File Your Taxes With Confidence

While tax season may never be your favorite time of year, you dont have to do it all on your own. Reach out to a tax Endorsed Local Provider in your area to help you sort out your tax situationtax liabilities and all! Get ready to walk into the next season feeling like a tax boss. Get a tax pro today!

Feel like your taxes are simple enough to do them yourself? With Ramsey SmartTax, you can! Ramsey SmartTax makes it easy to take control of your taxes and file your tax return in a matter of minutes. You wont be surprised by hidden fees and you wont have to make sense of confusing tax jargonwhat you see is what you get!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

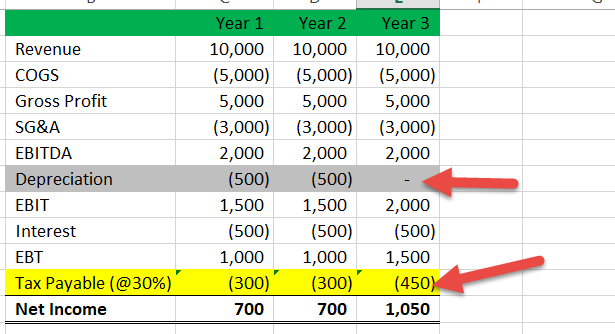

What Is An Example Of Deferred Tax Liability

A deferred tax liability usually occurs when standard company accounting rules differ from the accounting methods used by the government. The depreciation of fixed assets is a common example.

Companies typically report depreciation in their financial statements with a straight-line depreciation method. Essentially, this evenly depreciates the asset over time.

But for tax purposes, the company will use an accelerated depreciation approach. Using this method, the asset depreciates at a greater rate in its early years. A company may record a straight-line depreciation of $100 in its financial statements versus an accelerated depreciation of $200 in its tax books. In turn, the deferred tax liability would equal $100 multiplied by the tax rate of the company.

Assets That Will Be Recovered Through Receipt Of Cash Or Other Asset

In this case, you will not charge a carrying amount to profit or loss. Instead, you will credit a carrying amount against any cash or other consideration received in exchange. The examples of these assets are receivables.

Lets say you have an interest receivable of 500. However, you did not include this receivable into taxable profit calculation because in your country interest received is taxed when cash is received.

Whats left in the tank for future tax deductions when you recover this receivable?

The answer is zero. Nil. Why?

Because when you recover the receivable in the future by receiving the cash, then you need to include it in your tax return. How much can you deduct for tax purposes in the time of taxing? Zero. You must tax it in full.

As the carrying amount of this interest receivable is 500 and tax base is 0, you can work out the temporary difference and a deferred tax.

Recommended Reading: Do Seniors On Social Security Have To File Taxes

Tax Rules Were Written To Smooth Out Effects Of Business Cycles

If some corporations paid zero corporate income taxes because they were carrying forward past losses, it should be seen as a normal feature of the U.S. tax code, not a cause for concern. Deductions for carried-forward losses ensure firms are taxed on profitability over time and not penalized for losses that dont align with calendar years. Tax losses can be carried forward for 20 years with some limitations, so many companies could be carrying forward losses from the financial crisis or other company-specific downturns.

Some Examples Of Gst/hst Exempt Goods And Services Are:

- Used residential housing .

- Residential rental accommodation if equal to or greater than one month duration.

- Music lessons

- Medical and dental services – includes doctors, dentists, dental hygienists, orthodontists, optometrists, chiropractors, physiotherapists, audiologists, psychologists, podiatrists, dieticians, social workers . Note that some medical procedures are considered to be non healthcare-related and as such are subject to GST/HST. Examples include preparing medical-legal reports or disability certificates, expert witness fees, cosmetic surgery to enhance an individual’s appearance , etc.

- Issuing insurance polices .

- Educational services that lead to a certificate or diploma or are required to practice a trade or vocation. This includes tutoring services for courses that follow designated school curriculum.

- Most goods and services provided by charities.

- Financial services such as fees for bank accounts, lending, etc.

- Legal aid services.

- Day-care services for children 14 or younger if the service is not provided 24 hours per day.

- Food and beverages sold in an education institution such as a school or university cafeteria.

To add to the confusion, some goods and services which are exempt from the federal GST are not exempt at the provincial level in provinces that charge a provincial sales tax and are therefore subject to PST/RST/QST. Refer to the exemption list for your province for details:

You May Like: What Is Tax Liabilities On W2

Factors That Affect Your Tax Liability

Income tax is the largest component of tax liability for most people, and its determined in part by tax bracketsthe percentage of each portion of your income that you must pay in taxes. These percentages vary depending on both filing status and how much you earn.

You’d be in the 10% tax bracket and your income tax liability would be $950 if youre single and you earned just $9,500 in 2020. But you would be pushed up into a 24% tax bracket on the portion of your income that exceeds $85,525 if you earned $95,000.

The income parameters for each tax bracket are indexed to keep pace with inflation. They’re adjusted annually, generally increasing a bit.

Your tax liability is not based on the total money you earn in a given year. It’s based on your earnings minus the standard deduction for your filing status, or your itemized deductions if you decide to itemize instead. It’s also based on any other deductions or tax credits you might be eligible for.

The Internal Revenue Code allows you to whittle away at your taxable income so your tax liability isn’t based on your entire earnings but rather your taxable income.

The standard deduction increased for single filers from $6,350 in 2017 to $12,400 in 2020. It, too, is indexed for inflation. Using the hypothetical $9,500 single taxpayer earnings for 2020, subtracting the $12,200 standard deduction would leave a negative balanceand zero tax liability.

What Is A Tax Haven

A tax haven, or offshore financial center, is any country or jurisdiction that offers minimal tax liabilityInterest Tax ShieldsThe term “interest tax shield” refers to the reduced income taxes brought about by deductions to taxable income from a company’s interest expense. to foreign individuals and businesses. Tax havens do not require businesses to operate out of their country or the individuals to reside in their country to receive tax benefits.

Read Also: When Is Sales Tax Due

An Example Makes This Clearer

Letâs look at an example to see how a hypothetical flow-through entity would determine the amount of federal income tax it owes based on these tax tables. Suppose Wallyâs Widgets ends up with taxable income of $300,000 in 2018, and that Wally files a joint tax return with his wife, Wendy.

Wallyâs tax owed would be:

$28,765 + 24% of the amount over $168,400 .

The calculation: $28,765 + $31,584 = $60,349 total tax due for our friend Wally.

How Does A Tax Liability Work

Your employer likely deducted a percentage from your pay all year for taxes according to the information you submitted to the company on your Form W-4. They sent this moneyyour withholdingto the IRS on your behalf. This appears on line 25a of your 2020 tax return.

You might have made estimated tax payments during the year if youre self-employed, or because you enjoyed some source of unexpected income from which taxes weren’t withheld. These payments are made using Form 1040-ES, Estimated Tax for Individuals. The amount you paid should be entered on line 26 of your 1040 tax return.

All these payments are subtracted from the number that appears on line 24 to arrive at your tax liability.

You can expect a refund from the IRS if the difference between taxes paid and your total tax liability results in a negative balance.

You would receive a refund of $2,500 if your tax liability was $5,000 but your total payments, including refundable tax credits you qualified for, added up to $7,500. But you’d still owe the IRS $1,000 if your liability was $5,000 and you only made $4,000 in total payments, including refundable credits.

Read Also: Where Do I Get Federal Tax Forms

What Is Tax Liability On A W

Tax liability, in financial terms, is the total amount of tax you owe before subtracting prepayments or withholdings. “Liability,” at its root meaning, is similar to “responsibility,” so think of your tax liability as the money you are responsible for paying to the government. On a W-4, the section on “Tax liability” is used to determine whether or not you are exempt from tax withholdings on your earnings.

Businesses Dont Use Loopholes They Follow The Rules Enacted By Congress

Much like homeowners who take the mortgage interest deduction or parents who take the child tax credit, businesses utilize deductions and credits that Congress has enacted to encourage or discourage certain behavior.

For instance, Congress enacted accelerated depreciation to incentivize investment, which means when a business buys a machine or builds a factory, tax rules allow for faster and larger upfront deductions than allowed under accounting rules. Accelerated deprecation leads to short-term gaps between book and taxable income over the period when the tax deductions are larger. Business tax credits like that for research & development costs also lead to gaps in taxable and book income.

If some corporations paid little to no income taxes in a given year due to depreciation deductions or the R& D tax credit, the only way they benefited from such provisions was by investing in capital or performing R& D, economically beneficial activities recognized by tax rules Congress enacted.

Don’t Miss: How To Contact The Irs About My Tax Return

How To Reduce Your Tax Liability

Hello, deductions and credits! One way to reduce your tax liability is to take advantage of any deductions and tax credits that youre eligible for. These babies reduce your taxable income and can put you in a lower tax bracket, meaning less of your income will be taxed. Oh, yeah!

When it comes to these deductions, you can either take the standard deduction$12,400 for single filers and $24,800 for married couples for the 2020 tax yearor you can itemize your deductions.2 This includes certain medical expenses, gifts to charity or student loan interest payments, to name a few.

Keep in mind that if your itemized deductions are less than the standard deduction amount, your best route is likely to go ahead and take the standard deduction so less of your income gets taxed. Working with a tax pro can help you be sure youre making the right call at this step.

Tax credits are another way of reducing your total tax liability. These are different from deductions because credits reduce the dollar amount of your total tax bill after the tax percentages have been applied. These are things like the child or dependent tax credits, adoption credit, or the first-time home buyer credit.

While it may not save on your actual tax liability, checking in on your W-4 with your employer can help you be sure you arent paying more in taxes all year than you actually owe. For some people, getting their withholdings set correctly could feel like a raise!

How Governments Earn Money From Tax Havens

- Tax havens are not completely tax-free. They charge a lower tax rate than other countries. Low tax jurisdictions generally charge high customs or import duties to cover the losses in tax revenues.

- Tax havens may charge a fee for new registration of companies and renewal charges to be paid every year. Additional fees may also be charged such as license fees. Such fees and charges would add up to a recurring fixed income for the tax havens.

Read Also: What Is Agi On Tax Form

Some Examples Of Gst/hst Zero

- Basic groceries – This category includes meat, fish, poultry, cereals, dairy products, eggs, vegetables , coffee, tea, etc.

- Most fishery products if used for human consumption .

- Farm livestock sold for human consumption – . Some animals can be either. Rabbits and goats, for example, can either be raised for consumption, in which case they are zero-rated, or as pets, in which case they are not.

- Farm equipment such as tractors, seeders, planters, and processing equipment.

- Prescription Drugs and dispensing fees are zero-rated. Most off-the-shelf non-prescription medications such as aspirin, vitamins and minerals, cold remedies, bandages, etc. are not zero-rated and GST/HST must be charged. If the item is an over-the-counter product, meaning it is physically controlled by a pharmacist, and does not require a prescription, it is not zero-rated – GST/HST is charged. It is not taxable if a prescription has been issued for the item.

- Medical devices – artificial teeth or limbs, hearing aids, walkers, wheelchairs, canes, guide dogs, eyeglasses or contact lenses, asthmatic devices, modifications to motor vehicles to accommodate disabilities, orthodontics, etc. Also included are insulin pumps, syringes, and pens, and urinary catheters.

- Freight transportation services that involve the movement of goods from Canada to another country and vice versa.

- Feminine hygiene products such as tampons, sanitary napkins, etc.

Do I Need To Pay A Tax Liability

The bottom line is that you must pay the balance on line 37 of your tax return as quickly as possible to avoid paying interest and penalties on the amount until it’s paid off.

The IRS offers online payment options via Direct Pay or the Electronic Federal Tax Payment System . You can also pay by debit or credit card, electronic funds withdrawal, bank wire, check or money order, or even cash at certain retail partners.

And the IRS offers installment agreements so you can pay over time if you simply don’t have the funds to get rid of your liability right away. Interest will accrue and there’s a modest fee, but it’s much better to pay over time than to ignore your debt and hope it goes away.

Recommended Reading: Is Credit Card Interest Tax Deductible

Benefits To A Tax Haven

- Tax Haven Countries benefit by way of attracting capital to their banks and financial institutions, which can then be used to build a thriving financial sector.

- Individuals or Businesses benefit by saving tax, which in tax haven countries may range from zero to low single digits compared to high taxes in their country of citizenship or domicile.

Tips For Understanding Your Taxes

- A financial advisor can help you optimize your taxes for your investing and retirement goals. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors, get started now.

- Worried about comprehending your taxes? SmartAsset has you covered with a number of free online tax resources to help you manage your taxes. Go online to our website and check out our income tax calculator today.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. You might find that youd save a significant amount of money one way or another, so its best to educate yourself before the tax return deadline.

Recommended Reading: Are Donations To Churches Tax Deductible

Tax Liabilities And Tax Deductions

Your tax liabilities can add up. To counter the high cost of taxes, the IRS lets you claim tax deductions for certain things. Tax deductions reduce your tax liability, often resulting in you owing less in taxes.

You can claim a self-employment tax deduction that lets you deduct the employer-equivalent portion of your self-employment tax when figuring out your adjusted gross income.

Other common tax deductions for small businesses include interest on a business loan, retirement plan, car, home office, and health insurance premium tax deductions.

How Deferred Tax Liability Works

The deferred tax liability on a company balance sheet represents a future tax payment that the company is obligated to pay in the future.

It is calculated as the company’s anticipated tax rate times the difference between its taxable income and accounting earnings before taxes.

Deferred tax liability is the amount of taxes a company has “underpaid” which will be made up in the future. This doesn’t mean that the company hasn’t fulfilled its tax obligations. Rather it recognizes a payment that is not yet due.

For example, a company that earned net income for the year knows it will have to pay corporate income taxes. Because the tax liability applies to the current year, it must reflect an expense for the same period. But the tax will not actually be paid until the next calendar year. In order to rectify the accrual/cash timing difference, tax is recorded as a deferred tax liability.

Recommended Reading: Where Do I Mail My Taxes In California

More From Your Money Your Future:

Here’s a look at more on how to manage, grow and protect your money.

“The group not paying federal income taxes in any given year tend to be moderate income with children, as well as older people, who may not have earnings that they are paying tax on,” Maag said.

President Joe Biden’s next move to change individual taxes is expected to target higher-earning households. That could come in the form of increasing the top marginal income tax rate to 39.6% from the current 37% and changing the top capital gains tax rate to 39.6%, as well, from 20%.

As for details of the credits: The child tax credit is enhanced for 2021 in several ways, including by raising the per-child payment to $3,000 from $2,000 for families with income below certain thresholds , with an extra $600 for children under age 6. Children age 17 also qualify for the first time.

Those child tax credits will be advanced via direct payments beginning in July.

The earned income tax credit for childless workers also has been expanded by boosting the maximum credit in 2021 for that cohort to $1,502 from $543, research from the Tax Foundation shows. The benefit would be realized when taxpayers file their 2021 returns in spring 2022.