filing Deadline

New York states income tax filing deadline is being moved to July 15 to comply with the federal governments decision to push back the traditional filing date due to the coronavirus outbreak.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

How Is Estate Taxed In New York State

Any property that benefited from a previously allowed New York marital deduction must be included in the surviving spouses New York gross estate, whether the QTIP election was made on the transferring spouses New York estate tax return or via a federal proforma return if an actual federal return was not otherwise required.

Read Also: Do You Have To Report Roth Ira On Taxes

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

New York Proposes Capital Gains Business Tax Surcharges

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include a one percent surcharge on the capital gains of certain individuals for tax years beginning on or after January 1, 2021. The capital gain surcharge would be imposed in addition to individual income tax. Further, both proposals call for a surcharge to be imposed on corporations for tax years beginning on or after January 1, 20201. While both surcharges are structured differently, in either case the tax would apply to corporations with income or receipts above a designated threshold. The Assembly proposal calls for an 18 percent surcharge, while the Senate proposal would permanently raise the corporate franchise tax rate from 6.5% to 9.5%. Lastly, the Assembly version of the Bill would reinstate the 0.15 percent capital base tax that had previously been repealed for tax years beginning in 2021.

Read Also: Where Is My Tax Refund Ga

In Detailcorporate Tax Rates

The legislation increases the corporate franchise tax rate to 7.25% from 6.5% for tax years beginning on or after January 1, 2021 and before January 1, 2024 for taxpayers with a business income base greater than $5 million.

In addition, the scheduled phase-out of the capital base tax has been delayed. The rate of the capital base was to have been 0% starting in 2021. The legislation imposes the tax at the rate of 0.1875% for tax years beginning on or after January 1, 2021 and before January 1, 2024, with the 0% rate to take effect in 2024. However, the delay does not apply to deemed small businesses.

Is There A Way To Avoid Paying Sales Tax On Cars In New York

Unfortunately, there is no way around having to pay sales taxes on vehicles for New York residents. In fact, the state’s Department of Motor Vehicles has anticipated people buying cars in other states in an attempt to save money and has prevented them from being able to skirt paying taxes once back in New York. Plus, if you purchase a car in another state that doesn’t meet the emission standards of New York, you will be required to pay even more for modifications to the vehicle.

With this information, you should be well informed when making a vehicle purchase in New York State.

Read Also: How Much Does H& r Block Charge To Do Taxes

New York Median Household Income

| Year | |

|---|---|

| 2010 | $54,148 |

What your tax burden looks like in New York depends on where in the state you live. If you live in New York City, you’re going to face a heavier tax burden compared to taxpayers who live elsewhere. Thats because NYC imposes an additional local income tax.

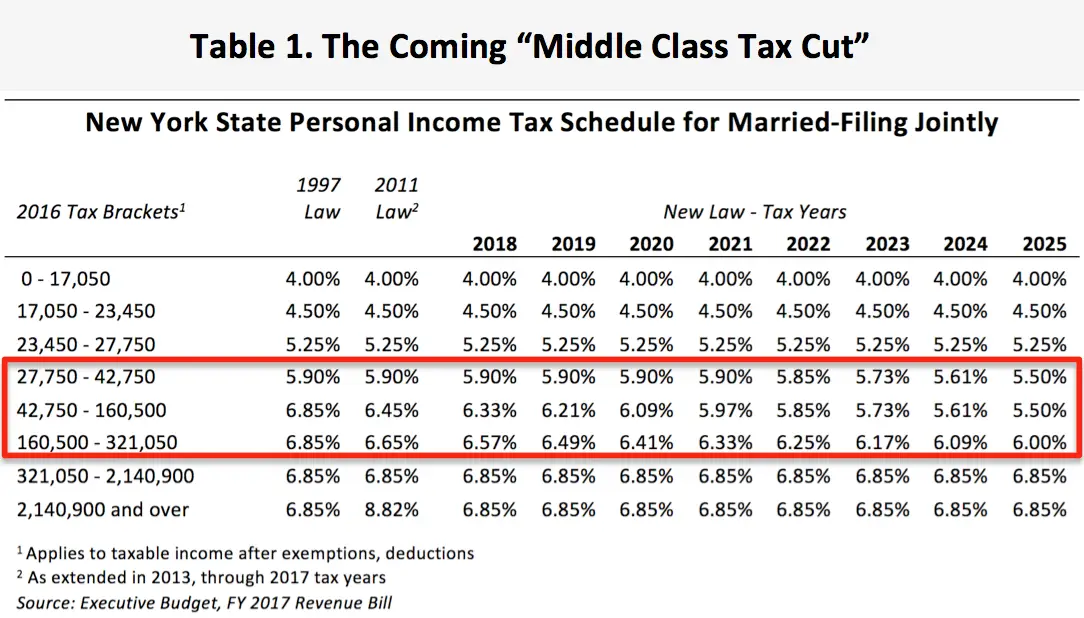

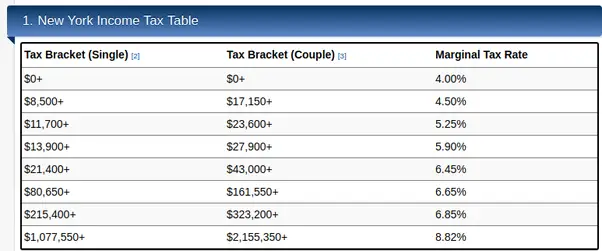

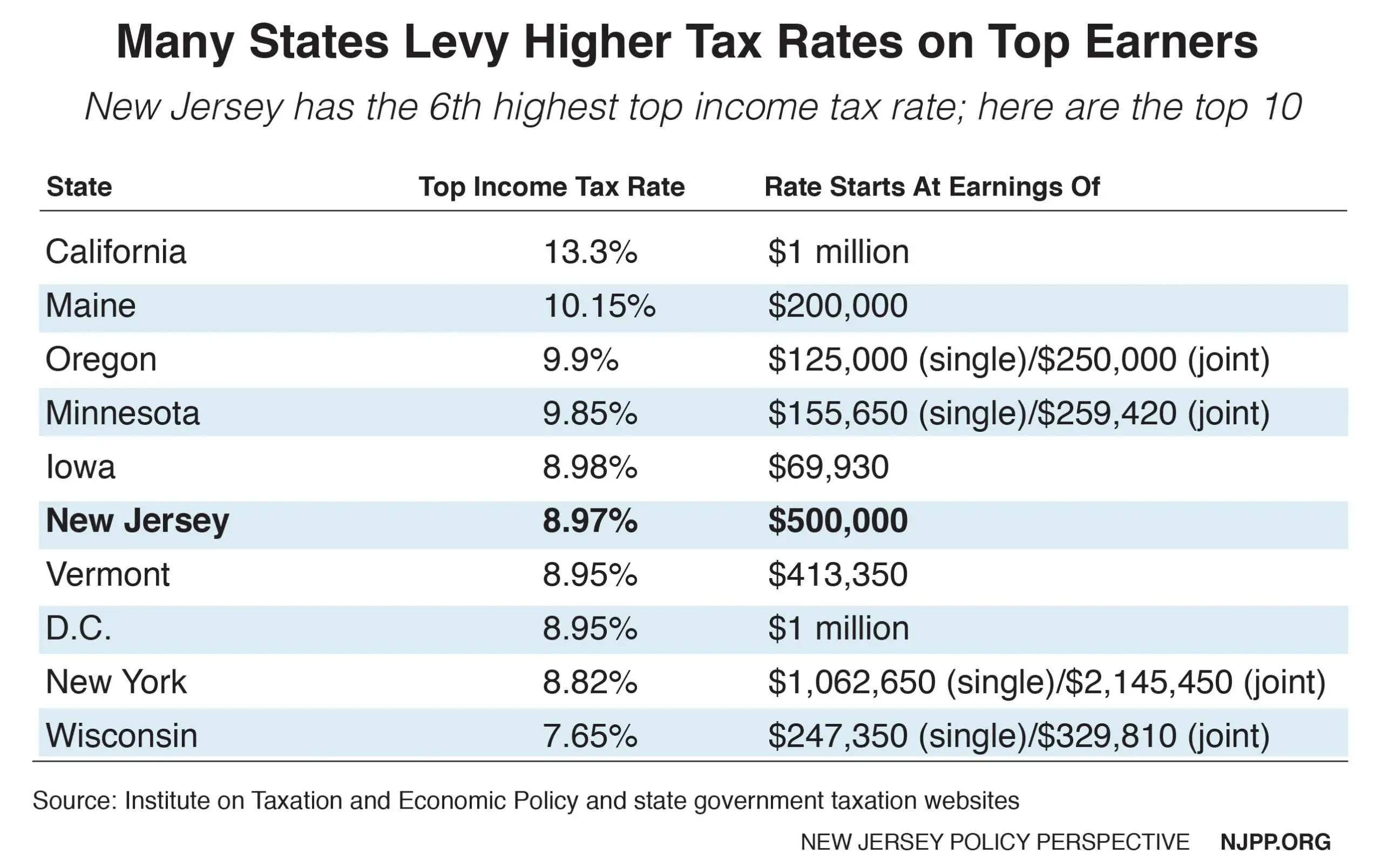

New York States progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level and filing status. Wealthier individuals pay higher tax rates than lower-income individuals. New Yorks income tax rates range from 4% to 8.82%. The top tax rate is one of the highest in the country, though only individual taxpayers whose taxable income exceeds $1,077,550 pay that rate. For heads of household, the threshold is $1,616,450, and for married people filing jointly, it is $2,155,350.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000. The rates are the same for couples filing jointly and heads of households, but the income levels are different.

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.

Types Of Residency Status In New York

|

If your New York residency type is … |

New York taxes this part of your income |

|---|---|

|

Resident |

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

You file Form IT-201. You may have extra paperwork if you live in New York City or Yonkers, since those cities assess local income tax on top of state tax.

PART-YEAR RESIDENT STATUS RULES

Generally, youre a part-year resident of New York if you were a nonresident for some of the tax year. This is often the case for people who moved to New York from another state.

-

If youre a part-year resident, you pay New York state tax on all income you received during the part of the tax year you were a resident of New York, plus on income from New York sources while you were a nonresident.

NONRESIDENT STATUS RULES

Also Check: How Do I Get My Pin For My Taxes

Personal Income Tax Rate

The legislation increases the personal income tax rates on higher incomes from 2021 through 2027. Currently, the highest state income tax rate is 8.82%. The legislation increases the rate to 9.65% on income over $2,155,350 but not over $5 million, for married individuals filing jointly $1,646,450 but not over $5 million, for resident heads of household and $1,077,050 but not over $5 million, for unmarried individuals, married individuals filing separately, estates, and trusts.

In addition, the legislation creates two additional tax brackets, with income over $5 million but not over $25 million taxed at a rate of 10.3%, and income over $25 million taxed at a rate of 10.9%. These thresholds and rates apply to all classes of taxpayers. The legislation also updates the states tax table benefit recapture provisions to correspond with the new increased rates.

Note: These tax increases, when coupled with New York City personal income taxes, will result in the nations highest state and local personal income tax rates for affected taxpayers. For example, a NYC resident with taxable income over $25 million will pay personal income tax at a combined rate of 14.776% .

Filing Requirements And Due Dates

If you have been issued a certificate of registration , you must file a highway use tax return even if no tax is due, or even if another person will pay any tax due on the use of the vehicle operated under the certificate of registration. There are two ways to file:

For more information, see Tax Bulletin Filing Requirements for Highway Use Tax .

Recommended Reading: What Does Locality Mean On Taxes

Why Is The Sales Tax On Cars In New York So High

New York has significantly higher car sales taxes than most other states in the nation. In fact, some states, such as Alaska and New Hampshire, don’t even tax car owners. According to Blunt Money, a primary reason for the high car sales tax in New York is related to politics and the revenue requirements of the state. Additional reasons why sales taxes are high in New York include:

- A deficiency in the overall budget of New York State

- The price of maintenance to repair roads after winter months

- Expenses of removing snow

- Higher cost of living overall

What Is The New York Star Exemption

There are two STAR property tax exemptions in New York: the basic exemption and the enhanced exemption. The basic exemption has no age restriction. It is available to any homeowner with household income of $250,000 or less. It exempts the first $30,000 in home value from school taxes.

The enhanced exemption is available only to senior citizens who are at least 65 years old and have an income of $90,550 or less. The first $69,800 in home value is exempt from school taxes.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Definition Of Qualified New York Manufacturer Changes

For tax years beginning on or after January 1, 2018, the definition of a qualified New York manufacturer has been changed to use the New York State adjusted basis rather than the federal adjusted basis when determining whether a manufacturer meets the $1 million or $100 million property thresholds for determining eligibility for the manufacturers tax rate reductions and the real property tax credit. A qualified New York manufacturer is a manufacturer that is principally engaged in the production of goods by manufacturing, processing, assembling, refining, mining, extracting, farming, agriculture, horticulture, floriculture, viticulture, or commercial fishing during the tax year that either has property in New York State of the type described for the investment tax credit that has an adjusted basis for New York State tax purposes of at least $1 million at the end of the tax year, or has all of its real and personal property in New York State. C, I, 10/18/2019.)

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state. It ensures that out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within the state. The seller will collect the regular New York sales tax. But if you buy a computer from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax. New York requires residents to report their out-of-state spending in their New York income taxes.

You May Like: File Missouri State Taxes Free

New York Update On Extension Of Filing Deadline

The New York Department of Taxation and Finance has issued a notice alerting taxpayers that the 2020 individual tax returns and related payments are now due on May 17, 2021. The Department emphasizes that the extension is for individual personal income tax returns only. However, estimated tax payments for 2021 have not been extended and are still due on April 15, 2021.

How Your Highway Use Tax Is Determined

The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you choose to report the tax. When completing your first return for the calendar year, you must choose to use either the gross weight methodor the unloaded weight method to compute your tax. After you select a method, you:

- must use the same method to compute your tax for each return filed during the year,

- cannot change the selected method until the following year, and

- must use it for all your vehicles.

You should base your method on your particular operations. One method may be more economical or convenient for you. For additional information concerning methods of computing HUT, see Tax Bulletin Howto Determine Your Highway Use Tax .

Read Also: How Can I Make Payments For My Taxes

Certificate Of Registration And Decals

Before operating a motor vehicle on the public highways of New York State you must obtain a certificate of registration and decal for each motor vehicle subject to the highway use tax. There are two types of registrations:

- A HUT certificate of registration is required for any truck, tractor, or other self-propelled vehicle with a gross weight over 18,000 pounds.

- An automotive fuel carrier certificate of registration is required for any truck, trailer, or semi-trailer, or other attached device transporting automotive fuel.

To establish your account and request your credentials, file:

- Form TMT-39, New Account Application for Highway Use Tax and Automotive FuelCarrier . If you plan to obtain your HUT credentials online, use our One Stop Credentialing and Registration system , or

- Form TMT-1, Application for Highway Use Tax and Automotive Fuel Carrier Certificates of Registration and Decals.

Parking Services Sold In New York City

Charges for parking services in New York City are subject to the 4% state tax, the 6% New York City local tax, and the % Metropolitan Commuter Transportation District tax .The borough of Manhattan has an additional 8% parking tax that applies unless the purchaser is a certified exempt resident . Eligibility rules and the application to apply for the exemption from the additional 8% parking tax can be found at www.nyc.gov.See Tax Bulletin Parking Services in New York City for additional information.

Recommended Reading: Www.1040paytax.com