To 6 Year Nys Tax Payment Plan

If a taxpayer requires more than 3 years to pay off a tax balance, NYS may request financial information. Therefore, in cases requiring financial verification, a DT-5 form or financial information will need to be provided.

In certain cases, NYS may file a tax warrant with the County Clerk and the Secretary of State. As a result, the tax warrant creates a tax lien. Therefore, it is generally a good idea to ask if DTF can refrain from issuing a tax warrant as long as you stay compliant with your IPA.

Earned Income Tax Credit

You can claim the earned income tax credit in New York if you have a qualifying child and can also claim the federal earned income tax credit. You are not entitled to this credit if you claimed the Noncustodial Parent New York State Earned Income Tax Credit . The credit equals to 30% of your allowable federal earned income tax credit minus your household credit.

How Do The Covid Relief Bills And Stimulus Payments Impact Taxes

In the interest of getting money into the hands of those who needed it, says Engel, many of the 2020 stimulus payments were based on 2019 tax returns since thats what was immediately available at the time. But Engel points out there are important tax considerations as a result of using this calculation method.

Many people experienced abrupt income changes in 2020. For example, you may have earned $100,000 in 2019 and lost your job in 2020, so you technically qualified for the stimulus payments in 2020 but didnt receive any. Conversely, you may have earned less than $75,000 in 2019 and received a stimulus payment but in 2020, you received a promotion that put you above $75,000, which means you actually werent qualified to receive that stimulus check .

What this all means is that in 2021, people should expect a lot of corrections, known as stimulus payment true-ups, says Engel. He advises that people who received a third stimulus payment in 2021 should be prepared to provide the exact amount when filing.

What else to look out for: Qualifying taxpayers may have noticed that theyve been receiving an advanced child tax credit in the latter half of 2021. Engel notes that its important to keep track of how much was received as this credit may need to be paid back in 2022. Additionally, dependent care credits are increasing in 2021 by 33% for eligible families, so if thats you, be prepared for adjustments when its time to file.

Also Check: How Can I Make Payments For My Taxes

Are There Different Rules For Active Duty Military Personnel

If your domicile was not New York State when you entered the military, but you were assigned to duty in New York State, you do not become a New York State resident even if you have a permanent place of abode here. You are a nonresident and your military pay is not subject to New York State income tax.

For more information see:

What Other New York Taxes Should I Be Concerned About

New York State has its own estate tax, which is collected in addition to the federal estate tax. The exemption for tax year 2020 is $5.85 million, while the 2021 exemption is $5.93 million. Estate tax rates for amounts above that exemption range from 3.06% to 16%.

Retirees who plan on supplementing their retirement income with investment income may also have to pay capital gains taxes. Capital gains are considered regular income in New York and taxed at the states income tax rates .

You May Like: How To File Taxes Without Income To Get Stimulus Check

Was Your Refund Less Than You Expected

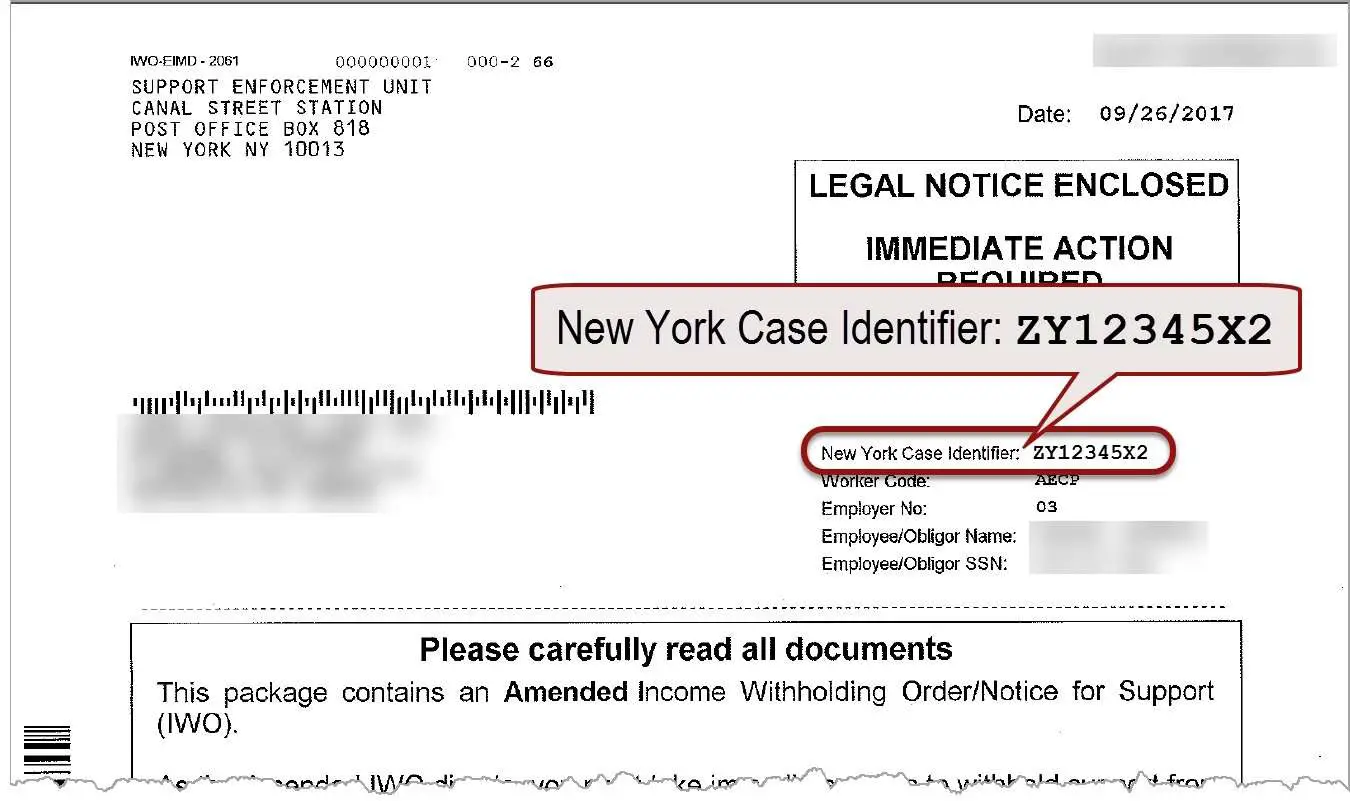

Owing money to any New York state agency can result in your income tax refund being seized. If youre behind on child support or have unpaid restitution or court fees, your state refund taxes can be used to pay those debts.

Your tax refund may be less than you expected because you made an error on your tax return. The Department of Taxation will notify you of the changes made to your return. Review the information provided to ensure you agree with the changes made.

Vehicle Taxes By State

Another important state tax to be aware of is gas tax. This can vary widely from the average, which is why the price of gas can be so different depending on where you are in the country.

A comparison of gas tax by state reveals some of the most favorable to by Wyoming’s , North Dakota, Delaware , Louisiana , Arizona and Mississippi . Alaska, which charges no income or sales tax, is known for having the lowest gas tax of any US state. As of October 2018, gas tax in Alaska was 15 cents per gallon.

More From QuestionsAnswered.net

Also Check: Where’s My Tax Refund Ga

Whats The Difference Between Filing As Resident Vs Nonresident

As a resident, you pay state tax on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state. If you are a nonresident, you are not liable for New York City personal income tax, but may be subject to Yonkers nonresident earning tax if your income is sourced to the city of Yonkers.

For a list of what does and does not constitute New York source income, plus other information, see:

- Tax Bulletin TB-IT-615, New York Source Income of Nonresident Individuals, Estates, and Trusts, and Part-Year Resident Individuals and Trusts

- Tax Bulletin TB-IT-620, New York Source Income-Sole Proprietorships and Partnerships

- IT-203-I, Instructions for Form IT-203 Nonresident and Part-Year Resident Income Tax Return

- TSB-M-18I, Definition of New York Source Income of Nonresident Expanded

- TSB-M-18I, Nonresident Partners Treatment of Gain or Loss on Certain Sales or Transfers of a Partnership or Membership Interest

- TSB-M-15C, I, Impact of New York State Corporate Tax Reform on New York S Corporations and their Nonresident and Part-Year Resident Shareholders

- TSB-M-10I, Income Received by a Nonresident Related to a Business, Trade, Profession, or Occupation Previously Carried on Within New York State

- TSB-M-09I, Amendment to the Definition of New York Source Income of a Nonresident Individual

Gains Or Losses From Real Property

In the past, the rules in this area were clear. Under current legislation, the phrase real property located in this state as defined in Tax Law section 631 is redefined to include interests in a partnership, limited liability company, S corporation, or closely held C corporation owning real property located in New York State if the value of the real property exceeds 50% of the value of all of the assets in the entity. There is a two-year lookback rule to avoid taxpayersstuffing assets into an existing entity before a sale. For sales of entity interests occurring on an after May 7, 2009, any gain recognized on the sale of an interest in that entity will be allocated among the assets in the entity, and the amount allocated to New York real property will be treated as New York-source income.

Also Check: Www.1040paytax

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state. It ensures that out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within the state. The seller will collect the regular New York sales tax. But if you buy a computer from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax. New York requires residents to report their out-of-state spending in their New York income taxes.

It Might Make Sense To Stay Where You Are

One advantage to living in New Jersey while working for a New York Citybased company is you wont be subject to any NYC taxes, as those city taxes are only relevant to taxpayers who reside in NYC for all, or part, of the year, notes Engel. Since NYCs city tax rate is over three percent, thats a significant saving. So if youre thinking of moving back to NYC after the pandemic is over, you might want to reconsider and stay put.

Also Check: Have My Taxes Been Accepted

My Company Is In Ny But I Relocated To Nc And Am Working From Home For The Ny Company Should I Have Ny & Nc Taxes Withheld Or One Or The Other Thank You

I work for a law firm in NY . It does not have any offices in NC. I am working remotely from my home for work provided to me by the NY office. I need to know if I should have my boss start taking out NC taxes as well as NY taxes and if I will be taxed double for the same income for each State. I currently just have NY taxes coming out.

Are Other Forms Of Retirement Income Taxable In New York

Yes, but they are deductible up to $20,000. Income from an IRA, 401 or company pension is all taxable. Seniors age 59.5 and older are eligible for the $20,000 deduction. This applies to the total of all retirement income. Any retirement income that exceeds the $20,000 deduction will be taxed according to the rates show in the table below.

Read Also: Form 1040 State Tax Refund

What If Youre Collecting Unemployment From Ny But Live In Nj

New Jersey doesnt tax unemployment compensation, but you will need to pay non-resident New York State taxes on this income, says Engel. In addition, while the American Rescue Plan Act exempts a certain portion of your unemployment compensation, New York has not adopted this tax exemption. Therefore, unemployment is fully taxable at the federal level.

Engel notes that its important to deduct both federal and New York state taxes from unemployment income to avoid any surprises on your 2021 tax return.

Other New York City Taxes

New York City charges a sales tax in addition to the state sales tax and the Metropolitan Commuter Transportation District surcharge. But food, prescription drugs, and non-prescription drugs are exempt, as well as inexpensive clothing and footwear.

There’s also a state and local tax on hotel rooms for inexpensive to moderately-priced rooms. This tax rate includes New York City and New York State sales taxes, as well as a hotel occupancy tax. Rooms renting for less expensive prices are subject to the same tax rates, but at lesser nightly dollar amount fees.

Medallion owners or their agents pay a tax for any cab ride that ends in New York City or starts in the city and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, or Westchester counties. This tax, known as the taxicab ride tax, is generally passed on to consumers. Medallion owners are those who are duly licensed with a medallion by the Taxi Limousine Commission of New York City.

Also Check: Michigan Gov Collectionseservice

If I Live In New York But Work In Another State Am I Taxed Twice

A person who lives in one state but works in another may have tax liability in both states, but typically will receive a tax credit in their state of residence to eliminate double taxation of that income.

If you were a full-year or part-year resident of New York State and you had income sourced to and taxed by another state you may claim a nonrefundable resident credit against your New York State tax. This credit is allowable only for the portion of the tax that applies to income sourced to and taxed by the other taxing authority while you were a New York State resident.

For more information see, IT-112-R-I, Instructions for Form IT-112-R New York State Resident Credit.

What Are The Rules For New York City Residency

The requirements to be a New York City resident are the same as those needed to be a New York State resident. You are a New York City resident if:

- your domicile is New York City or

- you have a permanent place of abode there and you spend 184 days or more in the city.

All city residents income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

The rules regarding New York City domicile are also the same as for New York State domicile. If your permanent and primary residence that you intend to return to and/or remain in after being away is located in one of the five boroughs of New York City, it is considered a New York City domicile.

Your New York City domicile does not change until you can demonstrate with clear and convincing evidence that you have abandoned your city domicile and established a new domicile outside New York City. Even if you live in a location outside of the city for a period of time, if its not the place you attach yourself to and intend to return to, its not your domicile. Your domicile will still be New York City and you will still be considered a New York City resident.

For more information see, IT-201-I, Instructions for Form IT-201 Full-Year Resident Income Tax Return.

Don’t Miss: How Much Is H& r Block Charge

New York Income Taxes

New York States top marginal income tax rate of 8.82% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $1,077,550 pay the top rate, and earners in the next bracket pay nearly 2% less. Joint filers face the same rates, with brackets approximately double those of single filers. For example, the upper limit of the first bracket goes up from $8,500 to to $17,150 if youre married and filing jointly.

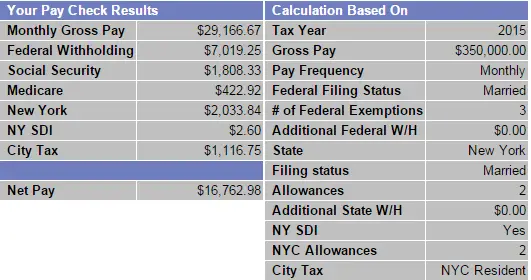

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: Have My Taxes Been Accepted

The Tax Headaches Of Working Remotely

Each state has its own rules, one tax expert says. So if you worked in a state other than your usual one in 2020, here are some tips on dealing with the tax season.

- Read in app

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

By Ann Carrns

Last year, Ariele Doolittle, a tax lawyer, got a call from a client who lived and worked in New York but was considering working remotely from California temporarily after his offices were shuttered in the pandemic.

Not a good idea, Ms. Doolittle told him.

California, she said, would tax his income because he was physically working there. And New York would probably tax his earnings as well. Plus, when he filed his New York resident tax return, the state probably wouldnt give him a credit for the taxes he paid to California.

He could be double taxed. He ended up going to Florida, she said, since that state doesnt have a state income tax.

Such are the complex tax considerations for millions of people who have been telecommuting during the pandemic and working in a different state from their usual workplace.

Workers may have to file more than one state tax return, and in certain situations they could end up owing taxes in both states. The details depend on your home state and what state you worked in during 2020.

Fifteen states have said they wont tax people who moved in temporarily during the pandemic, the C.P.A. institute says.

New York State Estate Tax

New York is one of the 14 states that charges taxes on the estates of the deceased, with rates ranging from 3.06 percent to 16 percent on any estates that exceed the basic exclusion amount, which is $5.25 million through the end of 2018. If an estate does exceed the BEA, it pays taxes at these tiered rates.

Find Out: How to Minimize Your Estate Tax

And if the New York State Department of Taxation and Finance wasnt already making things complicated enough with different brackets, New York states estate tax is also unique for what is commonly referred to as the estate tax cliff.

The estate tax at the federal level has a basic exclusion amount of $11.18 million, and you only pay taxes on your taxable estate, which is the portion of your estate thats over that value. The New York estate tax, though, taxes the entire value of the estate for any estate that clears the BEA. So, while an estate worth $5 million would owe nothing, an estate worth $5.5 million would owe a whopping $450,000 hence the cliff for estates that are right at or near the BEA.

The state of New York does not levy an inheritance tax.

More on Tax Laws

Also Check: How To Buy Tax Liens In California