Example : Increase In Municipal Costs

If your municipality needs more money, your property taxes may increase.

Using the original property values of $125,000, $175,000 and $200,000, an increase in municipal costs to $2,500 increases the overall tax rate to 0.5%.

The total value of the three properties is $500,000 and the cost of services is now $2,500, so the tax rate is 2,500/500,000 = 0.005, or 0.5%. Therefore:

- The owner of the $125,000 property pays 0.5%, or $625.

- The owner of the $175,000 property pays 0.5%, or $875.

- The owner of the $200,000 property pays 0.5%, or $1,000.

- The total of the tax paid by the three property owners is $2,500.

How New Jersey Property Taxes Work

Property taxes in New Jersey go entirely to local governments. Bills are paid annually across four installments, which are due on the first of February, May, August and November. The amount a homeowner in New Jersey pays depends primarily on the value of his or her home and the total tax rates among all local tax authorities.

Home value is determined by assessors in New Jerseys 565 municipalities. Since these assessors may use different techniques, its possible that they undervalue or overvalue homes in their district. The New Jersey Division of Taxation offsets this annually by determining an equalization ratio that ensures everyone in a tax district pays their fair share.

The Toronto City Council

The Toronto City Council approved a phased in assessment increase. This tax change was based on the change from the tax rate that residents currently pay, and the propertys new value, which has been assessed to be higher. The Council approved a phased in increase of the tax rate over a period of four years. The Council determined that a gradual increase was preferred over an immediate, one time increase of taxes based on the new assessed value of property. The assessed value is added onto the current city, education and transit expansion levies. Also you can ask our tax lawyers in Toronto.

MPAC & CVA

Residential properties are assessed by MPAC, an independent not-for-profit that works for the province of Ontario. The assessment is based on the CVA, or Current Value Adjustment, which compares sales figures of residential properties in Toronto against the current tax rate. Most of the CVA rate is based on these factors: the age of the residential property , the propertys size, its location and the quality of the propertys construction materials.The local tax authority provides assessment information to MPAC, which then computes the assessment values. An example of how the assessment is factored into tax rates (determined by local authorities is as follows: the assessed value is calculated to be $524,833.00, the 2016 tax rate is 0.6879731%. The assessed value is multiplied by the residential tax value.

549,586 X 0.6879731 = $3,781.00

You May Like: What Does H& r Block Charge

Dont Overlook Intangible Possessions

Personal belongings taxes are not simply carried out to actual, tangible belongings they also can make bigger to such things as stocks, bonds, mutual fund shares, and so on. While a few kinds of non-public belongings tax are pretty common, taxes on intangible belongings can range substantially from nation to nation, so take a look at your neighborhood tax authority for greater information.

- Sometimes, underneath a positive price, intangible belongings may be tax unfastened. For instance, earlier than 2007 in Florida, the first $250,000 of belongings become now no longer situation to tax.

- In our instance, shall we say that, further to our car, we additionally have $300,000 of trusts which can be eligible to be taxed. If the first $200,000 is tax-unfastened in our nation and, after that, the tax is 50 cents per $100 were going to want to pay 100,000 × 0.005 = $500.

This Service Allows You To Calculate The Amount Of Local Property Tax Due On Your Property For Any Period

Instructions

Read Also: How Much Does H& r Block Charge To Do Taxes

Mill Levy Or Millage Tax

The mill levy is the tax rate levied on your property value, with one mill representing one-tenth of one cent. So, for $1,000 of assessed property value, one mill would be equal to $1.

Tax levies for each tax jurisdiction in an area are calculated separately then, all the levies are added together to determine the total mill rate for an entire region. Generally, every city, county, and school district each have the power to levy taxes against the properties within their boundaries. Each entity calculates its required mill levy, and they are then tallied together to calculate the total mill levy.

For example, suppose the total assessed property value in a county is $100 million, and the county decides it needs $1 million in tax revenues to run its necessary operations. The mill levy would be $1 million divided by $100 million, which equals 1%.

Now, suppose the city and school district calculated a mill levy of 0.5% and 3%, respectively. The total mill levy for the region would be 4.5% or 45 mills.

How Your Property Taxes Are Calculated

The information on this page will help you understand how your taxes are calculated and answer frequently asked questions about property taxes in Multnomah County. Visit the Property Assessment page to get information about how we determine the value of your home.

You may also contact us with your questions via live chat, phone , or email at .

You May Like: 1040paytax.com Official Site

Property Taxes By State

Overall, homeowners pay the most property taxes in New Jersey, which has some of the highest effective tax rates in the country. The states average effective rate is 2.42% of a home’s value, compared to the national average of 1.07%.

With an average effective rate of 0.28%, the least expensive state for property taxes is Hawaii, surprisingly. Despite its reputation as a costly place to live, Hawaii has generous homeowners exemptions for primary residents that lower taxable values considerably. The tax break generally helps those who live in Hawaii full-time, rather than those who own a second home there.

Also of note are Colorado and Oregons property tax laws, which voters put in place to limit large taxable value increases. Many states dont have caps on how much property taxes can change annually, but those two are examples of state governments that put laws in place because of taxpayer concern.

Interest On Property Tax

Late payments towards property tax can attract a fine, generally equivalent to a certain percentage of the amount due. This interest varies from state to state, with some states choosing to waive off such interest and others charging rates from 5% to 20%, depending on their individual policies.

For Example:

Some states waived off penalties on property tax while Bangalore decided to slash interest for late payments from 20% to 10%, in a bid to get more people to pay their dues.

Also Check: How Much H And R Block Charge For Taxes

How To Figure Your Property Tax Bill

Property taxes in Tennessee are calculated utilizing the following four components:

The APPRAISED VALUE for each taxable property in a county is determined by the county property assessor.

The ASSESSMENT RATIO for the different classes of property is established by state law .

The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

The TAX RATE for Davidson County is set by the Metro Council based on the amount of monies budgeted to fund the provided services. These tax rates vary depending on the level of services provided and the total value of the countys tax base. The tax rates are not final until certified by the State Board of Equalization.

To calculate the tax on your property, assume you have a house with an APPRAISED VALUE of $100,000. The ASSESSED VALUE is $25,000 , and the TAX RATE has been set by the Metro Council at $3.288 or $2.953 per hundred of assessed value. To figure the tax simply multiply the assessed value by the tax rate of $3.288 or $2.953 per hundred dollars assessed.

How To Calculate Property Tax: Everything You Need To Know

Knowing how to calculate property tax is very important for both potential and existing homeowners.

When looking for a home, knowing how to calculate property tax will help you know whether you will be able to afford its property tax. Knowing the amount youll pay in property tax for the next year will also be helpful for determining your yearly budget.

Despite its importance, many first time homeowners are unsure how to calculate property tax. But dont worry, you came to the right place! We will walk you through everything you need to know about property tax.

What is Property Tax?

Lets start with what property tax is. Property tax is a tax on property owned by an individual or another entity. The local government uses property taxes for local services, such as school districts, police departments, fire departments, and road construction.

Property tax is calculated by the local government and is paid by the property owner. Those who rent property may also indirectly pay property tax if their landlord factors the cost of property tax into their monthly rent cost.

Property tax varies based on the value of the property and the location of the property.

How to Calculate Property Tax

Property tax is calculated by multiplying the local tax rate by the market value of the property.

Property tax= tax rate x current value of property

The Tax Rate

The Property Value

Property Tax in California

- Los Angeles County- 0.755%

What is a Homestead?

You May Like: How Much Does H& r Block Charge To Do Taxes

Calculating Your Annual Property Tax

taxable valuecurrent tax rateExample

| 1. Enter the Taxable Value from the Notice | $16,000.00 |

| 2. Multiply Taxable Value by the Tax Rate | X .20385 |

| $3,261.60 |

| Calculating Your Taxes with a Veteran’s Exemption Homeowners with a Veterans’ Exemption are required to pay tax to support public schools. Further reductions may be added if the veteran served in a combat zone or was disabled. | |

| 1. Enter the Taxable Value from the Notice | $16,000.00 |

| 2. Multiply Taxable Value by the Tax Rate | |

| Your Taxes | $1,362.56 |

Calculating the Taxable ValueStep 1Step 2For Class 1 Properties and Class 2 Properties with 10 Units or Less

| Class 1: | Assessed Value cannot increase more than 6 percent each year or more than 20 percent in five years. |

| Class 2: | Assessed Value cannot increase more than 8 percent each year or more than 30 percent in five years. |

Step 2a:

| Example: |

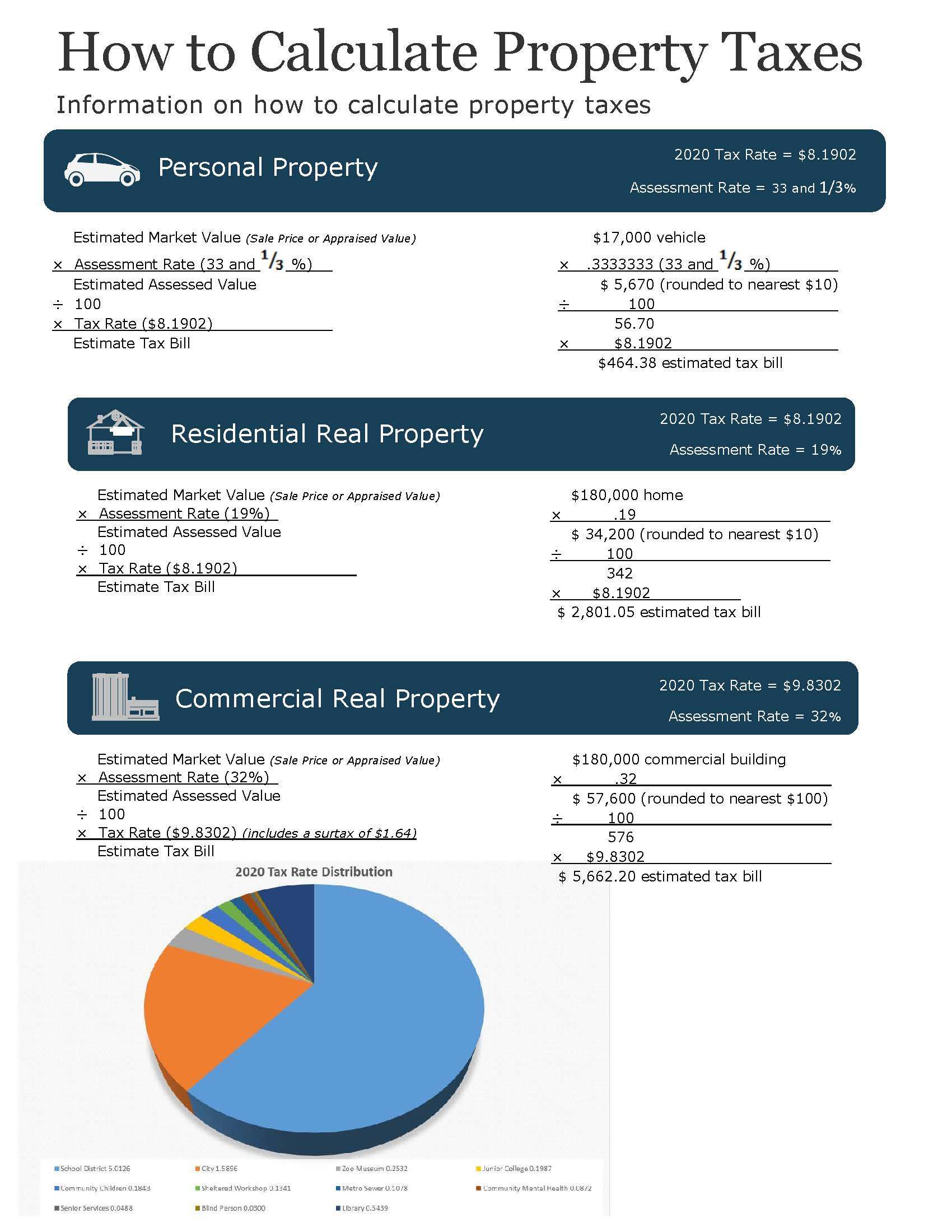

Residential Real Estate Tax Calculation Formula

The current statewide assessment rate for residential real estate property is 19%. To determine how much you owe, perform the following two-part calculation:

Heres an example of how this formula works

To calculate taxes owed on a $100,000 home at a 6.5694 total tax rate per $100 of assessed valuation:

You May Like: Where’s My Tax Refund Ga

How Property Tax Rates Are Determined In Bc

Municipal property tax rates are determined based on the budget needs of the municipality. Municipalities consider their expected spending and other revenue and use property taxes to make up for the rest. The specific property tax rate for a certain year depends on the budget of the municipality and its total assessment base . If more tax revenue is necessary, tax rates will need to go up, and vice-versa.

The School Tax is less transparent. Every year, BCs Minister of Finance determines the total amount needed from the School Tax. The Lieutenant Governor in Council then has until May 4th to determine the specific tax rates for each school district. School tax rates can differ between school districts as well as in the districts themselves.

Additional School Taxes on High-value Properties in BC

If you own a residential property assessed at more than $3 million, you will have to pay an additional school tax. You will also still have to pay the base school tax rate on the whole value.

As of 2020, you would have to pay:

- 0.2% on the value of your property between $3 million and $4 million

- 0.4% on the value of your property above $4 million.

A $5 million detached home would have to pay an additional school tax of $6,000 in 2020.

0.2% x $1M = $2,000 0.4% x $1M = $4,000 Total: $6000

Why Are My Taxes Higher Than My Neighbors

There are many reasons why the taxes on one property may be different than the taxes on another.

Generally your taxes would be higher than your neighbors because your property value is higher than your neighbors . This may be caused by

-

Improvements to the property made in prior years

-

Differences between your property and your neighbors such as square footage, lot size, condition, construction quality, or other differences.

-

Your neighbor may have an exemption on their property

In some cases, properties in close proximity with similar values may be in different Levy Code areas.

For information regarding the taxes for a specific property, please contact our customer service department by live chat, phone 988-3326 or by email at .

Don’t Miss: Www Michigan Gov Collectionseservice

Tax Deductions Against Income From Property

Section 24 is titled as Deductions from income from house property. Income from house property is applicable in the following cases:

- If you are renting out your house, then the rent received will be considered as part of your income

- If you have more than 1 house, then the Net Annual Value of the houses, except the house you are living in, will be considered as your income.

- If you own only 1 house and you are living in it, the income from house property will be considered as NIL. Any income derived from rent and annual value of additional houses, will be subject to tax after deductions made under Section 24.

Deductions under Section 24

There are 2 types of deductions under Section 24 of the Income Tax Act:

- Standard deduction: This is an exemption allowed to every taxpayer, where a sum equal to 30% of the net annual value does not come under the tax limit. This is not applicable if you are occupying the only house you own.

- Interest on loan: If you have taken a home loan for purchase, construction or renovation of the house, whatever interest you pay on the principal amount of the loan is exempted from tax payment. The sub-clauses in this category are:

Exceptions under Section 24

Deduction under Section 80C

Individuals can also claim a deduction towards any other expense during the process of transfer of property. Homeowners should keep in mind that this is applicable only for new residential properties.

Capital Gains Tax on Property:

What Is A Homes Fair Market Value

The market value of a home is basically the amount a knowledgeable buyer would pay a knowledgeable seller for a property, assuming an arms-length transaction and no pressure on either party to buy or sell. When a property sells to an unrelated party, the sales price is generally assumed to be the fair value of the property.

You May Like: Www.1040paytax

Computation Of Income From House Property

Understanding income from house property can be tricky. To make it simple, here are a few things to keep in mind:

- Only the Net Annual Value of your house is considered for taxation. Net Annual Value is arrived at when you deduct the municipal taxes paid on the property from the gross annual value of the house. For example, if you are receiving Rs.1.2 lakh as rent annually on a house you have let out, and you are paying Rs.40,000 as municipal taxes, then the Net Annual Value of your house is Rs.80,000, and you have to pay tax only on this amount.

- If your house is lying vacant for any period during the financial year due to lack of tenants, you have to consider only the income received as rent and not compute it against the whole 12 months. For example, if a house yielding Rs.17,000 as rent is vacant for 4 months of the fiscal year, then the gross value of the house will be Rs.1,36,000 . Tax payable on this income will be calculated after deducting the municipal tax amount paid and the standard deduction of 30%.

- If your house is lying vacant and not giving you any income, but you are paying municipal taxes, you can offset this loss against income from other sources such as your salary or rent from any other property during the same fiscal. If you are unable to offset the loss in the same year, you can carry forward this loss for up to 8 years.

Your Property Tax Is Proportional To The Value Of Your Property

In this example, a small municipality with three properties worth $125,000, $175,000 and $200,000 has services costs of $2,000 that are paid by property owners through property taxes.

Each property owner in the municipality pays a proportion of that $2,000 based on their property’s assessed value. This is calculated by first adding up the value of all three properties, for a total of $500,000. Since the cost of services is $2,000, the tax rate is 2,000/500,000 = 0.004, or 0.4%. Therefore:

- The owner of the $125,000 property pays $500.

- The owner of the $175,000 property pays $700.

- The owner of the $200,000 property pays $800.

- The total of the property tax paid by the three property owners is $2,000.

Recommended Reading: Can You Change Your Taxes After Filing